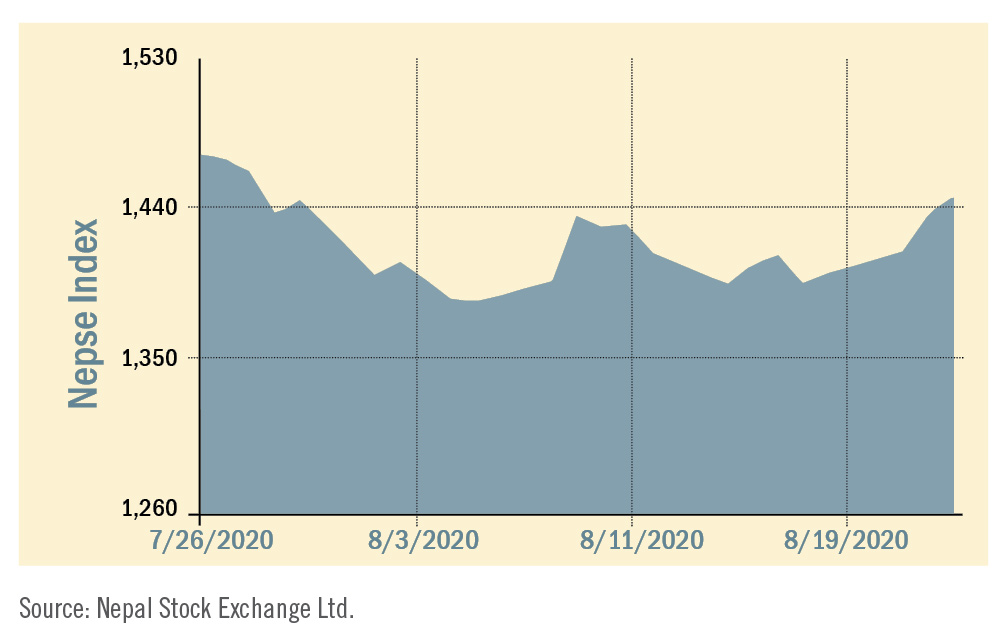

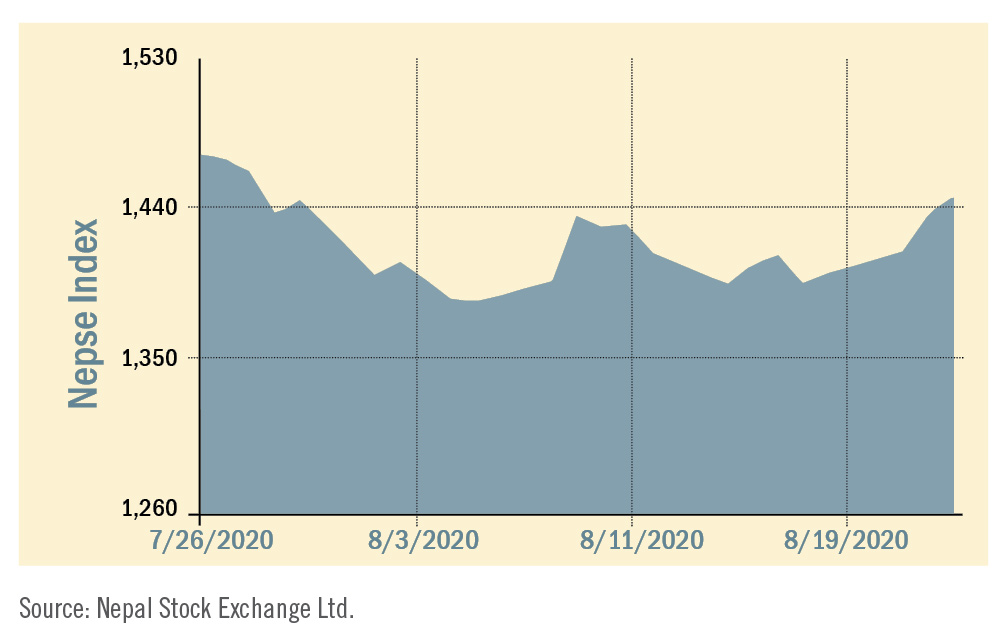

During the review period of July 23 to August 25, the Nepal Stock Exchange Index went down by 1.67 points (-0.12%) to close at 1,440.94 points. The market witnessed a volatile movement during the review period. With the reopening of the market and positive provisions to boost the secondary market, the market had started to gain its momentum and went as high as 1465 points. However, higher selling pressure along with growing Covid 19 cases nationwide dampened investor confidence and saw the market drop to as low as 1391.47 points. In addition, the expected dismal annual performance of listed companies especially the commercial banks also weighed down investor confidence. As the interest rates are on a downward spiral, the market is gradually picking momentum as the total market turnover during the review period went up by 46.20% and stood at Rs 29.09 billion.

