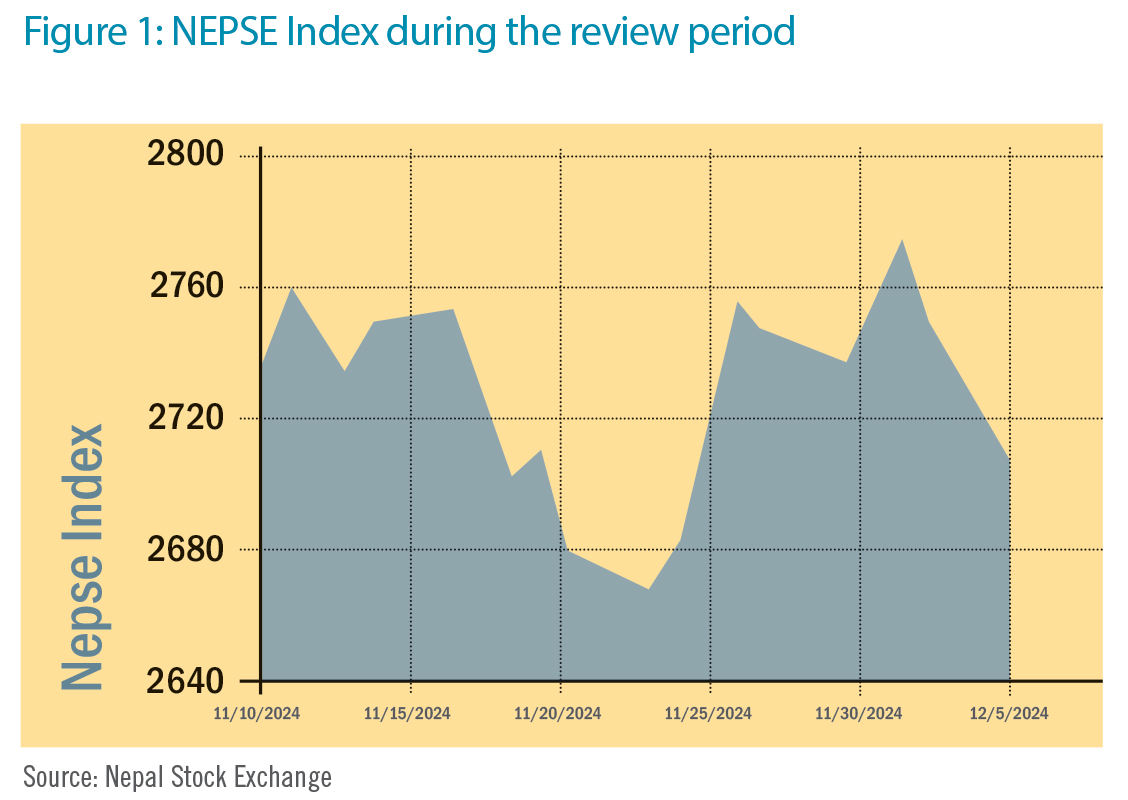

The Nepal Stock Exchange (NEPSE) index rose by 7.42 points (+0.28%) to close at 2,689 points during the review period between November 10 and December 8. It reached its highest point on December 2 at 2,775.85 points. The NEPSE index fluctuated sharply during the review period and ultimately managed to slightly recover at the end of the period. The overall market volume during the review period rose by 47% reaching Rs 167.19 billion.

