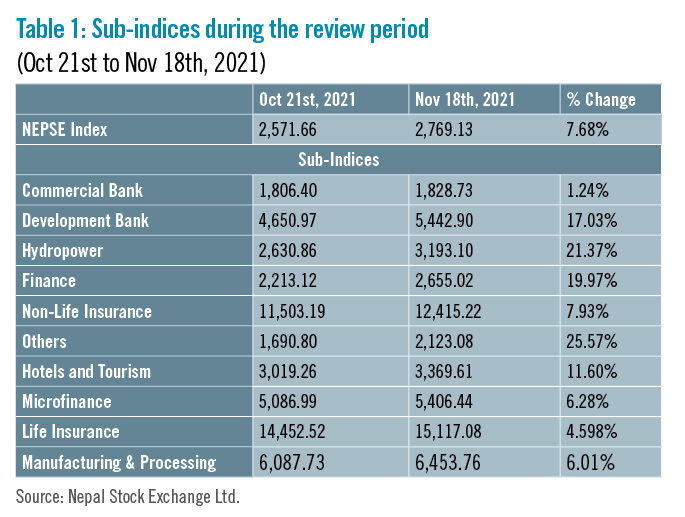

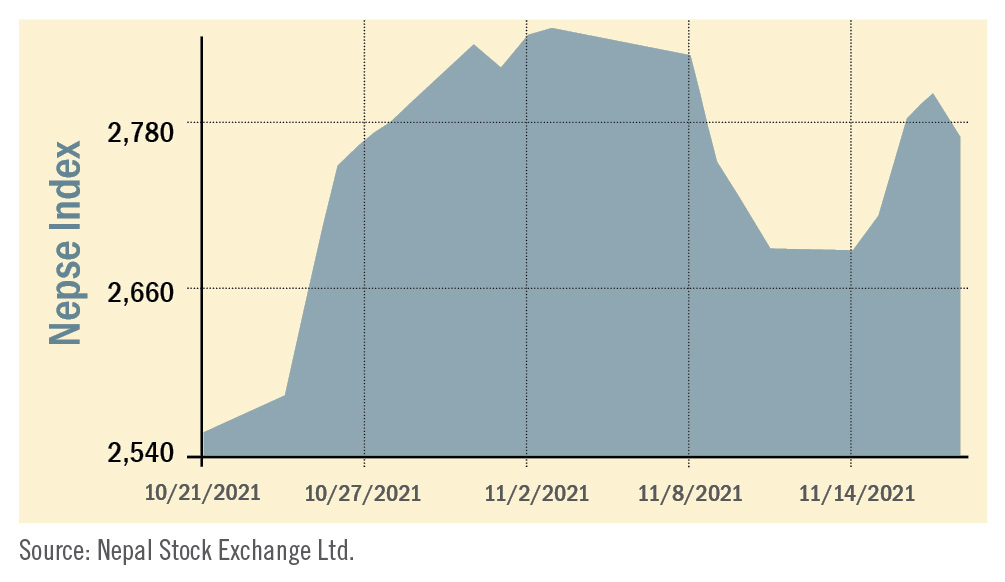

The Nepal Stock Exchange (NEPSE) index climbed considerably by 197.47 points (7.68%) to close at 2,769.13 points during the review period of October 21 to November 18, 2021. The market witnessed strong recovery after closing at 2,510.73 points on October 19, the lowest decline in recent trading days. Further, investor confidence has recently risen as they anticipate a positive first-quarter assessment of Monetary Policy by the central bank. With this, the overall volume during the review period increased notably by 133.18%, and reached Rs 100.343 billion.

During the review period, contrary to the previous review period, all sub-indices landed in the green zone.

Others sub-index (+25.57%) was biggest winner as share value of Nepal Telecom (+Rs 384) and Citizen Investment Trust (+Rs 81.1) substantially rose. Hydropower (+21.37%) was second in line with rise in share value of Ngadi Group Power (+Rs 184), Arun Kabeli Power (+Rs 156), and Radhi Bidhyut (+Rs 147). Finance (+19.97%) also witnessed a rise in share prices of ICFC Finance (+Rs 252), Goodwill Finance (+Rs 167.2), and Janaki Finance (+Rs 150). Development Bank sub-index (+17.03%) followed suit with rise in the share prices of Mahalaxmi Development (+Rs 162), Lumbini Development (+Rs 162) and Excel Development (+Rs 100.3). Likewise, Hotels and Tourism sub-index (+11.60%) also increased as share value of Taragaon Regency (+Rs 20), Soaltee Hotel (+Rs 15) and Oriental Hotels (+Rs 6) went up.

Non-life Insurance (+7.93%) saw a rise in share prices of Rastriya Beema (+Rs 1,055), United Insurance (+Rs 151) and Lumbini General Insurance (+Rs 128.1). Microfinance (+6.28%) also rose with an increase in share value of National Microfinance (+Rs 845), Forward Community Microfinance (+Rs 217) and Samudayik Microfinance (+Rs 180).

Along the same lines, Manufacturing & Processing sub-index (+6.01%) surged as share value of Bottlers Nepal (+Rs 3,100), Himalayan Distillery (+Rs 122) and Shivam Cements (+Rs 48.1) rose. Life Insurance sub-index (+4.59%) witnessed an increase in the share prices of Asian Life Insurance (+Rs 156), Life Insurance Company (+Rs 128) and National Life Insurance (+Rs 72). Likewise, Commercial Bank sub-index (+1.24%) increased marginally with rise in share value of Nabil Bank (+Rs 87), NIC Asia Bank (+Rs 52) and Siddhartha Bank (+Rs 46).

