The government unveiled the fiscal budget 2021-22 through the Ordinance following the dissolution of the parliament on May 22, despite serious objection from opposition political parties, civil society and legal experts which cited lack of financial accountability and probabilities of fiduciary risks in the absence of parliament.

The government unveiled the fiscal budget 45 days ahead of the closure of fiscal year calendar violating the provision of the Constitution section 114 which clearly states, ‘If at any time, except when both the Houses of the Federal Parliament is in session, the President is satisfied that circumstances exist which render it necessary to take action, the President may issue an Ordinance on the recommendation of the Council of Ministers.’

As per legal experts, there is no valid reason for unveiling the budget 45 days ahead of time when the parliament is not in session, and which is seen as a violation of section 114 of the Constitution.

Bipin Adhikari, a constitutional law expert says, “The Constitution has envisioned that the budget for the next fiscal is presented 45 days ahead so that there is sufficient time for parliamentarians to discuss it and endorse it prior to the beginning of the fiscal year. Our constitution has envisioned that the fiscal budget be presented only in the joint session of the parliament; house of representatives and national assembly.”

In the meantime, the Supreme Court has challenged the government’s decision of dissolution of parliament. The government was required to wait for the court’s verdict because it had sufficient time of 45 days to resort to the Ordinance Budget, according to former Finance Secretary Rameshore Prasad Khanal, “As there is no provision for the interim budget in the Constitution, the government could present a full-fledged budget at the end of this fiscal. If the court reinstates the parliament, the scenario would be different and the budget can be brought abiding regular parliamentary processes.”

On May 21, Prime Minister KP Sharma Oli led Cabinet has recommended the dissolution of the parliament for the second time despite the court having reinstated the parliament in February following the hearing on writ petition filed against the unconstitutional dissolution of December 20 last year.

Against this backdrop, President Bidhya Devi Bhandari issued Ordinances - Appropriation Ordinance, Finance Ordinance, Loan and Guarantee Ordinance and Ordinance to Raise Domestic Debt on May 29. And Finance Minister Bishnu Prasad Paudel presented the budget at the Prime Ministers Office in the absence of the parliament.

Experts say that ‘waiver and given revenue collection target are mutually exclusive; either the government can enforce waiver or increase revenue collection without providing such waivers’.

