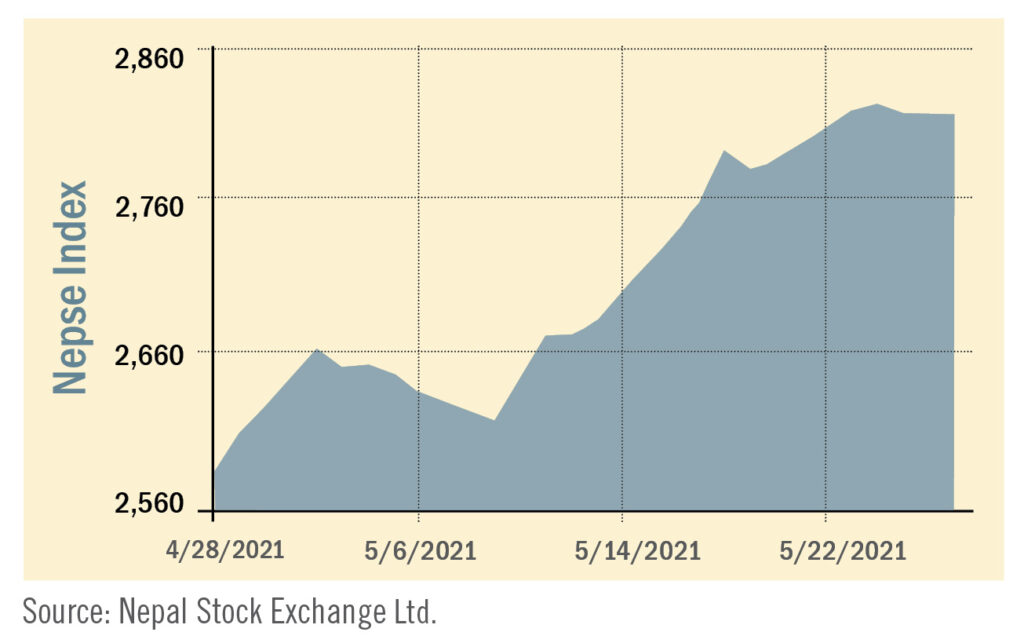

During the review period of April 28 to May 27, 2021, the Nepal Stock Exchange (NEPSE) index went up by a whopping 216.32points (+8.32%) to close at 2,815.39points. Although the country has been hard-hit by the second wave of coronavirus pandemic and the political turmoil, the secondary market continued with its upward momentum. On 27 May 2021, NEPSE crossed trading volume of over Rs 14.768 billion and reached 2815.39 points, making a record in terms of transactions in the history of secondary market in Nepal. As a result, the total market volume during the review period increased substantially by 27.15% and stood at Rs 173.93 billion.

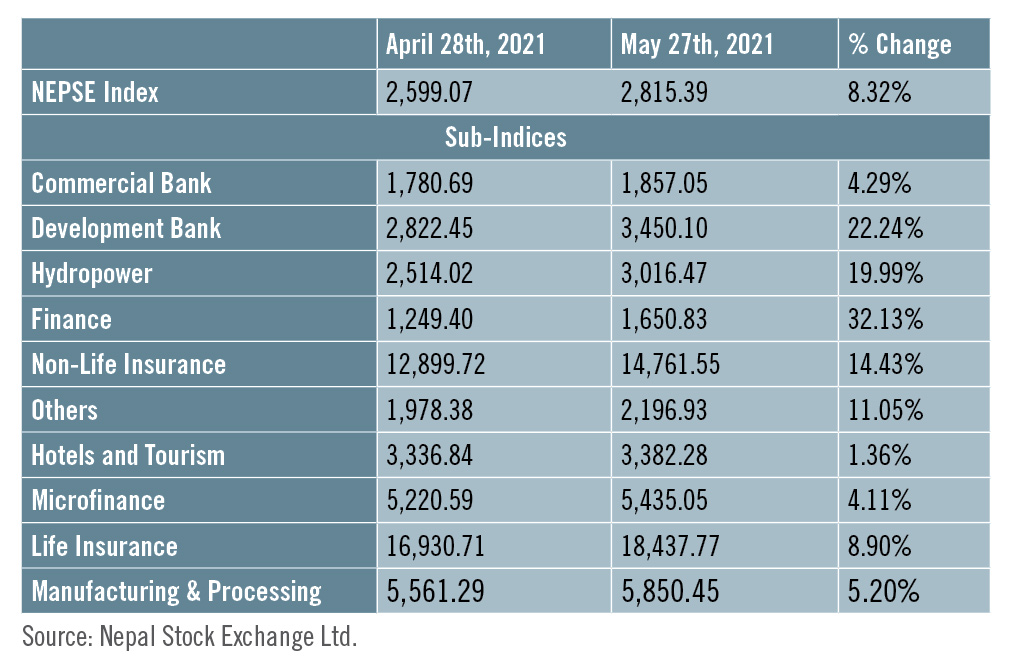

During the review period, contrary to the previous review period, all sub-indices landed in the green zone.

