Price of consumable goods started skyrocketing in the new normal after the Covid 19 pandemic, further triggered by rise in fuel price along with the effects of the prolonged Ukraine-Russia war on global markets. As an import driven economy, Nepal witnessed substantive rise on import bills with soaring inflation in source markets coupled with higher transportation and logistics costs.

Clearly it will be a herculean task for Nepal Rastra Bank (NRB) - the central regulatory and monetary authority - to limit inflation at desired level. NRB has set a target to tame inflation within 6.5% in fiscal 2021-22. It has envisaged to keep inflation to the given target lowering mobilisation of private sector credit compared to previous fiscal. But despite the slowdown in credit mobilisation and government spending which are responsible for creating demand, hyperinflation of goods and services are basically driven by the supply side rather than the demand side, according to economist Prof Bishwambher Pyakuryal, “We are importing inflation along with goods and services, only thing rising in the post-Covid economy is inflation.”

Pyakuryal assumes that the country may witness double-digit inflation if fuel prices continue to rise hitting new records in the coming days. Fuel price rise causes manifold impacts on the economy, prices of daily essentials goes up as an immediate impact affecting livelihoods. Similarly, rise in cost of production will have long lasting implications on the national economy. Low-income and middle-income families have to spend more for survival vis-à-vis their income. And with this, hyperinflation throws water on the government’s efforts at poverty alleviation.

High inflation, in fact, pushes low-income groups into the vicious cycle of poverty again, and the government then has to come up with initiatives for their protection as they face unprecedented hardships in their lives. According to Pyakuryal, “In my observation, Nepali economy is moving towards a situation of stagflation, in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. The government and the central bank in collaboration with the private sector should come up with effective interventions to cope with the current situation.”

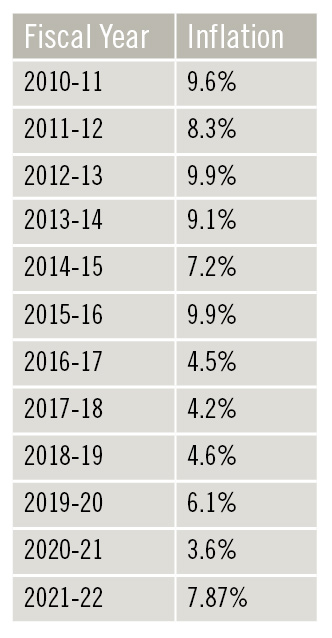

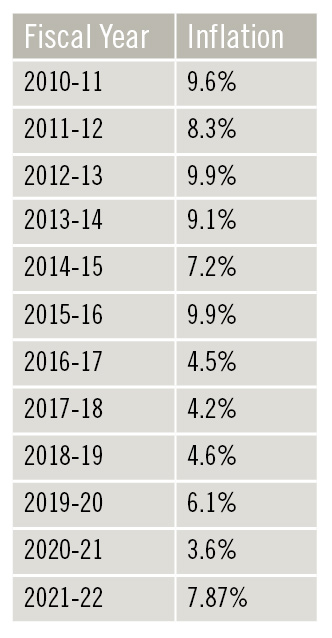

Year-on-year inflation trends show there was moderate inflation in recent years from 2015-16 to 2020-21 largely due to inflation peaking because of supply disruptions at Indo-Nepal border, prolonged protest in Tarai districts by the dissatisfied political parties following the promulgation of the new Constitution.

READ ALSO:

READ ALSO:

