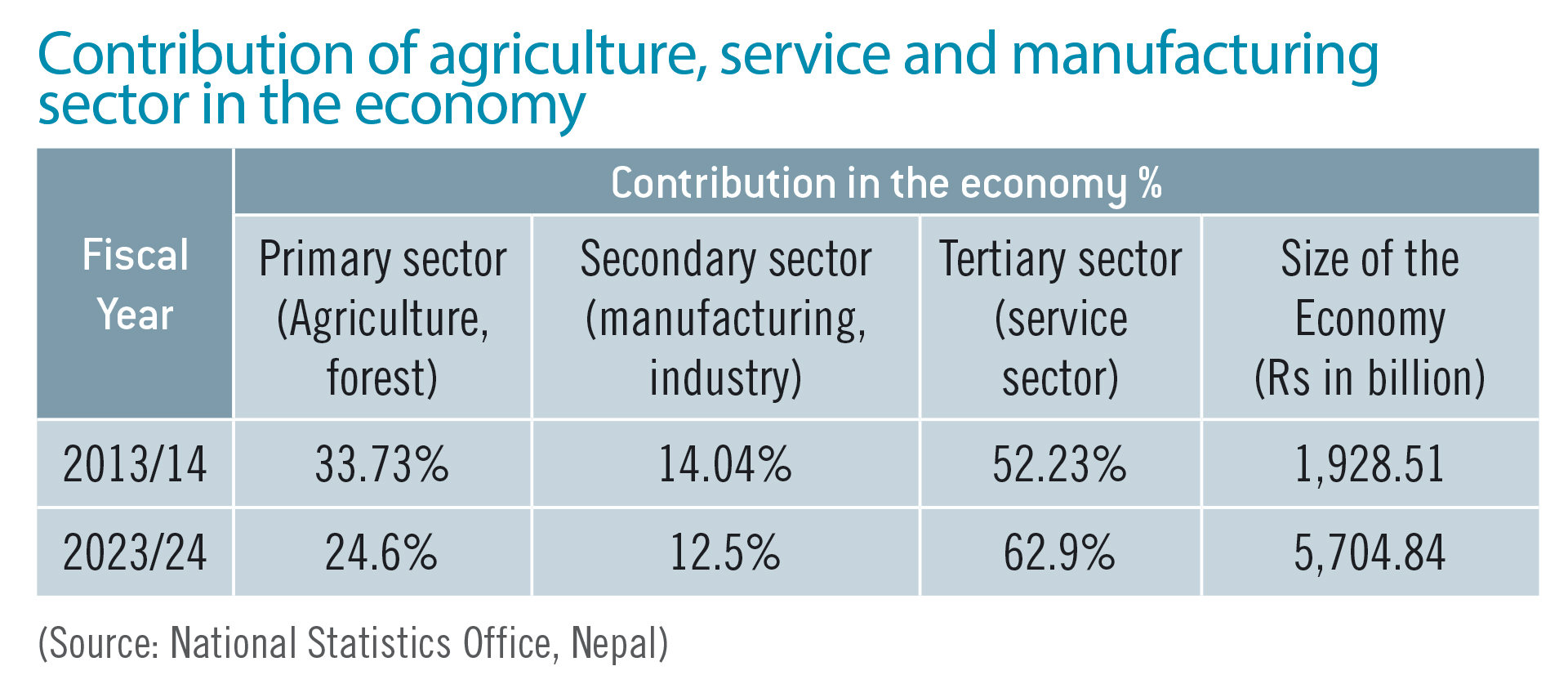

The manufacturing sector’s contribution to the Gross Domestic Product (GDP) in FY 2023/24 has plummeted to a mere 12.5%, and is expected to decline further. Industries are operating below capacity due to a slump in domestic demand, particularly in the construction sector.

The slowdown in construction has led to a significant mismatch between production capacity and demand for cement and other construction materials. Nepal’s annual cement production capacity exceeds 25 million tonnes but factories are operating at less than 32% capacity, producing only eight million tonnes. This under-utilisation has driven up production costs and hindered job creation.

A survey conducted by the Confederation of Nepalese Industries (CNI) revealed that the capacity utilisation of manufacturing industries averaged only 52.03% in FY 2023/24. The survey covered a range of sectors, including beverages, cement, cable and wire, agro processing, footwear, fast moving consumer goods (FMCG), and others.

