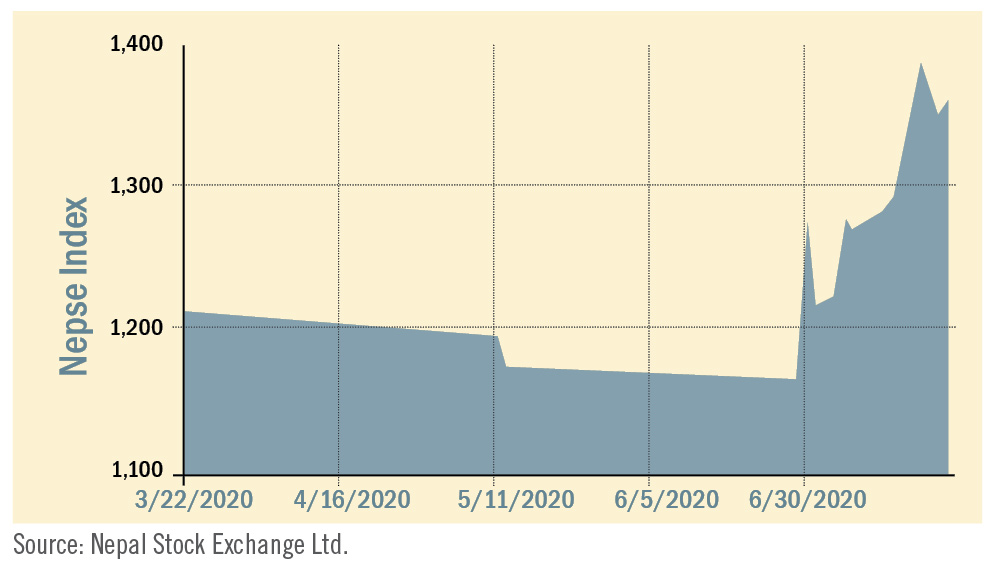

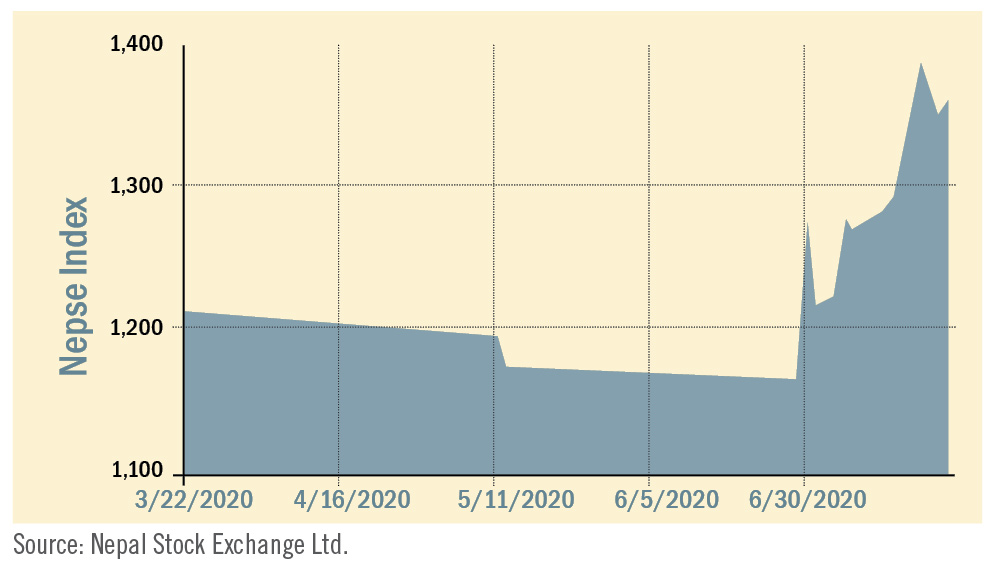

During the review period of March 22 to July 23, the Nepal Stock Exchange index went up by 173.31 points (+13.65%) to close at 1,442.61 points. The market remained closed from March 23 till June 28, and it briefly opened for two trading days on May 11 and 12. Even though NEPSE introduced NEPSE Online Trading System (NOTS) in 2018, lack of mechanisms and full-fledged implementation required for the system have severely affected automated operation of NEPSE leading to extended closure of market thus paralysing the sole secondary market.

