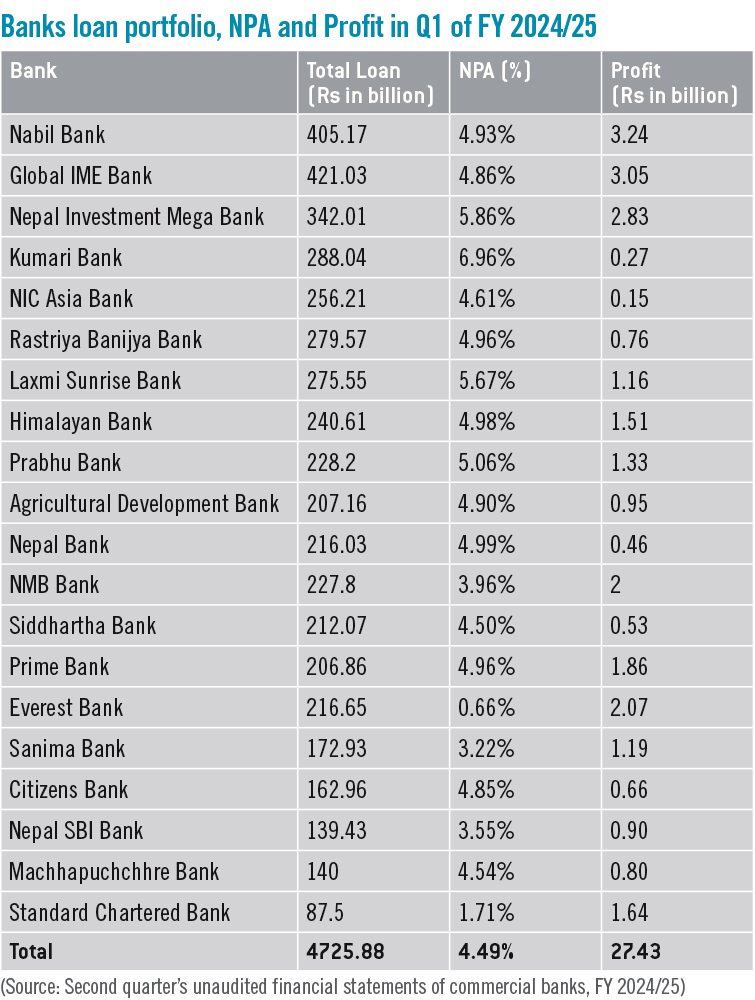

Commercial banks experienced rising non-performing loans (NPLs) and shrinking profits in the second quarter (Q2) of the current fiscal year. NPLs increased to 4.49% by mid-January, compared to 3.40% during the same period of the previous fiscal year. With a total loan portfolio of Rs 4,725.88 billion, the total NPL amount reaches Rs 212.19 billion.

Rising NPLs have negative economic consequences. “Primarily, more NPLs mean deteriorating financial institution soundness and shrinking lending capacity due to the high amount of NPLs in the banking industry,” says Biswash Gauchan, Executive Director at the Institute for Integrated Development Studies (IIDS). “Banks and financial institutions were deeply engaged in land monetisation rather than promoting the productive sector. The motive of generating high profits overnight through land monetisation was a risky strategy that ultimately led to the crisis.”

Within the industry, Kumari Bank has the highest NPL at 6.96%, followed by Nepal Investment Mega Bank at 5.86%. Everest Bank has the lowest NPL at 0.66%, followed by Standard Chartered Bank at 1.77% and Sanima Bank at 3.22%.

Loan portfolio review

The International Monetary Fund (IMF) has consistently raised concerns about the asset quality of banks and financial institutions. In its recent review of the Extended Credit Facility (ECF) arrangement, the IMF emphasised the urgent need for a Loan Portfolio Review (LPR) of the ten largest commercial banks. Nepal Rastra Bank (NRB), the central regulatory and monetary authority, has been delaying the initiation of the LPR.

“Despite the cancellation of the initial procurement for the Loan Portfolio Review (LPR) of the ten largest banks, NRB remains committed to completing the review and has restarted the process to hire an independent international consultant to assist with the LPR,” the fifth ECF review stated. “Key reforms accomplished as part of the fifth review include amendment of Nepal’s anti-money laundering (AML) law, strengthening the financial oversight of public enterprises, and completing audit of the Fiscal Year 2023/24 financial statement of Nepal Rastra Bank involving the services of experts with international experience in auditing other central banks.”