Hari Bhakta Sharma, former President of CNI and Executive Director of Deurali-Janata Pharmaceuticals, has observed a trend of industrialists transitioning to trading due to the challenges of operating industries and low profitability. He emphasises the urgent need for government interventions to create a favourable investment climate to sustain industrial growth. “It is time that the government start promoting the manufacturing sector of the country,” he stressed, saying that “not only does manufacturing boost the national economy but it also contributes significantly to employment generation.”

Nepal’s path to self-reliance was once spearheaded by sectors such as cement and clinker, footwear, poultry, sugar and dairy products which had strong backward and forward linkages. However, these industries are now facing significant challenges and losing momentum.

Rudra Prasad Neupane, President of Footwear Manufacturers Association of Nepal, said, “All industries striving for self-reliance are on the brink of collapse due to a lack of demand and numerous obstacles created by regulators and the government.”

Nepal’s competitive production capacity has eroded due to a lack of effective government intervention. In response, the government has imposed import bans and increased duties to protect domestic industries like sugar and dairy products.

Time government wakes up to address issues constraining production

Posh Raj Pandey, an international trade expert, criticised the government’s approach, stating that while raising import duties to a reasonable level can be justified to protect domestic industries, a complete ban is extreme and unjustified. He argued that the government’s inefficiency and the shortcomings of domestic production units should not be imposed on consumers.

Nepal’s sugar factories are operating significantly below capacity due to shortage of raw materials, leading to high production costs and difficulty in competing with cheaper imports. These factories rely heavily on government protection through import duties. However, industry experts believe that with adequate raw material supply, Nepal’s sugar factories could produce enough to meet domestic demand. Increasing raw material availability could boost capacity utilisation by up to one-third.

The sugar industry has been hampered by delayed payments to farmers, inadequate fiscal incentives, and limited extension services, discouraging sugarcane cultivation. Sugar factories, which also generate electricity from raw materials, face concerns regarding the quality of sugarcane and the availability of loans against sugar stocks as collateral.

To enhance competitiveness, numerous issues require attention. Anjan Shrestha, Senior Vice President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), advocates for government measures to reduce taxes on raw materials and intermediate goods, and lower logistics costs through improved infrastructure and streamlined processes. He added that the government also needs to minimise compliance requirements, adopt a facilitative rather than regulatory approach, improve access to credit, and offer lower and fixed interest rates for industries. Shrestha points to neighbouring India as an example, emphasising that attracting investment without significant reforms to the investment climate will be challenging.

Nara Bahadur Thapa, an economist and former Executive Director of Nepal Rastra Bank, suggested using the Ease of Doing Business indicators as a benchmark for reforms, focusing on areas such as starting a business, construction permits, electricity access, property registration, credit, minority investor protection, taxation, cross-border trade, contract enforcement, insolvency resolution, labour regulations and contract enforcement. Thapa added that industrialisation is crucial for achieving and sustaining stable economic growth.

Manufacturing units producing goods for export including carpets, garments, pashmina, yarn, zinc sheets and juices have demonstrated better capacity utilisation compared to those focused on domestic consumption.

To reap the benefits of niche market advantages, Nepal should focus on producing specialised products and integrating into the value chains of large-scale industries in India and China.

A recent survey by Nepal Rastra Bank revealed that Foreign Direct Investment (FDI) companies in Nepal have an average capacity utilisation of 60.69%. FDI in the tradable sector has played a crucial role in achieving stable export growth, as these companies actively explore foreign markets.

To reap the benefits of niche market advantages, Nepal should focus on producing specialised products and integrating into the value chains of large-scale industries in India and China. Pandey emphasised the global trend of fragmented production, suggesting that becoming an ancillary to large Indian or Chinese industries could provide a stable foundation for industrialisation in Nepal.

To maintain competitiveness, many industries worldwide source intermediate goods from countries where they can be produced cost-effectively. Nepal is encouraged to adopt a similar approach, capitalising on its abundant clean energy to drive large-scale industrialisation.

Having bypassed traditional industrialisation and transitioned directly from agriculture to a service-driven economy, Nepal’s foundations are somewhat fragile. Pandey argued that this opportunity for industrialisation should not be missed to ensure the stability and resilience of the economy.

He emphasised that by developing strong value chain integration with large industries in India, China, or other countries, Nepal can attract foreign direct investment, supplement domestic capital, and create a favourable environment for industries to thrive.

-1765706286.jpg)

-1765699753.jpg)