Despite the odds, favourable provisions outlined in the monetary policy for the current fiscal year 2020/21 has boosted investor confidence thus creating fresh buying pressure in the secondary market. Provisions such as margin lending ceiling which has been increased to 70% from 65%; and for share valuation, 120 days average price will be taken instead of 180 days while disbursing margin loan against shares. Likewise, restriction on distribution of cash dividend for Banks and Financial Institutions (BFIs) only up to 30% of their distributable profit for the last FY 2019/20 has further excited investors in the expectation of bonus shares. Also clarity in Capital Gain Tax (CGT) has further supported the growth. Within 17 days of trading post opening of the market, the market witnessed an encouraging market turnover of Rs 12.30 billion, with an average daily turnover of Rs 723.8 million.

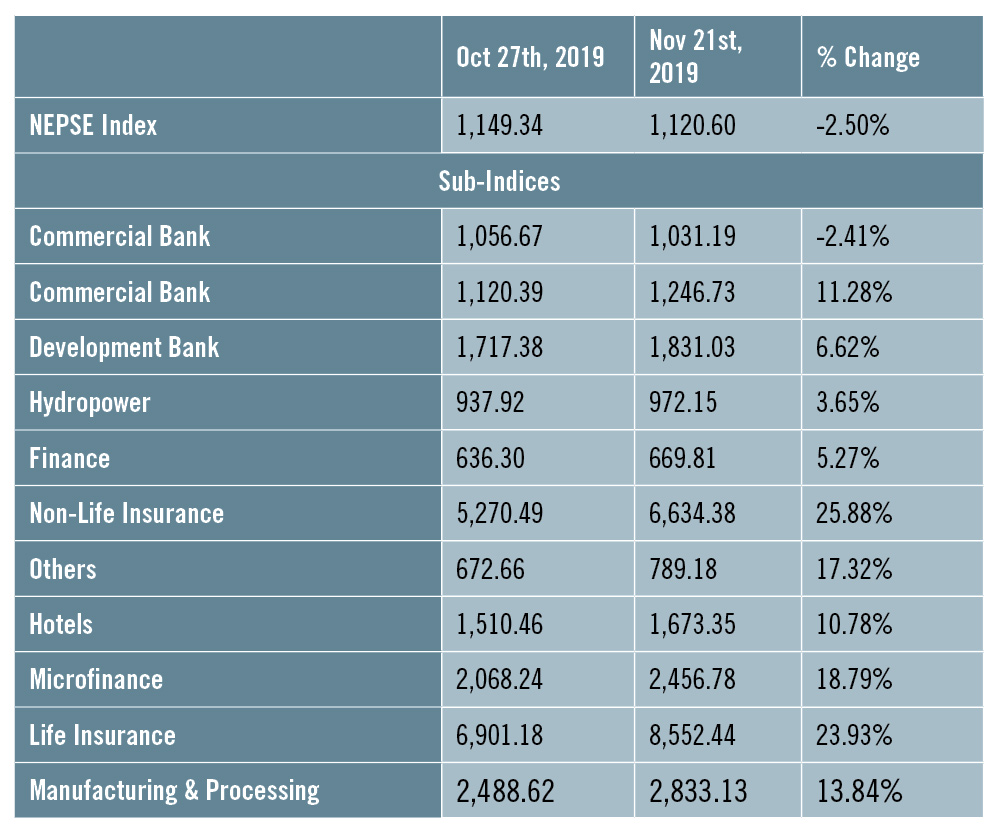

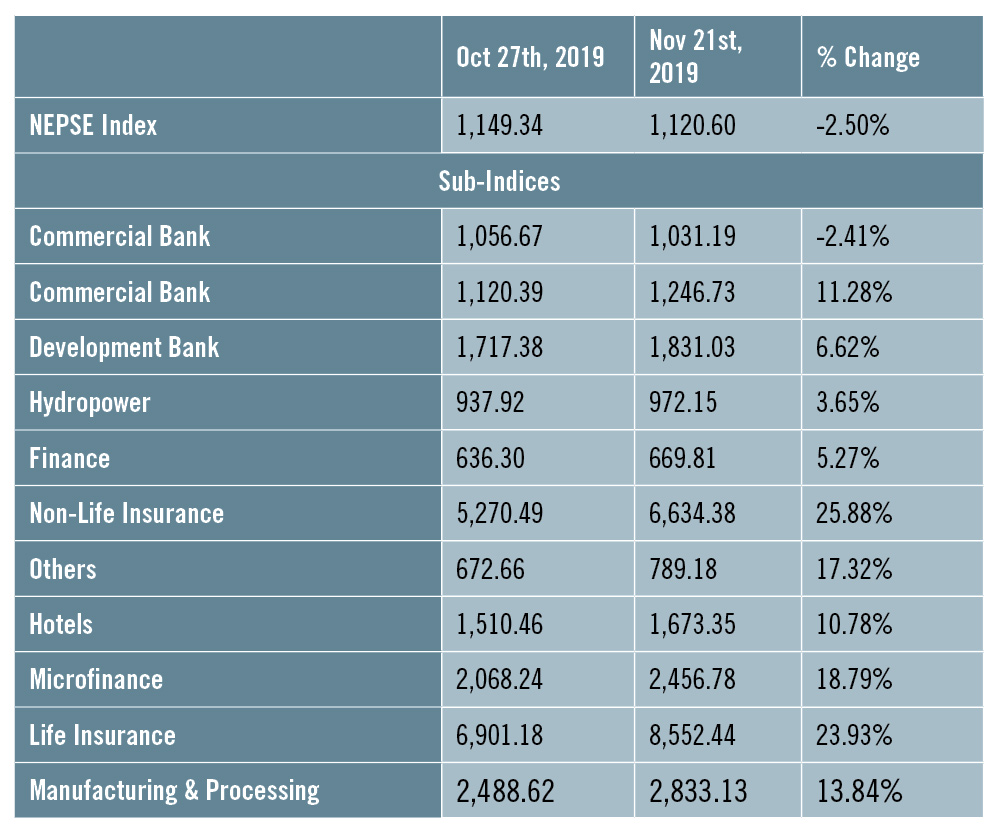

During the review period, all sub-indices landed in the green zone. The Non-Life Insurance sub-index (+25.88%) was the biggest winner as share value of Rastriya Beema (+Rs 1177), Shikhar Insurance (+Rs 368) and Neco Insurance (+Rs 179) went up. Life Insurance sub-index (+23.93%) was second in line with increase in the share value of Nepal Life Insurance (+Rs 283), Life Insurance (+Rs 275) and Asian Life Insurance (+Rs 150).

Microfinance sub-index (+18.79%) also followed suit with the rise in the share value of Sana Kisan (+Rs 283), Laxmi Microfinance (+Rs 185) and Mithila Microfinance (+Rs 185). Similarly, the Others sub-index (+17.32%) was also in the gaining side with increase in the share value of Citizen Investment Trust (+Rs 66) and Nepal Telecom (+Rs 45). Manufacturing & Processing sub-index (+13.84%) also grew as share value of Himalayan Distillery (+Rs 449) and Shivam Cements (+Rs 116) went up. Likewise, the Commercial Bank sub-index (+11.28%) also saw a rise with increase in the share value of Everest Bank (+Rs 129), Nabil Bank (+Rs 120) and Standard Chartered (+Rs 84). Hotels sub-index (+10.78%) also went up as share value of Oriental Hotels (+Rs 65) and Taragaon Regency (+Rs 21) surged. Similarly, Development Bank sub-index (+6.62%) also showed increment as share value of Muktinath Development (+Rs 40) and Garima Development (+Rs 30) went up.