Inflation trend

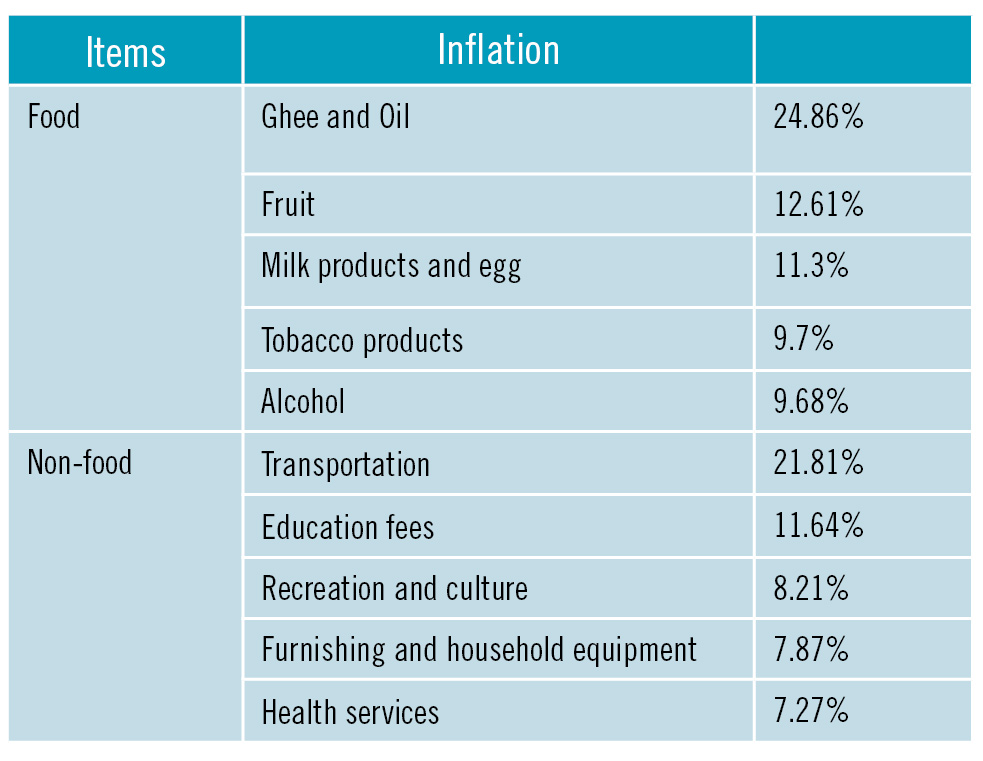

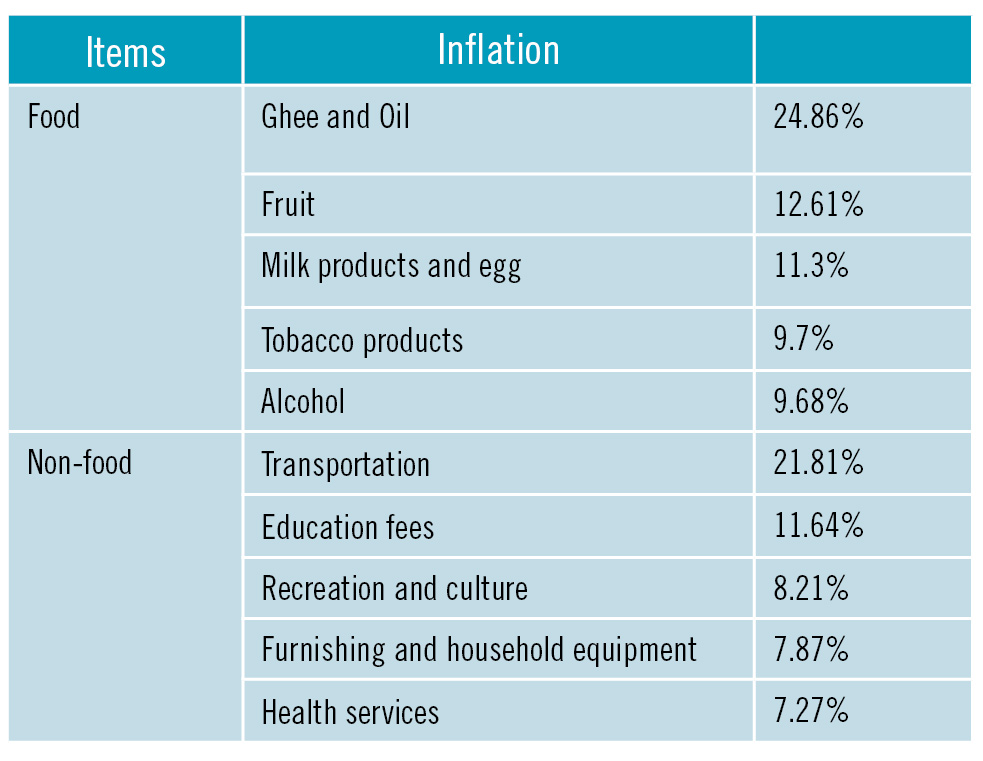

Inflation hits low-income families hard

High-inflation on both food and non-food items hits consumers hard. Daily essentials like ghee and oil, milk, egg, fruit and vegetables witnessed price rise up to 25%, according to NRB data. Likewise, vital services like transportation fare, education and health fees soared the most among other services. Low-income families have been facing trouble in availing such services.

