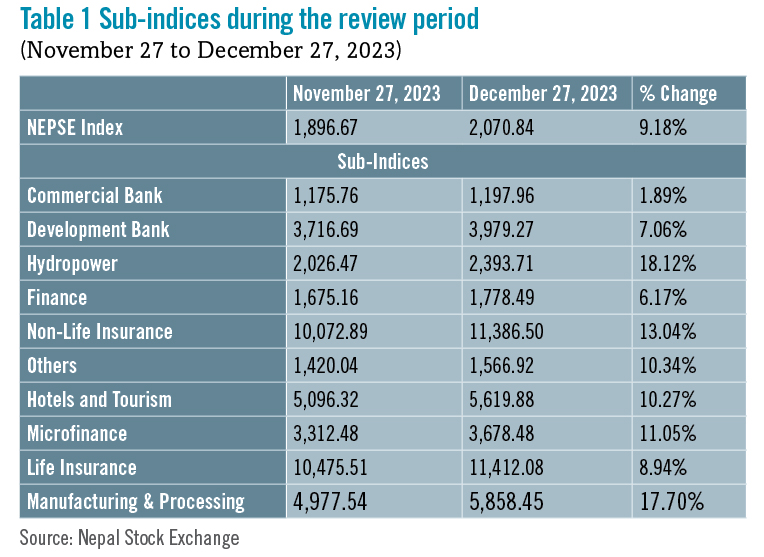

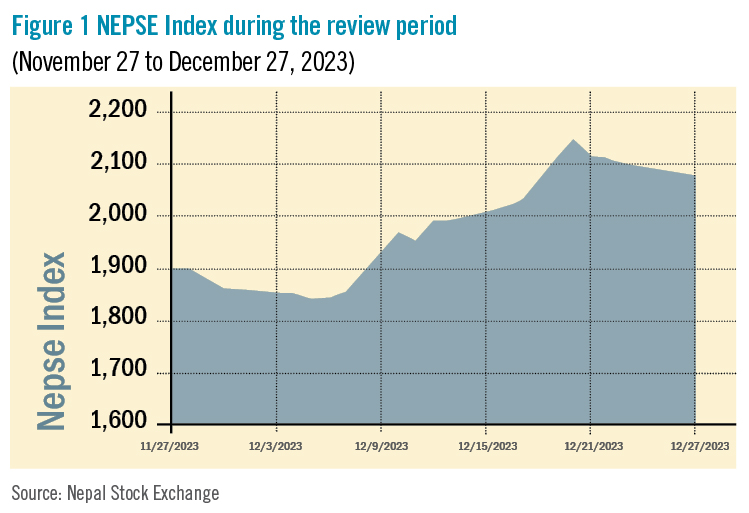

During the review period of November 27 to December 27, 2023, the Nepal Stock Exchange (NEPSE) index rallied by 174.17 points (+9.18%) to close at 2,070.84 points. It reached its highest point on December 20, at 2,141.88 points. While the market had seen a slight dip at the beginning of the review period, it showed a strong upward movement overall. The favourable movement in investor confidence was due to alterations in central bank policies, specifically the easing of margin lending and a beneficial decrease in bank interest rates via the first quarter review of the Monetary Policy for the current fiscal year 2023/24. The total market volume during the review period increased by a whopping 475% to reach Rs 73.56 billion.

During the review period, all 10 sub-indices landed in the bullish zone.

Hydropower sub-index (+18.12%) was the biggest gainer as the share value of Molung Hydropower (+Rs 216.3), Mid Solu Hydropower (+Rs 175) and Mandu Hydropower (+Rs 154) increased substantially. Manufacturing and Processing sub-index was second in line as it witnessed a rise in the share prices of Himalayan Distillery (+Rs 226), Ghorahi Cement Industry (+Rs 118.4) and Shivam Cement (+Rs 71).

Non-Life Insurance sub-index (+13.04%) followed suit with growth in the share prices of Rastriya Beema Company (+Rs 1,700), Nepal Insurance (+Rs 223) and Prabhu Insurance (+Rs 180.9). Likewise, Microfinance sub-index (11.05%) also rose as share value of BPW Microfinance (+Rs 476), Dhaulagiri Microfinance (+Rs 401) and Mahila Microfinance (+Rs 242.8) went up.

Similarly, other sub-indexes (+10.34%) went up as share prices of Nepal Republic Media (+Rs 148.1), Sonapur Minerals and Oil (+Rs 121.8) and Nepal Telecom (+Rs 74) increased. Likewise, Hotels and Tourism sub-index (10.27%) saw a rise in the share values of City Hotel (+Rs 151.8), Taragaon Regency (+Rs 119.1) and Kalinchowk Darshan (+Rs 66).

Life Insurance sub-index (+9.94%) followed suit with an increase in share value of Sun Nepal Life Insurance (+Rs 117.2), Reliable Nepal Life Insurance (+Rs 115) and Life Insurance Co Nepal (+Rs 88). Development Bank sub-index (+7.06%) also witnessed a growth in the share prices of Karnali Development Bank (+Rs 44.9), Garima Bikas (+Rs 27.8), and Muktinath Bikas (+Rs 26.4).

Finance sub-index (+6.17%) witnessed an increase in the share value of Reliance Finance (+Rs 35), Multipurpose Finance (+Rs 33.1) and ICFC Finance (+Rs 29). Finally, Commercial Bank sub-index (1.89%) saw the least growth with an increase in share prices of Everest Bank (+Rs 29), Siddhartha Bank (+Rs 23.8) and Sanima Bank (+Rs 14).

News and Highlights

Nepal Rastra Bank (NRB) has reduced bank rates from 7.5% to 7%, while policy rates remained at 5% in the first quarter review of the Monetary Policy for FY 2023/24. Additionally, risk weights for real estate loans and share mortgage loans exceeding Rs 5 million, lowered to 125% from the previous 150%. Further, five new brokerage firms will be joining NEPSE. The entrants include Himalayan Securities Ltd, a subsidiary of Rastriya Banijya Bank; Magnet Security and Investment Company; Prabhu Stock Market, and Sunrise Securities. While the initial three companies will enter the market soon, the latter two will follow suit after a certain period.

The Securities Board of Nepal (SEBON) has approved the Initial Public Offering (IPO) of Sarbottam Cement under Manufacturing and Processing worth Rs 1.29 billion for the general public. It will be the first company to determine the IPO price via a book-building process in Nepal. Global Capital IME has been appointed its issue manager. SEBON has included IPOs of three hydropower companies under preliminary review: Bikash Hydropower (Rs 445 million), Ridge Line Energy (Rs 580 million) and Laughing Buddha (Rs 657 million). Prabhu Capital is appointed the issue manager for the former two and Nabil Investment Bank for Laughing Buddha. It has also included the IPO of Orchid Holdings worth Rs 1.15 billion under Hotels and Tourism with Laxmi Capital designated as its issue manager. Additionally, Hospital for Advanced Medicine and Surgery, worth Rs 324 million, with Muktinath Capital as its issue manager, has been placed under SEBON’s preliminary review.

Outlook

During the review period, NEPSE observed a significant uptrend with recovery across all subsectors, signalling a positive trajectory. This was attributed to NRB’s policy changes, including relaxed margin lending and real estate loans, coupled with reduced interest rates. Recent developments, such as NRB’s review and addition of new brokerage firms, have contributed to a positive market trend. While the outlook remains cautiously optimistic, investors require monitoring market events within a specified range.

This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.