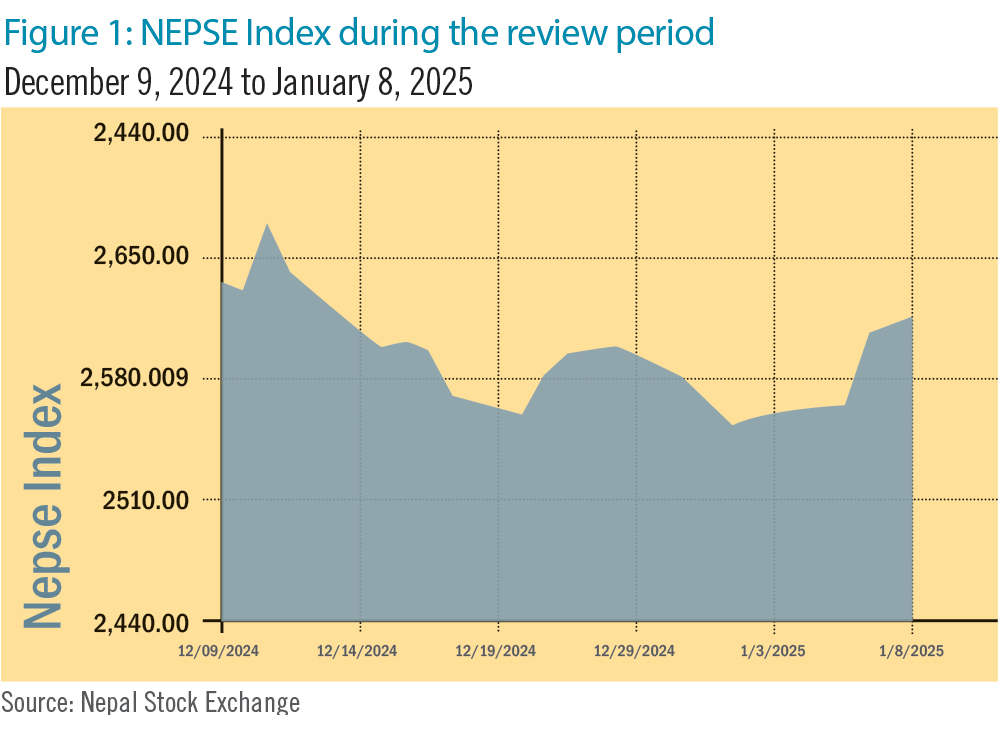

The Nepal Stock Exchange (NEPSE) index dropped by 34.51 points (-1.28%) to close at 2,653.23 points during the review period between December 9, 2024 to January 8, 2025. The index hit its lowest on December 31 at 2,576.50 points. The period was marked by significant turbulence in the index, and although there was an upward trend toward the end, it struggled to sustain the momentum. The market volume during the review period shrunk by 39%, down to Rs 102.33 billion. (See Figure 1)

