Nepal's banking history began 87 years ago with the establishment of Nepal Bank Ltd in November 1937. Since then, the banking sector has developed significantly, becoming a dynamic part of the nation's economy. Nepal Rastra Bank, the regulatory body, has been instrumental in shaping various banking models, facilitating resource mobilisation for enterprise development, supporting private sector growth, and contributing to the country's overall economic progress.

Status of gender lens investing in Nepal's banking sector

A study by Nepal Rastra Bank on access to finance revealed that women have less access to credit compared to men. This is primarily due to collateral-based lending practices and the prevalence of male ownership of property in Nepali society. However, cooperatives and microfinance institutions, which offer loans based on group guarantees rather than collateral, predominantly have female members and borrowers.

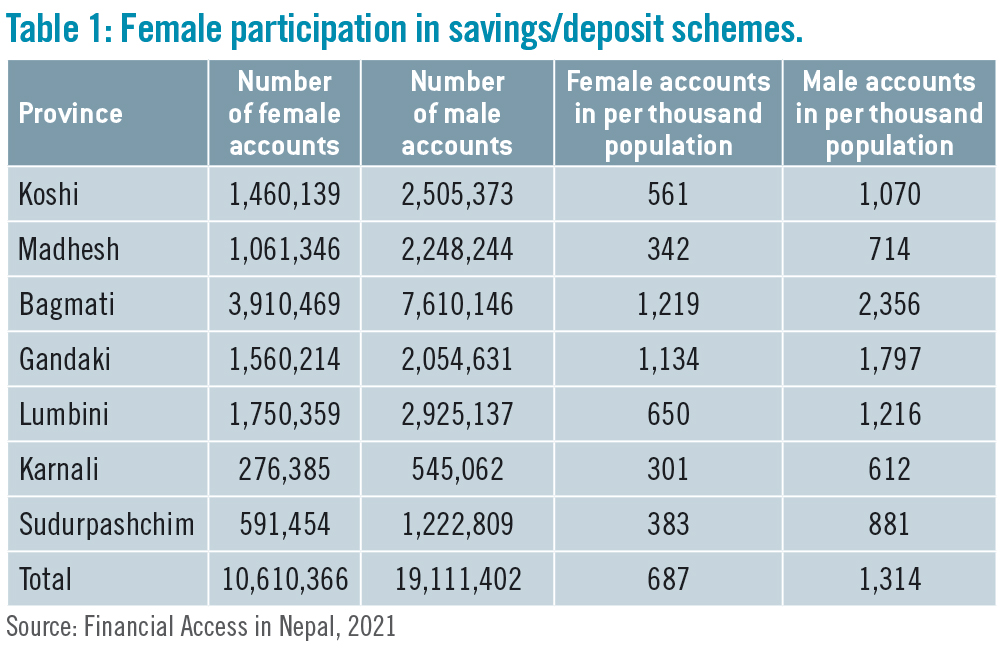

The 'Financial Access in Nepal' study (2021) highlights that women have significantly fewer savings accounts than men, with 10,610,366 accounts compared to 19,111,402 accounts held by men. Interestingly, female accounts are less likely to be dormant than male accounts. Credit accounts are considerably less common than savings accounts, with approximately 1.9 million reported.

Access to credit for women remains limited. While Nepal Rastra Bank has a policy of lending to deprived sectors, including women, and the fiscal policy incorporates gender-based budgeting, there are relatively few schemes specifically focused on gender-based financing. Banks and financial institutions do offer various deposit schemes tailored to women. According to Rena Rijal, a banker turned insurance professional, "The smaller number of dormant accounts and participation in deposit or saving schemes shows female are disciplined in banking transactions."

The central bank enforces a mandatory deprived sector lending policy, initially set at 3% from 1990 to 2017, and subsequently raised to 5% of commercial banks' total loan portfolio from 2018. Instead of directly lending to the deprived sector, banks channel these funds to microfinance institutions (MFIs) which then invest in the intended communities. Unfortunately, the interest rates for end-users are often high due to increased intermediation costs.

While there is a lack of specific data on female access to bank credit, Nepal Rastra Bank's access to finance study provides segregated data on female participation in savings/deposit schemes.

Female participation in banking stands at 687 per thousand people. Regrettably, Karnali Province exhibits the lowest participation, followed by Madhesh and Sudurpashchim Provinces. (See Table 1)

Lack of gender-responsive financing models

The 2015 constitution not only guarantees liberty and civil rights of its citizens but also safeguards economic and collective rights (fraternity rights) while aiming to eliminate all forms of discrimination, including gender-based discrimination. Although diversity and inclusion are core tenets of the constitution, Nepali society continues to grapple with numerous challenges related to gender-based discrimination.

Gender discrimination should not be viewed in isolation, as it is interconnected with factors such as education, awareness, civic practices and property rights. To reduce gender disparities, the family, community and the nation must ensure equitable economic participation, education, health, civic engagement and political empowerment. While Nepal is making progress in women's empowerment, the pace remains slow.

