A downside is the revision of public expenses in the mid-term review of the fiscal budget, a common occurrence in budgetary implementation. As in previous fiscal years, the government has revised expenditure in the recently released mid-term review of the fiscal budget 2024/25.

For the past several years, the government has released an inflated budget for public perception and then revised the targets mid-year. The mid-term review, released by Deputy Prime Minister and Finance Minister, Bishnu Prasad Paudel, has revised the budget size from Rs 1,860.30 billion to Rs 1,692.73 billion, which is 90.99% of the initial estimates.

Capital/development expenditure has been substantially reduced to 85% of initial estimates from Rs 352.35 billion, and recurrent expenses to 90.24% of initial estimates from Rs 1,140.66 billion. After this revision, resources mobilised for development works are estimated to be Rs 299.50 billion.

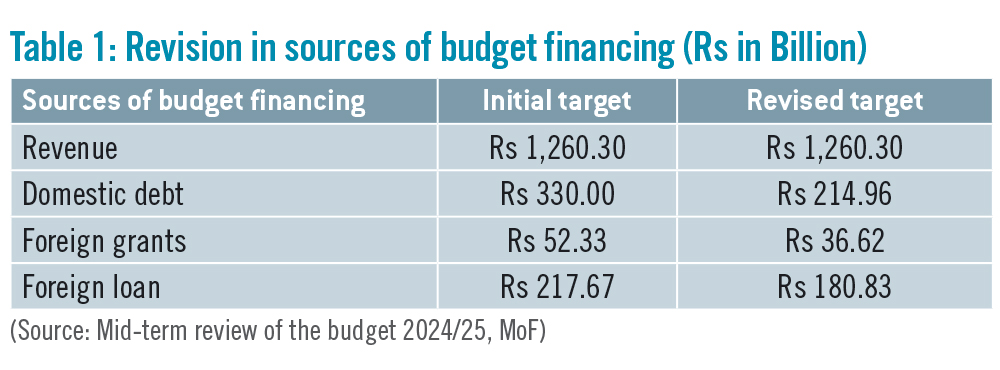

Under financing, used for debt servicing, almost 99.09% of the initial allocation will be utilised. The government’s debt servicing liability is expanding annually, surpassing the budget allocated for capital/development expenses. According to the mid-term review, Rs 363.93 billion is expected to be spent on debt servicing. (See Table 1)

Intergovernmental fiscal transfer

The government has emphasised that the procedure for amending the proper management of equalisation and special grants is in its final stages. Fiscal transfers from the federal government to provinces and local levels stand at Rs 34.89 billion and Rs 150.26 billion, respectively. To date, 36.17% of the total allocation has been transferred to provinces, and 48.10% to local levels.

Provinces and the federal government reportedly each received 15% of the Value Added Tax and Excise revenue, totalling Rs 64.55 billion (Rs 32.27 billion each for local levels and provinces), from the divisible fund in the first six months of Fiscal Year 2024/25. This amount is 14.17% higher than the corresponding period of the previous fiscal year.

Half yearly expenses

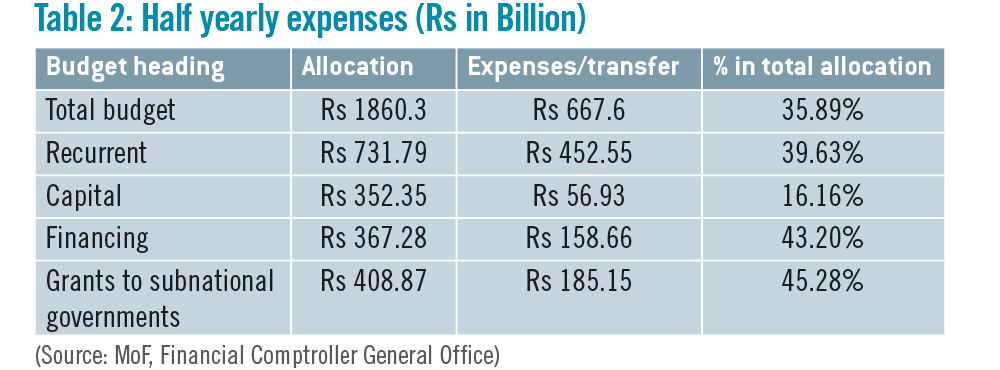

The government spent 35.89% of the total earmarked budget of Rs 1,860.30 billion in the first six months, amounting to Rs 667.6 billion. Total spending in the first half is 17.66% higher compared to the same period in the previous fiscal year. Of this, Rs 452.55 billion was spent on recurrent expenses, Rs 56.93 billion on capital expenses, and Rs 158.66 billion under financing. (See Table 2)