Budget 2021-22: A glimpse

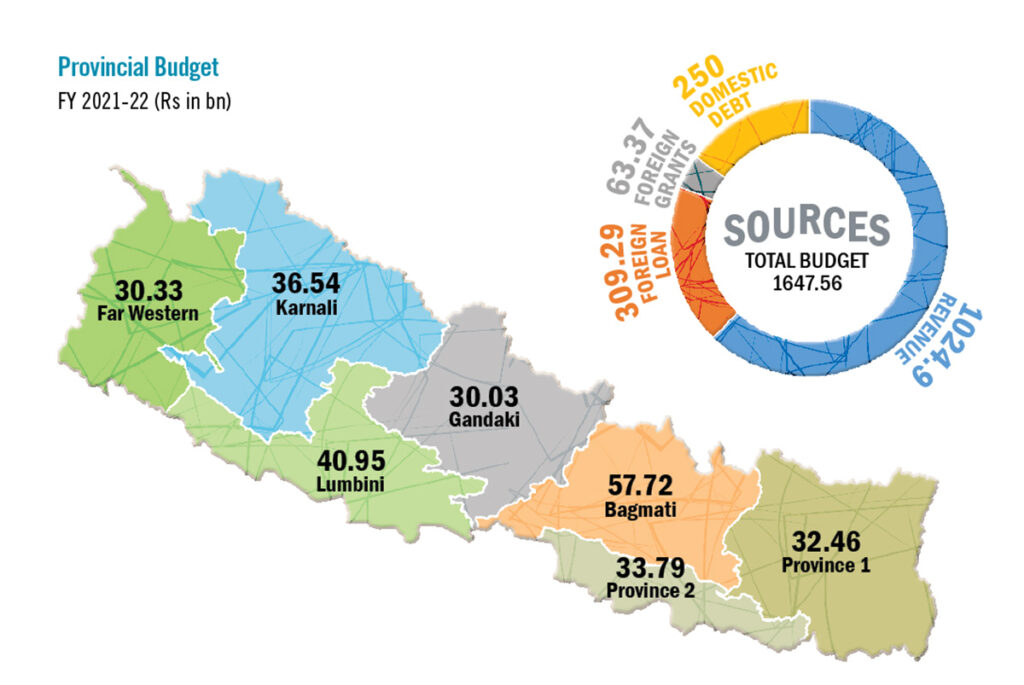

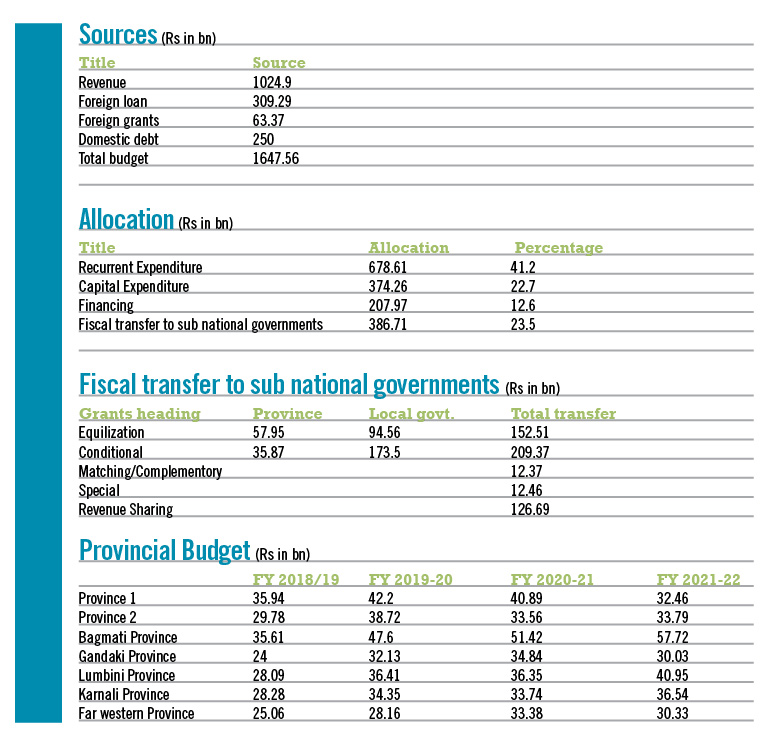

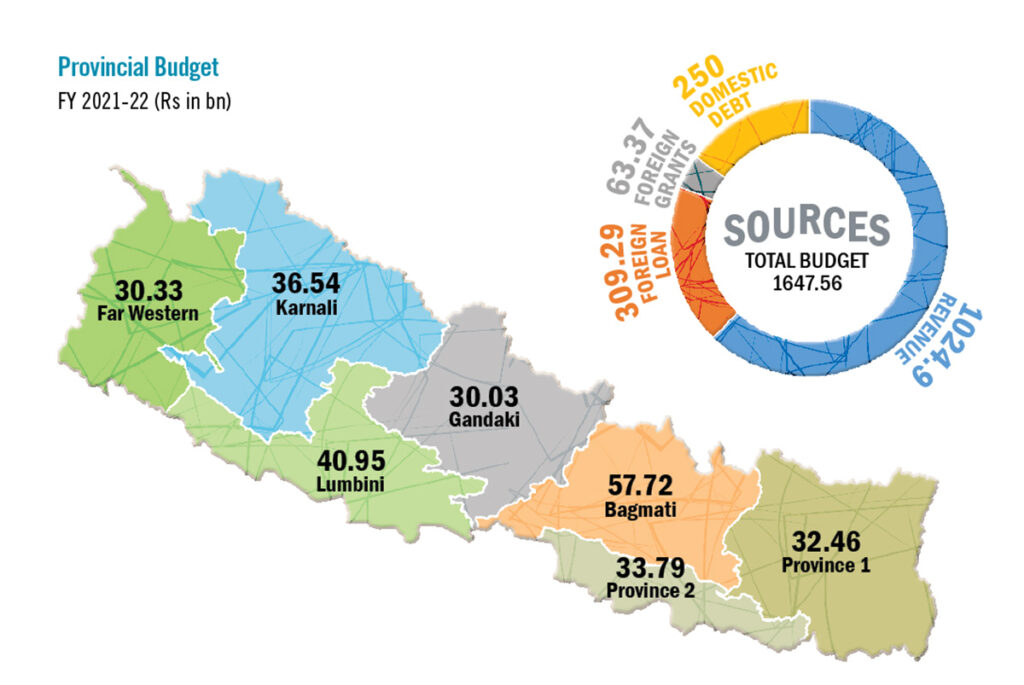

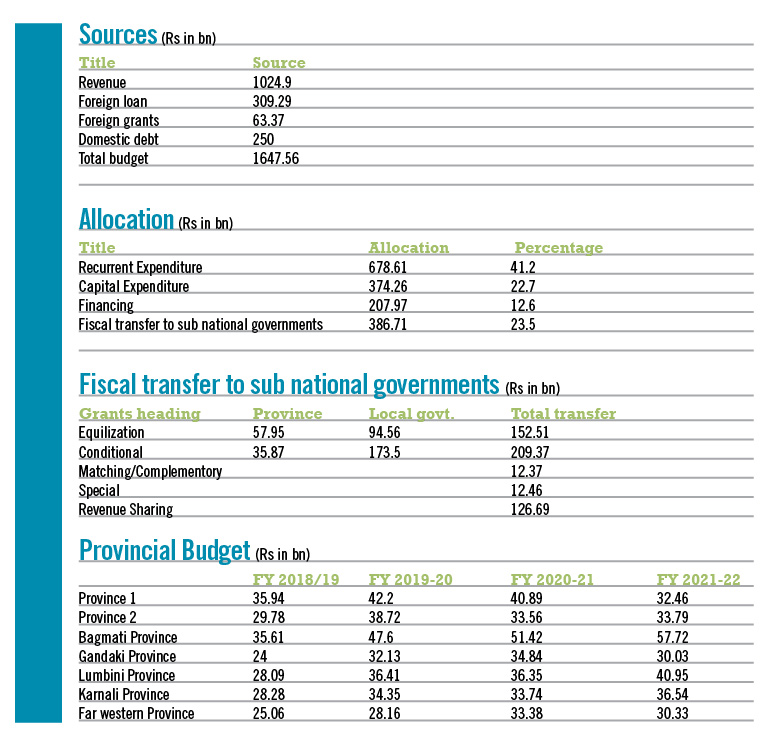

Finance Minister Paudel presented a budget of Rs 1647.57 billion for the next fiscal focusing on prioritising saving of lives of people during the coronavirus pandemic. In recent days, thousands of people lost their lives, rate of hospitalisation skyrocketed, and there was rampant spread of the virus amidst shortages of medical supplies, oxygen and an overstretched manpower. The government has allocated Rs 122.77 billion or 7.5% of the total budget for the health sector and Rs 26.75 billion from the health budget is earmarked for purchasing vaccines against Covid 19. The fiscal budget has earmarked sufficient budget for the Prime Minister Employment Program (PMEP) at Rs 12 billion to create 200,000 jobs in the fiscal 2021-22. Budget allocation for PMEP increased substantially over the years from Rs 3.10 billion of fiscal 2018-19 to Rs 5.01 in fiscal 2019-20. In the ongoing fiscal, the government has earmarked Rs 11.60 billion for this program. The government has increased allocation by four times without any substantial achievement from this project. Economist Biswo Poudel opined that such employment scheme programs should enhance skillsets of human resource. “When the government is going to pour billions into job creation, it should also create assets for the country like infrastructure, production and others,” Poudel iterated, “Simultaneously, those connected with this employment scheme in a particular fiscal year must be enabled to find jobs in the market, and no longer be relying on this program in the next year.” The fiscal budget has not announced substantial relief focusing on the revival of the economic recovery, it has announced to give continuity of the initiations of ongoing fiscal 2020-21.Major allocation for fiscal budget 2021-22:

