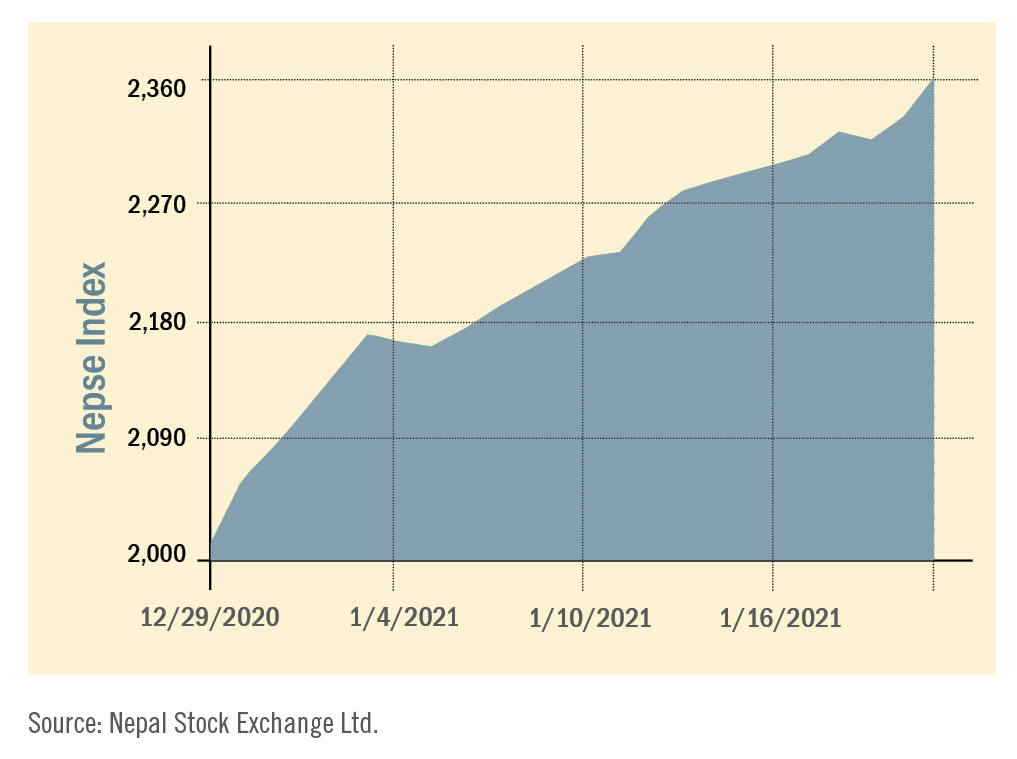

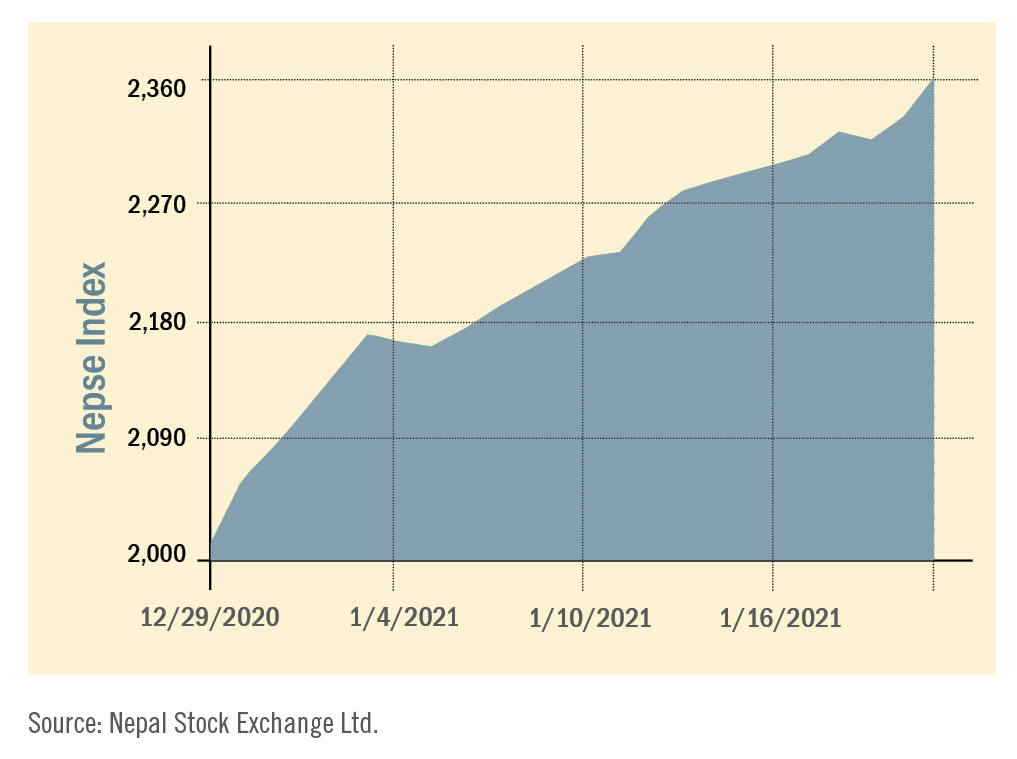

During the review period of December 29, 2020 to January 21, 2021, the Nepal Stock Exchange (NEPSE) index went up by a whopping 367.35 points (+18.30%) to close at 2,374.64 points. The market witnessed a new record on the first trading day of 2021 as the NEPSE index surged past the psychological threshold of 2,100 points. Continuing its record-setting spree, the secondary market traded above 2000 points throughout the review period, and even reached an all-time high of 2,374.64 on January 21. However, the total market volume during the review period decreased by -14.41% and stood at Rs 98.328 billion.

During the review period, contrary to the previous review period, all of the sub-indices landed in the green zone. Finance sub-index (+33.61%) was the biggest gainer as share value of Gurkhas Finance (+Rs 216), United Finance (+Rs 79) and Reliance Finance (+Rs 64) went up. Life Insurance sub-index (+27%) was second in line with increase in the share value of Nepal Life Insurance (+Rs 684), Life Insurance Company (+Rs 596) and Asian Life Insurance (+Rs 221). Microfinance sub-index (+25.69%) also followed suit with rise in the share value of Janautthan Samudayik Microfinance (+Rs 850), National Microfinance (+Rs 598) and Forward Community Microfinance (+Rs 575). Likewise, Non-life insurance sub-index (+22.44%) surged as share value of Rastriya Beema Company (+Rs 2300), Shikhar Insurance (+Rs 444) and IME General Insurance (+Rs 317) went up. Manufacturing & Processing sub-index (+21.83%) also surged as share value of Bottlers Nepal (+Rs 636) and Shivam Cements (+Rs 251) rose.

Following this, Others sub-index (+20.67%) saw a rise in the share value of Nepal Telecom (+Rs 257). Similarly, Development Bank sub-index (+19.73%) increased with surge in the share prices of Corporate Development Bank (+Rs 336) and Sindhu Development Bank (+Rs 47). Hydropower sub-index (+18.75%) gained value with rise in the share values of Chilime Hydropower (+Rs 93), Upper Tamakoshi (+Rs 93) and Barun Hydropower (+Rs 52). Likewise, Commercial Bank sub-index (+12.41%) continued with its upward momentum as share values of Everest Bank (+Rs 125) and Prabhu Bank (+Rs 102) went up. Lastly, Hotels sub-index (+5.92%) also attracted investors as share value of Oriental Hotels (+Rs 21) and Taragaon Regency (+Rs 20) increased.

News and Highlights

