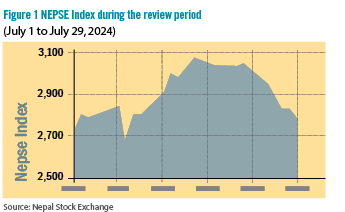

During the review period of July 30 to August 29, 2024, the Nepal Stock Exchange (NEPSE) index grew by 80.16 points (+3.00%) to close at 2,749.57 points. It reached its highest point on August 15, at 3,000.81 points. The market had a favourable reaction to the annual macroeconomic data released by Nepal Rastra Bank (NRB) in mid-August which estimated a growth in agriculture, manufacturing and service sectors. Similarly, the NRB circular reducing counter cyclical buffer to boost lending capacity amongst banks and financial institutions (BFIs) has been received positively. The total market volume during the review period increased by 92% to reach Rs 403.58 billion.

Figure 1 NEPSE Index during the review period July 30 to August 29, 2024

During the review period, eight of the 11 sub-indices landed in the green zone with the remaining three landing in the red zone.

Finance sub-index (+16.16%) was the biggest winner as the share value of Goodwill Finance (+Rs 409), Nepal Finance (+Rs 271) and Multipurpose Finance (+Rs 161.9) increased substantially. Others sub-index (+8.86%) followed suit with a rise in share prices of Himalayan Re-Insurance (+Rs 220), Nepal Reinsurance (+Rs 27) and Nepal Republic Media (+Rs 24).

Life Insurance sub-index (+7.93%) was next in line as the share value of Life Insurance Corporation Nepal (+Rs 674), Sanima Reliance (+Rs 55.7) and Citizen Life Insurance (+Rs 51) went up. Similarly, Hotels and Tourism sub-index (+7.78%) saw an increase in share prices of Taragaon Regency (+Rs 312), Oriental Hotels (+Rs 198) and City Hotel (+Rs 72).

Hydropower sub-index (+6.65%) witnessed a rise in share values of Kutheli Bukhari Small Hydropower (+Rs 534.3), Three Star Hydropower (+Rs 456.9) and Mid-Solu Hydropower (+Rs 361). The Development Bank sub-index (+5.35%) also grew with increase in share prices of Miteri Development (+Rs 146.5), Corporate Development (+Rs 209) and Green Development (+Rs 200).

The Trading sub-index (+1.97%) surged with a rise in share values of Salt Trading Corporation (+Rs 120) and Bishal Bazar (+Rs 80). Non-Life Insurance sub-index (+0.28%) followed suit with increased share values of NLG Insurance (+Rs 129), Prabhu Insurance (+Rs 75) and Neco Insurance (+Rs 40).

However, the Commercial Bank sub-index (-1.60%) was in the red zone with drop in share values of Nabil Bank (-Rs 44), NIC Asia (-Rs 40.5) and NMB Bank (-Rs 18.5). Similarly, Microfinance sub-index (-5.05%) saw a decline in share prices of Ganpati Microfinance (-Rs 434), Unnati Sahakarya Microfinance (-Rs 306.2) and Suryodaya Womi Microfinance (-Rs 250). The biggest loser in the review period was the Manufacturing & Processing sub-index (-6.77%) which witnessed a drop in share prices of Unilever Nepal (-Rs 2,100), Bottlers Nepal Terai (-Rs 1,670) and Himalayan Distillery (-Rs 231.9).

|

|

30-Jul-24 |

29-Aug-24 |

% Change |

|

NEPSE Index |

2,669.41 |

2,749.57 |

3.00% |

|

Sub-Indices |

|||

|

Commercial Bank |

1,585.15 |

1,559.76 |

-1.60% |

|

Development Bank |

5,160.20 |

5,436.27 |

5.35% |

|

Hydropower |

3,206.22 |

3,419.34 |

6.65% |

|

Finance |

3,064.67 |

3,559.94 |

16.16% |

|

Non-Life Insurance |

13,072.72 |

13,108.97 |

0.28% |

|

Others |

1,930.50 |

2,101.49 |

8.86% |

|

Hotels and Tourism |

6,639.42 |

7,155.68 |

7.78% |

|

Microfinance |

5,379.06 |

5,107.24 |

-5.05% |

|

Life Insurance |

12,494.81 |

13,486.03 |

7.93% |

|

Manufacturing & Processing |

7,825.45 |

7,295.83 |

-6.77% |

|

Trading |

3,699.22 |

3,772.09 |

1.97% |

News and Highlights

The Commission for the Investigation of Abuse of Authority (CIAA) raided the NEPSE office on August 15 over suspicions of NEPSE staff being involved in insider trading. A preliminary investigation revealed that staff members were trading in the name of family and friends. The government has proposed harsher measures to combat insider trading through a bill to amend the Securities Act 2007. As presented by Finance Minister, Bishnu Prasad Paudel, in the House of Representatives, it has raised the penalties for insider trading to include cash fine of up to Rs 30 million, a jail term of three years, or both if individuals are found guilty of insider trading in the secondary market. This is in addition to confiscating the traded amount and being penalised with an equivalent amount. Currently, the offender of the case has to pay a cash fine of only the amount in question and serve a one-year jail term. The bill has been under general discussion since August 27, 2024.

Nepal Rastra Bank (NRB) has issued a circular stating for the counter cyclical buffers to be set at 0% for Fiscal Year 2024/25. Previously, the buffer was set at 0.5%. The decision aims to increase the lending capacity of banks, offering relief to banks with constrained Tier 1 Capital. On the other hand, NRB has also permitted microfinance institutions (MFIs) to reschedule and restructure loans of their clients for the next three years. MFIs are required to implement this facility by mid-December 2024. However, this service will be available only to those who have failed to pay back the loans due to financial problems.

Outlook

The market has remained receptive to new policies and economic developments which has translated into an upward movement of the market. However, the prolonged vacancy of the position of SEBON Chairperson paired with increasing concerns about insider trading and market manipulation can dampen investor spirit. While the outlook remains cautiously optimistic, there is a need to monitor market events within a specified range