Additionally, on the gaining streak, Finance sub-index (+5.27%) soared as share value of Manjushree Finance (+Rs 52), United Finance (+Rs 16) and ICFC Finance (+Rs 16) went up. Hydropower sub-index (+3.65%) also witnessed moderate gains as the share value of Butwal Power (+Rs 32), Sanima Mai (+Rs 27) and Chilime Hydropower (+Rs 27) rose.

During the review period, all sub-indices landed in the green zone. The Non-Life Insurance sub-index (+25.88%) was the biggest winner as share value of Rastriya Beema (+Rs 1177), Shikhar Insurance (+Rs 368) and Neco Insurance (+Rs 179) went up. Life Insurance sub-index (+23.93%) was second in line with increase in the share value of Nepal Life Insurance (+Rs 283), Life Insurance (+Rs 275) and Asian Life Insurance (+Rs 150).

Microfinance sub-index (+18.79%) also followed suit with the rise in the share value of Sana Kisan (+Rs 283), Laxmi Microfinance (+Rs 185) and Mithila Microfinance (+Rs 185). Similarly, the Others sub-index (+17.32%) was also in the gaining side with increase in the share value of Citizen Investment Trust (+Rs 66) and Nepal Telecom (+Rs 45). Manufacturing & Processing sub-index (+13.84%) also grew as share value of Himalayan Distillery (+Rs 449) and Shivam Cements (+Rs 116) went up. Likewise, the Commercial Bank sub-index (+11.28%) also saw a rise with increase in the share value of Everest Bank (+Rs 129), Nabil Bank (+Rs 120) and Standard Chartered (+Rs 84). Hotels sub-index (+10.78%) also went up as share value of Oriental Hotels (+Rs 65) and Taragaon Regency (+Rs 21) surged. Similarly, Development Bank sub-index (+6.62%) also showed increment as share value of Muktinath Development (+Rs 40) and Garima Development (+Rs 30) went up.

Additionally, on the gaining streak, Finance sub-index (+5.27%) soared as share value of Manjushree Finance (+Rs 52), United Finance (+Rs 16) and ICFC Finance (+Rs 16) went up. Hydropower sub-index (+3.65%) also witnessed moderate gains as the share value of Butwal Power (+Rs 32), Sanima Mai (+Rs 27) and Chilime Hydropower (+Rs 27) rose.

Securities Board of Nepal (SEBON) also released its policies and programmes for the securities and commodities exchange market for FY 2020/21. As per the policies and programmes, SEBON will focus on four core areas in the next fiscal year which include secondary market development, regulatory structuring, institutional regulation and research and investor literacy. SEBON also hinted that it would be creating an SME platform for the trading of securities of small businesses and industries.

In the public issue front, public offering of AJod insurance, NIC Asia Microfinance and Sadhana Microfinance was carried out which was successfully subscribed. Meanwhile, SEBON has approved the proposed Initial Public Offering (IPO) of Mountain Energy Nepal Hydropower worth Rs 393 million. Nabil Investment Banking has been appointed as its issue manager. Care Nepal has assigned ‘CARE-NP IPO Grade 4+ [IPO Grade Four Plus]’ grading to this. Similarly, SEBON has added the IPO of Reliance Life Insurance worth Rs 630 million to its pipeline. Sanima Capital has been appointed as the issue manager. It has also added the IPO of Chandragiri Hills worth Rs 184.09 million and Dish Media Network worth Rs 238 million to its pipeline. Global IME Capital is the issue manager for both the IPOs.

Securities Board of Nepal (SEBON) also released its policies and programmes for the securities and commodities exchange market for FY 2020/21. As per the policies and programmes, SEBON will focus on four core areas in the next fiscal year which include secondary market development, regulatory structuring, institutional regulation and research and investor literacy. SEBON also hinted that it would be creating an SME platform for the trading of securities of small businesses and industries.

