KATHMANDU: The High-Level Recommendation Committee on Tax System Reforms, formed by the government, has stated that the country could receive an additional Rs 300 billion, provided that the tax systems were revised.

The Committee has suggested that the provision to write off value-added tax afforded to some goods should be abolished, the existing cap on income tax should be amended, excise duty should be waived except for goods that harm human health, a green tax should be imposed, social security tax should be revised, and the amount of digital payment should be increased while discouraging cash payments.

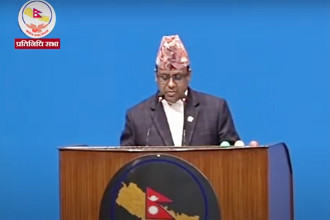

The government had established the four-member committee under the chairmanship of Bidhyadhar Mallik around nine months ago.

Committee chair Mallik submitted its report three months ago.

The Committee has proposed the establishment of an Implementation Facilitation and Monitoring Unit under the leadership of the Revenue Secretary for effective implementation of the recommendations on tax system reforms.

If the reform measures stated in the Committee's report were implemented, the country could receive an additional Rs 291 billion in revenue, according to the report made public by the Ministry of Finance.

Laxman Aryal, Prof Dr Ram Prasad Gyawali and Shyam Prasad Dahal were members of the Committee.

Committee Chair Mallik said that the possibility of revenue collection was projected based on extensive study and sectoral calculations. "This is a challenging task but not impossible," Mallik argued. The upcoming fiscal year's budget has also included plans to implement the committee's recommendations.

He expressed optimism about implementing the report's recommendations. "The results will be positive if the recommendations are implemented within three to five years," he reasoned.

Similarly, Aryal, who is also a former secretary with extensive expertise in tax systems and revenue administration, said that the projection of receiving Rs 300 billion more is based on current context and that it will exceed this estimation in future. "The report has clearly stated how and from where this is possible," Aryal noted.