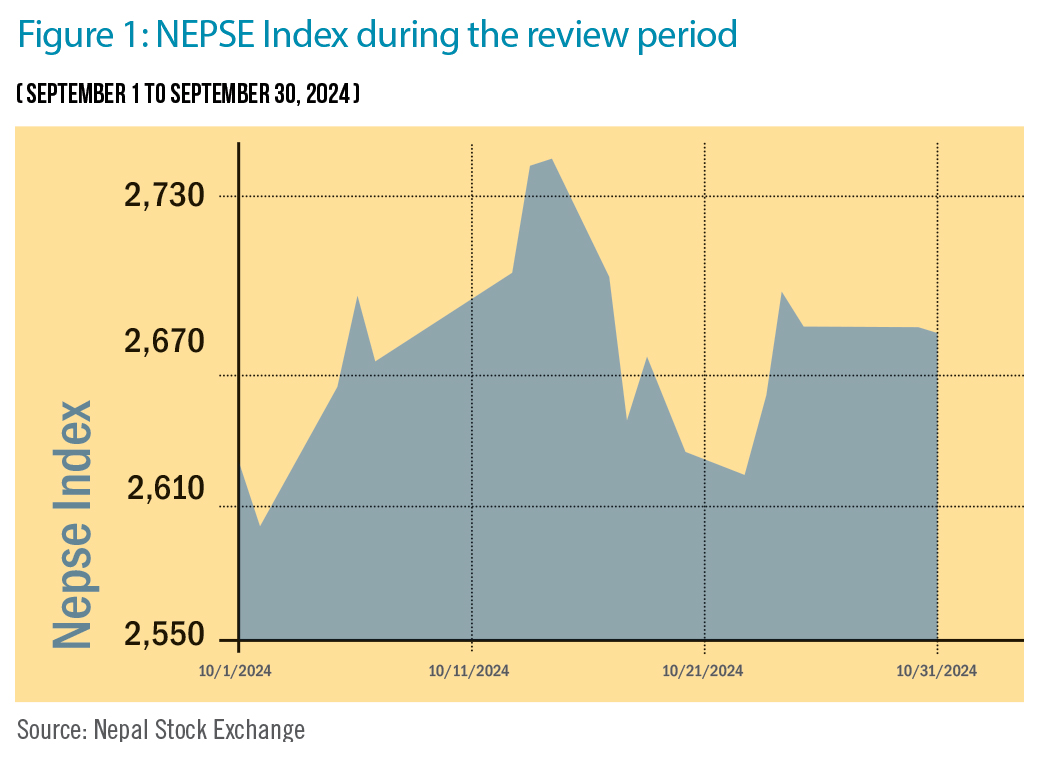

The Nepal Stock Exchange (NEPSE) index rose by 165.17 points (+6.58%) to close at 2,675.51 points during the review period between October 1 to November 6, 2024. It reached its highest point on October 17 at 2,745.36 points. The NEPSE index saw tumultuous movement, without any fixed trend, during the review period. However, it managed to recover from the decline in the previous period. The overall market volume during the review period dropped to Rs 113.44 billion, a 29% decrease. (See Figure 1)

