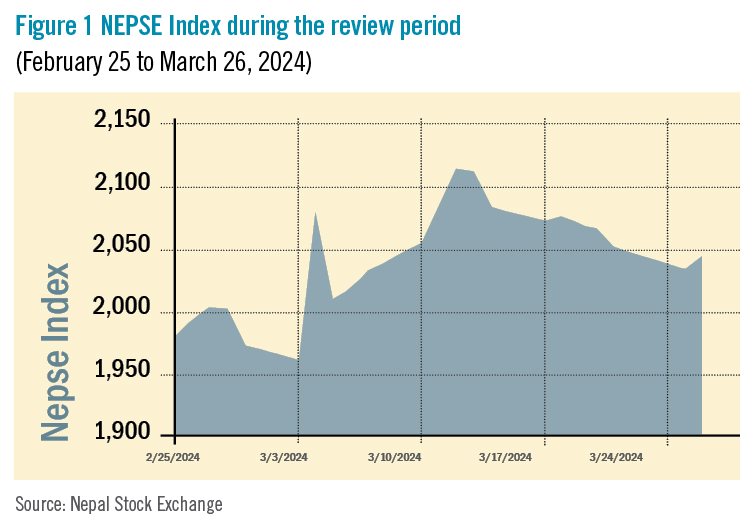

During the review period of February 25 to March 26, the Nepal Stock Exchange (NEPSE) index rose by 62.68 points (+3.17%) to close at 2,041.70 points. The market started on a negative note with regular fluctuations throughout the review period and the market reached its highest point on March 12 at 2,111.21 points. The sudden change of the coalition and the cabinet directly influenced investors who showed concern and curiosity at the political instability. The market now seems to be hopeful of the new government bringing in encouraging policies following the Principles and Priorities of the Budget for Fiscal Year 2024/25 presented by the Ministry of Finance prioritising the financial sector and the stock market. Moreover, declining interest rates have encouraged people to invest in the stock market instead. Despite the surge, the total market volume during the review period decreased by 5% amounting to Rs 63.06 billion.

