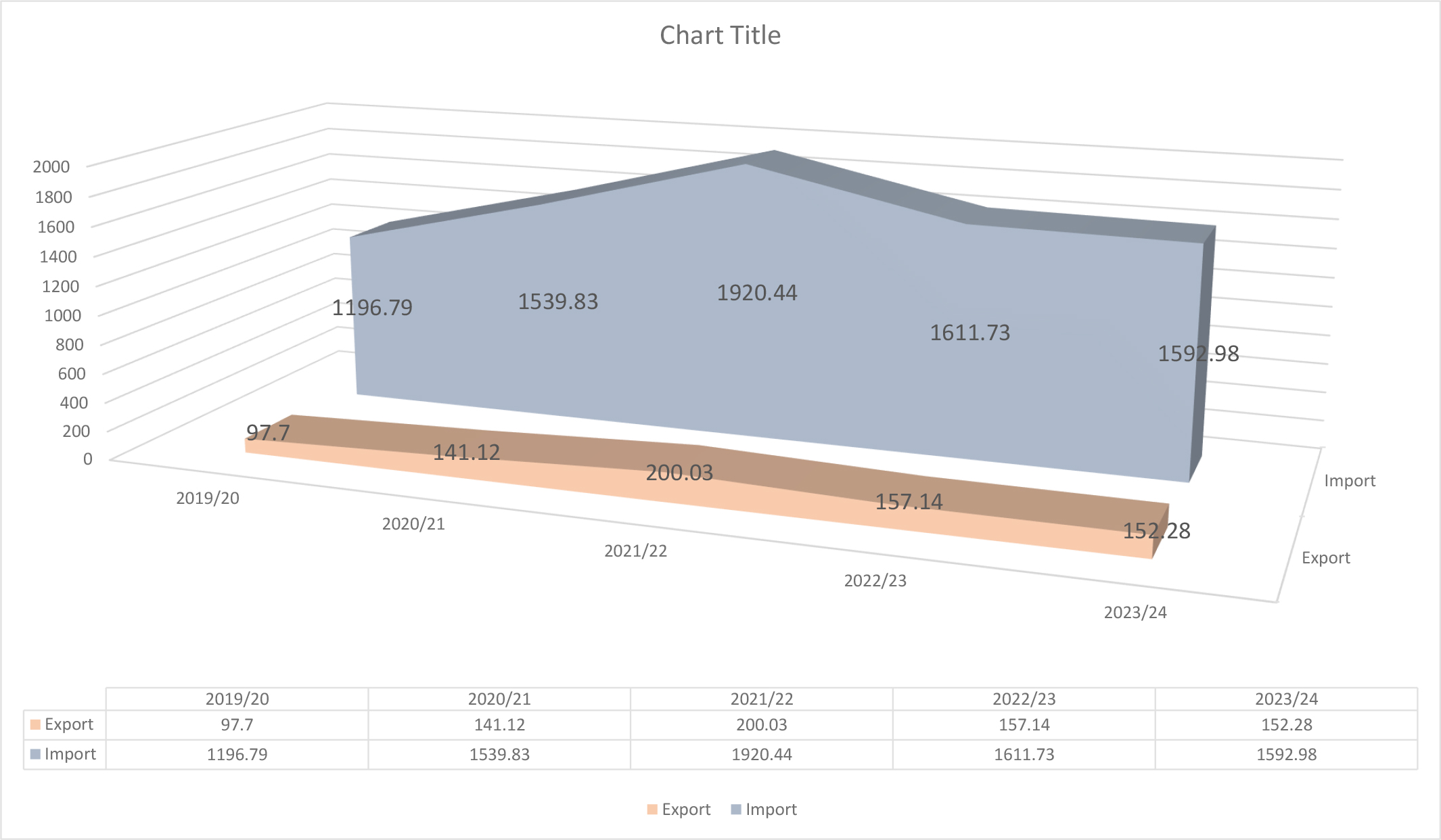

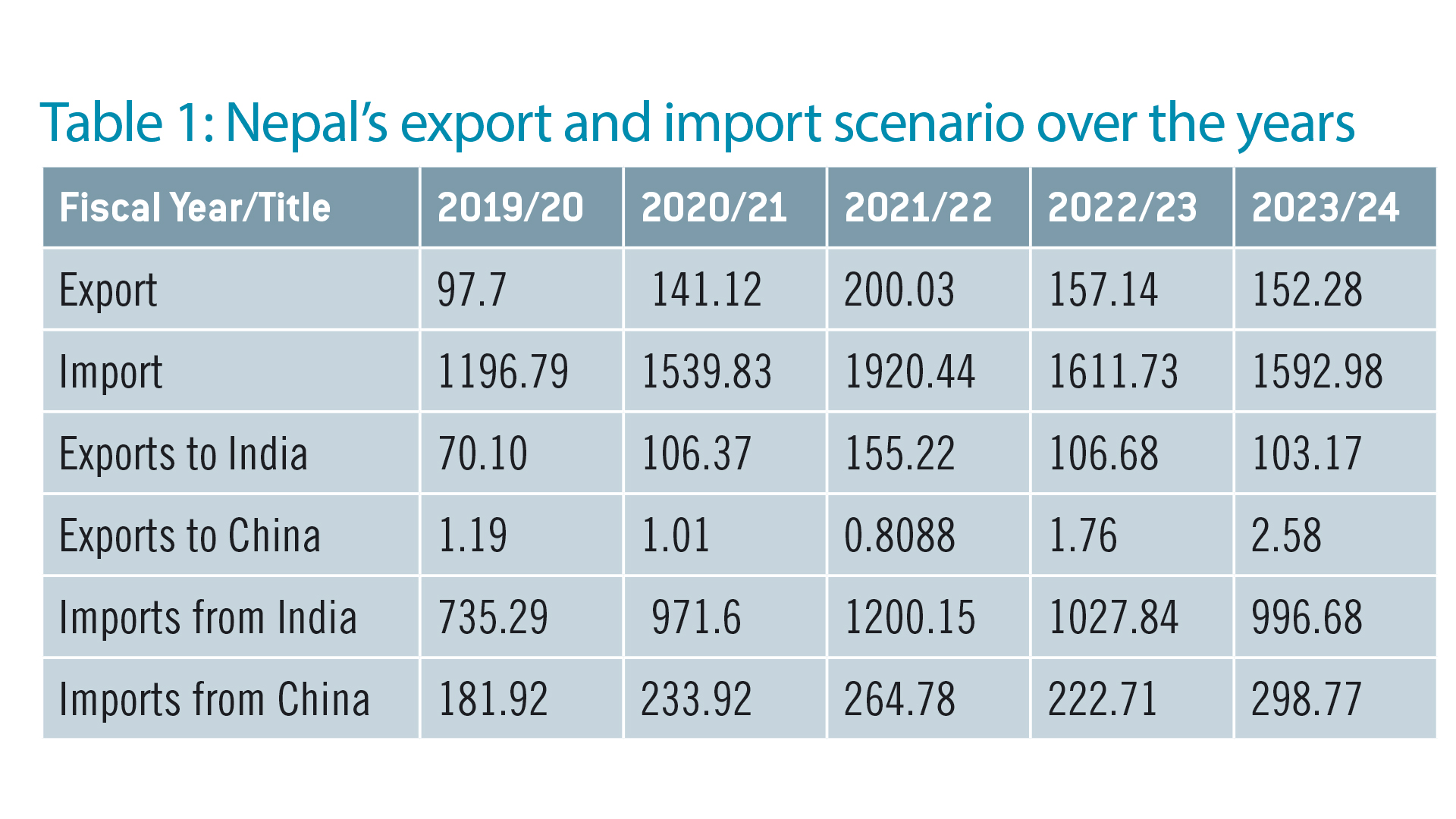

Nepal’s exports are highly volatile due to the country’s lack of a strong production base. While Nepal has boosted exports through minimal value addition in palm oil and soybean oil, it has faced challenges in sustaining this growth in recent years.