• Social Security Allowance: Rs 127.78 bn • Salary and perks of civil servants: Rs 101.08 bn • Pension and gratuity: Rs 89.14 bn • Continuation of business (affected by covid19) fund: Rs 50 bn • Reconstruction: Rs 33.55 bn • Irrigation and river training: Rs 31.86 bn • Vaccination against Covid-19: Rs 26.75 bn • University grant: Rs 18.34 bn • East-west highway expansion: Rs 15.34 bn • Subsidised credit (5% interest waiver): Rs 13 bn • Prime Minister Employment Program: Rs 12 bn • Subsidy for chemical fertilizer: 12 bn • President Education Improvement Program: Rs 10 bnPriorities of the fiscal budget 2021-22

• Control of Covid 19 and strengthening of the health sector • Relief and subsidies • Employment generation • Social security and protection • Boosting agriculture productivity and food security • Education infrastructure development • Industrialisation and infrastructure development • Coordination and collaboration with subnational governments • Equitable development and reinforce resilience in economy • Promoting good governance

Social Security Allowance: A distributive approach

The government has increased social security allowance by 33% or Rs 1000 from next fiscal. The government has been providing social security allowance to senior citizens, widows, disabled and marginalised indigenous peoples; the total beneficiary under this scheme is more than 2.2 million, according to the Ministry of Finance. The approach to raise social security allowance by the care taker government which has already announced general elections in November this year raises eyebrows as opposition political parties have slammed it as ill intention of the government to woo votes. “The government is simply unaccountable and autocratic in nature,” said Gagan Thapa, former Health Minister and leader of Nepali Congress, “We cannot accept this budget entered from the backdoor dissolving the parliament through unconstitutional way.” Thapa said that the ill practices of the incumbent government has posed risk that every government announce populist budget through ordinance in the year of election dissolving the parliament. “The fundamentals and way to present budget is unconstitutional, we will not accept this,” he stressed. Former Justice of the Supreme Court, Bala Ram KC has said that it is only the parliament that allows the government to spend from the government treasury with the commitment to execute policies and programs of the government announced by the President at the parliament. “There are two major rules, first the Prime Minister requests the President to announce policies and programs at the parliament that is commitment of the government to execute the announced policies and programs and the Prime Minister then sends the Finance Minister to seek approval of parliamentarians to allocate resources, raise debt/collect taxes to execute the commitments announced in the parliament,” said KC, “Without parliamentary approval, the government has no right to raise debt, tax and spend from state treasury. The care taker government should consult with the opposition to present vote on account when the election is going to happen in the near term.” The government has also violated the Financial Procedure Act, which clearly says the Finance Minister has to present the principal and priorities of the budget at the parliament 15 days ahead of the budget presentation. The main opposition Nepali Congress has termed the budget as ‘Hail Mary Budget’ as it seems like a desperate attempt to score late in the game of elections, violating the accountability towards public finance which has increased fiduciary risks.