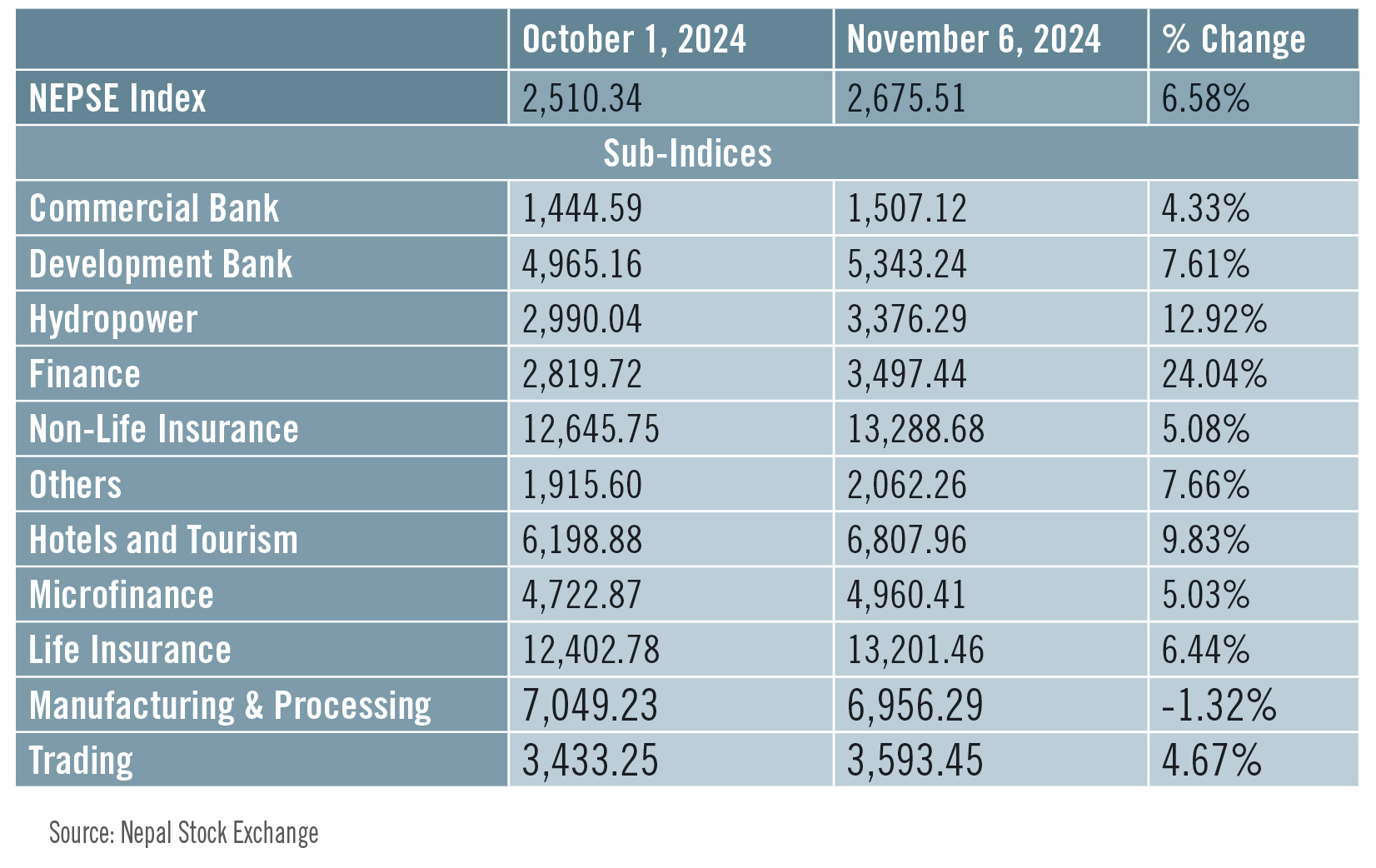

During the review period, 10 of the 11 sub-indices landed in the green zone while only one landed in red.

Finance sub-index (+24.04%) was the biggest winner as the share value of Samriddhi Finance (+Rs 313.9), Janaki Finance (+Rs 240.4) and Nepal Finance (+Rs 202.1) increased substantially. Hydropower sub-index (+12.92%) followed suit with rise in share prices of Kutheli Bukhari Small Hydropower (+Rs 751), Peoples Hydropower (+Rs 283.51) and River Falls Power (+Rs 199.1).

Hotels and Tourism sub-index (+9.83%) was next in line as the share value of City Hotel (+Rs 107), Soaltee Hotel (+Rs 84.5) and Kalinchowk Darshan (+Rs 76) went up.

Others sub-index (+7.66%) saw an increase in share prices of Muktinath Krishi (+Rs 241), Nepal Warehousing (+Rs 110) and Himalayan Reinsurance (+Rs 95).

Development Bank sub-index (+7.61%) witnessed a rise in share values of Narayani Development (+Rs 166.8), Sindhu Bikash (+Rs 150) and Karnali Development (+Rs 142.8). Life Insurance sub-index (+6.44%) also saw increase in share prices of Citizen Life Insurance (+Rs 73.3), Asian Life (+Rs 67.5) and Nepal Life Insurance (+Rs 64.3).

Non-Life Insurance sub-index (+5.08%) surged with rise in share value of Rastriya Beema Company (+Rs 202), Sanima GIC Insurance (+Rs 121) and IGI Prudential Insurance (+Rs 58.8). Microfinance sub-index (+5.03%) followed suit with increase in share values of Samaj Microfinance (+Rs 803.9), Mithila Microfinance (+Rs 330.6) and Unique Nepal Microfinance (+Rs 238).

Trading sub-index (+4.67%) saw the share values of Salt Trading Company (+Rs 267) and Bishal Bazar Company (+Rs 155) climb up. Commercial Bank sub-index (+4.33%) came next with rise in share prices of Standard Chartered (+Rs 60.1), Nepal SBI (+Rs 51.7) and Nepal Bank (+Rs 20.1).

Meanwhile, Manufacturing and Processing sub-index (-1.32%) was the only loser with drop in share prices of Unilever Nepal (-Rs 2,490), Sarbottam Cement (-Rs 29.7) and Ghorahi Cement (-Rs 19.6). (See Table 1)

News and Highlights

The Ministry of Finance has advanced SEBON's proposal for the issuance and trading of securities by small and medium-sized enterprises (SMEs); the draft regulations are now awaiting approval from the cabinet. It has proposed a dedicated trading platform for SMEs or companies with a maximum paid-up capital of Rs 250 million.

On the public issue front, SEBON was unable to approve any new Initial Public Offerings due to the continuing vacancy of its chairperson’s position. However, SEBON has approved the Further Public Offerings (FPOs) of Samata Gharelu Microfinance worth Rs 35.09 million under Microfinance sub-index. Muktinath Capital has been appointed as the issue manager for the FPO. Similarly, right shares of Liberty Energy (Rs 750 million) and Balephi Hydropower (Rs 1.82 billion) were approved under the Hydropower sub-index. Prabhu Capital and NIMB Ace Capital have been appointed as respective issue managers.

Outlook

A majority of the sub-sectors witnessed positive changes compared to the previous period. However, investors remain cautious, closely monitoring the market for signs of a trend reversal that might spark a rebound. Economic activities have started to pick up post-festivities and listed companies continue to announce dividends from the earnings of the previous year, which can contribute to optimism in the market.