In the public issue front, public offering of AJod insurance, NIC Asia Microfinance and Sadhana Microfinance was carried out which was successfully subscribed. Meanwhile, SEBON has approved the proposed Initial Public Offering (IPO) of Mountain Energy Nepal Hydropower worth Rs 393 million. Nabil Investment Banking has been appointed as its issue manager. Care Nepal has assigned ‘CARE-NP IPO Grade 4+ [IPO Grade Four Plus]’ grading to this. Similarly, SEBON has added the IPO of Reliance Life Insurance worth Rs 630 million to its pipeline. Sanima Capital has been appointed as the issue manager. It has also added the IPO of Chandragiri Hills worth Rs 184.09 million and Dish Media Network worth Rs 238 million to its pipeline. Global IME Capital is the issue manager for both the IPOs.

During the review period, all sub-indices landed in the green zone. The Non-Life Insurance sub-index (+25.88%) was the biggest winner as share value of Rastriya Beema (+Rs 1177), Shikhar Insurance (+Rs 368) and Neco Insurance (+Rs 179) went up. Life Insurance sub-index (+23.93%) was second in line with increase in the share value of Nepal Life Insurance (+Rs 283), Life Insurance (+Rs 275) and Asian Life Insurance (+Rs 150).

Microfinance sub-index (+18.79%) also followed suit with the rise in the share value of Sana Kisan (+Rs 283), Laxmi Microfinance (+Rs 185) and Mithila Microfinance (+Rs 185). Similarly, the Others sub-index (+17.32%) was also in the gaining side with increase in the share value of Citizen Investment Trust (+Rs 66) and Nepal Telecom (+Rs 45). Manufacturing & Processing sub-index (+13.84%) also grew as share value of Himalayan Distillery (+Rs 449) and Shivam Cements (+Rs 116) went up. Likewise, the Commercial Bank sub-index (+11.28%) also saw a rise with increase in the share value of Everest Bank (+Rs 129), Nabil Bank (+Rs 120) and Standard Chartered (+Rs 84). Hotels sub-index (+10.78%) also went up as share value of Oriental Hotels (+Rs 65) and Taragaon Regency (+Rs 21) surged. Similarly, Development Bank sub-index (+6.62%) also showed increment as share value of Muktinath Development (+Rs 40) and Garima Development (+Rs 30) went up.

Additionally, on the gaining streak, Finance sub-index (+5.27%) soared as share value of Manjushree Finance (+Rs 52), United Finance (+Rs 16) and ICFC Finance (+Rs 16) went up. Hydropower sub-index (+3.65%) also witnessed moderate gains as the share value of Butwal Power (+Rs 32), Sanima Mai (+Rs 27) and Chilime Hydropower (+Rs 27) rose.

During the review period, all sub-indices landed in the green zone. The Non-Life Insurance sub-index (+25.88%) was the biggest winner as share value of Rastriya Beema (+Rs 1177), Shikhar Insurance (+Rs 368) and Neco Insurance (+Rs 179) went up. Life Insurance sub-index (+23.93%) was second in line with increase in the share value of Nepal Life Insurance (+Rs 283), Life Insurance (+Rs 275) and Asian Life Insurance (+Rs 150).

Microfinance sub-index (+18.79%) also followed suit with the rise in the share value of Sana Kisan (+Rs 283), Laxmi Microfinance (+Rs 185) and Mithila Microfinance (+Rs 185). Similarly, the Others sub-index (+17.32%) was also in the gaining side with increase in the share value of Citizen Investment Trust (+Rs 66) and Nepal Telecom (+Rs 45). Manufacturing & Processing sub-index (+13.84%) also grew as share value of Himalayan Distillery (+Rs 449) and Shivam Cements (+Rs 116) went up. Likewise, the Commercial Bank sub-index (+11.28%) also saw a rise with increase in the share value of Everest Bank (+Rs 129), Nabil Bank (+Rs 120) and Standard Chartered (+Rs 84). Hotels sub-index (+10.78%) also went up as share value of Oriental Hotels (+Rs 65) and Taragaon Regency (+Rs 21) surged. Similarly, Development Bank sub-index (+6.62%) also showed increment as share value of Muktinath Development (+Rs 40) and Garima Development (+Rs 30) went up.

