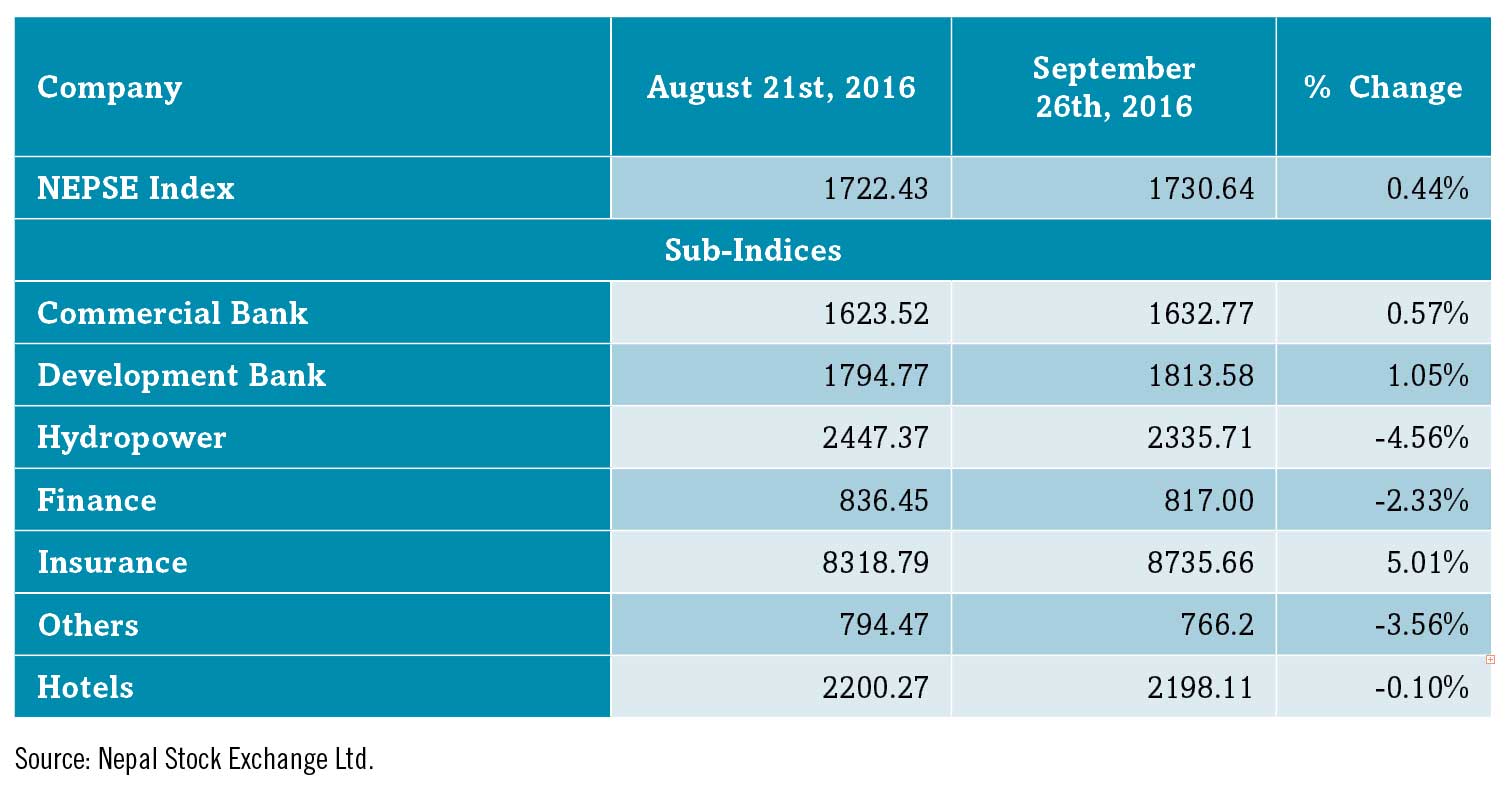

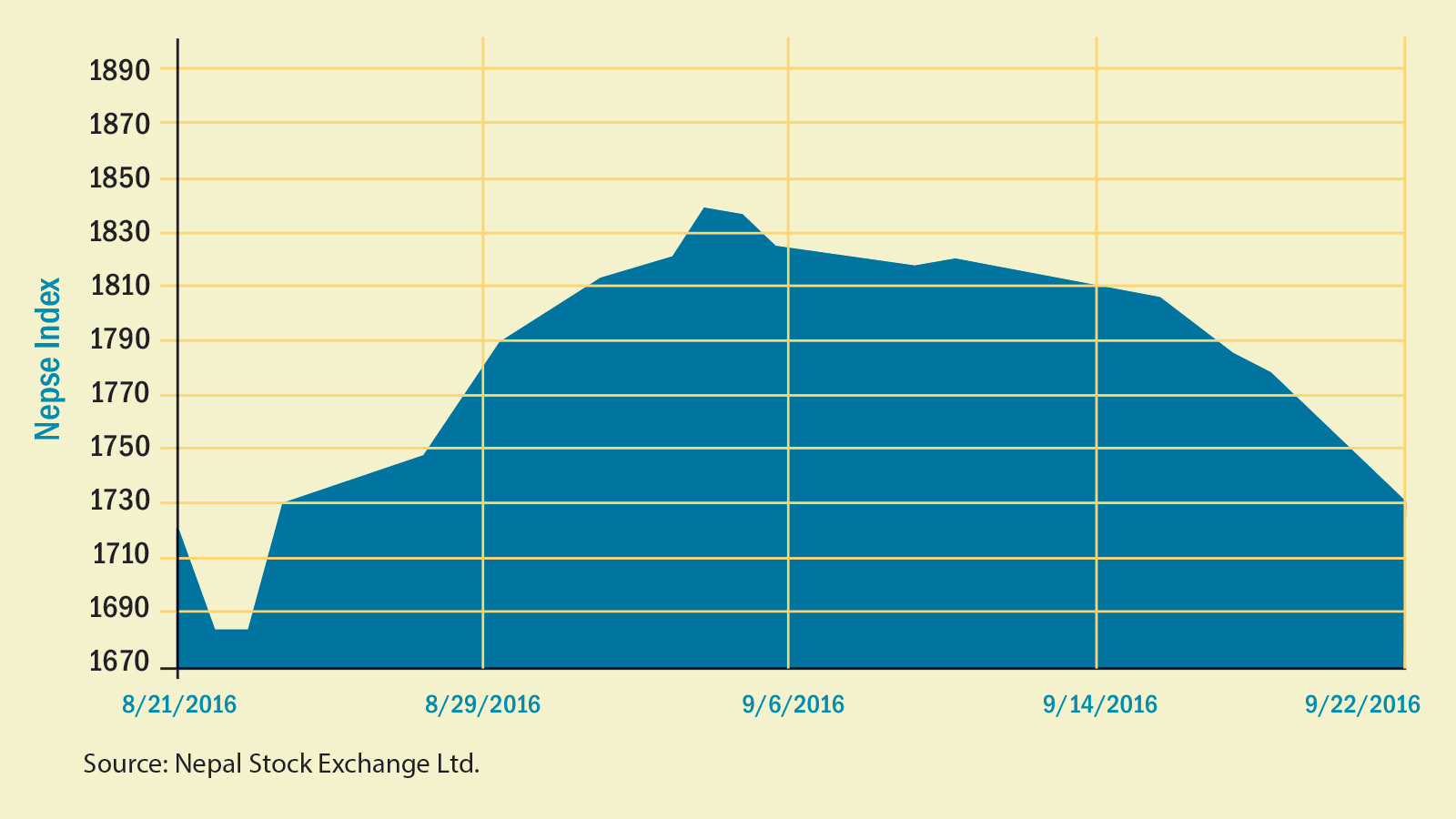

During the review period (August 21 to September 26), the Nepal Stock Exchange (NEPSE) index went up by 8.21 points (-0.48%) and closed at 1,730.64 points. The secondary market witnessed a turbulent month; the index started on a negative note and plunged to 1681.86 points on 23August after which it posted a steady recovery and touched a new high of 1834.80 points on 5 September. Nonetheless, the market has been in a correction mode since then.