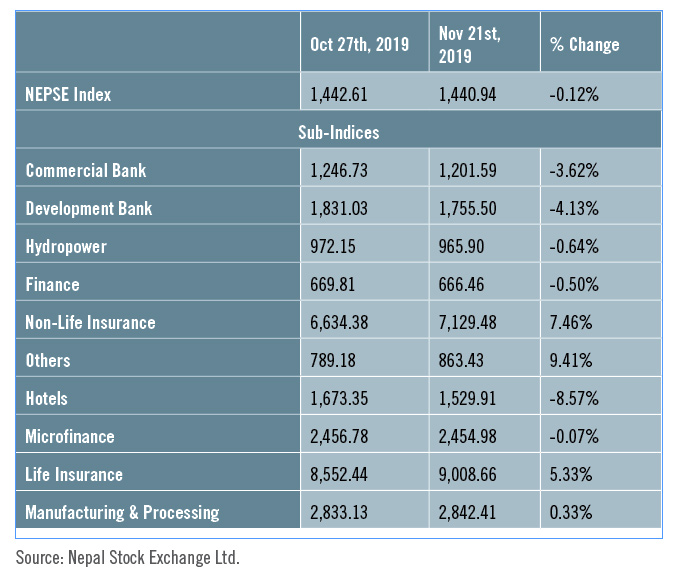

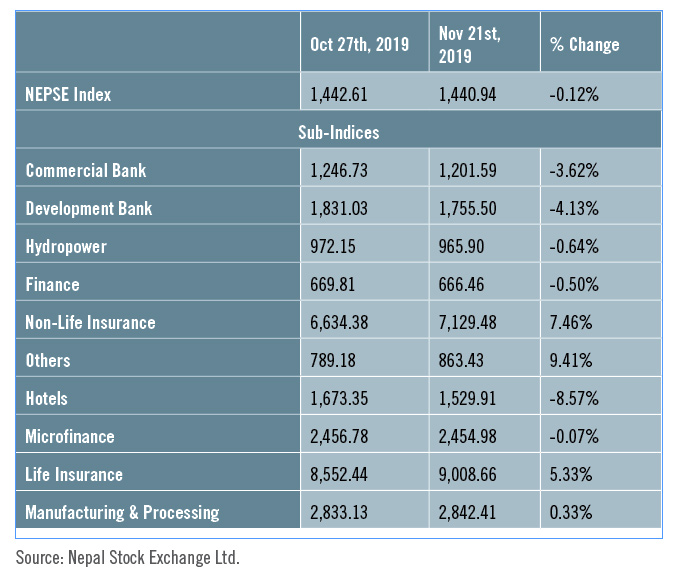

During the review period, four of the sub-indices landed in the green zone while six of them fell into the red zone. The Others sub-index (+9.41%) was the biggest winner as share value of Citizen Investment Trust (+Rs 344) and Nepal Telecom (+Rs 10) went up. Non-Life Insurance (+7.46%) was second in line with the increase in the share value of Sagarmatha Insurance (+Rs 100), Premier Insurance (+Rs 81) and Neco Insurance (+Rs 66). Life Insurance sub-index (+5.33%) also followed suit with the rise in the share value of Prime Life Insurance (+Rs 64), Surya Life Insurance (+Rs 62) and Asian Life Insurance (+Rs 60). Likewise, Manufacturing & Processing sub-index (+0.33%) was also in the gaining side with increase in the share value of Shivam Cements (+Rs 29).

