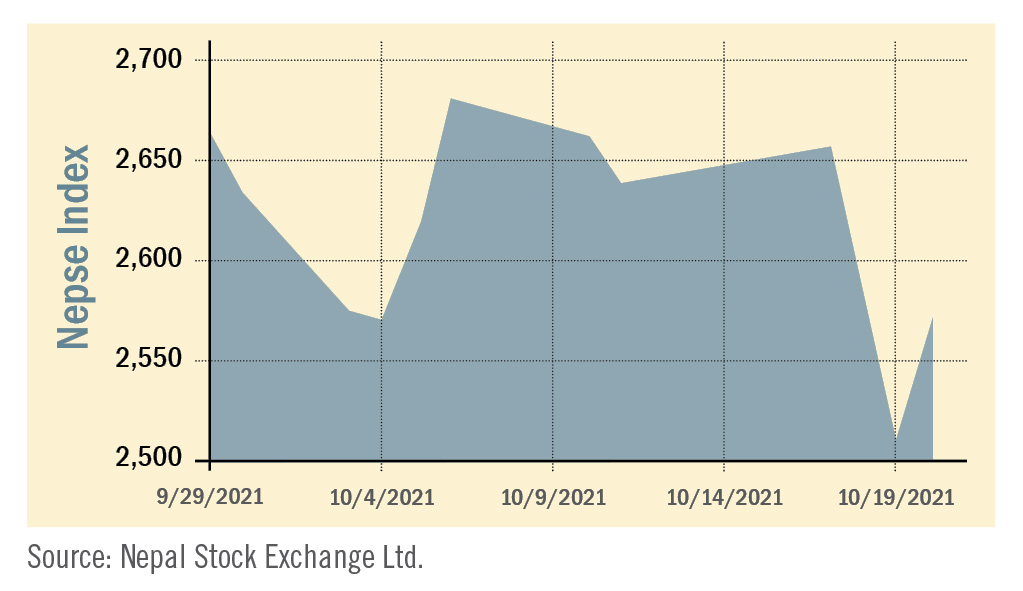

During the review period of September 29 to October 20, the Nepal Stock Exchange (NEPSE) index decreased by 43.74 points (1.67%) to rest at 2,571.66 points. The market continued to fall as selling pressure increased in the run-up to the Dashain holidays. Further, investor trust has been harmed by the banking system’s extreme liquidity which has resulted in rising interest rates. As a consequence, the overall volume during the review period fell by 73.08% compared to 48.37% in the previous review period, and only reached Rs 43.03 billion.