Import bill of fuel almost doubled

Nepal Oil Corporation (NOC) has reviewed fuel prices 16 times between August and June, prices increased in each revision, except twice. In this fiscal (by the end of June), price of petrol, diesel and cooking gas increased up to 55.5%, 72.9% and 26.3% respectively, before the government intervened to lower fuel price on June 25 cutting taxes levied on petroleum products. The government decided to lower the price of petrol and diesel by Rs 20 and Rs 29 per litre, respectively. However, NOC officials have said that this is a temporary solution, they can’t bear the losses and need to adjust consumer prices in line with international market prices eventually. According to NRB data, the country’s import bill of fuel increased by almost two-folds in 10 months (mid-July to mid-May) of 2021-22 to hover at Rs 253.16 billion as compared to Rs 139.8 billion of the corresponding period in the previous fiscal year. Share of petroleum products stands at 15.8% in the total imports of the country.High inflation on import-goods dents foreign exchange reserves

Import bills have swollen due to high global commodity prices putting a dent on the country’s foreign exchange reserves which are plummeting sharply since the beginning of ongoing fiscal 2021-22. Nepal Rastra Bank as the custodian of the foreign exchange reserves has introduced multiple provisions to curb imports including cent per cent L/C margin for import of goods and services. It has raised the risk weightage of import credit and provided moral suasions to bankers to orient resources towards boosting domestic production instead of encouraging rampant imports. External sector stability is a critical challenge for a country like Nepal which sorely lacks stable foreign exchange earnings, and is highly dependent on imports due to its deficient competitive production base in manufacturing, agricultural and industrial fronts. The country has sufficient foreign exchange reserves to cover imports of 6.5 months till mid-May and given the current scenario of imports, the situation is alarming, according to Maha Prasad Adhikari, Governor of NRB, ‘We must bring foreign currency at par of the level of our import bills, otherwise it will be difficult for us to keep importing as we wish.” The country’s foreign currency reserve which was at $11.75 billion in the beginning of the ongoing fiscal year (mid-July, 2021) depleted by 21% in 10 months (mid-May) and hovers at $9.27 billion. Experts have said that the government must step in with effective and innovative actions to expand foreign exchange reserves of the country. In view of depleting foreign exchange reserves, Bangladesh decided to defer works of non-urgent government projects to minimise its import bills on construction materials through which the country intends to address the dire need of foreign currencies in priority areas. Such experience of a neighbouring country can be viewed as lesson for Nepal, according to senior economist Dr Dilli Raj Khanal.Contractors halt work, development projects stalled

Seeking cost variation on government-run development projects in line with inflation, contractors have halted works on ongoing development projects. This move by the contractors slows the pace of project execution affecting the project performance and overall project-lifecycle. Ravi Singh, President of the Federation of Contractors Associations of Nepal (FCAN), the umbrella association of contractors in the country, has said that the government has summoned them to talk and find a solution to take projects forward. “Normally, multiyear contracts have room price adjustment of up to 10% if the price of construction materials shoots up, and it minimises accordingly if the cost of construction materials plummets,” Singh told Business 360, “The government has not reviewed the Technical Guidelines issued for the first time in June 2008.” He urged the government to include single-year projects to be eligible for cost adjustment like multiyear contracts citing the unexpected price rise of petroleum products, bitumen, iron, sand, aggregates and others. It is reported that around 5,000 projects of total estimated project cost of Rs 500 billion are stalled due to increase in price of construction materials. READ ALSO:

READ ALSO:

Published Date: July 27, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Feature