Finance sub-index (+32.13%) was the biggest gainer as share value of Gurkhas Finance (+Rs 234), Goodwill Finance (+Rs 151) and Manjushree Finance (+Rs 156) went up. Development Bank sub-index (+22.24%) was second in line with the increase in the share value of Excel Development (+Rs 112), Miteri Development (+Rs 105) and Karnali Development (+Rs 96). Hydropower sub-index (+19.99%) also followed suit with the rise in share value of Radhi Bidhyut (+Rs 590), Barun Hydropower (+Rs 268) and Arun Valley Hydropower (+Rs 268). Likewise, Non-Life Insurance sub-index (+14.43%) surged as share value of Rastriya Beema Company (+Rs 6200), Shikhar Insurance (+Rs 266) and IME General (+Rs 230) went up. Others sub-index (+11.05%) also rose marginally with increase in share value of Nepal Telecom (+Rs 88).Similarly, Life Insurance sub-index (+8.90%) also witnessed a rise in the share value of Asian Life Insurance (+Rs 220), Surya Life Insurance (+Rs 204) and Life Insurance (+Rs 189).

Manufacturing & Processing sub-index (+5.20%) witnessed an increase in the share value of Bottlers Nepal (Terai) (+Rs 2309), Himalayan Distillery (+Rs 176) and Shivam Cements (+Rs 41).Following this, Commercial Bank sub-index (+4.29%) increased with the drop in share prices of Sanima Bank (+Rs 58), Bank of Kathmandu (+Rs 36) and Laxmi Bank (+Rs 36). Similarly, Microfinance sub-index (+4.11%) also saw a rise in the share value of Mahila Microfinance (+Rs 642), National Microfinance (+Rs 338) and RMDC Microfinance (+Rs 224). Likewise, Hotels and Tourism sub-index (+1.36%) went up marginally as share price of Taragaon Regency Hotel (+Rs 42) went up.

News and Highlights

The Securities Exchange Board of Nepal (SEBON) released a press statement to notify all involved in the secondary market to not engage in sharing information on the rise or fall of share price of NESPE indicators and listed companies so that it does not encourage, motivate or discourage investors on the basis of unauthorised statements. SEBON believes that various individuals and groups have been giving unaccredited interviews and statements on various social media platforms regarding the increment or decrement of share price. In line with this, SEBON is vigilant in preventing any activities affecting the securities market, especially at a time when the second wave of coronavirus is hitting the economy, and thus, it is closely monitoring such activities. Nepal Rastra Bank (NRB) issued a directive barring banks and financial institutions (BFIs) from making short-term investments in the secondary market and prohibiting them from investing in the stocks of microfinance companies. At a time when the economy is facing excess liquidity due to fall in loan investment to real sectors, BFIs have been found investing large amounts of money in the secondary market and thus, earning profits on their third quarter results even though the nation is undergoing negative effects due to Covid 19 pandemic. As per the directive, BFIs are permitted to invest in stocks of listed companies only for a period of more than a year. By doing this, NRB is ensuring that a capping measure can prevent BFIs from over exposure in share-trading In the public issue front, during the review period, SEBON has added the Initial Public Offering (IPO) of Dordi Khola Hydropower worth Rs 295 million to its pipeline. Siddhartha Capital has been appointed as the issue manager. SEBON has also approved two debenture issuances namely: ‘10 years, 8.5%, Prabhu Bank Debenture 2087’ by Prabhu Bank worth Rs 1.6 billion and ’6 Years, 8.5% RBBL Debenture 2083’ by Rastriya Banijya Bank worth Rs 1 billion.Outlook

Despite the prohibitory restrictions in place in almost every part of the nation due to the threat of the second wave of Coronavirus and uncertainty on the political front, investors strong participation continued to drive NEPSE towards a new unchartered zone. Even though the market showed some correction at the beginning of the review period, the market has continued to swing upwards since the second week of May. It is yet to see the impact of the new directive by the central bank directing BFIs participation in the secondary market, nonetheless considering the current market movement, retail investors should refrain from making investments based on ‘herd mentality’ and make investment decisions based on adequate fundamental analysis of the scrips. This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Published Date: June 30, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take