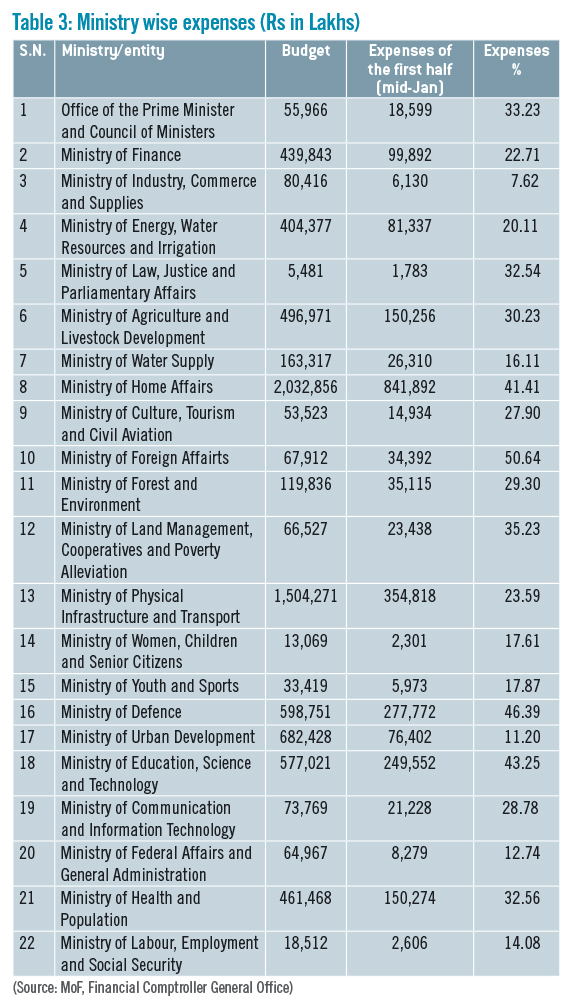

Recurrent expenditure has progressed due to fiscal transfers and investments in projects through state-owned enterprises, which are accounted for under recurrent expenditure. “There is a component of the development budget under the recurrent heading, as we account for fiscal transfers to subnational governments and all forms of grants under this heading,” remarked Bishnu Prasad Paudel, Deputy Prime Minister and Finance Minister. “Similarly, conditional and special grants are separated as capital and recurrent expenses when transferred to subnational governments, however, in the federal accounting system, they fall under recurrent expenditure, which is why the actual status of capital/development expenditure is not properly represented.” (See Table 3)

Revenue mobilisation

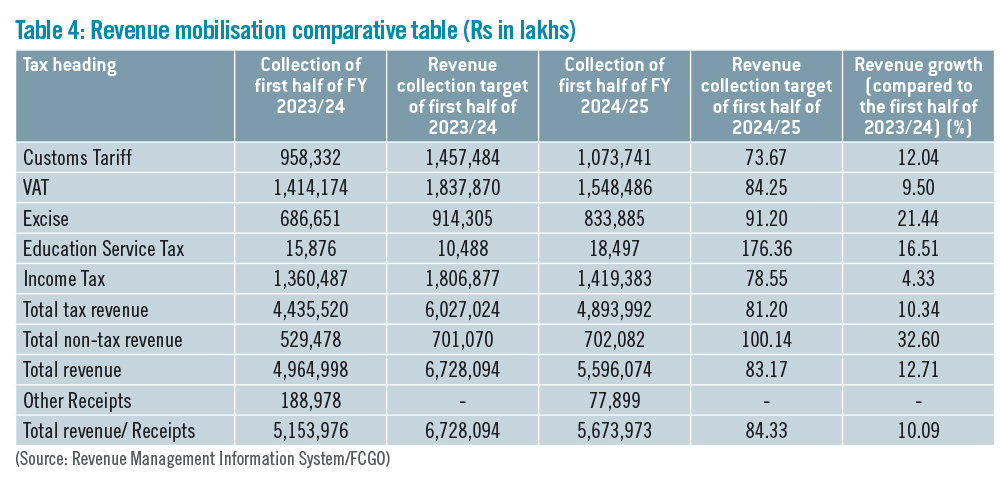

The government has maintained its initial revenue mobilisation target. The federal government aims to mobilise approximately Rs 1,260.30 billion in the current fiscal year. Similarly, Rs 159.90 billion is expected to be shared with subnational governments from the divisible fund. The share of tax revenue is projected to be 90.48%, and other revenue 9.52%. However, the largest portion of revenue, approximately 72%, is mobilised from indirect taxes. VAT is the largest contributor to tax revenue at 30.1%, followed by income tax at 27.53%, customs tariff at 21.66%, excise at 13.74%, and education service tax at 0.33%. The Inland Revenue Department mobilises 49.43% of the revenue, and the Department of Customs mobilises 41.05%. Other agencies contribute the remaining 9.52%. (See Table 4)

Low absorption of public investment

The Ministry of Finance has identified various systemic challenges hindering public expenses. These challenges exacerbate inefficiencies in public expenditure, particularly in development project implementation, resulting in low capital expenditure absorption.

The Ministry of Finance has urged strengthening institutional and technical capacity, improving procurement and contract management, ensuring safeguards compliance, and digitising government processes to overcome these challenges. According to erstwhile ‑Finance Secretary Ram Prasad Ghimire, a steadfast commitment from executing and implementing agencies is required for effective intervention and to overcome these ingrained inefficiencies.

“Moreover, the ministries have been proposing/requesting smaller budgets for projects with guaranteed resources and proposing numerous new projects within the budget ceiling,” Ghimire added. “Thus, they are accumulating incomplete projects rather than focusing efforts and resources on completing existing ones.”

The budget’s mid-term review highlighted a lack of coordination across the three tiers of government and among federal ministries.

A lack of procedures, guidelines, bid document preparation, matching funds and frequent transfers of senior project staff have been consistently emphasised as obstacles to timely project implementation and increased capital/development

expenses.

-1765706286.jpg)

-1765699753.jpg)