The Securities Exchange Board of Nepal (SEBON) has selected 46 institutions out of 62 applicants to be permitted to work as institutional investors for the upcoming Initial Public Offering (IPO) issues which would be floated following the book building method. These institutions are expected to help maintain stability in the stock exchange market. With this new advancement, SEBON also aims to encourage more number of real sector companies to float IPOs and go public using the book building method. Besides, SEBON has also approved the proposal submitted by CDS and Clearing Limited regarding the need to change the current settlement and clearing system from T+3 to T+2 system. This indicates that the settlement process of securities traded will take lesser time than before. In the public issue front, during the review period, SEBON has approved the issuance of Initial Public Offering (IPO) of Singati Hydro Energy worth Rs 435 million and Greenlife Hydropower worth Rs 349.6 million. Mega Capital Markets has been appointed as the issue manager for Singati Hydro whereas BOK Capital has been appointed for Greenlife Hydropower Company. Likewise, SEBON has added the issuance of IPO of Samling Power Company worth Rs 500 million and Nyadi Hydropower worth Rs 405 million to its pipeline. Nepal SBI Merchant Bank and Global IME Capital have been appointed as issue managers respectively. Similarly, SEBON has also approved issuance of debentures of NCC Bank Limited, ‘NCC Rinpatra 2086’ with a rate of 9.5% and a maturity of 10 years and worth Rs 1.2 billion. Nabil Investment Banking has been appointed as its issue manager. Further, right shares of Narayani Development Bank with a 1:1 ratio worth Rs 65.61 million has also been approved.

Outlook

The bullish trend in the secondary market has also attracted significant number of investors into the primary market which is key to long-term market development and depth. The recently concluded largest public issuance was able to attract over 1.5 million investors contrary to an average participation of over half million investors before the pandemic. This is the outcome of limited avenues for investments, slashed interest rate in the banking sector and timely development of required digital infrastructure and regulation. As listed companies have started to roll out its second quarter financial results, the positive movement of market is likely to extend further in the coming days as well.

Published Date: February 23, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take