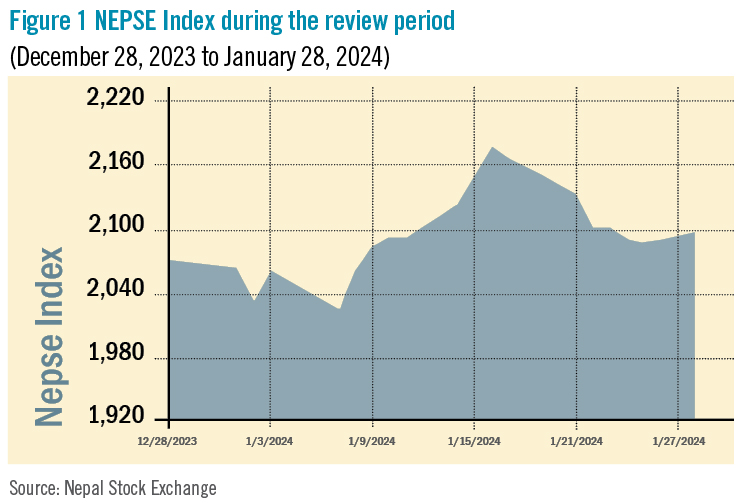

During the review period of December 28, 2023 to January 28, 2024, the Nepal Stock Exchange (NEPSE) index grew by 25.56 points (+1.24%) to close at 2,094.46 points. It reached its highest point on January 16 at 2,175.17 points. While the market showed a strong upward movement leading up to the peak, it could not sustain the upward movement. The second quarter performance of the listed companies, particularly financial institutions, failed to meet investor expectations, leading to a sharp decline in the second-half of the review period. However, the total market volume during the review period increased by 48% to reach Rs 109.18 billion.

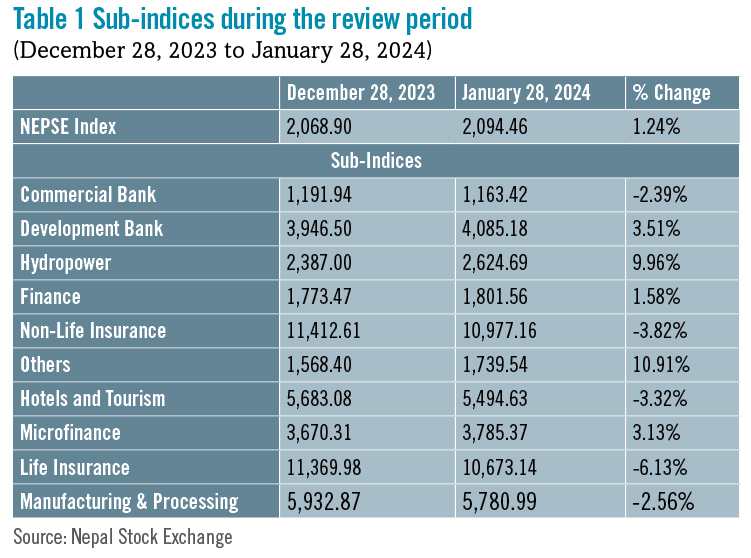

During the review period, five sub-indices landed in the green zone and the remaining five in the red zone.

Other sub- index (+10.91%) was the biggest gainer as the share value of Muktinath Krishi (+Rs 586.4), Sonapur Minerals and Oil (+Rs 67.9) and Nepal Reinsurance (+Rs 59) increased substantially. Moreover, Himalayan Reinsurance started trading during the review period, closing at Rs 645. Hydropower sub-index (+9.96%) was second witnessing a rise in the share prices of Mid-Solu Hydropower (+Rs 206.09), Tehrathum Power (+Rs 170.7) and Trishuli Jalvidyut (+Rs 130).

Development Bank sub-index (+3.51%) followed suit with growth in the share prices of Karnali Development Bank (+Rs 33.1), Sindhu Bikash Bank (+Rs 32.9) and Miteri Development Bank (+Rs 27). Microfinance sub-index (+3.13%) also rose as share value of Samaj Microfinance (+Rs 280.8), Gurans Microfinance (+Rs 216.9), and Ganapati Microfinance (+Rs 179.1) went up. Similarly, Finance sub-index (+1.58%) went up as share prices of Multipurpose Finance (+Rs 23.5), Samriddhi Finance (+Rs 15.1) and both Reliance Finance and Pokhara Finance (+Rs 15) increased.

Amongst the losers, Commercial Bank sub-index (-2.39%) saw the smallest dip with decline in share values of NIC Asia (-Rs 39), Laxmi Sunrise (-Rs 25.9) and Siddhartha Bank (-Rs 20.1). Manufacturing and Processing sub-index (-2.56%) followed suit with decline in share prices of Unilever Nepal (-Rs 4,199), Bottlers Nepal Terai (-Rs 886.7) and Himalayan Distillery (-Rs 219).

Hotels and Tourism sub-index (-3.32%) also witnessed a decline as the share prices of City Hotel (-Rs 53.8), Taragaon Regency (-Rs 45.1) and Chandragiri Hills (-Rs 38) dropped. Non-Life insurance sub-index (-3.82%) witnessed a decrease in the share value of Rastriya Beema (-Rs 1,100), Nepal Insurance (-Rs 105) and NLG Insurance (-Rs 47.9). Finally, Life Insurance sub-index (-6.13%) was the biggest loser with decline in shares prices of Citizen Life Insurance (-Rs 82.2), Life Insurance Co Nepal (-Rs 73) and Prabhu Mahalaxmi (-Rs 67).

News and Highlights

Nepal Insurance Authority has revised investment guidelines for reinsurance, non-life, life, and micro-insurance companies, allowing them to purchase 15% of shares of a public company. It is an increase from the previous 5%. Further, insurance companies will also be able to invest in both institutional and ordinary shares through the revision.

The Securities Board of Nepal (SEBON) has granted approval for the initial public offering (IPO) of Reliance Spinning Mills (Manufacturing and Processing) for 770,640 units of shares for qualified institutional investors. Global IME Capital has been appointed its issue manager. SEBON has also included IPOs of two manufacturing and processing companies under preliminary review: Shaurya Cement Industries (Rs 4.23 billion) and Maruti Cement (Rs 3.21 billion). Nabil Investment Bank has been appointed as the issue manager for both. SEBON has also included the IPO of Annapurna Cable Car worth Rs 310 million under preliminary review, with Muktinath Capital serving as the issue manager. Additionally, Barun Investment worth Rs 247.5 million, with Global IME as its issue manager has been placed for review.

Outlook

The second quarter results of the listed companies, financial institutions in particular, have had an impact on investor sentiment. However, investors are taking a wait-and-watch stance as market interest rates have continued to decline and are predicted to do so even further. It is likely that the market will continue to be volatile, so investors must exercise caution.

This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.