Banks and financial institutions (BFIs) in Nepal have been grappling with phenomenal challenges in expanding credit. Due to lack of credit demand from the business fraternity, interest rates have been going down to the lowest minimum. Big borrowers, mainly corporate clients, are under pressure to pay back the loans they had availed as working capital during the Covid 19 pandemic to leverage their businesses through cheaper funds. However, the enforcement of the Working Capital Guideline consequently has built pressure on them to pay back the loans.

Against this backdrop, BFIs have been reportedly exploring new sectors for financing. However, the collateral-based lending policy of banks and financial institutions has been impeding the concept of project financing. Projects that have been designed based on market potential, and backed by innovative ideas and entrepreneurial skillsets are deprived of financing as they lack immovable assets to furnish as collateral.

Ashok Sherchan, CEO of Prabhu Bank, says that bankers cannot issue project-based loans at their own risk. He stated that if the project fails due to any reason, the concerned BFI’s loan sanctioning authority is held accountable along with the borrowers. “In this situation no one wants to take any risk because any project could succeed or fail,” he said, adding, “Considering the fact that credit mobilisation is close to the size of the gross domestic product (GDP), which shows an overvaluation of collaterals or something else, the government must come up with clear policies and guidelines for project financing.”

However, it does not mean that project financing is not happening at all in Nepal. It is happening but the banks issue credit only against the land of the project such as hotels/hospitality business or mill/machinery, raw materials or production outputs of the factories along with the credibility of the borrower.

However, the broader discussion centres around providing access to finance for those aspiring to entrepreneurship, with BFIs comfortable financing based on project proposal evaluations. Many global brands began as startups with innovative ideas, such as Eric Schmidt of Google, Phil Knight of Nike, and Mark Zuckerberg of Facebook.

Who avails the loan?

Till October 2024, commercial banks in Nepal have mobilised loans worth Rs 4.63 trillion. So far, only 1.9 million borrowers have availed credit from banks, however, the number of deposit accounts has exceeded 56.7 million, according to Nepal Rastra Bank. The number of deposit accounts maintained in banks is high due to duplications. However, the state of loan accounts interprets the whole story of access to finance. Only a few business people have been enjoying credit facilities and BFIs have remained confined only among the big borrowers.

Nepal Rastra Bank’s instruction to lend in the directed sectors of national priority, such as agriculture; micro, small and medium enterprises (MSMEs); and to the deprived sector has contributed a bit to the expansion of access to finance. Class ‘A’, ‘B’ and ‘C’ category of BFIs lend to the deprived sector through Microfinance Institutions (MFIs) or class ‘D’ financial institutions. However, the sad truth is even the MFIs are not able to lend to half of their members. According to the central bank, MFIs have over six million members but only 2.6 million have availed credit from them.

Commercial banks have to provide 5% of their total lending to the deprived sector while the requirement for development banks and finance companies has been fixed at 4.5% and 4%, respectively.

Authorities in the central bank claim that deprived sector lending has been instrumental in providing access to finance and unleashing the entrepreneurial potential of youth, women and marginalised communities, among others.

Chiranjibi Nepal, Former Governor of Nepal Rastra Bank, has suggested that banks should explore new avenues instead of staying confined to a few big corporates if they want to expand their credit. He added that BFIs in Nepal have overlooked their responsibility towards the society, which can be fulfilled by accommodating more enterprises and aspiring entrepreneurs by providing access to finance and assisting them to thrive.

