Stagnation in credit growth could dampen economic growth in the ongoing fiscal year. Though Nepal Rastra Bank – central regulatory and monetary authority – has introduced flexible provisions to support credit expansion, credit growth in the first quarter (August to October 2024) stood at only 5.25%, a dismal improvement compared to 5% of the previous fiscal 2023/24.

“Normally, the first quarter determines the scenario of credit growth for the entire fiscal year as demand is placed by borrowers at the beginning of the fiscal as per their plans of business operations and expansion for the whole year. For example, L/Cs are opened to import goods targeting the festivals,” said Ashoke SJB Rana, CEO of Himalayan Bank.

The private sector has long alleged Nepal Rastra Bank for restricting credit expansion through various measures, including the 'Working Capital Guideline.' Addressing these concerns, the central bank has eased credit mobilisation. Enforcement of the Working Capital Guideline has been halted for this year. Despite these regulatory facilitations, credit stagnation persists, indicating a lack of appetite among the business community, according to Keshav Acharya, a senior economist.

“The large corporates, overfinanced, were compelled by the Working Capital Guideline to repay loans that could not be justified within their projects,” added Acharya.

Private sector representatives, however, have stated that the government should improve the investment climate and boost investor confidence in the country. Further, bankers have said that the private sector might have been waiting to avail credit as interest rates are declining to their lowest minimum.

Commercial banks’ profit surges by 20% in Q1

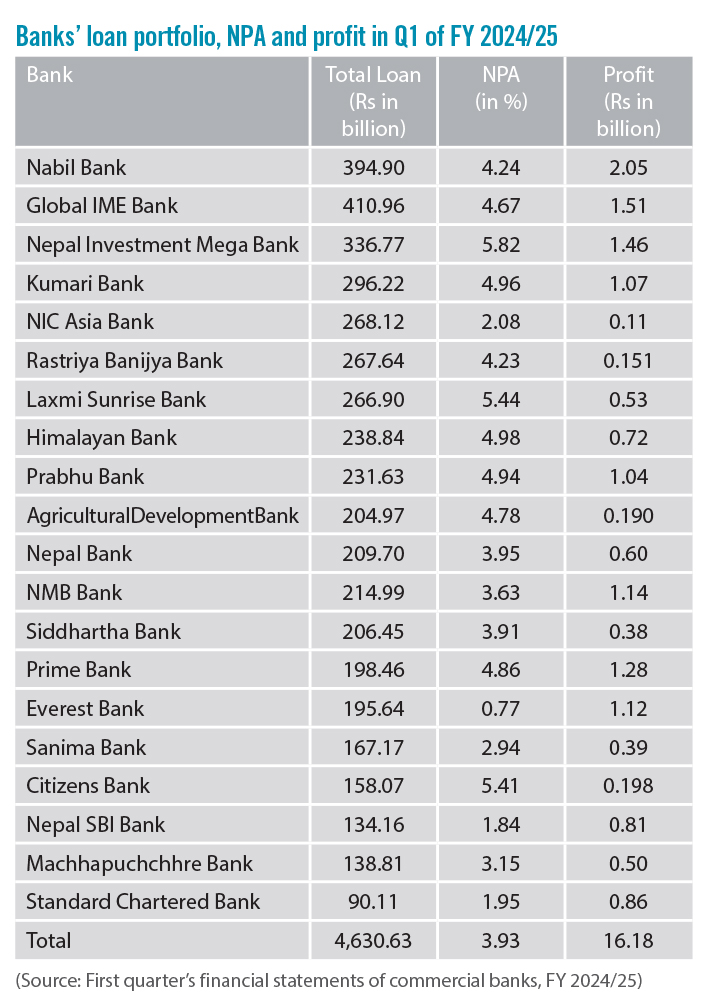

The profit made by commercial banks surged by 20% in the first quarter (Q1) of Fiscal Year 2024/25, according to their financial statements. The 20 commercial banks that are in operation have earned a total of Rs 16.18 billion in the first quarter, compared to Rs 13.47 billion in the corresponding period of the previous fiscal 2023/24.

