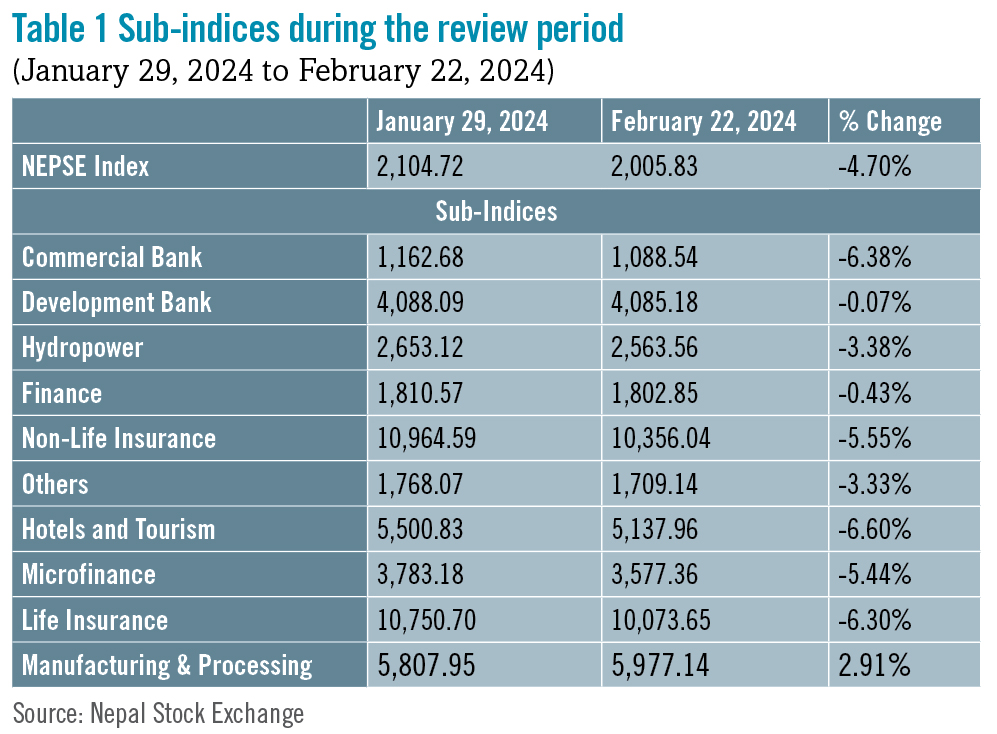

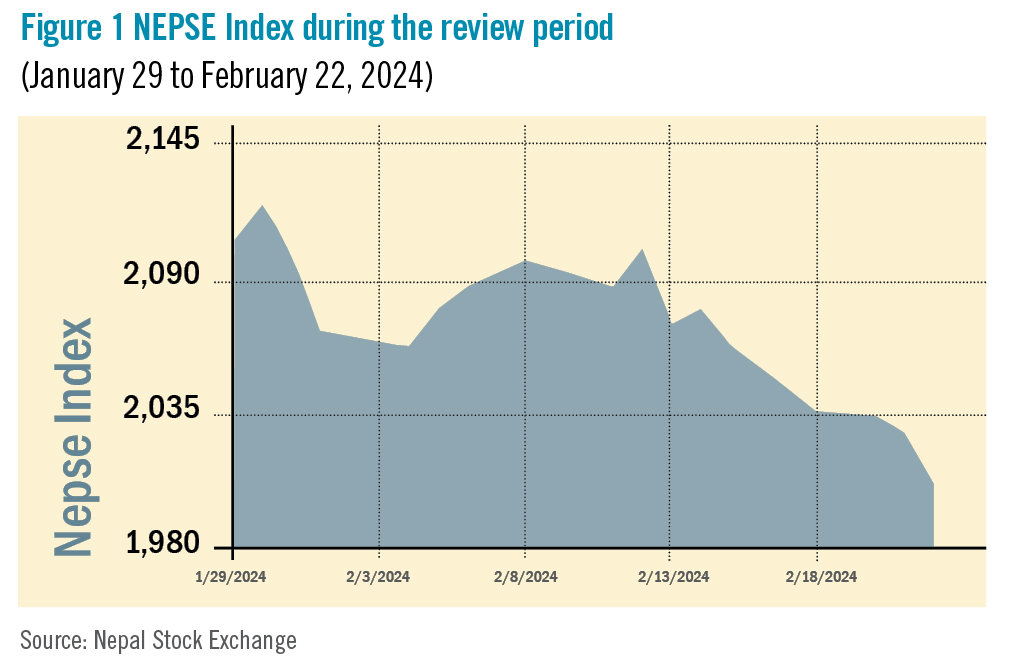

The Nepal Stock Exchange (NEPSE) index fell by 98.89 points (-4.70%) to close at 2,005.83 points, which was also its lowest point in the review period between January 29, 2024 and February 22, 2024. The market lost ground during the review period despite having a strong start to the period. It was unable to maintain its momentum. Investors were not impressed by the second quarter review of the Monetary Policy while the market interest rate continues to go down. Consequently, the overall market volume during the review period dropped to Rs 66.68 billion, a 39% decrease.

