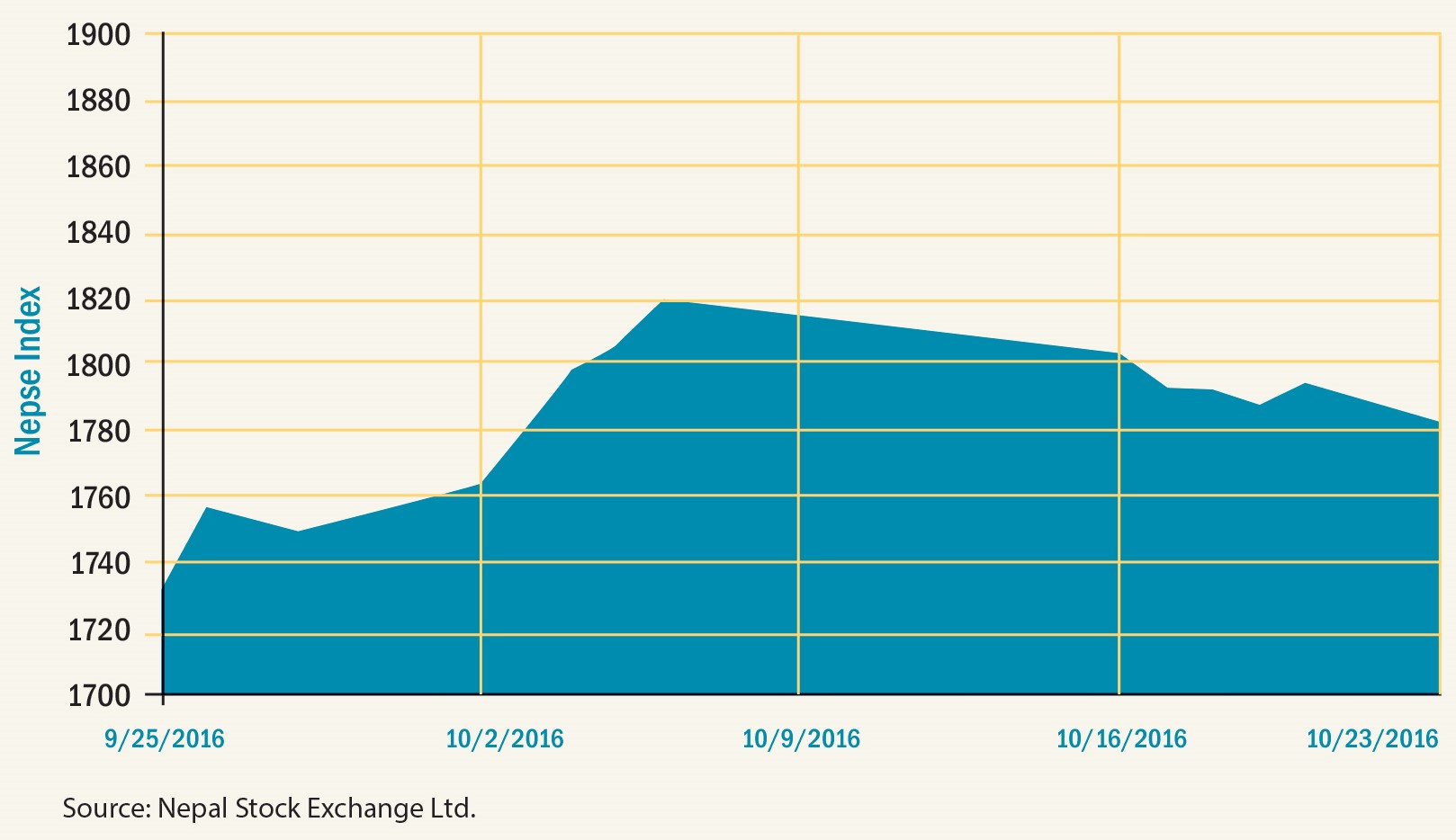

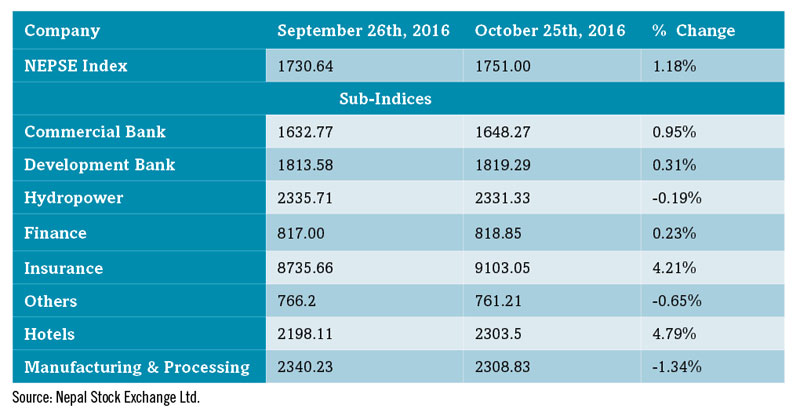

During the review period of September 26 to October 25, the Nepal Stock Exchange (NEPSE) index went up by 20.36 points (+1.18%) and closed at 1,751.00 points. The secondary market was full of ups and downs; the index started on a negative note and plunged to 1,730.64 points on 25 September after which it posted a steady recovery and touched a high of 1,819.88 points on 6 October. Nonetheless, the market has been in a correction mode since then and has witnessed continued selling pressure amid the festive season. The Hotel sub-index (+ 4.79%) led the pack of gainers with increase in share value of Soaltee Hotel Limited (+ NPR 34). This was followed by Insurance sub-index (+ 4.21%); the top five gainers in this index were Shikhar Insurance (+ NPR 700), Siddhartha Insurance (+ NPR 236), Lumbini General Insurance (+ NPR 224), LIC Nepal (+ NPR 170), Neco Insurance (+ NPR 170) and NLG insurance (+ NPR 163). Similarly, Commercial Bank sub-index (+ 0.95%) increased as share value of key banks such as Everest Bank (+ NPR 100), Himalayan Bank (+ NPR 45), and Nabil Bank (+ NPR 29) went up. Likewise, the Development Bank sub-index (+ 0.31%) increased as share values of Muktinath Bikash Bank (+ NPR 171), NMB Microfinance Bittiya Sanstha (+ NPR 60), and Nagbeli Laghubitta Bikash Bank (+ NPR 44) increased. Also, the Finance sub-index (+ 0.23%) increased marginally as share values of Manjushree Financial Institution (+ NPR 18), Guheshowori Merchant Bank & Finance (+ NPR 14), and Synergy Finance Ltd. (+ NPR 13) inclined. Even though the index went up marginally, few sub-indices ended in red zone during the review period. For the third consecutive period, the Manufacturing and Processing sub-index (-1.34%) continued to be the biggest loser as share price of Bottlers Nepal (Terai) Limited (-NPR 3,682) plummeted. The Other sub-index (-0.65%) shed value with decline in share values of Nepal Telecom (-NPR 5) and Hydroelectricity Investment and Development company Ltd. (- NPR 2). Finally, the Hydropower sub-index (-0.19%) went down as share values of key Hydropower companies such as Barun Hydropower Company (- NPR 29), Chilime Hydropower Company (-NPR 17), and Api Power (- NPR 14) slumped.

News and Highlights

