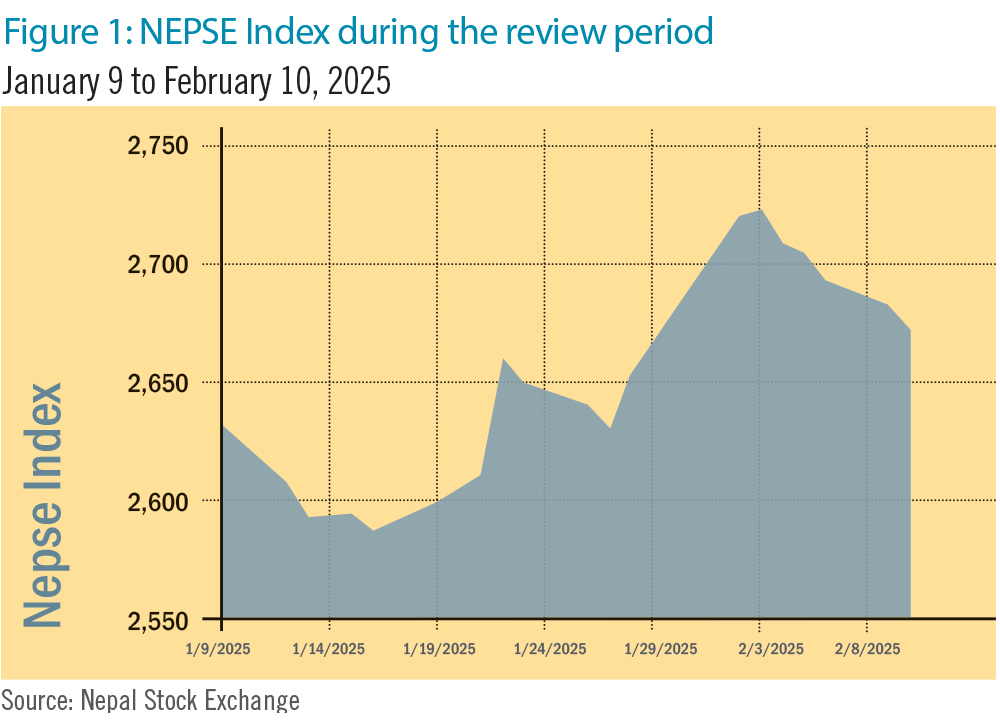

The Nepal Stock Exchange (NEPSE) index increased by 20.83 points (+0.78%) to close at 2,677.32 points during the review period between January 9, 2025 to February 10, 2025. The index hit its highest point on February 3, at 2,730 points. While the period saw turbulence, it was marked by an overall upwards movement with sporadic dips. However, towards the end of the review period, the market was not able to sustain the momentum and dropped by 52.68 points to close at 2,677.32 points. Nonetheless, the market volume during the review period rose by 57% to reach Rs 160.56 billion, indicating improving investors’ confidence. (See Figure 1)