Announcement of tunnel road projects

The fiscal budget has given due prioriti to the development of tunnel road projects considering the efficiency of travel and transportation of goods. The country has only one tunnel road, Nagdhunga-Naubise section of Prithvi Highway which is under construction. The fiscal budget 2021-22 has envisaged to take forward dozens of tunnel road projects to shorten travel time and cost while travelling and transporting goods through roads constructed on difficult terrains in the hills and mountain regions. The government has earmarked budget for the construction of Siddhababa-Dobhan of Siddhartha Highway; Lamabagar-Lapche section of Dolakha; Dharan-Leuti section of Dharan-Dhankuta road from 2021-22. Likewise, Rs 1.8 billion is allocated to construct the tunnel road at Tinkune-Jadibuti section of Araniko Highway to manage traffic congestion. The government has also announced to commence construction of few other tunnel projects in the next fiscal along with completion of their detailed project reports. Tokha-Chhahare-Gurjubhanjyang tunnel road project that connects Nepal’s capital with northern neighbour via Rasuwagadhi will commence its construction in 2021-22. Khurkot-Chiyabari section (Sindhuli) of BP highway, Thankot-Chitlang are expected to begin construction works along with completion of DPR. The fiscal budget has also announced some other tunnel projects to initiate feasibility study and DPR in next fiscal namely Majhimtar-Shaktikhor section of Prithvi Highway; Hemja-Nayapul section of Pokhara-Baglung Highway; Dumling-Bangsing section of Chepang Highway; Dumkibas-Bardaghat section of East-West Highway; Babai-Chhinchu section of Kohalpur-Surkhet Highway; Kapase-Siyakot section of Surkhet-Dailekh road; Pravas-Jorthe section of Palpa-Tamghas road and BP nagar-Khutiya-Dipayal.Industrialisation and startups

Attention has been given to startups; the fiscal budget has announced up to Rs 2.5 million loan against project collateral to promote startups. The government has waived registration and renewal fees for startups and announced to provide single window services to them. Similarly, flexible legal approach will be taken to attract foreign direct investment in startups, according to the budget. The government has earmarked Rs one billion to setup a ‘challenge fund’. The fiscal budget has owned ‘Made in Nepal’ and ‘Make in Nepal’ campaigns imitated by the private sector that envisages using local raw materials as well as local labour. Adequate resources are allocated for the development of industrial estates, industrial villages and Special Economic Zones. The fiscal budget has announced to become self-reliant in production of cement, pharmaceuticals, iron rods, furniture and foot ware.The fiscal budget has not announced substantial relief focusing on the revival of the economic recovery, it has announced to give continuity of the initiations of ongoing fiscal 2020-21.

Viability gap funding

The fiscal budget 2021-22 initiates viability gap funding to encourage public-private partnership in execution of infrastructure projects. The government will provide up to 30% of viability gap as cash grant to promote the private sector for the development and operation of infrastructure projects such as roads, energy, rail projects, airports among others.Promoting a resilient economy

With the onslaught of shocks to the economy due to unforeseen circumstances, the fiscal budget has been envisaged to develop a resilient economy that seeks to minimise the impact of disaster and simultaneously promote green growth. In recent years, human activities related to encroachment of nature have caused natural disasters and negative environmental impact. In addition, instability in global financial markets, earthquakes and the current pandemic has harshly affected efforts of human development as well as infrastructure development. Against this backdrop, the country is compelled to adopt green growth measures mitigating climate change impacts, promote circular economy towards achieving its long-term goal to be an inclusive and self-reliant economy, encourage green-infrastructures to attain the sustainable development goals (SDGs).Allocation and resource management

Critics are claiming that the resource management for the inflated budget will be challenging. Among the manifold challenges in the economy, shrinking revenue will continue to affect public spending. Another major contradiction witnessed in the fiscal budget 2021-22 is the announcement of waiver in fees and charges although the government aims to collect Rs 1,151 billion in revenue. From the total revenue collection target Rs 126 billion will be transferred to subnational governments from the divisible fund and the rest will be collected in the federal government’s coffer. Experts say that ‘waiver and given revenue collection target are mutually exclusive; either the government can enforce waiver or increase revenue collection without providing such waivers’. The government aims to mobilise Rs 250 billion as domestic debt, Rs 309 billion from foreign debt and Rs 63.37 billion from foreign grants. Plan of mobilising huge debt without efficiency in execution of projects could be deadly and lead to debt trap as the country has enormously raise its debt liability in recent years. Country’s outstanding debt till 2020-21 is expected to hover at Rs 1.59 trillion or 37.3% of the country’s GDP.Key targets

The fiscal budget 2021-22 has aimed to achieve 6.5% growth with revival of economic activities shattered by the more than year-long pandemic. The country witnessed 1.99% negative growth in fiscal 2019-20 and the projections of growth in fiscal 2020-21 also paints a gloomy picture of stagnating growth. The government anticipates that economic activities will gather pace following massive inoculation campaigns to control the pandemic targeted in the next fiscal. The fiscal budget targets taming inflation within 6.5% in fiscal 2021-22; Nepal Rastra Bank—the central regulatory and monetary authority— will come up with necessary regulatory provisions to contain inflation within the given ‘tight spot’.