Non-life Insurance (+7.93%) saw a rise in share prices of Rastriya Beema (+Rs 1,055), United Insurance (+Rs 151) and Lumbini General Insurance (+Rs 128.1). Microfinance (+6.28%) also rose with an increase in share value of National Microfinance (+Rs 845), Forward Community Microfinance (+Rs 217) and Samudayik Microfinance (+Rs 180).

Along the same lines, Manufacturing & Processing sub-index (+6.01%) surged as share value of Bottlers Nepal (+Rs 3,100), Himalayan Distillery (+Rs 122) and Shivam Cements (+Rs 48.1) rose. Life Insurance sub-index (+4.59%) witnessed an increase in the share prices of Asian Life Insurance (+Rs 156), Life Insurance Company (+Rs 128) and National Life Insurance (+Rs 72). Likewise, Commercial Bank sub-index (+1.24%) increased marginally with rise in share value of Nabil Bank (+Rs 87), NIC Asia Bank (+Rs 52) and Siddhartha Bank (+Rs 46).

On public issue front, SEBON has added IPOs of Swetganga Hydropower and Mandakini Hydropower worth Rs 477 million and Rs 176 million to its pipeline. Sanima Capital has been appointed as issue manager for Swetganga Hydropower whereas BoK Capital is issue manager for Mandakini Hydropower. SEBON has also approved rights shares of Narayani Development (1:1 ratio) worth Rs 131.23 million for which Global IME Capital has been appointed issue manager.

On public issue front, SEBON has added IPOs of Swetganga Hydropower and Mandakini Hydropower worth Rs 477 million and Rs 176 million to its pipeline. Sanima Capital has been appointed as issue manager for Swetganga Hydropower whereas BoK Capital is issue manager for Mandakini Hydropower. SEBON has also approved rights shares of Narayani Development (1:1 ratio) worth Rs 131.23 million for which Global IME Capital has been appointed issue manager.

Non-life Insurance (+7.93%) saw a rise in share prices of Rastriya Beema (+Rs 1,055), United Insurance (+Rs 151) and Lumbini General Insurance (+Rs 128.1). Microfinance (+6.28%) also rose with an increase in share value of National Microfinance (+Rs 845), Forward Community Microfinance (+Rs 217) and Samudayik Microfinance (+Rs 180).

Along the same lines, Manufacturing & Processing sub-index (+6.01%) surged as share value of Bottlers Nepal (+Rs 3,100), Himalayan Distillery (+Rs 122) and Shivam Cements (+Rs 48.1) rose. Life Insurance sub-index (+4.59%) witnessed an increase in the share prices of Asian Life Insurance (+Rs 156), Life Insurance Company (+Rs 128) and National Life Insurance (+Rs 72). Likewise, Commercial Bank sub-index (+1.24%) increased marginally with rise in share value of Nabil Bank (+Rs 87), NIC Asia Bank (+Rs 52) and Siddhartha Bank (+Rs 46).

Non-life Insurance (+7.93%) saw a rise in share prices of Rastriya Beema (+Rs 1,055), United Insurance (+Rs 151) and Lumbini General Insurance (+Rs 128.1). Microfinance (+6.28%) also rose with an increase in share value of National Microfinance (+Rs 845), Forward Community Microfinance (+Rs 217) and Samudayik Microfinance (+Rs 180).

Along the same lines, Manufacturing & Processing sub-index (+6.01%) surged as share value of Bottlers Nepal (+Rs 3,100), Himalayan Distillery (+Rs 122) and Shivam Cements (+Rs 48.1) rose. Life Insurance sub-index (+4.59%) witnessed an increase in the share prices of Asian Life Insurance (+Rs 156), Life Insurance Company (+Rs 128) and National Life Insurance (+Rs 72). Likewise, Commercial Bank sub-index (+1.24%) increased marginally with rise in share value of Nabil Bank (+Rs 87), NIC Asia Bank (+Rs 52) and Siddhartha Bank (+Rs 46).

News and Highlights

As per official data released on November 9, the number of DEMAT accountholders has crossed 4.6 million. Of the total number of users, 100,000 new Demat accounts were added in a single month. The number of subscribers to ‘Mero Share’ platform, where initial public offerings can be digitally filled, has also reached 3.7 million. Additionally, the current Macroeconomic and Financial Situation Update (based on three months’ data ending mid-October) released by Nepal Rastra Bank has revealed share of each sector based on stock market capitalisation. This has been depicted in the table 2: On public issue front, SEBON has added IPOs of Swetganga Hydropower and Mandakini Hydropower worth Rs 477 million and Rs 176 million to its pipeline. Sanima Capital has been appointed as issue manager for Swetganga Hydropower whereas BoK Capital is issue manager for Mandakini Hydropower. SEBON has also approved rights shares of Narayani Development (1:1 ratio) worth Rs 131.23 million for which Global IME Capital has been appointed issue manager.

On public issue front, SEBON has added IPOs of Swetganga Hydropower and Mandakini Hydropower worth Rs 477 million and Rs 176 million to its pipeline. Sanima Capital has been appointed as issue manager for Swetganga Hydropower whereas BoK Capital is issue manager for Mandakini Hydropower. SEBON has also approved rights shares of Narayani Development (1:1 ratio) worth Rs 131.23 million for which Global IME Capital has been appointed issue manager.

Outlook

Investor confidence has recently been upbeat owing to expectations of a favourable first-quarter review of the Monetary Policy. Further, the positive performance of listed firms at the end of the first quarter of this fiscal year has boosted confidence. Commercial banks’ profits increased by 21.11% in the first quarter of this fiscal year compared to the same period of the last fiscal. The market witnessed increased purchasing pressure as investors attempt to book dividends from the previous fiscal year and establish fresh holdings. This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Published Date: December 15, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take