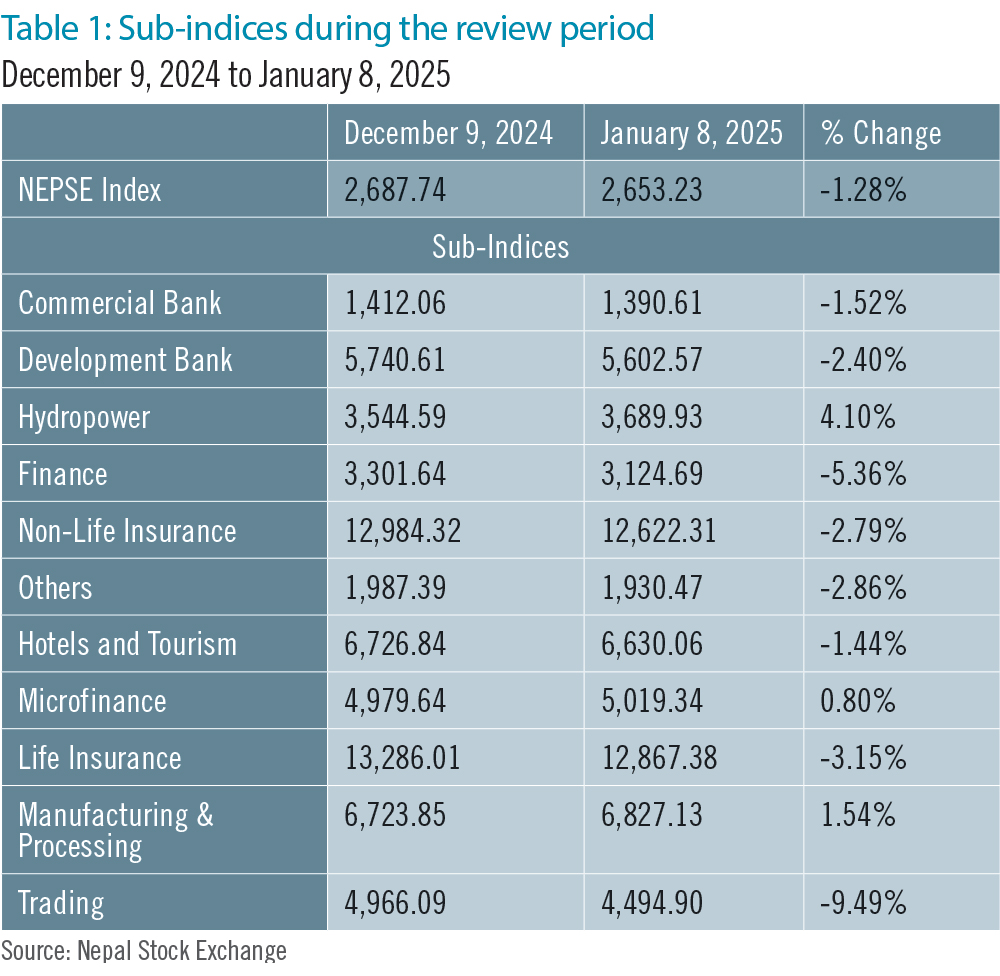

During the review period, eight of the 11 sub-indices landed in the red zone, and the remaining three in green.

The Trading sub-index (-9.49%) was the biggest loser as the share value of Bishal Bazar (-Rs 643) and Salt Trading Corporation (-Rs 208) decreased substantially. Finance sub-index (-5.36%) followed suit with drop in share prices of Nepal Finance (-Rs 194.3), Janaki Finance (-Rs 139.9) and Pokhara Finance (-Rs 67.5).

Life-Insurance sub-index (-3.15%) was next in line as the share value of Life Insurance Corporation-Nepal (-Rs 279.5), National Life Insurance (-Rs 19) and Suryajyoti Life Insurance (-Rs 16) went down. Similarly, Others sub-index (-2.86%) witnessed a fall in share values of Nepal Telecom (-Rs 37.1), Nepal Warehousing Company (-Rs 31) and Nepal Reinsurance (-Rs 29.2).

Non-Life Insurance sub-index (-2.79%) saw a decline in the share prices of Rastriya Beema Company (-Rs 2,897.9), Shikhar Insurance (-Rs 33.4) and Prabhu Insurance (-Rs 23.9). Development Bank sub-index (-2.40%) was next in line with fall in share values of Narayani Development Bank (-Rs 170), Miteri Development Bank (-Rs 77) and Excel Development Bank (-Rs 53).

Similarly, Commercial Bank sub-index (-1.52%) also went down with drop in share prices of Agricultural Development (-Rs 39.1), Nepal SBI (-Rs 28), NIC Asia (-Rs 18) and Laxmi Sunrise (-Rs 18). The Hotels and Tourism sub-index (-1.44%) followed with decline in share values of Oriental Hotels (-Rs 59.8), Chandragiri Hills (-Rs 28) and Kalinchwok Darshan (-Rs 20).

In the green zone, Microfinance sub-index (+0.80%) witnessed a slight increase in the share prices of Aatmanirbhar Microfinance (+Rs 1,560), Upakar Microfinance (+Rs 819) and Swarojgar Microfinance (+Rs 355). Manufacturing and Processing sub-index was next (+1.54%) with rise in share prices of Ghorahi Cement (+Rs 31.9) and Sarbottam Cement (+Rs 7.7). Finally, Hydropower sub-index (+4.10%) was the biggest gainer with surge in the share values of Super Madi Hydropower (+Rs 470), Nyadi Hydropower (+Rs 306) and River Falls Power (+Rs 286). (See Table 1)

News and Highlights

During the review period, Nepal Rastra Bank (NRB) declared Karnali Development Bank, Banke as a ‘problematic institution’, following which share trading of the institution was suspended from NEPSE. NRB listed multiple reasons for the action including weak institutional governance, inability to maintain required capital adequacy ratio, and the non-performing loan ratio reaching 40.85%, among others. NRB has formed a three-member management team under the leadership of the Deputy Director of the Bank and Financial Institution Regulation Department, which assumed responsibility for Karnali Development Bank from December 26, 2024.

While the Securities Board of Nepal has Initial Public Offerings (IPOs) of 85 companies worth Rs 51.74 billion in its pipeline, no IPOs were issued during this review period.

Outlook

The market showed significant volatility during the review period, reflecting investor sentiment. Furthermore, as many listed companies are not distributing any dividends to its shareholders from the earnings of the last fiscal, it has further dampened investor confidence. Investors appear to be exercising caution and are keeping a close watch on market trends.