Eligibility

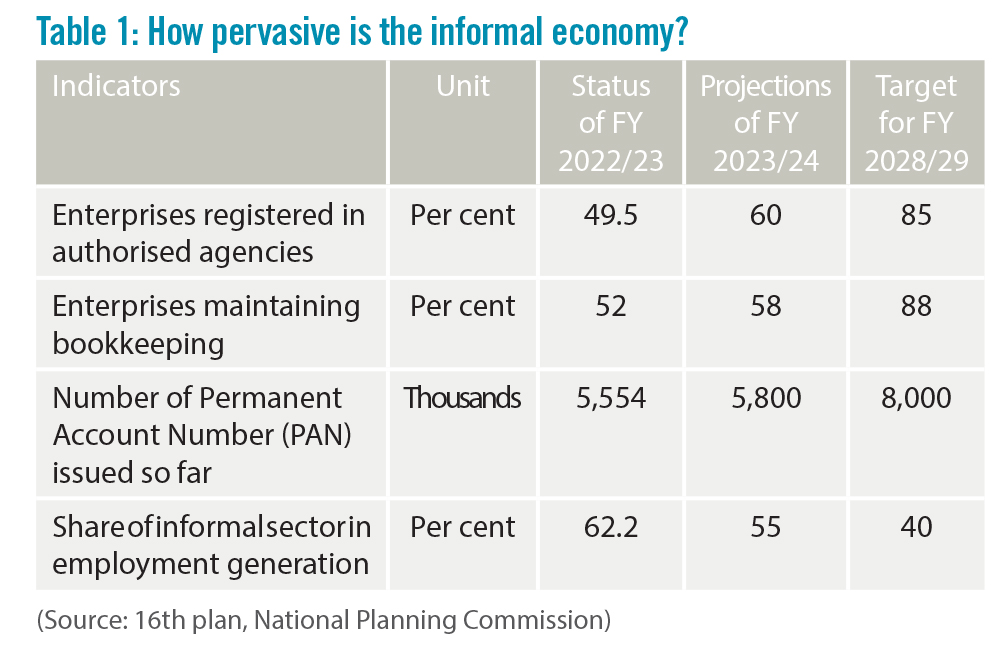

Though the central bank claims that there has been an improvement in the access to finance situation, the reality is drastically different. According to the government's 16th periodic plan (2024/25–2028/29), 49.5% of enterprises are not registered with government agencies and operate informally. Of these, only 52% maintain proper bookkeeping, while the remaining 48% do not. This means that 48% of enterprises are not eligible to avail loans.

Bankers have also admitted that many MSMEs and cottage industries are availing credit from cooperatives, loan sharks and other informal markets due to their inability to follow the procedural steps to make them eligible to avail loans from banks and financial institutions. Also, collateral, company and tax registration, bookkeeping and other requirements such as developing business proposals are essential to be eligible to avail credit from BFIs, according to Gyanendra Prasad Dhungana, Chief Executive Officer of Nabil Bank. (See Table 1)

To address the challenge of access to finance, the government and central bank have to launch a joint initiative, according to Nara Bahadur Thapa, Former Executive Director of Nepal Rastra Bank.

Formalisation of the economy not only builds transparency but will also provide avenues for revenue mobilisation, jobs, facilitate realistic projections and policy making, and most importantly it will also open up new lending avenues for BFIs, according to Thapa.

As banks and financial institutions are struggling to achieve the mandatory threshold for SME financing despite excess liquidity in their vaults, formalisation of the economy offers a significant opportunity for BFIs to expand credit. Besides, the government also has to devise and execute mechanisms to help firms in the informal sector to transition to the formal sector.

Thapa suggested that the government could launch Business Development Services (BDS) to assist in the formalisation of a large number of enterprises by supporting them in registering, maintaining bookkeeping, conducting audits, forecasting business needs and preparing necessary documents. These initiatives will certainly lead to significant progress in expanding access to finance and being more inclusive as well as promoting broad based financing. Consequently, this will end the compulsion for budding entrepreneurs to rely on informal credit sources, such as loan sharks, who exploit their borrowers.

Thapa underlined the urgency of establishing BDS as a financial auxiliary like the Credit Information Bureau, Nepal Clearing House, and the Financial Intelligence Unit, among others, to enhance access to finance. “Easy access to finance will provide room for the youth to explore opportunities in the homeland and rampant youth migration will be discouraged to some extent,” he added.

Room for financing

There is enough room for financing in agriculture, MSMEs and other sectors where BFIs have been mandated by the central bank to extend credit. But these lending requirements are largely unmet as per the central bank’s requirement. However, bankers have said that they are exploring potential credible borrowers. “We will certainly lend if we receive convincing proposals,” said Dhungana. To meet this goal, Nepal Rastra Bank has also enabled banks to invest in bonds issued by BFIs with expertise in specific sectors, thereby channeling funds into production through priority sector lending.

Banks have still not been able to meet the requirement of allocating 15% credit from their total loan portfolio to MSMEs by mid-July 2024. In addition, the central bank had instructed BFIs to lend 15% of their total loan portfolio to the agriculture sector by mid-July 2023 and 10% to the energy sector by mid-July 2024, however, the target has been largely unmet.

Recently, Nepal Rastra Bank through its Monetary Policy, has also announced it will increase the ticket size of MSMEs loan from the existing Rs 10 million. Further, MSMEs can enjoy a stable interest rate (base rate + 2%), which includes support for agro-based industries, ICT, tourism, and domestic production. (See Table 2)