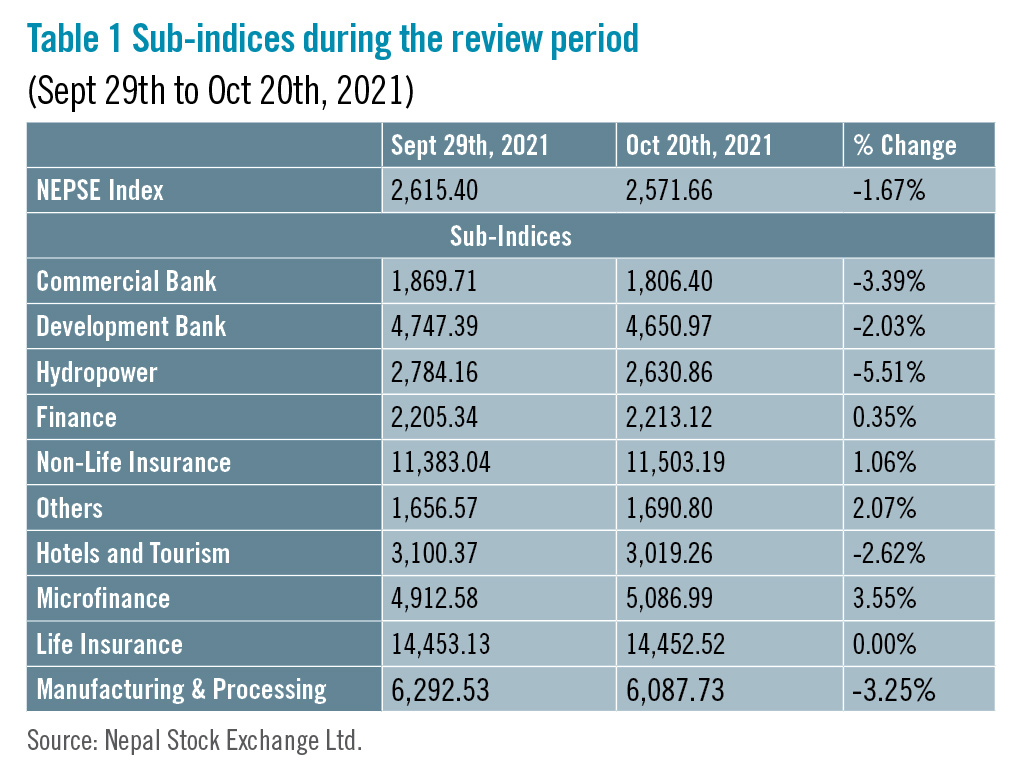

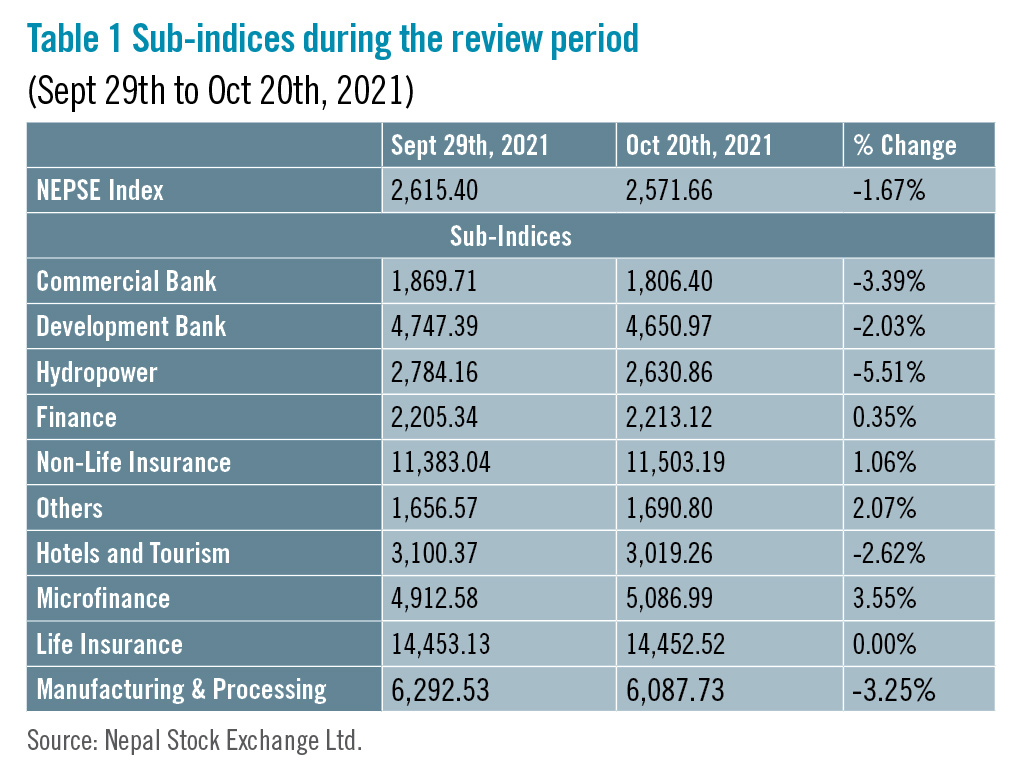

Contrary to the previous review period, in this period, four of the sub-indices landed in the green zone while the remaining six landed in the red zone.

