As investors in this burgeoning nascent ‘private equity and venture capital’ space, it has been fascinating to observe the evolution of this asset class in Nepal with a number of intriguing case studies to absorb from. From four PEVC investors up until 2017, the market has grown to 20 players today. The fundamental function of fund managers of this asset class is to back potential business winners that may disrupt the status quo with sustainable and scalable business models providing handsome returns. In exchange, a fund manager invests risk capital to back such businesses and may also provide capacity building and network support, and where necessary shepherding support. During the deal negotiation, the paradox of human behaviour meets the ingenious creativity of mathematical science – 'Valuation vs Pricing'.

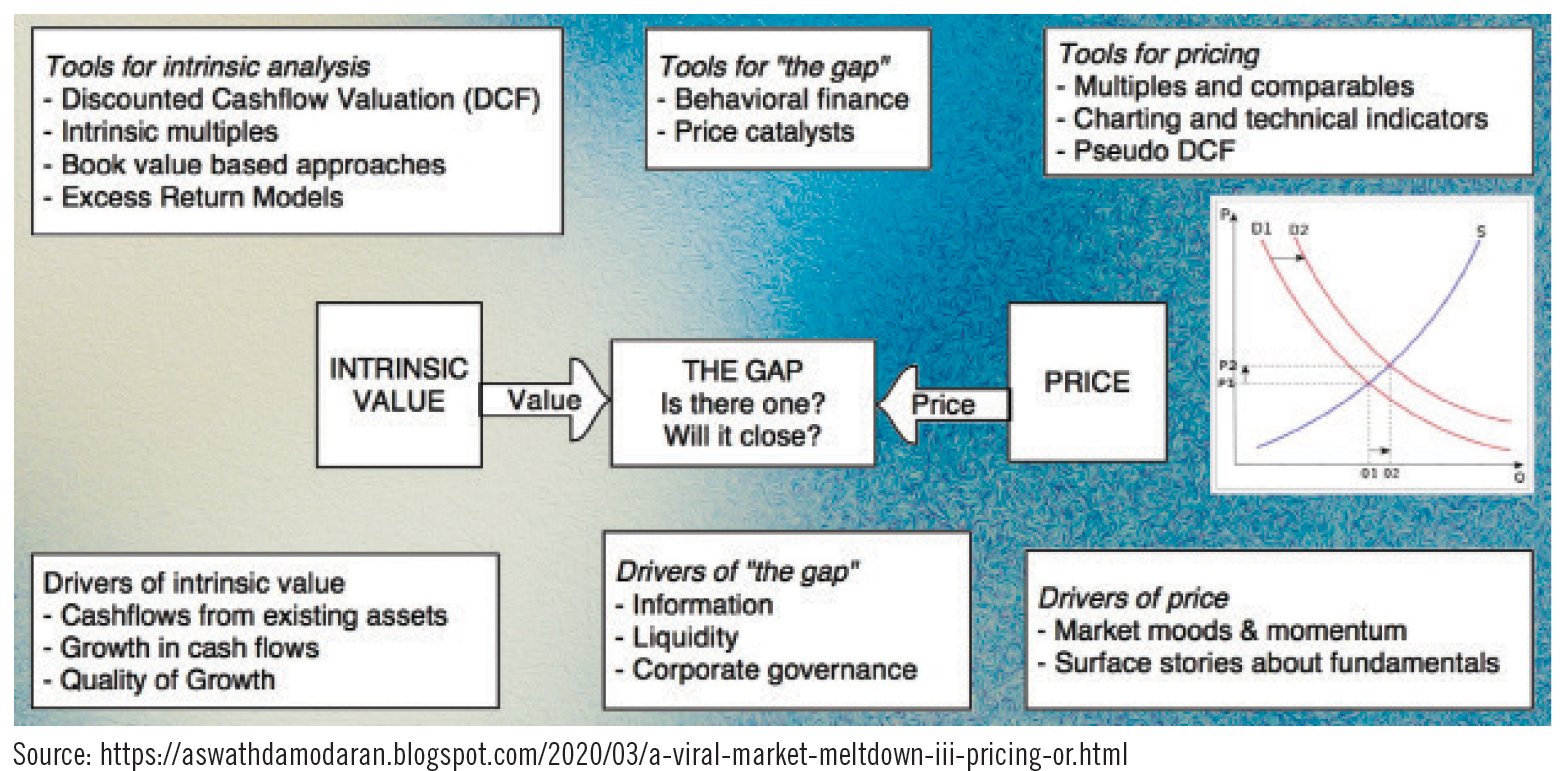

There are numerous articles and academic papers that highlight how to ‘value’ a business, yet with so much rational science thrown to us, the exercise of valuation in most cases incites the fundamentals of behavioural science testing our acumen and self-prophesised expertise on forecasting the future. Many a times ‘valuing’ a business gets misinterpreted with ‘pricing’. Basically, valuing a business is an introspective exercise to examine the potential of the business based on certain underlying pragmatic assumption while pricing is an external negotiation exercise based on market forces and comparable variables. Damodaran through the figure below succinctly outlines the differences, yet while we soldier on the ground, both as investors and businesses observe blurring lines between the two.

valuing a business is an introspective exercise to examine the potential of the business based on certain underlying pragmatic assumption while pricing is an external negotiation exercise based on market forces and comparable variables

With years of experience as business accelerators, investors and investment banking advisors, we have encountered, on multiple occasions, the dilemma between valuing a business and pricing it. In our formative years as business accelerators, we ran sessions on valuation to cohort companies primarily explaining the science and examples from more developed markets. However, we were caught off-guard when the companies used the learnings from those sessions to expect Silicon Valley numbers while raising funds from us. It took us a few years to temper founders’ expectations based on local context and nuances and we believe we are still at it.

