At a time when the country has prioritised ‘going digital’, unfavourable policies are hindering the realisation of results. Although political leadership has vowed to support the digital ecosystem, the process-oriented, maze-like administration has thrown cold water on this initiative.

Despite Prime Minister KP Sharma Oli’s promise to address the hiccups in digital payments caused by taxation a few months ago, the constraints are yet to be resolved.

The government, in the fiscal budget 2024/25, has levied Value Added Tax (VAT) on digital transactions settled through Nepal Clearing House Ltd (NCHL) and Fonepay. Earlier, digital payment settlement service providers enjoyed VAT exemption. However, former Finance Minister, Barsha Man Pun, provisioned VAT on digital payments, adversely affecting digital payment services as consumers were hit hard, compelled to pay an additional 13% on each transaction.

Digital payment service providers have been criticised for exorbitant service charges since the beginning. The government’s decision to levy VAT has dug deeper into consumer pockets discouraging them from relying on digital solutions.

Nepal Rastra Bank (NRB), the central regulatory and monetary authority, is poised to introduce the Central Bank Digital Currency (CBDC). “NRB has completed the conceptual study, established a dedicated division, and partnered with various platforms of the Bank for International Settlements (BIS),” said Nepal Rastra Bank Governor, Maha Prasad Adhikari, citing the provisions of the Monetary Policy 2024/25. “In the next phase, NRB will engage with stakeholders to develop a wholesale CBDC configuration. Subsequently, we will finalise the system design, select the configuration, conduct testing, and collaborate with the public in a trial phase to gather feedback for improvement with an aim to launch a CBDC pilot by 2026,” he said.

NRB has initiated this endeavour on the foundation of the digital transaction ecosystem. It encompasses infrastructure, literacy, data security, legislation and other enablers, all of which have been instrumental in the widespread acceptance of digital transaction settlement platforms and digital payment solutions.

According to Sanjib Subba, a financial sector expert, the groundwork for the CBDC rollout is prepared with the widespread acceptance of digital payment platforms, data security and consumer awareness, among other factors. The central bank has been developing digital, legal and physical infrastructure to facilitate the CBDC rollout. “Thus, brick-and-mortar banks will be transformed into click-and-mortar banks once CBDC comes into force,” Subba stated.

Enhancing regulatory capacity and enabling data security

Nepal’s financial sector has been undergoing a significant transition, embracing advanced technologies that are user-friendly, enhancing access and promoting inclusivity. The various solutions offered to clients of banks and financial institutions (BFIs) are undoubtedly a result of technological disruptions.

Experts have suggested four crucial dimensions to embark on the journey towards digitisation of the economy in a rapid and sustainable manner: digital sandbox, digital financial literacy, discrete digital teams and departments at banks, and digital funds.

Digital sandbox refers to digital supervision by the regulator. The regulator should be well-equipped with enhanced capacity for effective regulation and supervision of BFIs launching digital solutions supported by FinTech companies. For the past several years, Nepal Rastra Bank has been promoting digital transactions and effective institutional coordination. A study to establish an innovation centre/regulatory sandbox has been carried out.

The Covid 19 pandemic acted as a catalyst for accelerating digitisation of the economy, particularly in the financial sector. The ecosystem flourished raising literacy and wider acceptance of digital payment platforms among Nepali consumers. However, instead of incentivising digital transactions by establishing a digital fund through a public-private partnership (PPP), the government-imposed VAT on digital transactions, discouraging users.

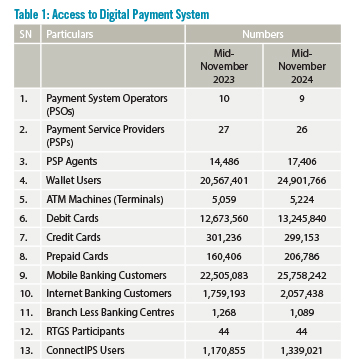

Economist Dr Dilli Raj Khanal asserts that the government’s irrational, inconvenient and inconsistent tax policy has not only discouraged consumers but also hindered the growth of the digital payment industry. (See Table 1)

Reducing cost is critical

NRB has already implemented the Digital Lending Guideline which offers cost-effective, simplified and accessible lending. Additionally, the country has its own National Payment Switch, facilitating the settlement and recording of domestic payments. The payment system has been simplified with the widespread adoption of QR (quick response) codes by sellers of goods and services, ranging from grocery stores to restaurants.