The drop in the market was led by the Hydropower sub-index (-5.51%) as share value of Ridi Hydropower (-Rs 134), Radhi Hydropower (-Rs 100), and Rairang Hydropower (-Rs 99) went down. Commercial Bank (-2.03%) was second in line with drop in the share value of Citizens Bank (-Rs 85), NIC Asia Bank (-Rs 57) and Mega Bank (-Rs 44.8). Similarly, Manufacturing & Processing sub-index (-3.25%) also fell marginally with decrease in share value of Shivam Cements (-Rs 105.2). Hotels and Tourism sub-index (-2.62%) also witnessed a decrease in the share prices of Soaltee Hotel (-Rs 14), Taragaon Regency (-Rs 10) and Oriental Hotels (-Rs 10). Development Bank sub-index (-2.03%) was also on the losing side with fall in the share prices of Excel Development (-Rs 65.4), Lumbini Development (-Rs 53) and Corporate Development Bank (-Rs 41). Lastly, Life Insurance sub-index (-0.004%) also fell marginally with slump in the share value of Asian Life Insurance (-Rs 46), Gurans Life Insurance (-Rs 19) and National Life Insurance (-Rs 14).

Contrary to the overall market sentiment, the Microfinance sub-index (+3.55%) was the biggest winner as share value of Janautthan Samudayik Microfinance (+Rs 335), Support Microfinance (+Rs 311.5) and Mero Microfinance (+Rs 274.8) surged. Others sub-index (+2.07%) was second in line with increase in the share value of Nepal Telecom (+Rs 55). Likewise, Non-life Insurance sub-index (+1.06%) followed suit with the rise in the share value of Rastriya Beema Company (+NPR 235), Sagarmatha Insurance (+NPR 94) and NLG Insurance (+NPR 67). Similarly, Finance sub-index (+0.35%) also saw a hike as share value of Manjushree Finance (+Rs 74), Janaki Finance (+Rs 40) and Goodwill Finance (+Rs 27.8) went up.

News and Highlights

During the review period, three stock brokers were approached by NEPSE to provide explanation for submitting fake details of their clients. In view of the fraud that they had committed under the guise of human error, NEPSE issued a public notice and urged Sumeru Securities, Trishakti Securities and Naasa Securities to provide clarification within seven days and verify the details of the investors. Failure in doing so would result in severe action against them. Securities Board of Nepal (SEBON) also issued a notice stating that the current price change limit in the initial trading session of the secondary market has been reduced from 5% to 2%. SEBON has also approved the Second Amendment of the Securities Trading Operations Regulations 2075 that consists of the regulation to reduce the current minimum price change limit of Re 1 to 10 paisa. These amendments have been made in view of the unnatural fluctuations in the price of securities traded and also in line with international best practices such as that of India with an aim of enabling buyers and sellers to buy and sell securities at competitive prices and increase transactions. On the public issue front, SEBON has added the IPOs of CyC Nepal Microfinance and Adarsha Microfinance worth Rs 39 million and Rs 6 million respectively to its pipeline. Global IME Capital has been appointed as the issue manager for CyC Nepal Microfinance whereas BoK Capital is the issue manager for Adarsha Microfinance SEBON has also added the rights shares of Nepal Finance Ltd (1:0.70 ratio) worth Rs 345.44 million to its pipeline. Prabhu Capital has been appointed as the issue manager.Outlook

Investor confidence had been shaken by the Central Bank’s Monetary Policy measures which has now been further exacerbated by the current banking sector liquidity crisis. Further, rising bank lending interest rates and favourable long-term bank deposit returns have deterred investors from entering the secondary market. Despite several regulatory measures and a recent Central Bank order to limit interest rate vulnerability in the banking system, the market is expected to remain volatile as a result of growing uncertainties. This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Published Date: November 15, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take