Exports doubled between 2019/20 and 2021/22, from Rs 97 billion to Rs 200 billion. However, export earnings dropped sharply after 2021/22 as the export of new products, such as palm oil and soybean oil, declined significantly, leading to lost market opportunities in India.

Top export commodities

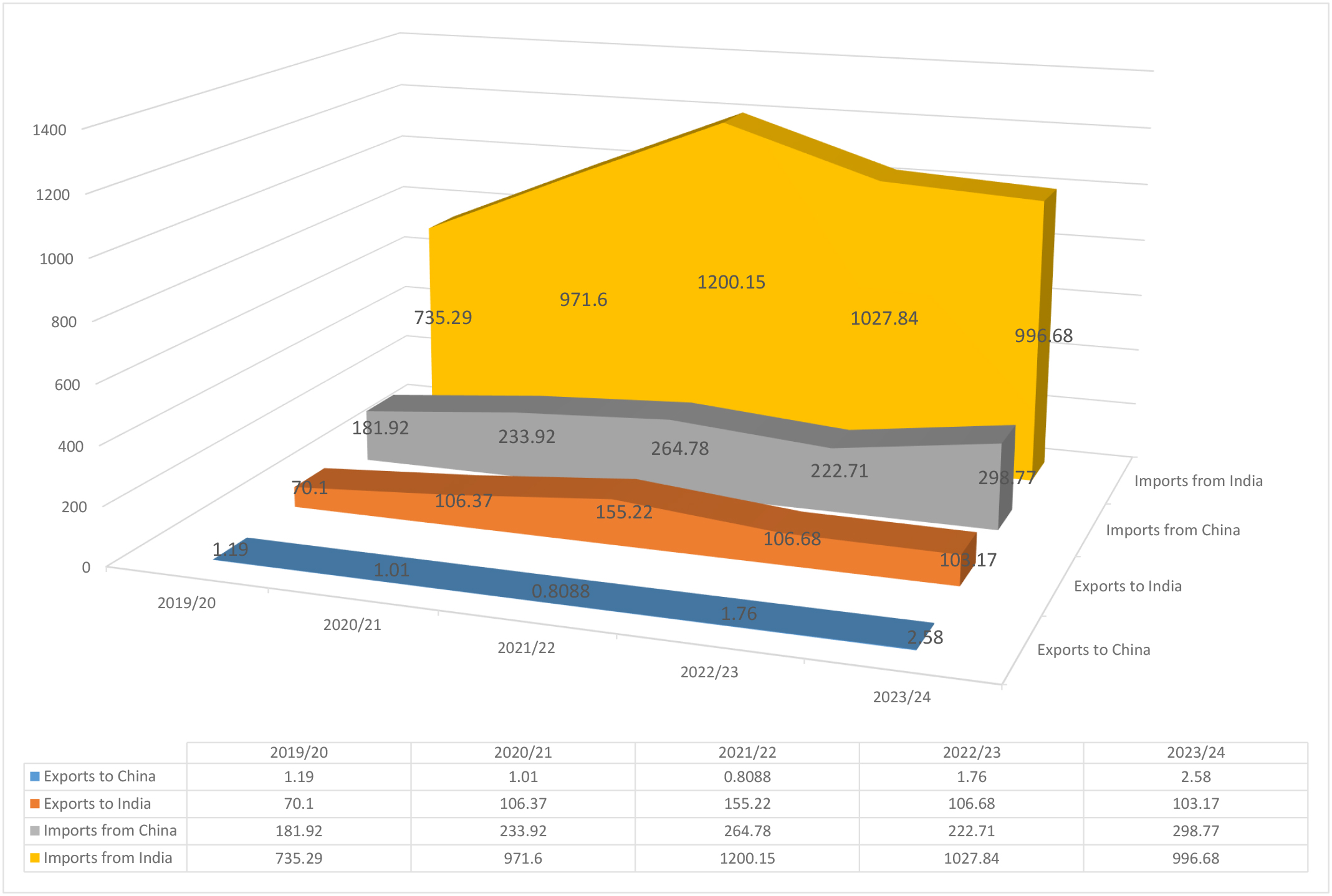

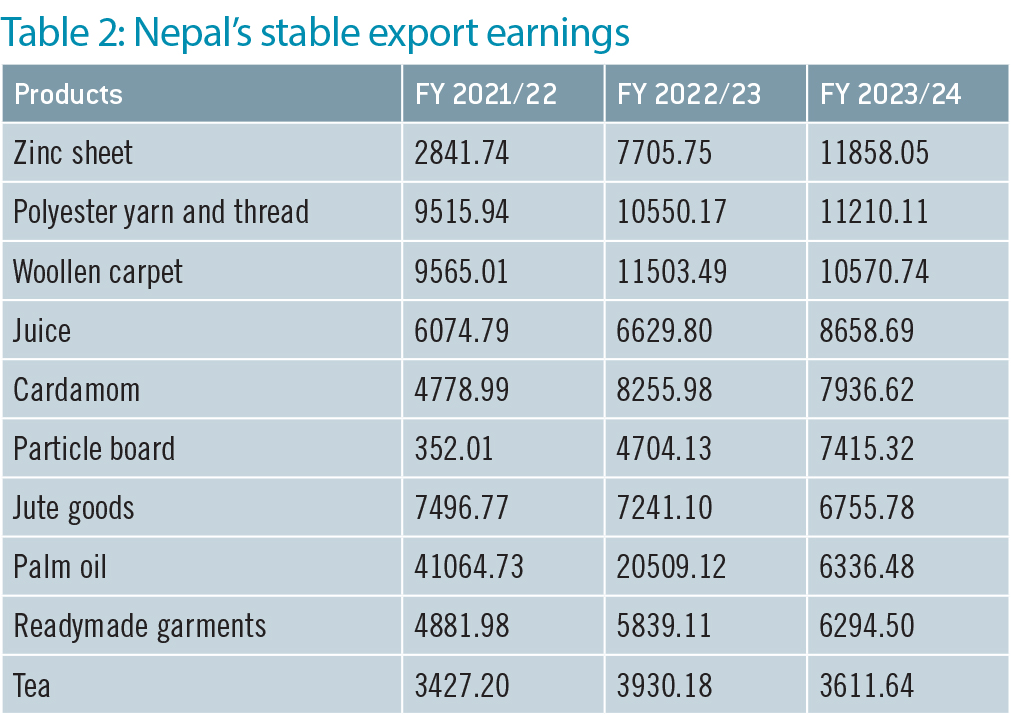

Two-thirds of Nepal’s exports and imports are conducted with India. The traditional list of commodities has consistently sustained Nepal’s stable export earnings. However, some products have emerged and disappeared within a short period, including vegetable ghee, palm oil, betel nuts and soybean oil among others. (see table 2)

Nepal recorded high export of palm oil worth Rs 41.06 billion in FY 2021/22 which plummeted to Rs 6.33 billion in FY 2023/24. Such products emerged for a short period and then disappeared, mainly due to the duty differences between the Nepali and Indian markets. As these products began flooding the Indian market, India started questioning the level of value addition.

The Indo-Nepal Trade Treaty mandates a 30% value addition requirement for exporting any commodity to the Indian market. However, under the provisions of SAFTA (South Asian Free Trade Area), the domestic value addition in the exporting country must be at least 25%. Palm oil exporters in Nepal have claimed a 40% value addition, despite importing raw materials from third countries.

Production base and emerging sectors

Zinc sheets, polyester yarn and thread, woollen carpets, juice and cardamom are Nepal’s major export commodities, with a strong production base for these select products. Additionally, the country has numerous products with competitive and comparative advantages, offering significant value addition and strong forward and backward linkages, such as handicrafts, cardamom, woollen carpets, medicinal herbs, aromatic plants, tea, pashmina and juices, among others.

Shashi Kant Agrawal, Managing Director of MS Group, highlighted various challenges for exports and the fundamental production base in the country which are tied to the overall investment climate. He has been operating Reliance Spinning Mills in Nepal for the past three decades producing 127,000 spindles per year, which falls short of taking advantage of economies of scale. “If the spinning mill were operated in countries with better investment climate, it would certainly produce 500,000 spindles per year.”