On the losing side, Microfinance sub-index (-0.07%) went down with the plunge in the share value of Janauttan Microfinance (-Rs 245), National Microfinance (-Rs 136) and Mahila Microfinance (-Rs 91). Similarly, Finance sub-index (-0.50%) also fell with drop in the share value of Manjushree Finance (-Rs 21), ICFC Finance (-Rs 10) and Best Finance (-Rs 6). Hydropower sub-index (-0.64%) also tumbled as share value of Chilime Hydropower (-Rs 9) and Upper Tamakoshi Hydropower (-Rs 6) went down. Likewise, the Commercial Bank sub-index (-3.62%) also dropped with the slip in the share value of Standard Chartered (-Rs 40), Everest Bank (-Rs 39) and Nepal Investment Bank (-Rs 39). Similarly, Development Bank sub-index (-4.13%) also went down with decrease in the share value of Excel Development (-Rs 22), Mahalaxmi Development (-Rs 16) and Muktinath Development (-Rs 14). Hotels sub-index (-8.57%) also went up down as share value of Oriental Hotels (-Rs 51), Taragon Regency (-Rs 19) and Soaltee Hotel (-Rs 14) declined.

On the losing side, Microfinance sub-index (-0.07%) went down with the plunge in the share value of Janauttan Microfinance (-Rs 245), National Microfinance (-Rs 136) and Mahila Microfinance (-Rs 91). Similarly, Finance sub-index (-0.50%) also fell with drop in the share value of Manjushree Finance (-Rs 21), ICFC Finance (-Rs 10) and Best Finance (-Rs 6). Hydropower sub-index (-0.64%) also tumbled as share value of Chilime Hydropower (-Rs 9) and Upper Tamakoshi Hydropower (-Rs 6) went down. Likewise, the Commercial Bank sub-index (-3.62%) also dropped with the slip in the share value of Standard Chartered (-Rs 40), Everest Bank (-Rs 39) and Nepal Investment Bank (-Rs 39). Similarly, Development Bank sub-index (-4.13%) also went down with decrease in the share value of Excel Development (-Rs 22), Mahalaxmi Development (-Rs 16) and Muktinath Development (-Rs 14). Hotels sub-index (-8.57%) also went up down as share value of Oriental Hotels (-Rs 51), Taragon Regency (-Rs 19) and Soaltee Hotel (-Rs 14) declined.

In the public issue front, during the review period, the Initial Public Offering (IPO) of Reliance Life Insurance worth Rs 630 million, Samaj Microfinance worth Rs 8.6 million and Liberty Energy worth Rs 356 million were successfully oversubscribed. Likewise, SEBON has approved the right shares of Samriddhi Finance worth Rs 363.96 million. Bank of Kathmandu Capital has been appointed as its issue manager. Similarly, SEBON has added the IPO of Ru Ru Hydropower worth Rs 89.69 million to its pipeline. NMB Capital has been appointed as the issue manager. It has also added the debenture of Siddhartha Bank, SBL Debenture 2084, with a maturity of seven years at 8.5% worth Rs 3 billion to its pipeline.

In the public issue front, during the review period, the Initial Public Offering (IPO) of Reliance Life Insurance worth Rs 630 million, Samaj Microfinance worth Rs 8.6 million and Liberty Energy worth Rs 356 million were successfully oversubscribed. Likewise, SEBON has approved the right shares of Samriddhi Finance worth Rs 363.96 million. Bank of Kathmandu Capital has been appointed as its issue manager. Similarly, SEBON has added the IPO of Ru Ru Hydropower worth Rs 89.69 million to its pipeline. NMB Capital has been appointed as the issue manager. It has also added the debenture of Siddhartha Bank, SBL Debenture 2084, with a maturity of seven years at 8.5% worth Rs 3 billion to its pipeline.

On the losing side, Microfinance sub-index (-0.07%) went down with the plunge in the share value of Janauttan Microfinance (-Rs 245), National Microfinance (-Rs 136) and Mahila Microfinance (-Rs 91). Similarly, Finance sub-index (-0.50%) also fell with drop in the share value of Manjushree Finance (-Rs 21), ICFC Finance (-Rs 10) and Best Finance (-Rs 6). Hydropower sub-index (-0.64%) also tumbled as share value of Chilime Hydropower (-Rs 9) and Upper Tamakoshi Hydropower (-Rs 6) went down. Likewise, the Commercial Bank sub-index (-3.62%) also dropped with the slip in the share value of Standard Chartered (-Rs 40), Everest Bank (-Rs 39) and Nepal Investment Bank (-Rs 39). Similarly, Development Bank sub-index (-4.13%) also went down with decrease in the share value of Excel Development (-Rs 22), Mahalaxmi Development (-Rs 16) and Muktinath Development (-Rs 14). Hotels sub-index (-8.57%) also went up down as share value of Oriental Hotels (-Rs 51), Taragon Regency (-Rs 19) and Soaltee Hotel (-Rs 14) declined.