With a view to create a favourable investment environment for Non-Resident Nepali (NRNs), Securities Board of Nepal (SEBON) has formed a committee comprising of Ministry of Finance (MoF), Nepal Rastra Bank, and NEPSE to draft a working procedure for such investments. The committee will study the impact of NRN representation in the secondary market and economy of Nepal. SEBON has recently declared a moratorium on issuance of license for new merchant bank until the Merchant Banker Regulations is amended. At present, there are 19 corporate bodies working as merchant banks while 10 more have applied for the license. SEBON currently allows merchant bankers to offer four types of services namely; share registrar, issue management, underwriting and portfolio management. In the IPO front, Arun Kabeli is issuing Initial Public Offering (IPO) worth NPR 300 million from 25 October to 28 October, 2016. The company‘s paid-up capital will reach NPR 1.50 billion after the issuance of primary shares to the general public. The credit rating agency ICRA Nepal has provided grade 4 plus rating to the issue, indicating below average fundamentals of the company. One of the largest foreign Joint venture bank, Standard Chartered Bank (SCB) has finally proposed capital plan to meet minimum paid-up capital of NPR 8 billion as stipulated by the central bank. SCB plans to meet the capital requirement by issuing bonus share and Further Public Offering (FPO) worth NPR 3.30 billion at a premium subject to the approval from SEBON. Currently, the paid up capital of SCB is NPR 2.81 billion.

Outlook

At the moment, correction of index seems at the card fairly supported by gradual interest rate hike by BFIs propelled by liquidity crunch amidst declining remittance growth and negative balance of payments situation. It appears BFIs which largely dominate the index would find difficult to increase their profitability proportionate to its increased capital, thus lowering the overall return to its shareholders in the days ahead. Going forward, the performance of key listed companies during first quarter of the fiscal year, being published in mid-November, is likely to affect the future direction of the index.

Disclaimer

This is an analysis from beed invest ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.