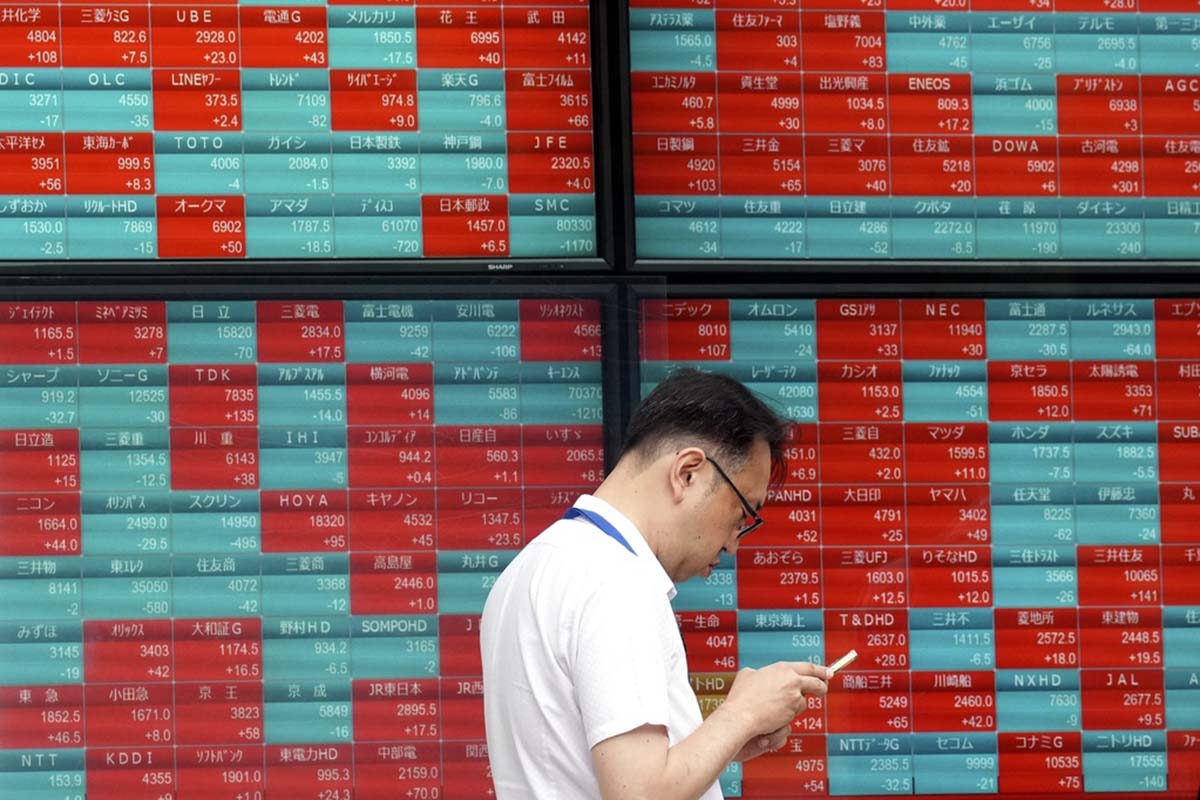

TOKYO: Asian shares traded in a mixed manner on Wednesday, as investors considered recent data that underscored a slowing US economy, presenting both advantages and disadvantages for Wall Street.

Japan's benchmark Nikkei 225 fell 1.0% in early trading to 38,448.61. Australia's S&P/ASX 200 nudged up 0.3% to 7,759.20. South Korea's Kospi surged 1.2% to 2,695.02. Hong Kong's Hang Seng increased 1.2% to 18,659.24, while the Shanghai Composite dipped nearly 0.1% to 3,088.18.

Analysts suggested that recent data on wage growth in Japan will become more noticeable once the results of the recent spring labour negotiations take effect. This implies that the Bank of Japan may be more inclined to raise interest rates.

On Tuesday, the S&P 500 rose by 0.2% to 5,291.34, although more stocks within the index declined than advanced. The Dow Jones Industrial Average increased 0.4% to 38,711.29, and the Nasdaq composite added 0.2% to 16,857.05.

Activity was stronger in the bond market, where Treasury yields fell after a report showed US employers advertised fewer job openings at the end of April than economists had anticipated.

Wall Street actually desires the job market and overall economy to slow sufficiently to bring inflation under control and persuade the Federal Reserve to reduce interest rates. This would alleviate pressure on financial markets. Traders raised their expectations for rate cuts later this year following the report, according to data from CME Group.

The risk is that the economy might overshoot and end up in a painful recession that would result in layoffs for workers nationwide and weaken corporate profits, pulling stock prices lower.

Tuesday's report indicated that the number of US job openings at the end of April fell to the lowest level since 2021. The figures suggest a return to "a normal job market" following years filled with unusual numbers caused by the Covid 19 pandemic, according to Bill Adams, chief economist for Comerica Bank.

But it also followed a report on Monday that showed US manufacturing contracted in May for the 18th time in 19 months. Concerns about a slowing economy have particularly impacted the price of crude oil this week, raising the possibility of less growth in demand for fuel.

A barrel of US crude has dropped close to 5% in price this week and is roughly back to where it was four months ago. This sent oil-and-gas stocks to some of the market's worst losses for a second consecutive day. Halliburton dropped 2.5%.

Early Wednesday, benchmark US crude lost 2 cents to $73.23 a barrel. Brent crude, the international standard, added 3 cents to $77.55 a barrel.

Companies whose profits tend to fluctuate with the cycle of the economy also suffered sharp losses, including steel makers and mining companies. Copper and gold miner Freeport-McMoRan lost 4.5%, and steelmaker Nucor fell 3.4%.

The smaller companies in the Russell 2000 index, which tend to prosper most when the US economy is at its strongest, fell 1.2%.

Elsewhere on Wall Street, Bath & Body Works plummeted 12.8% for the worst loss in the S&P 500 despite exceeding expectations for revenue and profit in the latest quarter.

GameStop also relinquished some of its significant gain from the previous day, when euphoria broke out after a central character in the stock's 2021 run returned to announce he had built a stake in the video-game retailer. It dropped 5.4%.

On the winning side of Wall Street were dividend-paying stocks. They tend to benefit from lower interest rates because bonds paying lower yields can direct more income-seeking investors to real-estate investment trusts, utilities and other stocks that pay relatively high dividends.

Camden Property Trust, which offers multifamily housing around the country, rose 2.6% for one of the largest gains in the S&P 500. Mid-America Apartment Communities rose 2.1%.

Some Big Tech stocks whose fortunes seem to continue to rise regardless of the state of the economy also drove the market higher. Nvidia was the strongest force pushing the S&P 500 upward. It rose 1.2% as it continues to ride a furore on Wall Street around artificial intelligence technology.

Also on Wednesday, the US dollar rose to 155.38 Japanese yen from 154.84 yen. The euro cost $1.0884, little changed from $1.0883.

By RSS/AP