The country’s first payment switch is already operational. With the National Payment Switch in place, Nepal can issue its own cards, a crucial step in reducing the costs associated with payment gateways like Visa, MasterCard and UPI (Unified Payment Interface).

Prior to the establishment of the National Payment Switch, the Retail Payment Switch was operationalised for settling transactions made through QR codes and wallets or non-card payments. Nepal’s ability to issue its own cards and operate the National Payment Switch can minimise the country’s foreign currency expenses to payment card network processors.

NCHL has been promoting digital payment in cross-border transactions at the individual level. Last year, upon the request of Nepal Rastra Bank, the Reserve Bank of India (RBI) updated its regulations to allow Nepali account holders to send up to INR two lakhs per transaction (without any limit) to Nepal. Similarly, walk-in customers can remit INR 50,000 per transaction from India with a maximum of 12 transactions per year.

An agreement was reached between India’s UPI and Nepal’s NCHL in which Nepal Rastra Bank also holds a stake to establish a mechanism to eliminate the inconvenience of carrying cash. This agreement was signed during former Prime Minister, Pushpa Kamal Dahal’s, visit to India in June 2023.

Subsequently, on February 15, Nepal Rastra Bank and the Reserve Bank of India signed and exchanged Terms of Reference to interlink India’s fast payment system (UPI) and Nepal’s NCHL, in the presence of then RBI Governor Shaktikanta Das and NRB Governor Maha Prasad Adhikari.

Along with the updated regulations from RBI, the stage has been set for the formal inauguration of cross-border payment linkages. With these arrangements, person-to-person (P2P) and subsequently, person-to-merchant (P2M) cross-border fund transfers between Nepal and India have become a reality. This digital fund transfer mechanism allows millions of workers and travellers from India to Nepal to transfer money instantly and at a low cost, according to authorities.

While it may not be easy to replace cards issued by global payment card network processors, the country could consider co-branding its cards with international payment card networks to enable Nepali card users to make transactions in foreign countries. Currently, there are 13.24 million cards in use in Nepal, according to NRB, with 80% of them issued by Visa.

NRB has instructed banks to make at least two off-US transactions free for card users. However, banks must bear the cost of these transactions. Off-US transactions are typically a source of income for banks, as the ATM owner bank (also known as the acquirer bank) charges a fee for each financial and non-financial transaction.

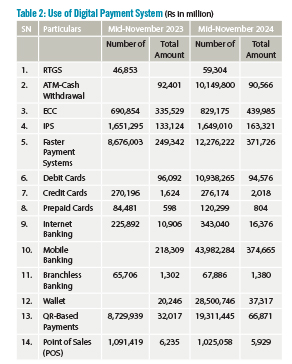

Encouraging users to maximise digital transactions (such as mobile banking) can reduce the cost of cash withdrawals from ATMs which involve fees. The government's decision to impose VAT on digital transactions is considered irrational by NRB authorities as it could hinder the adoption of digital payments. (See Table 2)

Digitalisation: Key to promote transparency

The digitisation of the financial sector is poised to provide the necessary impetus for digitisation across various sectors of the economy, leveraging supply chains and simultaneously promoting convenience, inclusivity, resilience, transparency and e-governance.

The Government of Nepal's Digital Nepal Framework, unveiled in 2019, envisions digitising eight sectors: digital foundation, agriculture, health, education, energy, tourism, finance, and urban infrastructure. This framework outlines 80 digital initiatives, developed through close engagement with stakeholders, aiming to unlock the country's growth potential.

As the government aspires to accelerate digitalisation, promote transparency and curb corruption, experts emphasise the imperative of digitising the economy.