Beyond the insufficient scale of production, there are numerous obstacles to both production and export, including high logistics costs for importing raw materials and exporting goods, unstable policies, poor infrastructure, lack of skilled human resources, and high funding costs (credit). While labour relations and the supply of electricity have improved to some extent, the reliability of electricity and labour efficiency remain concerns.

Additionally, tariff and non-tariff barriers imposed by importing countries discourage Nepal’s exports. Given these high barriers, former Finance Minister, Yubaraj Khatiwada, once suggested that Nepal should focus more on service trade rather than goods trade. A study by the Institute of Integrated Development Studies (IIDS) aligns with this view, identifying IT as Nepal’s major USP (unique selling proposition). The study, titled ‘Unleashing IT: Advancing Nepal’s Digital Economy’, released by IIDS in July 2023, reveals that Nepal’s IT service export (ITeS) industry is valued at approximately $515 million. It includes over 106 IT service export companies, 14,728 IT freelancers in software development and technology, and 51,781 ITeS freelancers engaged in exporting IT services through various digital platforms.

“The total IT service export reached $515 million in 2022, representing a 64.2% growth since 2021. Both IT companies and freelancers experienced substantial growth with IT companies recording an 80.5% increase in service exports and freelancers achieving a 55.2% growth compared to the previous year,” the study reports.

The ICT sector, though largely under-reported, is Nepal’s largest export contributor, engaging more talent to expand their horizons beyond borders. This type of export doesn’t require customs clearance or quality control at the importing country’s quarantines, which has left the state largely unaware of the sector’s activities and potential.

While the fiscal budget for 2023/24 announced the withdrawal of the minimum threshold in the ICT sector, this provision failed to come into force as it was overlooked during the amendment of the Foreign Investment and Technology Transfer Act (FITTA).

Nara Bahadur Thapa, former Executive Director of Nepal Rastra Bank, advised that ICT companies should be granted certain exchange facility through Nepal Rastra Bank to open contact offices in foreign countries for marketing and branding. “ICT companies require funds for marketing since most of their business comes from abroad,” he stated. “The ICT sector has enormous competitive strength, similar to other sectors like tourism and hydroelectricity,” he added.

It is certain that ICT and hydropower will transform the dynamics of Nepal’s exports. India, the southern neighbour, has allowed Nepal to export 10,000 MW of electricity to the Indian market over the next ten years. So far, Nepal has realised about 10% of that capacity, exporting 941 MW of electricity generated from 28 hydropower plants to India. Additionally, India has permitted Nepal to sell electricity to Bangladesh via Indian power grids. Nepal and Bangladesh are set to sign a deal on October 3 this year for the sale of 40 MW of power to Bangladesh in the first phase. Nepal’s earnings from power exports could increase significantly this year, compared to approximately Rs 17 billion in the previous Fiscal Year 2023/24.

What next?

The Ministry of Industry, Commerce, and Supplies (MoICS) recently unveiled the 2023 edition of the Nepal Trade Integration Strategy (NTIS), prioritising sectors such as tourism, ICT, hydroelectricity, construction, and skilled and semi-skilled human resources (remittance-earning services) as areas of comparative and competitive advantage. These sectors have been identified as having high potential to boost exports, reduce the alarming trade deficit, and support the economy in achieving a stable growth trajectory.

Purushottam Ojha, former Secretary of the Ministry of Industry, Commerce and Supplies, stated that the current market is a buyer’s market, not a seller’s market, emphasising the need for Nepal to address production and supply-side constraints. “Buyers have multiple options and competition among sellers is high,” he said. “To gain trust, timely delivery without compromising on quality is critical, otherwise the seller will lose the market.”

Ojha further suggested that Nepal should focus on reducing production costs and addressing other barriers to enhance exports. He noted that some countries like Bangladesh have implemented ‘export ambulances’ and emphasised the importance of enhancing production capacity.