Bank asset quality is a concern as credit mobilisation is nearly equivalent to the country’s GDP, yet it hasn’t supported productivity and real sector growth. Nepal has past experience with state-owned banks requiring significant capital injections to revive them; this after more than half of their credit became NPLs.

A Loan Portfolio Review conducted by an internationally renowned audit firm will reveal the banks’ true financial status and provide necessary reformative actions.

Systematically important banks under scanner

Nepal Rastra Bank has intensified onsite and offsite supervision of several commercial banks deemed systemically important to ensure their prudent operation. Global IME Bank, Nepal Investment Mega Bank, Kumari Bank, Rastriya Banijya Bank and NIC Asia Bank are reportedly considered systemically important based on their turnover, capital base and portfolio, among other factors. Following the 2008 financial crisis, regulatory bodies began focusing on systemically important financial institutions (SIFIs).

“Formal announcements regarding systemically important banks are pending due to a lack of policy provisions, however, banks with turnover exceeding 10% of GDP require special attention in regulation and supervision,” a high-ranking source at Nepal Rastra Bank said. The Basel Committee on Banking Supervision has emphasised differentiated regulatory and supervisory treatment for such institutions, including risk-based capital and other compliances.

Shrinking profits

Unaudited financial statements published by 20 operating commercial banks reveal a 4.6% profit decrease in the second quarter of Fiscal Year 2024/25. Total profit reached Rs 27.43 billion, down from Rs 28.76 billion during the same period of the previous fiscal year.

Most banks experienced profit declines during the review period due to increased provisioning necessitated by loan recovery challenges. NIC Asia Bank and Kumari Bank reported the lowest profits, at Rs 150 million and Rs 270 million, respectively. Nine banks, including NIC Asia Bank, Kumari Bank, Rastriya Banijya Bank, Agricultural Development Bank, Nepal Bank, Siddhartha Bank, Citizens Bank, Nepal SBI Bank and Machhapuchchhre Bank recorded profits below one billion rupees. State-owned banks also saw significant profit reductions.

Conversely, Nabil Bank earned the highest profit among commercial banks, at Rs 3.24 billion, followed by Global IME Bank at Rs 3.05 billion and Nepal Investment Mega Bank at Rs 2.83 billion in the second quarter of FY 2024/25. Along with Nabil, Global IME, and Nepal Investment Mega, banks earning profits above one billion rupees include Himalayan Bank (Rs 1.51 billion), Laxmi Sunrise Bank (Rs 1.16 billion), Prabhu Bank (Rs 1.33 billion), Prime Bank (Rs 1.86 billion), Everest Bank (Rs 2.07 billion), and Sanima Bank (Rs 1.19 billion).

Traditional banking may not work

The recent economic crisis has raised questions about traditional banking practices. Credit growth has fuelled consumption and heavily monetised land prices, rather than supporting real sector growth. Banks must prioritise financing the real sector to achieve positive economic outcomes that spur growth and create jobs. The cumulative loan portfolio of banks and financial institutions (BFIs) is nearly equivalent to the country’s GDP. Commercial banks alone hold a cumulative loan portfolio of Rs 4,725.88 billion as of the second quarter of this fiscal year, demonstrating unparalleled financial sector growth compared to other economic sectors. This has strained the financial sector’s ability to maintain such isolated momentum. “The growth of the financial sector must be complemented by the growth of other sectors, especially the real sector, for its sustainability,” said Nara Bahadur Thapa, Former Executive Director of Nepal Rastra Bank.

Gyanendra Prasad Dhungana, CEO of Nabil Bank, has urged government and private sector collaboration on project development across various sectors. “Banks have financed numerous energy (generation) projects,” he said. “If the government opens up transmission and distribution for private sector investment, this will create new avenues for bank financing.”

Dhungana acknowledged that traditional banking practices may be ineffective and that bank financing must support the country’s production base. “The IT sector is emerging as a vibrant sector. We encourage private sector collaboration to analyse sectoral gaps and design/study projects,” he said, adding, “Banks are always ready to lend if credible projects are available.” Along with a slump in consumption, loan demand has slowed, and resources are accumulating in banks. They reportedly have the capacity to lend Rs 600 billion at present.

Furthermore, the IMF has emphasised that amidst the ongoing correction from the post-pandemic credit boom, vulnerabilities in the financial sector are increasing. The banking sector’s non-performing loans reached 4.49% in Q2 of 2024/25, and the deteriorating financial health of savings and credit cooperatives (SACCOs) has exacerbated the recovery challenges faced by BFIs.