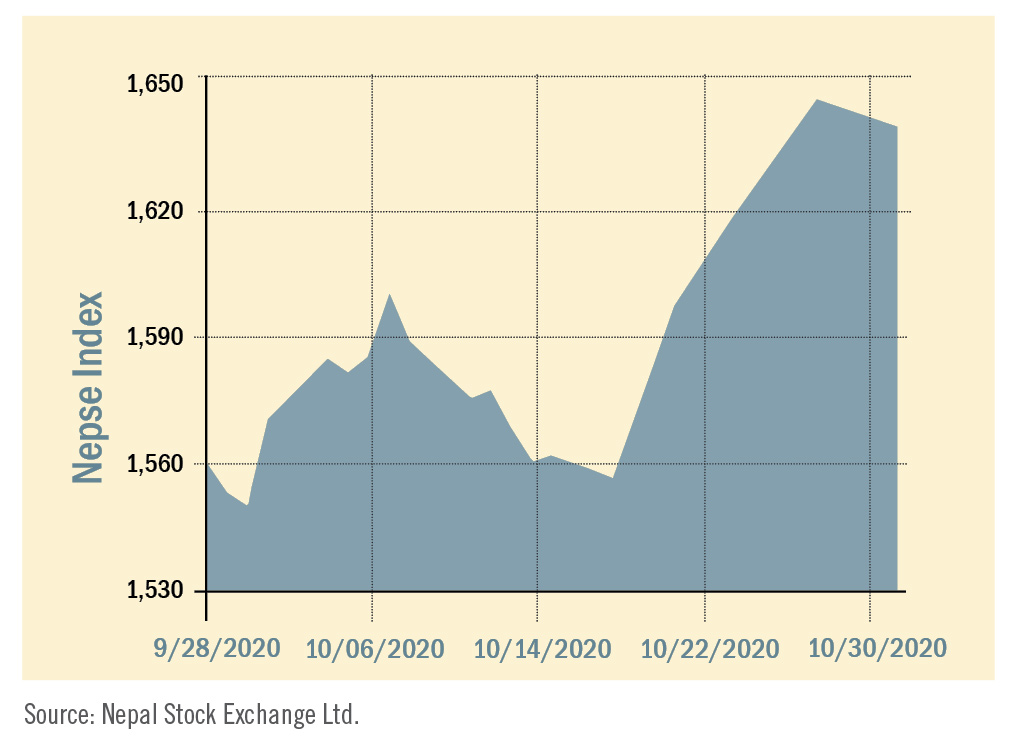

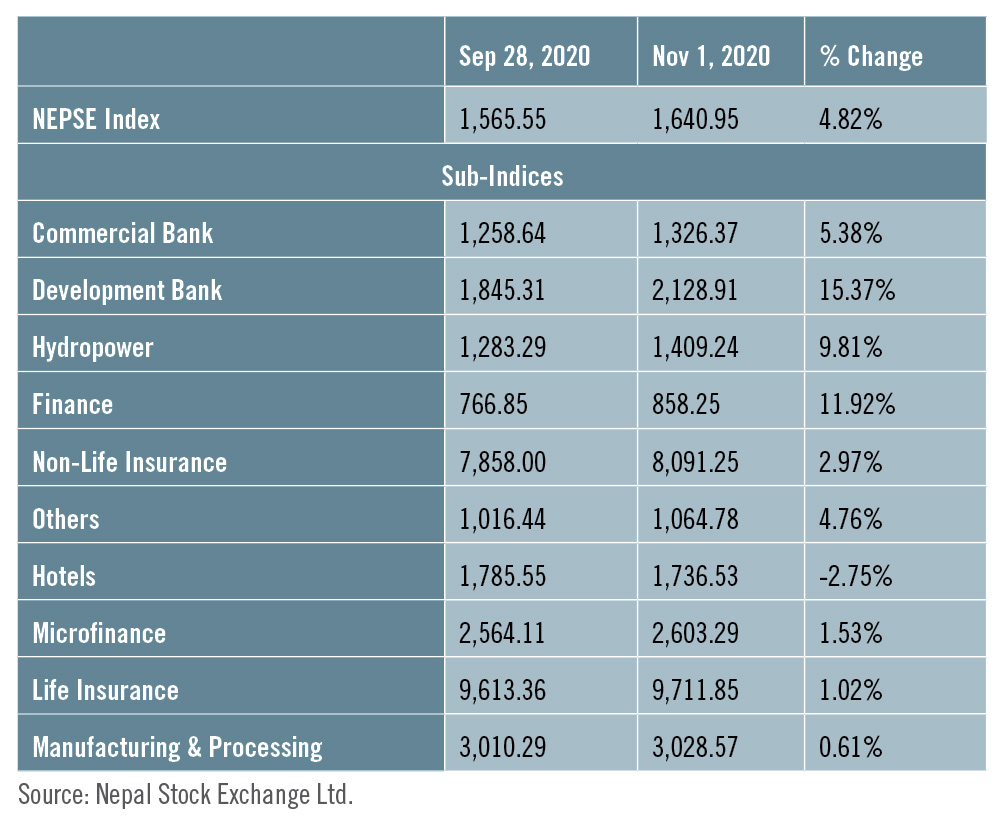

During the review period of September 28 to November 1, the Nepal Stock Exchange (NEPSE) index went up by a whopping 75.40 points (+4.82%) to close at 1,640.95 points. The secondary market usually witnesses high selling pressure during the festive season of Dashain and Tihar as investors try to cover festival expenses. Nonetheless, this year so far the market has remained bullish with high level of transactions. The total market volume during the period went down by -18.72% and stood at Rs 47.65 billion. Yet market investors are upbeat about the upcoming days as key listed companies have started to announce better than expected dividends for its shareholders. The appointment of a new Finance Minister after the Cabinet reshuffle has also kept investor confidence upbeat.

During the review period, nine of the sub-indices landed in the green zone while one sub-index landed in the red zone. The Development Bank Hydropower sub-index (+15.37%) was the biggest gainer as share value of Kamana Sewa Development (+Rs 74), Corporate Development (+Rs 42) and Muktinath Development (+Rs 40) went up. Finance sub-index (+11.92%) was second in line with increase in the share value of ICFC Finance (+Rs 104), Pokhara Finance (+Rs 25) and Manjushree Finance (+Rs 24). Hydropower sub-index (+9.81%) followed suit with rise in the share value of Api Power (+Rs 55), Rairang Hydropower (+Rs 51) and Arun Valley Hydropower (+Rs 48).

The Commercial Bank sub-index (+5.38%) was also on the gaining side with increase in the share value of Prime Commercial (+Rs 52), NIC Asia (+Rs 42) and Himalayan Bank (+Rs 38). Others sub-index (+4.76%) went up with rise in the share value of Citizen Investment Trust (+Rs 230) and Nepal Telecom (+Rs 32). Similarly, Non-life Insurance sub-index (+2.97%) also increased with rise in the share value of Rastriya Beema Company (+Rs 948) and Shikhar Insurance (+Rs 72). The Microfinance sub-index (+1.53%) also saw a jump as share value of Global IME Microfinance (+Rs 89), National Microfinance (+Rs 59) and Mahila