Changes in tax/revenue provisions

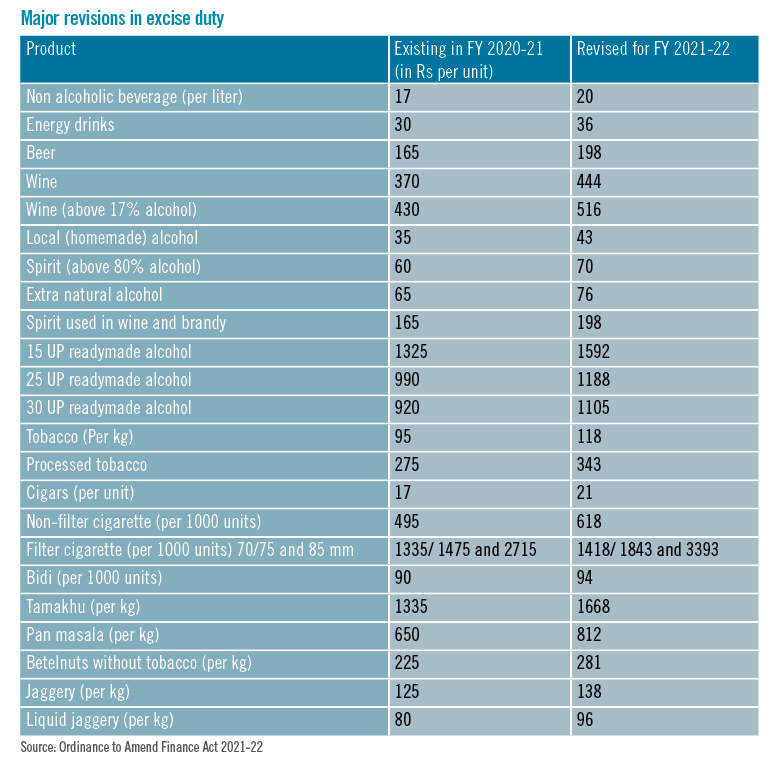

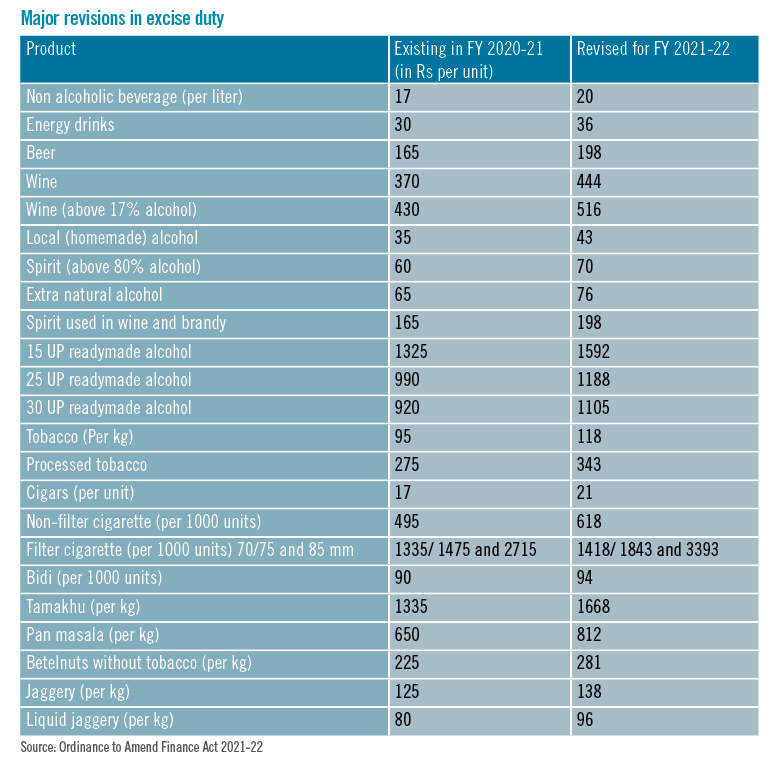

The fiscal budget has extended waiver and incentives in a bid to revive economic activities. It has promised to continue refinance schemes, subsidised credit through business continuation funds to support severely affected sectors. As the budget is issued through an ordinance, it has not made major revisions in taxes. The fiscal budget 2021-22 has extended offer to waive 90% income tax for tax payers having annual transactions up to Rs two million, 75% waiver is granted for taxpayers having annual transaction size from Rs 2 to 5 million and 50% waiver to those taxpayers having annual transaction of Rs 5 to 10 million. Severely affected businesses like hotels, travel & trekking, transportation, aviation, cinema industry and media houses can transfer their losses for 10 years and plan their losses accordingly, they will be able to enjoy hefty income tax waiver as fiscal budget provisions only 1% income tax for them. Private companies and firms can enjoy tax and penalty exemption if they submit tax details till fiscal 2018-19 and 10% of accrued fees and penalty by the first quarter of fiscal 2021-22. Cases filed in Inland Revenue Department for administrative review and also in Revenue Tribunal and Courts for judicial review except forged and fake VAT bills related cases can enjoy 50% waiver in interest accrued in tax amount slapped by the respective tax authority if taxpayer withdraw petition and file tax with 50% per cent interest accrued within first five months of upcoming fiscal.The main opposition Nepali Congress has termed the budget as ‘Hail Mary Budget’ as it seems like a desperate attempt to score late in the game of elections, violating the accountability towards public finance which has increased fiduciary risks.CSR amount contributed for Covid 19 prevention, control and treatment funds as well as such amount extended to Covid hospitals can be deducted while calculating taxable amount. Likewise, 25% waiver is extended in taxable amount for those receiving pensions. Oxygen plant installation and production of related products are offered customs, VAT and excise exemption till first half of fiscal 2021-22. Similarly, the fiscal budget announced to lessen the lease