It is imperative for businesses when raising money to have an optimistic orientation based on aggressive assumptions. As investors it becomes our responsibility and duty to scenario-test those assumptions for value at risk while assessing the capabilities of the business owner and teams to deliver on such promises amongst many other variables. Local market dynamics and recurring black swan events challenge the excel sheets based on superficial stories. We lean heavily on the founder and team on their resilience, hunger for hustle, transparency and openness to ideas and pivots.

In our years of investment, we have had six successful exits out of 14 investments with above market returns. Our exit track record is currently the best in the industry. Yet, these exits have stories that significantly diverge from their original fairy tale trajectories. It is our learning that, at the end of the day, a firm’s values at different stages are determined most significantly by rational behaviour and responsiveness of the founder, more than anything else in our neck of woods.

As mentioned earlier, valuation is an inward-looking exercise which may serve as an anchor or a reference point or even serve as a strategic tool to organise business plans and approach. Within our portfolio, we periodically undertake this exercise to shape our actions and in many cases, to better understand our businesses and the pivots and iterations they may need. These exercises have helped us to pivot business models from ‘Service to Product’ or enter ‘Business to Customer’ segments from existing ‘Business to Business’ models, which in many cases have yielded favourable returns. Valuation exercises enable better understanding of cash flow cycles which in turn widens and provides better understanding on the options of financing.

As sell side investment advisors to portfolio or non-portfolio companies, pricing has always been swayed by market forces and founder or business owner biases. However, our belief is that ‘price is what the buyer is willing to pay for the business’. In some cases, precedented prices or the conditional interest to avoid down round sets a range. There are instances where we have observed significant down round investment asks, while in some cases pricing has been so high that we wonder if there will be a next investor beyond those prices.

In Nepal’s context, it may be appropriate to balance the value and pricing aspects separately, one as an introspective reference tool and the other as negotiation skill. The alternate investment landscape of Nepal has been evolving and as we journey further, lessons and cases of investments shall showcase better understanding of value and price.