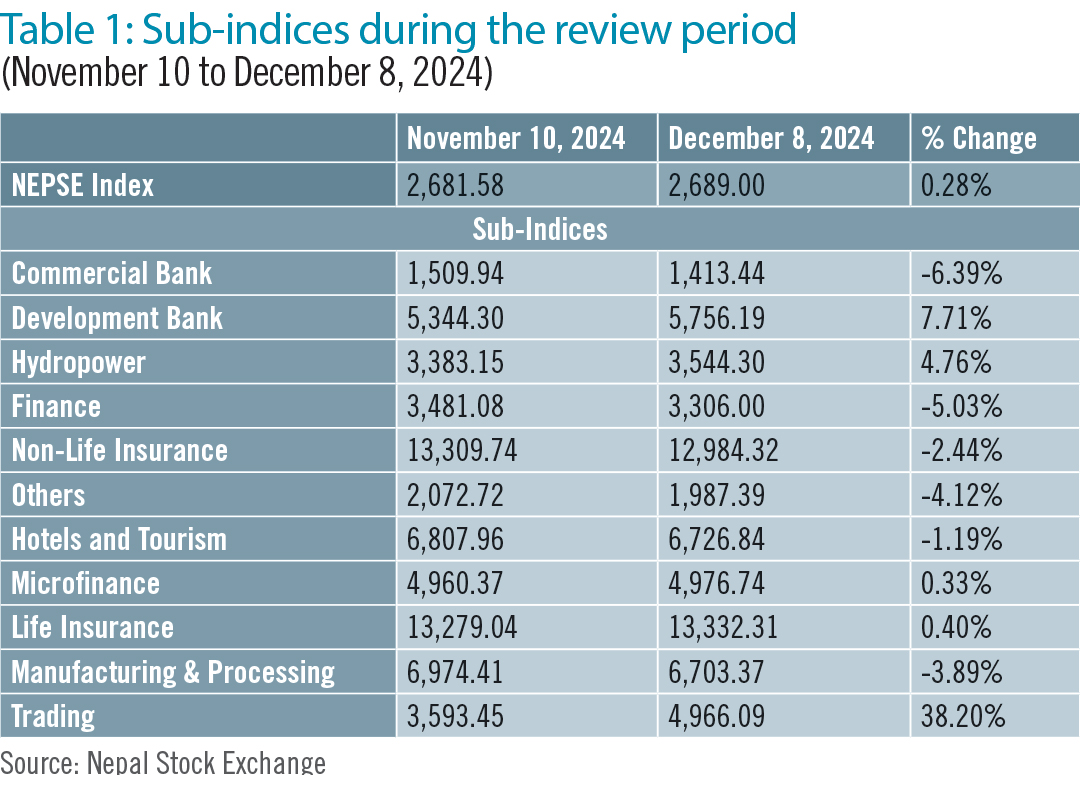

During the review period, five of the 11 sub-indices landed in the green zone, and the remaining six in the red zone.

The Trading sub-index (+38.20%) was the biggest winner as the share value of Bishal Bazar (+Rs 2,223) increased substantially. Development Banks sub-index (+7.71%) followed suit with rise in share prices of Corporate Development Bank (+Rs 758), Narayani Development Bank (+Rs 452.2) and Saptakoshi Development Bank (+Rs 452).

Hydropower sub-index (+4.76%) was next in line as the share value of Super Madi Hydropower (+Rs 395), River Falls Power (+Rs 311) and Upper Hewakhola Hydropower (+Rs 217.9) went up. Similarly, Life Insurance sub-index (+0.40%) saw an increase in the share prices of Life Insurance Corporation (+Rs 217.5), Sun Nepal Life Insurance (+Rs 40.5) and Citizen Life Insurance (+Rs 11.7). Microfinance sub-index (+0.33%) witnessed a rise in share value of Support Microfinance (+Rs 877), Swabhimaan Microfinance (+Rs 830) and Manushi Microfinance (+Rs 540).

Hotels and Tourism sub-index (-1.19%) saw a decline in the share price of Soaltee Hotel (-Rs 74.9). Non-Life Insurance sub-index (-2.44%) saw a fall in the share value of NLG Insurance (-Rs 429.9), Sanima GIC Insurance (-Rs 65) and IGI Prudential Insurance (-Rs 59.8).

Similarly, Manufacturing and Processing sub-index (-3.89%) witnessed drop in share prices of Unilever Nepal (-Rs 2,000), Bottlers Nepal Terai (-Rs 380), Bottlers Nepal Balaju (-Rs 64) and Himalayan Distillery (-Rs 64). The Others sub-index (-4.12%) experienced decline in the share value of Himalayan Reinsurance (-Rs 46), Nepal Telecom (-Rs 39.9), and Sonapur Minerals and Oil (-Rs 21.5).

The Finance sub-index (-5.03%) also witnessed a decrease in the share prices of Nepal Finance (-Rs 226.5), Goodwill Finance (-Rs 178) and Samriddhi Finance (-Rs 128.9). Finally, the Commercial Banks sub-index (-6.39%) was the biggest loser with decline in the share value of Standard Chartered (-Rs 100), Nabil Bank (-Rs 50.1) and NIC Asia Bank (-Rs 35). (See table 1)

News and Highlights

The government has appointed Santosh Narayan Shrestha as Chairman of Securities Board of Nepal (SEBON), a position that had remained vacant since January. Shrestha previously served as a board member of Nepal Electricity Authority. His appointment has also paved the way for the approval of Initial Public Offerings (IPOs) which had been halted since SEBON was without leadership.

SEBON has now approved the IPO of Guardian Micro Life Insurance worth Rs 750 million under the Micro-Insurance sector. Kumari Capital has been appointed its Issue Manager. Similarly, it has also approved the Further Public Offering (FPO) of Mahuli Microfinance worth Rs 82.63 million under the Microfinance sector, with Laxmi Sunrise Capital as the Issue Manager.

SEBON has also amended its Securities Issuance and Allotment Guidelines (Eighth Amendment, 2081) to include provisions facilitating Non-Resident Nepalis (NRNs) to invest in joint investment companies established in partnership with the government, wherein NRNs can hold up to 10-49% of the company’s issued capital. As per the guidelines, the joint investment company will be required to secure approval from SEBON prior to issuing shares.

Outlook

Compared to the previous review period, the market experienced greater volatility with a larger number of sub-indices ending in the red zone due to selling pressure. While the appointment of a new SEBON chairman and provisions to boost NRN participation offer some positive signals, they have yet to significantly uplift investor sentiment. Caution is advised, and investors should remain vigilant, closely monitoring market trends.