amount to set up industries in special economic zones (SEZs). It has offered land without lease charge/fees for the assembling and production of electric vehicles in Nepal and announced to provide tax incentives as well. Major tax revisions are witnessed in electric home appliances and electric vehicles. Excise slapped by former Finance Minister Yubaraj Khatiwada on electric vehicles and electric home appliances are scrapped from the fiscal budget 2021-22. Only 1% customs duty is levied for induction heaters to encourage households towards electricity consumption. Customs duty of electric appliances on everyday household electric utilities has been slashed from 15% to 10%. Likewise, custom duty on dishwashers and washing machines has been trimmed from 30% to 20%. The fiscal budget announced levying only 15% customs duty on refrigerators and freezers instead of the prevailing 20%. The fiscal budget has increased customs duty on cocoa powder and chocolates from 30 to 40%, and doubled customs duty on panels and concrete used in prefabricated buildings to 20% on panels and 30% on concrete respectively. The fiscal budget has also raised 2.5 percentage points capital gain tax (CGT) for individual investors if they sell securities in short span of less than a year. Those holding securities for a year are allowed to file only 5% as CGT. However, those who sell within a year have to submit 7.5% as CGT.

Private sector lauds the budget

The private sector has hailed the budget as it has envisaged to revive the economy hit hard by the pandemic encouraging private investment through incentives and facilities. “The budget has incorporated the feedbacks of the private sector and also motivates private sector investment in a bid to enhance productivity and create jobs”, said Shekhar Golchha, President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), “Proper execution of the budget will be able to deliver results. The waivers and incentives offered by the government will stimulate private sector activities,” he added. Further, Golchha appreciated the government’s policy to support startups and lure private sector in infrastructure development through viability gap funding for public-private partnership projects.

Published Date: July 6, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Feature