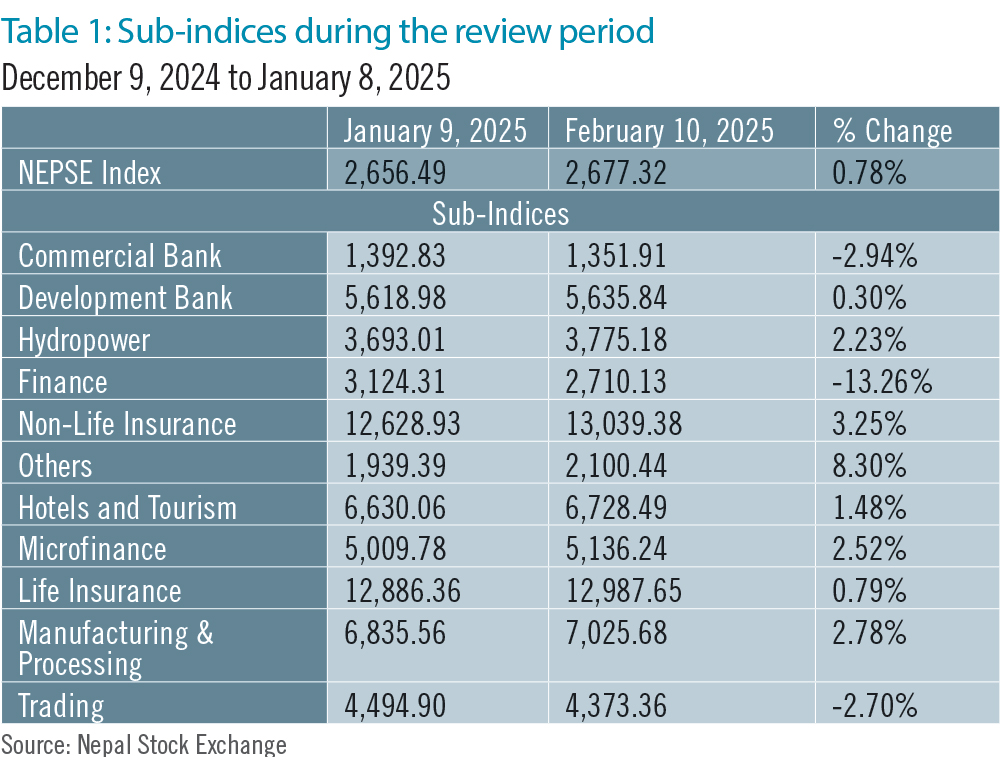

During the review period, eight of the 11 sub-indices landed in the green zone, and the remaining three sub-indices landed in the red zone.

Others sub-index (+8.30%) was the biggest winner as the share value of Nepal Reinsurance Company (+Rs 234), Muktinath Krishi (+Rs 204) and Nepal Republic Media (+Rs 162.5) went up. Non-Life Insurance sub-index (+3.25%) followed with a rise in share prices of NLG insurance (+Rs 168), Siddhartha Premium Insurance (+Rs 50) and Shikhar Insurance (+Rs 42.4).

Manufacturing and Processing sub-index (+2.78%) was next in line as the share value of Unilever Nepal (+Rs 1,950), Sarbottam Cement (+Rs 35.5) and Bottlers Nepal Terai (+Rs 10) increased. Similarly, Microfinance sub-index (+2.52%) witnessed a rise in share values of Upakar Microfinance (+Rs 1,730), Samudayik Microfinance (+Rs 289.9) and Unnati Sahakarya (+Rs 233.9).

Hydropower sub-index (+2.23%) saw a rise in the share prices of Barahi Hydropower (+Rs 356), Sikles Hydropower (+Rs 339.8) and Bhugol Energy Development (+Rs 206.3). Hotels and Tourism sub-index (+1.48%) was next in line with an increase in share values of Kalinchowk Darshan (+Rs 69.9), City Hotel (+Rs 27) and Soaltee Hotel (+Rs 13.9).

Similarly, Life Insurance sub-index (+0.79%) was next in line with a hike in share prices of Reliable Nepal (+Rs 30), Asian Life Insurance (+Rs 26) and Citizen Life Insurance (+Rs 17.6). Development sub-index (+0.30%) followed with a growth in share values of Narayani Development Bank (+Rs 273.5), Corporate Development Bank (+Rs 211) and Green Development (+Rs 165).

In the red zone, Trading sub-index (-2.70%) witnessed a slight drop in the share prices of Salt Trading Corporation (-Rs 376.9) and Bishal Bazar (-Rs 140). Commercial Bank sub-index (-2.94%) was next with a decline in share prices of NIC Asia (-Rs 22.9), Siddhartha Bank (-Rs 20.5) and Nepal Bank (-Rs 13.8). Finance sub-index (-13.26%) was the biggest loser with a fall in the share values of Nepal Finance (-Rs 271.1), Janaki Finance (-Rs 245) and Pokhara Finance (-Rs 180.6). (See Figure 2)

News and Highlights

During the review period, the government amended the Companies Act to allow startups to allocate up to 40% of shares to venture capital firms and up to 20% to individual investors. The amendments also streamlined the process for private companies to issue premium shares by eliminating requiring approval from the Office of the Registrar of Companies. Other than this, the Securities Board of Nepal (SEBON) also resumed the issuance of licences for merchant banking services, specifically for issue management and share registrar operations. The process was previously suspended in July 2018. Institutions seeking this approval are required to have at least 10 years of experience in merchant banking operations and maintain a minimum paid-up capital of Rs 1 billion with at least 30% allocated to equity capital.

SEBON approved the Initial Public Offerings (IPOs) of two companies under the Micro Insurance sector. The IPOs of Nepal Micro Insurance (Rs 750 million) and Crest Micro Insurance (Rs 750 million) were approved with NIMB Ace Capital as the issue manager for both. SEBON also approved the IPO of Om Megashree Pharmaceuticals worth Rs 600 million, with Prabhu Capital as the issue manager. The Further Public Offering (FPO) of Swarojgar Microfinance was also approved under the Microfinance sector. It is worth Rs 19.58 million with NMB Capital as the issue manager.

Outlook

The government’s amendment to the Companies Act aims to benefit the private sector by expanding access to funding and encouraging greater participation in the market. The uptick in market volume suggests growing investor confidence as they seek value investment opportunities. While investors remain observant of market trends, the increasing activity indicates a positive shift in sentiment.