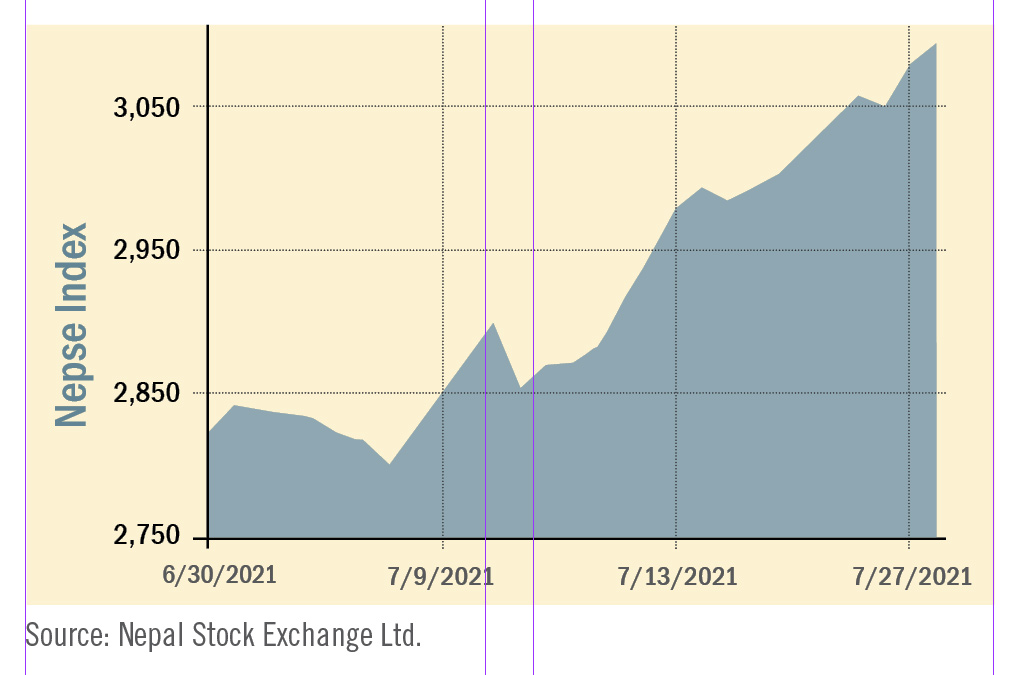

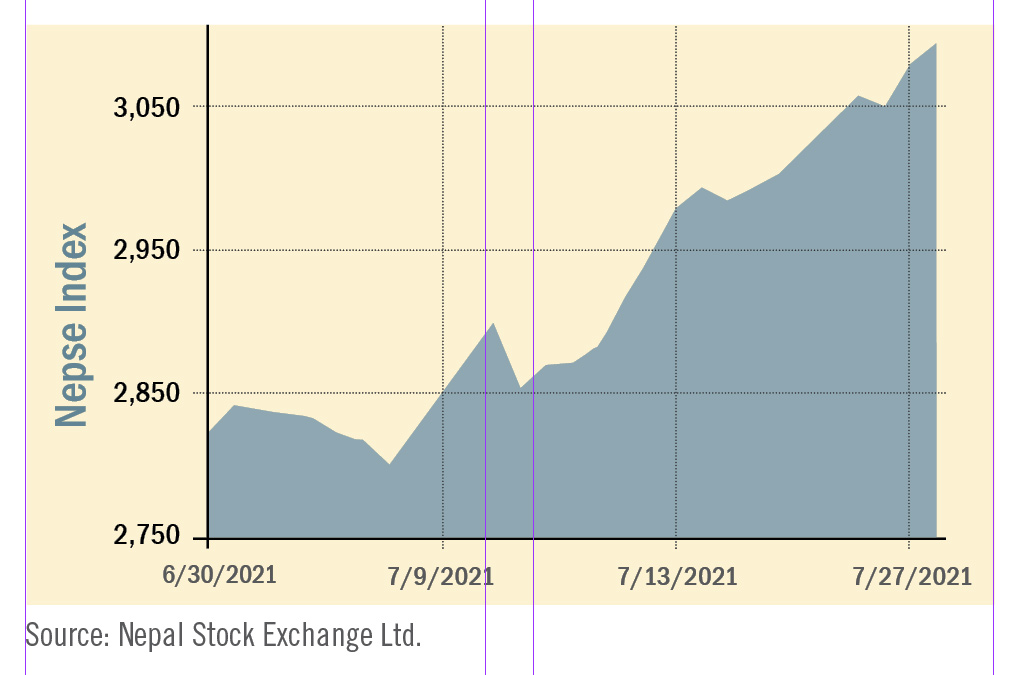

During the review period of June 30 to July 28, the Nepal Stock Exchange (NEPSE) index went up by a whopping 266.94 points (+9.44%) to close at 3,094.94 points. The NEPSE index surpassed the previous all-time high of 3,061.81 points that was witnessed in the last review period on June 15 and set a new milestone by reaching an all-time high of 3,094.94 points on July 28. Despite a 7.3% increase since the start of the new fiscal year, the market remained subdued during the first half of the review period. Although market growth has picked up since the start of the new fiscal year, market volume has remained low. As a result of the initial volatility, the total market volume fell by 43.12% to Rs 172.49 billion. During the review period, the highest single-day trading occurred on July 28, with a total of Rs 13.29 billion booked.