On the losing side, Microfinance sub-index (-0.07%) went down with the plunge in the share value of Janauttan Microfinance (-Rs 245), National Microfinance (-Rs 136) and Mahila Microfinance (-Rs 91). Similarly, Finance sub-index (-0.50%) also fell with drop in the share value of Manjushree Finance (-Rs 21), ICFC Finance (-Rs 10) and Best Finance (-Rs 6). Hydropower sub-index (-0.64%) also tumbled as share value of Chilime Hydropower (-Rs 9) and Upper Tamakoshi Hydropower (-Rs 6) went down. Likewise, the Commercial Bank sub-index (-3.62%) also dropped with the slip in the share value of Standard Chartered (-Rs 40), Everest Bank (-Rs 39) and Nepal Investment Bank (-Rs 39). Similarly, Development Bank sub-index (-4.13%) also went down with decrease in the share value of Excel Development (-Rs 22), Mahalaxmi Development (-Rs 16) and Muktinath Development (-Rs 14). Hotels sub-index (-8.57%) also went up down as share value of Oriental Hotels (-Rs 51), Taragon Regency (-Rs 19) and Soaltee Hotel (-Rs 14) declined.

News and Highlights

The Securities Exchange Board of Nepal (SEBON) implemented the Specialised Investment Fund Regulations (First Amendment) 2075 with the approval from the Government of Nepal and the Ministry of Finance from July 20. The regulations provide that a fund or fund manager registered abroad may establish or manage a fund in Nepal under full or majority ownership of such fund or fund manager subject to the prevailing Nepali law. The amendments will thus facilitate the inflow of foreign funds and investments in the capital market. NEPSE instructed stock brokering companies regarding the online submission of Know Your Customer (KYC) application forms and the online trading application form indicating that investors willing to trade online can now set up their online platform from their home without having to physically visit broker offices. For this, investors have to go to the Trade Management System (TMS) of their respective stockbroker and register online. After filling the required details, the process is good to go. However, a proper implementation plan is yet to be devised as respective brokers will still have the freedom to choose whether or not to accept such applications. Also, NEPSE has introduced the much awaited guidelines for stock dealer operations. In the public issue front, during the review period, the Initial Public Offering (IPO) of Reliance Life Insurance worth Rs 630 million, Samaj Microfinance worth Rs 8.6 million and Liberty Energy worth Rs 356 million were successfully oversubscribed. Likewise, SEBON has approved the right shares of Samriddhi Finance worth Rs 363.96 million. Bank of Kathmandu Capital has been appointed as its issue manager. Similarly, SEBON has added the IPO of Ru Ru Hydropower worth Rs 89.69 million to its pipeline. NMB Capital has been appointed as the issue manager. It has also added the debenture of Siddhartha Bank, SBL Debenture 2084, with a maturity of seven years at 8.5% worth Rs 3 billion to its pipeline.

In the public issue front, during the review period, the Initial Public Offering (IPO) of Reliance Life Insurance worth Rs 630 million, Samaj Microfinance worth Rs 8.6 million and Liberty Energy worth Rs 356 million were successfully oversubscribed. Likewise, SEBON has approved the right shares of Samriddhi Finance worth Rs 363.96 million. Bank of Kathmandu Capital has been appointed as its issue manager. Similarly, SEBON has added the IPO of Ru Ru Hydropower worth Rs 89.69 million to its pipeline. NMB Capital has been appointed as the issue manager. It has also added the debenture of Siddhartha Bank, SBL Debenture 2084, with a maturity of seven years at 8.5% worth Rs 3 billion to its pipeline.

Outlook

Strong market volume over the review period indicates increased investor confidence amidst the pandemic. Lower returns on bank savings coupled with lower interest rates on margin lending and fewer avenues for investments, the secondary market is expected to see increased participation in the coming days. Further, the recent surge in uptake of online trading services by investors is likely to boost market participation and daily transactions.

Published Date: September 14, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take