Sahatarya Microfinance (+Rs 59) went up. Likewise, the Life Insurance sub-index (+1.02%) also witnessed a surge as the share value of Nepal Life Insurance (+Rs 37) and Life Insurance Company (+Rs 23) increased. Manufacturing & Processing sub-index (+0.61%) saw a rise as share value of Himalayan Distillery (+Rs 70) and Shivam Cements (+Rs 2) gained value.

On the other hand, Hotels sub-index (-2.75%) was on the losing side as share value of Oriental Hotels (-Rs 10), Soaltee Hotel (-Rs 6) and Taragon Regency (-Rs 4) decreased.

News and Highlights

On the public issue front, during the review period, Securities Exchange Board of Nepal (SEBON) has added Initial Public Offering (IPO) of Bindhyabasini Hydropower worth Rs 225 million and Dish Media Network at Rs 238.5 million to its pipeline. Sanima Capital Limited has been appointed as the issue manager of Bindhyabasini Hydropower and Global IME Capital is the issue manager of Dish Media. The right share of Nepal Finance Limited worth Rs 169.7 million with a ratio of 1:1.25 has been approved by SEBON, and Prabhu Capital has been appointed as its issue manager. API Power Company is issuing 1:0.47 units rights to its shareholders starting from October 30.Outlook

This year most listed companies have opted out from announcing dividends before the Dashain holidays. Thus a large number of listed companies are yet to announce dividends from earnings from last FY 2019/2020. Investor confidence is high in anticipation of higher proportion of bonus shares from listed Banks and Financial Institutions (BFIs) due to the existing mechanism of the Central Bank. Further appointment of an investor friendly finance minister has boosted their confidence as during his last tenure the secondary market had scaled to an all-time high. With anticipation of positive provisions to facilitate the share market and easier online trading, the secondary market seems to be becoming a more lucrative option for investment. This might further fuel the market performance in the coming days.

Published Date: November 18, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take