During the review period, contrary to the previous review period, all sub-indices landed in the green zone.

Finance sub-index (+34.09%) was the biggest gainer as share value of Manjushree Finance (+Rs 370), Goodwill Finance (+Rs 315), Janaki Finance (+Rs 239) and Multipurpose Finance (+Rs 216) went up. Development Bank sub-index (+18.921%) was second in line with increase in the share value of Excel Development (+Rs 298), Sindhu Development Bank (+Rs 141) and Corporate Development (+Rs 117). Hydropower sub-index (+15.19%) followed suit with rise in the share value of Ngadi Group Power (+Rs 437), Himalayan Power (+Rs 212) and Synergy Power (+Rs 198). Likewise, Manufacturing & Processing sub-index (+13.49%) surged as share value of Himalayan Distillery (+Rs 1495), Bottlers Nepal (+Rs 1099) and Shivam Cements (+Rs 110) went up. Commercial sub-index (+9.66%) also rose marginally with the increase in share value of Nabil Bank (+Rs 186), NIC Asia Bank (+Rs 127) and Agricultural Development Bank (+Rs 85).

Similarly, Hotels and Tourism sub-index (+9.11%) also witnessed an increase in the share prices of Oriental Hotels (+Rs 81), Taragaon Regency (+Rs 39) and Soaltee Hotel (+Rs 30). Microfinance sub-index (+6.87%) was also on the gaining side with rise in the share prices of Support Microfinance (+Rs 345), Mirmire Microfinance (+Rs 310) and Asha Microfinance (+Rs 255).

Along the same lines, Life Insurance sub-index (+6.87%) surged as share value of Life Insurance (+Rs 209), National Life Insurance (+Rs 133) and Prime Life Insurance (+Rs 93) rose. Non-life Insurance sub-index (+6.58%) witnessed increase in the share prices of Rastriya Beema (+Rs 315), Prabhu Insurance (+Rs 179) and Siddhartha Insurance (+Rs 132). Likewise, Others sub-index (+3.60%) also gained marginally with rise in the share value of Citizen Investment Trust (+Rs 545) and Nepal Telecom (+Rs 28).

News and Highlights

According to NEPSE, the government has been able to collect tax revenue worth Rs 13.33 billion from the stock exchange market during mid-July 2020 till mid-June 2021. The amount is more than double the amount that had been collected in the past five years from the share market. The reason behind the multifold increase in tax collection has been attributed to the increased transaction volume in the secondary market during the first 11 months of the fiscal year as the government collects Capital Gains Tax (CGT), dividend tax, income tax and advance tax from the stock exchange market. On the public issue front, SEBON approved the Initial Public Offering (IPO) of two hydropower companies - Mailung Khola Hydropower worth Rs 73.62 million and Samling Hydropower at Rs 123 million. Siddhartha Capital has been appointed as the issue manager for Mailung Khola Hydropower whereas Nepal SBI Merchant is the issue manager for Samling Hydropower. Likewise, SEBON also approved the IPO of Sanima Life Insurance worth Rs 600 million and Manushi Microfinance worth Rs 39.37 million. Prabhu Capital is the issue manager for Sanima Life Insurance and Nepal SBI Merchant is the issue manager for Manushi Microfinance. SEBON has also added the IPO of four companies to its pipeline: Emerging Nepal worth Rs 55.56 million, Jalpa Samudayik Microfinance worth Rs 52.20 million, Rastra Utthan Microfinance worth Rs 85 million and Molung Hydropower worth Rs 353.10 million. SEBON approved two debenture issuances namely: ‘10 years, 8.5%, Laxmi Bank Debenture’ by Laxmi Bank and ‘10 years, 8.5% Machhapuchchhre Debenture 2087’ by Machhapuchchhre Bank during the review period.

Outlook

The market increased by a staggering 127.2% in the fiscal year 2020/21, smashing all previous market milestones and records. Since the market’s resumption following the first lockdown on June 29, 2020, the market has remained bullish. Since the Monetary Policy for the current fiscal year was expected to be released soon, investors appeared to be waiting on the sidelines as the provisions in the policy could have a significant impact on the market. Furthermore, the central bank’s new directive on additional provisioning is likely to have an impact on banks and financial institutions (BFIs) ability to distribute dividends and may have a short-term impact on the market. This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Published Date: August 31, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take