During the review period, all but one of the sub-indices landed in the red zone.

Hotels and tourism sub-index (-6.60%%) was the biggest loser as the share value of Chandragiri Hills (-Rs 112), Kalinchowk Darshan (-Rs 79) and Taragaon Regency Hotel (-Rs 70)) decreased substantially. Commercial Bank sub-index (-6.38%) was second in line as it witnessed a decline in the share prices of NIC Asia Bank (-Rs 54), Nabil Bank (-Rs 46) and Standard Chartered Bank Nepal (-Rs 26.9).

Life Insurance sub-index (-6.30%) followed suit with a drop in the share prices of Reliable Nepal Life Insurance (-Rs 148.9), Asian Life Insurance (-Rs 85.1) and Life Insurance Corporation Nepal (-Rs 64.5). Likewise, Non-life Insurance sub-index (-5.55%) also fell as the share value of Rastriya Beema (-Rs 687), United Ajod Insurance (-Rs 113) and Nepal Insurance (-Rs 82.1) went down.

Microfinance sub-index (-5.44%) declined as share prices of BPW Microfinance (-Rs 204), Mahila Microfinance (-Rs 202) and Nesdo Microfinance (-Rs 102.9) dropped. Hydropower sub-index (-3.38%) also saw a dip with decline in share values of Mid- Solu Hydropower (-Rs 117.9), Ridi Power (-Rs 99) and Arun Valley Hydropower (-Rs 90.2).

Others sub-index (-3.33%) followed suit with a decline in share prices of Sonapur Minerals and Oil (-Rs 64.5), Nepal Republic Media (-Rs 51) and Muktinath Krishi (-Rs 29). Finance sub-index (-0.43%) also witnessed a decline as the share prices of Reliance Finance (-Rs 30.7), Central Finance (-Rs 14.8) and Guheshowori Merchant Bank & Finance (-Rs 11.6) went down. Development Bank sub-index (-0.07%) witnessed the smallest dip with decrease in the share value of Miteri Development Bank (-Rs 29), Shine Resunga Development Bank (-Rs 22.3) and Lumbini Bikas Bank (-Rs 19.7).

Meanwhile, Manufacturing and Processing sub-index (+2.91%) was the only winner in the review period with a rise in shares prices of Bottlers Nepal (Terai) (+Rs 2,000) and Unilever Nepal (+Rs 199).

News and Highlights

Nepal Rastra bank (NRB) has amended the Foreign Investment and Foreign Loan Management Regulations 2078 waiving the requirement for its approval for foreign investments. It has waived its requirement in the context of companies where foreign investment would not diminish the overall shareholding ratio of Nepali shareholders, in companies that are already listed, and in ailing industries as per the Industrial Business Act 2076. This move anticipates making the Nepali market more investor-friendly.

Further, in an exciting update, NEPSE has made public the companies that are eligible for margin trading. The list consists of 112 companies, which includes all commercial banks other than the government-owned Rastriya Banijya Bank.

The Securities Board of Nepal (SEBON) has not granted approval for any initial public offering (IPO) in the review period. Nonetheless, SEBON has included IPOs of two hydropower companies under preliminary review: Kalinchowk Hydropower (Rs 75 million) and Him River Power (Rs 133 million). Their issue managers are RBB Merchant Banking and Siddhartha Capital, respectively. Likewise, it has also placed under preliminary review the IPO of two companies under the Others sub-sector: Pure Energy (Rs 160 million) and Annapurna Cable Car (Rs 310 million). Nabil Investment Banking and Muktinath Capital have been appointed as their issue managers respectively.

SEBON has also placed under preliminary review the IPO of Reliance Spinning Mills (Rs 948.8 million) under Manufacturing and Processing sub-sector with Global IME Capital as the issue manager. Likewise, Swastik Microfinance (Rs 8 million) has been placed under preliminary review under the Microfinance sub-sector with Nabil Investment Banking as the issue manager. Additionally, Barun Investment worth Rs 247.5 million, with Global IME as its issue manager, has been placed under the Investment sector for review.

Outlook

During the second quarter Monetary Policy review, the central bank did not change the risk weighting of loans in the real estate and stock market sectors, contrary to what investors had expected. Since it is expected that market interest rates will continue to drop, investors will likely remain vigilant and the market will likely remain somewhat volatile.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warranty is made for the usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.