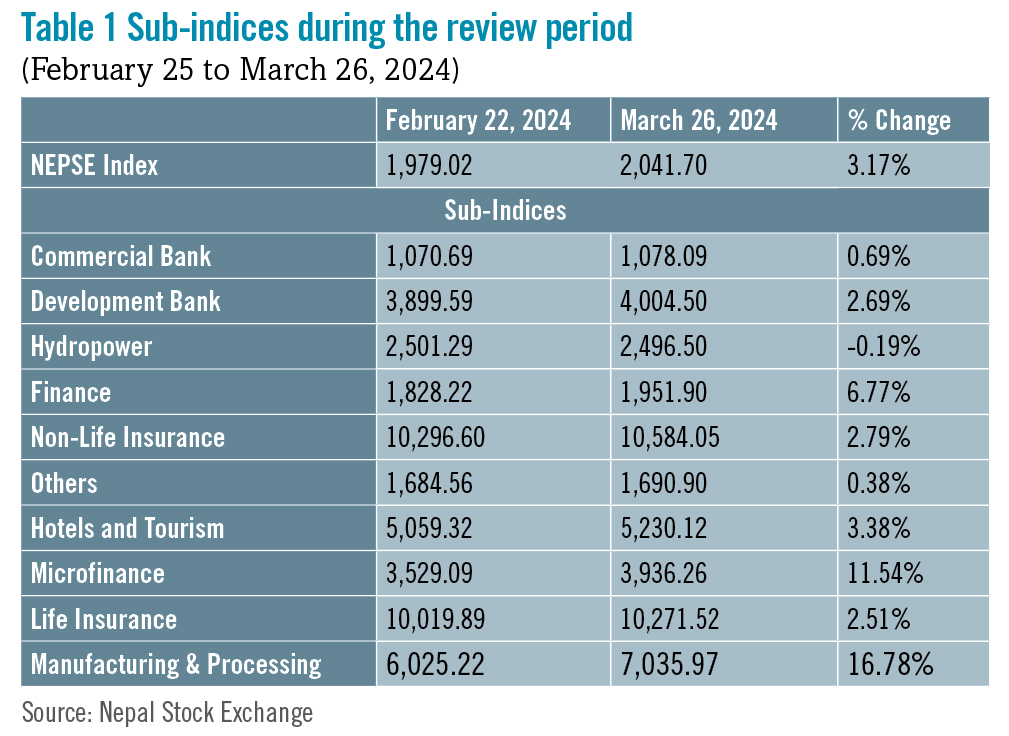

During the review period, all subindices except one, landed in the green zone.

Manufacturing and Processing sub-index (+16.78%) was the biggest winner as the share value of Bottlers Nepal (+Rs 5,128.4), Shivam Cement (+Rs 62.9) and Ghorahi Cement (+Rs 59) increased. Nepal Lube Oil also stared trading under this sub-index in the review period. Microfinance sub-index (+11.54%) was second in line as it witnessed a rise in share prices of Unnati Sahakarya (+Rs 664), Dhaulagiri Microfinance (+Rs 633.6) and Gurans Microfinance (+Rs 422).

Finance sub-index (+6.77%) followed suit with rise in the share prices of Gurkhas Finance (+Rs 258.1), Pokhara Finance (+Rs 38.7) and Nepal Finance (+Rs 36.2). Likewise, Hotels and Tourism sub-index (+3.38%) also increased with the share value of Taragaon Regency (+Rs 53.8), City Hotel (+Rs 14.2) and Oriental Hotels (+Rs 10.1) going up.

Non-life Insurance sub-index (+2.79%) went up as share prices of Rastriya Beema Company (+Rs 387), NLG Insurance (+Rs 28.2) and Himalayan Everest Insurance (+Rs 26.8) increased. Development Bank sub-index (+2.69%) witnessed growth in the share values of Saptakoshi Development (+Rs 50.8), Karnali Development (+Rs 47.1) and Sindhu Bikas (+Rs 45).

Life Insurance sub-index (+2.51%) followed suit with an increase in share prices of Sun Nepal Life (+Rs 36), Citizen Life (+Rs 22.8) and Himalayan Life (+Rs 18.8). Commercial Bank sub-index (+0.69%) also witnessed a growth in the share prices of Standard Chartered (+Rs 11.9), Agricultural Development (+Rs 4.5) and Himalayan Bank (+Rs 3.8). The Others sub-index (+0.38%) also saw a marginal increase with growth in share prices of Sonapur Minerals and Oil (+Rs 68.5), Nepal Republica Media (+Rs 41) and Nepal Telecom (+Re 0.8).

Hydropower sub-index (+2.91%) was the only loser in the review period with a decline in shares prices of Molung Hydropower (-Rs 178), Samling Power (-Rs 129) and Mountain Energy Nepal (-Rs 66.1).

News and Highlights

The ‘Principles and Priorities of the Budget for Fiscal Year 2024/25’ submitted by the Ministry of Finance to the Parliament has highlighted strengthening the financial sector through effective supervision and regulatory measures. It has underscored the importance of reinforcing transparency and accountability in banks, financial institutions, microfinance, insurance companies and the share market.

The Securities Board of Nepal (SEBON) has not approved new initial public offerings (IPOs) during the review period. Nonetheless, SEBON has placed the IPO of Lower Erkhuwa Hydropower (Rs 280.57 million) under preliminary review in the Hydropower sub-index with Muktinath Capital as the issue manager.

Outlook

Investors have shown some confidence in anticipation of a favourable policy environment following the sudden change in government. Even though a majority of the sub-sectors saw positive recovery during the review period, investors are expected to continue to exercise caution, resulting in a market that is expected to remain somewhat volatile without a clear or steady trend.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warranty is made for the usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.