The Insurance sub-index (+ 5.01%) led the pack of gainers; the top five gainers in this index were Himalayan General Insurance (+ NPR 350), Shikhar Insurance (+ NPR 270), National Life Insurance (+ NPR 250), United Insurance (+ NPR 240) and Everest Insurance (+ NPR 195). Similarly, the Development Bank sub-index (+ 1.05%) increased due to the hike in share value of Mirmire Microfinance Development Bank (+ NPR 349), Bhargav Bikash Bank (+ NPR 331), NMB Micro Finance (+ NPR 117) and Naya Nepal Micro Finance (+ NPR 110). Likewise, the Commercial Bank sub-index (+ 0.57%) increased marginally as share value of key banks such as Standard Chartered Bank (+ NPR 303), Everest Bank (+ NPR 250), and Nepal Bangladesh Bank (+ NPR 142) and Sunrise Bank (+ NPR 91) went up.

Even though the index went up marginally, few sub-indices ended in red zone during the review period. For the second consecutive period, the Manufacturing and Processing sub-index (-6.48%) continued to be the biggest loser as share price of Unilever Nepal (- NPR 2,243) and Bottlers Nepal (Terai) Limited (-NPR 3,682) plummeted. The Hydropower sub-index (-4.56%) followed suit as share values of key Hydropower companies such as Butwal Power Company (- NPR 92), Api Power Company (-NPR 55), Ridi Hydropower Development (- NPR 55) and Sanima Mai Hydropower (- NPR 52) went down. Likewise, the Other sub-index (-3.56%) shed value with the decline in share values of Hydroelectricity Investment and Development company Ltd. (- NPR 51). Finally, the Finance sub-index (-2.33%) went down as share prices of Guheshowori Merchant Banking & Finance Co. (- NPR 150), ICFC Finance (- NPR 26) and Reliance Lotus Finance (- NPR 19) slumped.

News and Highlights

With the aim of controlling money laundering activities, Securities Board of Nepal (SEBON) has planned to enforce a directive in accordance with Anti- Money Laundering Act where the broking companies will be required to report cumulative transaction of individual stock investors amounting more than NPR 1 million a day. Currently, there is no requirement to report share transaction of less than NPR 1 million at a time which has allowed investors to split into multiple transactions of less than NPR 1 million in a day without falling into reporting requirement. Likewise, SEBON has also directed the listed companies to start share transactions of merged entity immediately after the completion of mergers and acquisitions as they would not be given more than 15 days of grace period to do so.

In order to smoothen the share trading process and make the capital market robust, NEPSE has prepared a draft on Trade-guarantee Fund Bylaws and Auction-Trading Working Procedure and updated the Securities-listing Bylaws which has been sent to SEBON for approval. Accordingly, after the enforcement of Trade-guarantee Fund bylaws, a fund would be created that would reimburse the seller brokerages or investors whenever there is a shortfall in payment from the buyer. Similarly, Auction-Trading working procedure will allow the auction trading of securities so that any deficit of shares from the seller can be bought and provided to the buyers.

On the Public Issue front, the market witnessed issuance of primary shares of Suryodaya Lagubitta Bitiya Sanstha worth NPR 12 million which was oversubscribed by 340 times, collecting a total of NPR 3.71 billion. Likewise, two close ended mutual fund schemes; Nabil Equity Fund (NPR 1 billion) and NMB Hybrid Fund L-1 (NPR 800 million) were also offered during the review period, which were subscribed by over six times and four times respectively.

Further, six companies are in the pipeline for approval for issuing primary shares worth NPR 603.22 million and 20 companies are in pipeline for issuing right shares worth NPR 10.55 billion. Out of the six companies issuing primary shares, five are hydropower companies and one is a microfinance institution. Similarly, among the companies issuing right shares, 17 are banks and financial institutions (BFIs), one is a hydropower company and the remaining two are insurance companies.

Outlook

Despite the current correction in the market, the volume in the secondary market indicates strong investors’ confidence and market expectations. The selling pressure is expected to continue in the secondary market with the key festivals of the year nearing. Moreover, the effect of tightening in margin lending by the central bank and a slight increase in interest income in bank deposits might impact the market in the future.