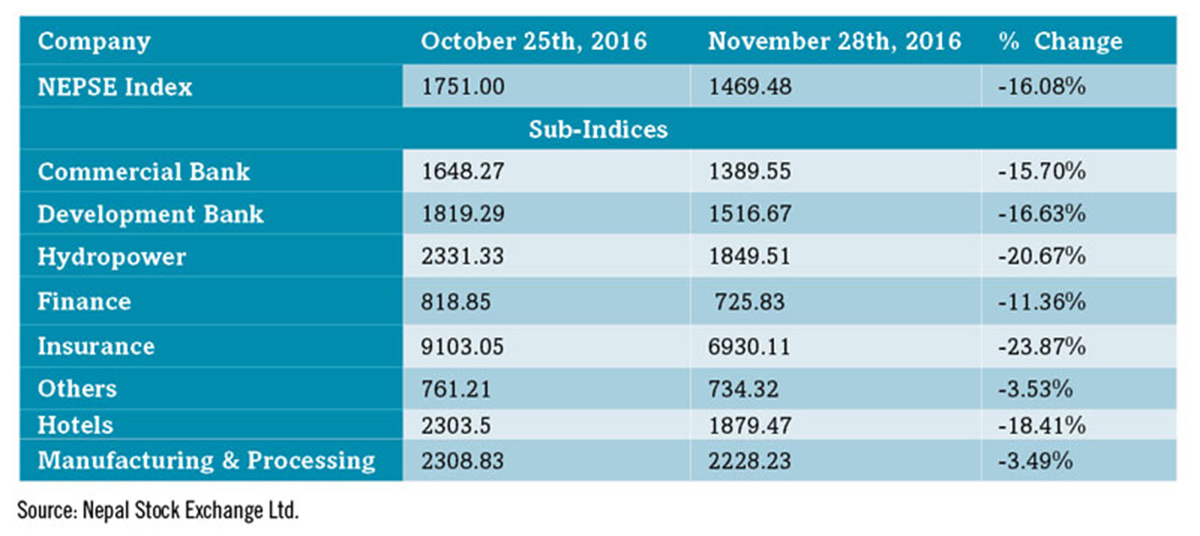

During the review period of October 25 to November 27, the Nepal Stock Exchange (NEPSE) index plunged by whopping 281.52 points (-16.08%) and closed at 1,469.48 points. The country’s only stock exchange witnessed strong selling pressure causing free fall to go below 1500 points, lowest in the last six months, weakening investor sentiment by a number of factors such as: squeezed liquidity in the banking system leading to tightening of margin lending by banks and financial institutions (BFIs) and hike in interest rates on such products. This has been further fueled by fear of excessive supply of shares in days ahead as Banking and Financial Act (BAFIA) has allowed conversion of promoter shares to public shares.

During the review period, all sub-indices ended in red zone with most of them declining in double digits. The Insurance sub-index (-23.87%) led the pack of losers by huge slump in share values of major insurance companies such as National Life Insurance (- NPR 1,107), Shikhar Insurance

(- NPR 860), Premier Insurance (- NPR 777), Life Insurance

(- NPR 769) and NLG Insurance (- NPR 740). The second biggest looser is the Hydropower sub-index (-20.67%) with decline in share values of Chilime Hydropower (- NPR 240), Butwal Power

(- NPR 225), Sanima Mai (- NPR 142) and Api Power

(- NPR 140).

Likewise, the Hotel sub-index (- 18.41%) went down with the decrease in share values of Soaltee Hotel Limited (- NPR 96) and Taragoan Regency (- NPR 51). Also the Development Bank sub-index (-16.63%) declined as share values of Swabalambhan Bikas Bank (- NPR 729), Deprosc Development Bank (- NPR 684), Laxmi Laghubitta Bittya (- NPR 608) and Muktinath Bikas Bank (- NPR 534) went down. This was followed by the Commercial Bank sub-index (- 15.70%); the top five losers in this index were Standard Chartered Bank (- NPR 735), Himalayan Bank (- NPR 489), Everest Bank (- NPR 395) and Nepal SBI (- NPR 373). Following suit, the Finance sub-index (-11.36%) decreased as share values of Seti Finance (-NPR 299), Sagarmatha Finance (- NPR 203), Janaki Finance (- NPR 78) and Lumbini Finance (- NPR 74) decreased. The Others sub-index (-3.53%) shed value with decline in share values of Nepal Telecom (-NPR 7) and Hydroelectricity Investment and Development Company Ltd. (- NPR 36). Finally, the Manufacturing and Processing sub-index (-3.49%) went down as share values of Bottlers Nepal (Terai) (- NPR 774) and Unilever Nepal (- NPR 770) dipped. Key Hydropower companies such as Barun Hydropower Company (- NPR 29), Chilime Hydropower Company (-NPR 17), and Api Power (- NPR 14) also declined.

News and Highlights

With the objective of modernizing the country’s capital and secondary market, SEBON has announced the launch of Applications Supported by Blocked Amount (ASBA) system from mid-January 2017 and has sought applications from commercial and development banks that are interested in operating a platform which will simplify and shorten the IPO and stocks issuance process. Further, Securities Board of Nepal (SEBON) is considering enforcement of a regulation that will restrict listed companies from influencing the capital market by taking multiple corporate actions at the same time i.e. this would bar the listed companies to reverse crucial decisions made in the past and jump to the next without executing the previous ones.

SEBON has approved Securities Registration and Issue Regulation 2073 paving way for issuance of local currency bonds by international financial institutions such as Asian Development Bank (ADB) and International Finance Corporation (IFC). The funds issued through such bonds will be allowed to invest in local infrastructure projects. With this approval, various real sector companies are expected to enter the primary market as new provisions allows companies to issue shares at justified premium value which was one of the key impediments to attract real sector companies earlier.

In the public issue front, the market witnessed two mutual fund schemes allotment during the review period. NMB Hybrid Fund L-1 managed by NMB Capital has allotted 100 million units of face value NPR 10 each mutual fund scheme worth NPR 1 billion to the general public on 25 October. The credit rating agency ICRA Nepal has provided grade 3 rating to the issue, indicating adequate assurance on management quality. Similarly, Nabil Equity Fund managed by Nabil Investment Bank Limited has allotted 125 million units of face value NPR 10 each mutual fund scheme worth NPR 1,250 million to the general public on 4 November. Both the issues were provided grade 3+ rating by ICRA Nepal.

Outlook

Despite attractive first quarter results posted by listed companies, especially BFIs, NEPSE has been witnessing free fall since early October. High selling pressure mounting from above mentioned reasons has weakened investor sentiment. The current situation has further deteriorated due to likely exit of large investors from the market to hedge their risk.

The future course of market is likely to be determined by policy on easing margin lending which could add confidence to retail investors which dominates the market. According to the current macroeconomic and financial reports based on three months data of 2016/17 prepared by the Central Bank, BFIs’ total margin lending extended against the collateral of shares staning at 2.2 percent (Rs 38.58 billion) of their total credit exposure.

Disclaimer

This is an analysis from beed invest ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.