Additionally, on the gaining streak, Finance sub-index (+5.27%) soared as share value of Manjushree Finance (+Rs 52), United Finance (+Rs 16) and ICFC Finance (+Rs 16) went up. Hydropower sub-index (+3.65%) also witnessed moderate gains as the share value of Butwal Power (+Rs 32), Sanima Mai (+Rs 27) and Chilime Hydropower (+Rs 27) rose.

News and Highlights

With the objective to fully automate online trading, SEBON has directed NEPSE to connect investor’s bank account and DEMAT account with NEPSE’s Online Trading System (NOTS). Such provision will electronically settle share transactions and payments. For instance, the traded shares will be electronically credited in the investors DEMAT account (purchaser) while the transaction amount will be automatically credited in the sellers bank account. Likewise, SEBON has directed NEPSE to make arrangements settle payment of transactions in the market completely via online payment mediums only starting from Mid-July 2020. Securities Board of Nepal (SEBON) also released its policies and programmes for the securities and commodities exchange market for FY 2020/21. As per the policies and programmes, SEBON will focus on four core areas in the next fiscal year which include secondary market development, regulatory structuring, institutional regulation and research and investor literacy. SEBON also hinted that it would be creating an SME platform for the trading of securities of small businesses and industries.

In the public issue front, public offering of AJod insurance, NIC Asia Microfinance and Sadhana Microfinance was carried out which was successfully subscribed. Meanwhile, SEBON has approved the proposed Initial Public Offering (IPO) of Mountain Energy Nepal Hydropower worth Rs 393 million. Nabil Investment Banking has been appointed as its issue manager. Care Nepal has assigned ‘CARE-NP IPO Grade 4+ [IPO Grade Four Plus]’ grading to this. Similarly, SEBON has added the IPO of Reliance Life Insurance worth Rs 630 million to its pipeline. Sanima Capital has been appointed as the issue manager. It has also added the IPO of Chandragiri Hills worth Rs 184.09 million and Dish Media Network worth Rs 238 million to its pipeline. Global IME Capital is the issue manager for both the IPOs.

Securities Board of Nepal (SEBON) also released its policies and programmes for the securities and commodities exchange market for FY 2020/21. As per the policies and programmes, SEBON will focus on four core areas in the next fiscal year which include secondary market development, regulatory structuring, institutional regulation and research and investor literacy. SEBON also hinted that it would be creating an SME platform for the trading of securities of small businesses and industries.

In the public issue front, public offering of AJod insurance, NIC Asia Microfinance and Sadhana Microfinance was carried out which was successfully subscribed. Meanwhile, SEBON has approved the proposed Initial Public Offering (IPO) of Mountain Energy Nepal Hydropower worth Rs 393 million. Nabil Investment Banking has been appointed as its issue manager. Care Nepal has assigned ‘CARE-NP IPO Grade 4+ [IPO Grade Four Plus]’ grading to this. Similarly, SEBON has added the IPO of Reliance Life Insurance worth Rs 630 million to its pipeline. Sanima Capital has been appointed as the issue manager. It has also added the IPO of Chandragiri Hills worth Rs 184.09 million and Dish Media Network worth Rs 238 million to its pipeline. Global IME Capital is the issue manager for both the IPOs.

Outlook

The sole secondary market unfortunately remained closed for almost three months. Key stakeholders should work on a robust plan to ensure the existing structure is fully automated and able to operate without any obstructions which will increase the trust of investors in the market. Despite huge fear and ambiguity, new provisions and policies outlined in the monetary policy has created a favourable environment for investors. Further as interest rates are on a downward spiral, with this vibrancy, the market is likely to witness some fresh buying pressure with some corrections.

Published Date: August 13, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take