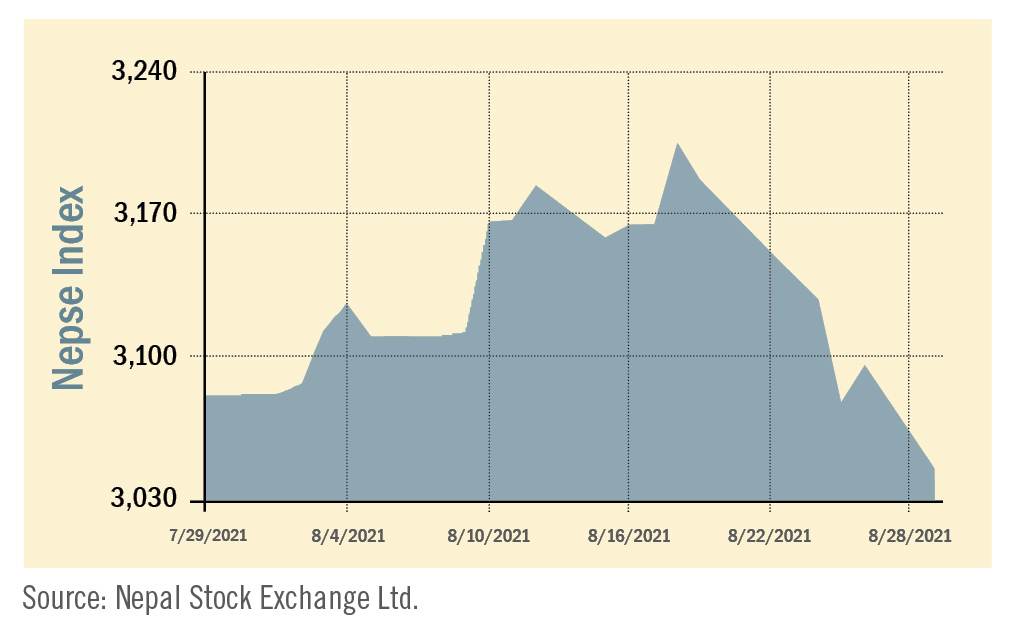

During the review period of July 29 to August 29, the Nepal Stock Exchange (NEPSE) index slumped by 50.08 points (-1.62%) to close at 3,044.86 points. The NEPSE index surpassed the previous all-time high of 3,094.94 points that was witnessed in the last review period on July 28, and set a new milestone by reaching an all-time high of 3,198.60 points on August 18. On August 15, the market witnessed a total volume of Rs 21.647 billion. With this, the total volume of the review period increased by 79.48% in comparison to last review period, and reached Rs 309.58 billion.

During the review period, contrary to the previous review period, five of the sub-indices landed in the green zone while the remaining five landed in the red zone.The Development Bank sub-index (+2209%) was the biggest gainer as the share value of Corporate Development Bank (+Rs 275), Miteri Development Bank (+Rs 204), and Mahalaxmi Development Bank (+Rs 202) went up. Finance sub-index (+20.03%) was second in line with an increase in the share value of ICFC Finance (+Rs 422), Central Finance (+Rs 240) and Reliance Finance (+Rs 178).

Hydropower sub-index (+10.86%) followed suit with a rise in the share value of Ridi Hydropower (+Rs 381), Arun Valley Hydropower (+Rs 245), and Arun Kabeli Power (+Rs 232). Likewise, Manufacturing and Processing sub-index (+5.77%) surged as share value of Himalayan Distillery (+Rs 402) and Shivam Cements (+Rs 151) went up. Microfinance sub-index (+4.26%) also rose marginally with increase in share value of First Microfinance (+Rs 309), RMDC Microfinance (+Rs 181) and RSDC Microfinance (+Rs 152).

Contrarily, Commercial Bank subgroup (-1.62%) witnessed a decrease in the share prices of NIC Asia Bank (-Rs 122), Siddhartha Bank (-Rs 52) and Nabil Bank (-Rs 49). Life Insurance sub-index (-5.87%) was also on the losing end with fall in share prices of Life Insurance (-Rs 262), Nepal Life Insurance (-Rs 178) and National Life Insurance (-Rs 105).

On the same lines, Non-life Insurance subgroup (-5.98%) fell as the share value of Rastriya Beema Company (-Rs 2020), NLG Insurance Company (-Rs 239) and Prabhu Insurance (-Rs 194)decreased. Hotels and Tourism sub-index (-9.55%) declined due to slack in the share prices of Oriental Hotels (-Rs 92), Taragaon Regency (-Rs 32) and Soaltee Hotel (-Rs 30). Likewise, Others sub-index (-10.79%) also fell marginally with slump in the share value of Citizen Investment Trust (-Rs 219) and Nepal Telecom (-Rs 130).

News and Highlights

According to the Securities Board of Nepal (SEBON), Mero Share platform has 2.8 million users as of the current FY 2021/22 indicating that there has been a 3.5% increment in comparison to the previous FY 2020/21. The officials of SEBON have also reported that the number of Dmat account users has reached 3.7 million till the end of last FY 2020/21. Moreover, SEBON was also successful in contributing Rs 14.15 billion in revenue in capital gain tax (CGT) to the government in the last FY 2020/21. Most of the revenue has been possible because of increase in the number of active technology-friendly investors in the secondary market standing at 880,000 investors. On the public issue front, SEBON approved the Initial Public Offering (IPO) of three hydropower companies: Nyadi Hydropower worth Rs 405 million with Global IME Capital as the issue manager, Sahas Urja worth Rs 1.05 billion with NIBL Ace Capital as the issue manager and Buddha Bhumi Nepal Hydropower worth Rs 280 million with Civil Capital Market as the issue manager. Similarly, SEBON has added the IPOs of one insurance company, one micro-finance and two hydropower companies to its pipeline. On the insurance company front, the IPO of Reliable Life Insurance worth Rs 1.27 billion is under preliminary review. Civil Capital Market has been appointed as its issue manager. On the microfinance front, the IPO of Upakar Microfinance worth Rs 26.62 million is in the pipeline. Nepal SBI Merchant Banking is the issue manager for the microfinance. On the hydropower front, the IPO of River Falls Power worth Rs 343 million and Three Star Hydropower worth Rs 123.12 million is SEBON’s pipeline. Prabhu Capital and Himalayan Capital have been appointed as the issue managers for the two hydropower companies respectively.Outlook

The Monetary Policy for the current fiscal year 2021/22 has prioritised the secondary market. Even though the permissible margin lending percentage has remained unchanged at 70% of the value of shares, the policy has set limits on the amount of margin loan available to an entity or an individual which is likely to impact the market volume in the coming days. This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. Read this also:

Published Date: September 27, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take