Eight banks have earned a profit of above Rs 1 billion. The banks in the billionaire club in Q1 are Nabil Bank (Rs 2.05 billion), Global IME Bank (Rs 1.51 billion), Nepal Investment Mega Bank (Rs 1.46 billion), Prime Bank (Rs 1.28), NMB Bank (Rs 1.14 billion), Everest Bank (Rs 1.12 billion), Kumari Bank (Rs 1.07 billion) and Prabhu Bank (1.04 billion).

None of the banks have recorded negative profit growth. The bottom five banks in terms of profit are NIC Asia Bank (Rs 110.15 million), Rastriya Banijya Bank (Rs 151.3 million), Agricultural Development Bank (190.92 million), Citizens Bank (Rs 198.22 million) and Siddhartha Bank (Rs 382.08 million). NIC Asia Bank and Rastriya Banijya Bank have witnessed a significant decline in profits, with a slump of 89% and 82.4%, respectively.

Rising NPA and its ramifications

Non-Performing Assets (NPAs) of banks remain high despite the soft measures introduced by the Monetary Policy 2024/25. The NRB has been accused of helping banks raise profits by tweaking prudential norms. The central bank has revised the loan loss provisioning for pass category loans from 1.20% to 1.10% through the Monetary Policy. Additionally, the Monetary Policy has accommodated the demand of bankers to classify loans under the watchlist immediately upon resumption of debt servicing. Previously, despite the resumption of debt servicing, loss loans remained unchanged under the loss loan category for six months, requiring 100% provisioning.

If the debt servicing of loss/bad loans returns to normal, such loans will be classified under the watchlist for six months before being classified as pass/good loans. Under the watchlist category, only 5% loan loss provisioning is required.

Gyanendra Prasad Dhungana, CEO of Nabil Bank, admitted that the aforementioned provision of the Monetary Policy 2024/25 helped reduce NPAs by 0.5 percentage point. Compared to the corresponding period of the previous fiscal year, NPAs increased by 0.53 percentage point to 3.93% of the total loan portfolio. The existing loan portfolio of commercial banks as of Q1 of FY 2024/25 stood at Rs 4,630.63 billion, and NPAs hovered at Rs 181.98 billion. NPLs have been consistently rising from Rs 149.58 billion in the corresponding period of the previous fiscal year. They reached Rs 159.84 billion at the end of the previous Fiscal Year 2023/24.

Despite attempts by the central bank and banks to conceal NPAs through classification and soft supervision, NPAs have been increasing significantly. The consistent rise in NPLs has vindicated the concerns of the International Monetary Fund (IMF) regarding the asset quality of BFIs. The IMF has been urging the central bank to reclassify loans and audit the top ten Nepali banks using international audit firms. However, Dhungana has stated that the current level of NPAs is not alarming, considering Nepal's banking history. Private banks have been in operations for over 40 years, and government-owned banks have an even longer history.

Many believe that the reported figure significantly understates the actual NPA situation. A key criterion for determining NPL is loan ageing. A loan deteriorates from the 'pass' category if repayment stalls for 1-3 months, requiring a 5% loan loss provision under the watchlist category. It is then classified as 'substandard' if repayment stalls for 3-6 months, requiring a 25% provision. If payment stalls for 6-12 months, it is classified as 'doubtful,' requiring a 50% provision. After one year or more, it is classified as a 'loss' loan, requiring a 100% provision.

Rising NPAs have exposed the recovery challenges faced by banks and financial institutions (BFIs). However, bankers say that the current challenge is largely attributed to economic slowdown, and that recovery will improve as economic activities accelerate.

Nepal Rastra Bank should take immediate actions to lower NPAs, according to Anal Raj Bhattarai, a financial sector analyst. "NRB, however, has announced plans to formulate a draft Bill for establishing an Asset Management Company (AMC) to manage and enhance the recoveries of distressed assets removed from the banking system," he added. “If NPAs continue to rise, it will hamper the loan expansion capacity of banks, which is why it must be taken care of considering the risk in financial stability,” Bhattarai stated.

The first quarter statements of commercial banks show that Nepal Investment Mega Bank, Laxmi Sunrise Bank, Citizens Bank, Kumari Bank and Himalayan Bank have the highest NPA in the industry against their portfolio. Banks with the largest loan portfolios, Global IME Bank and Nabil Bank also have high NPAs worth Rs 19.19 billion and Rs 16.47 billion, respectively

-1765706286.jpg)

-1765699753.jpg)