Nepal Rastra Bank, in its regulatory role, has issued various directives to banks and financial institutions (BFIs) concerning priority sector lending. This is intended to stimulate the country's productive sectors, particularly given the tendency of traders to utilise significant financial resources for imports, thereby fuelling consumerism. More recently, a green financing model has been introduced. However, due to prevailing collateral-based lending practices, women who often lack property ownership are often excluded from accessing credit.

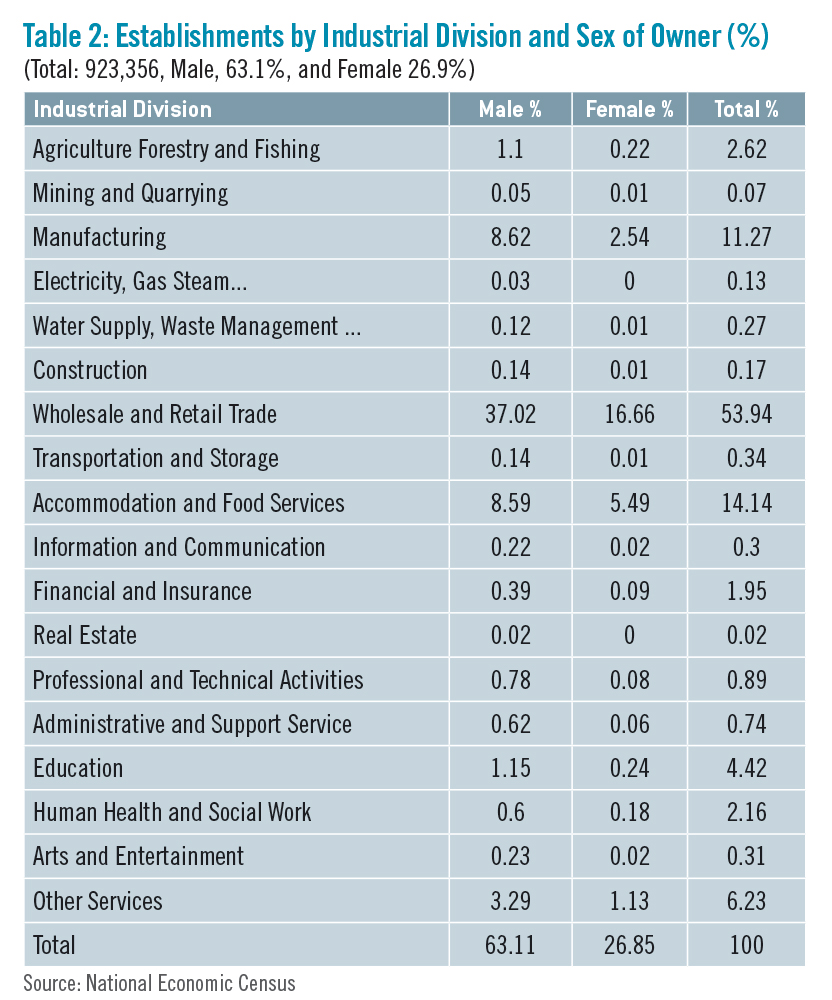

Significantly, the number of women venturing into entrepreneurship has been on the rise in recent years. However, access to credit remains a substantial obstacle for women seeking to become entrepreneurs. They have been actively advocating for gender-responsive financing models and the implementation of project financing approaches. Shova Gyawali, President of the Federation of Women Entrepreneurs' Associations of Nepal (FWEAN), stated that their network comprises 5,500 members, all of whom operate formally registered businesses, a requirement for FWEAN membership. Gyawali emphasised that due to limited access to bank credit, they have been lobbying the government and Nepal Rastra Bank to introduce gender-responsive financing models, interest rate subsidies for women, and other fiscal and monetary incentives.

Guru Prasad Paudel, Executive Director of NRB, states the provision of a 5% interest subsidy for micro, cottage, small and medium-scale industries involved in processing and producing primary agricultural products such as milk, vegetables, fruits, fish, meat, grains, tea, coffee, spices, organic and biological fertilisers, and ayurvedic medicines derived from herbs.

Furthermore, the Startup Enterprise Loan Operation Procedure, 2081, offers loans of up to Rs 2.5 million at a 3% interest rate with a five-year repayment period, using the enterprise or project itself as collateral. Entrepreneurs are limited to submitting one proposal and must declare that they have not received concessional loans from other sources.

Given the significant disparity, policymakers and state mechanisms are urged to work with a sense of urgency to achieve tangible results. (See Table 2)

Female representation in financial sector leadership

Conversely, the financial sector's decision-making roles are predominantly held by men. Only a small number of women have attained leadership and semi-leadership positions. Notably, Neelam Dhungana was appointed Senior Deputy Governor at Nepal Rastra Bank, the central regulatory and monetary authority. Anupama Khunjeli (formerly of Mega Bank) and Barsha Shrestha (formerly of Clean Energy Development Bank) have served as Chief Executive Officers. Others in semi-leadership roles include Samata Pant (Deputy CEO, Nepal Bank), Bandana Pathak (Deputy CEO, formerly of NCC Bank), and Aarti Rajyalaxmi Rana (Chief Business Officer, Laxmi Sunrise Bank).

Despite a considerable proportion of female employees in banks, only a few have secured leadership opportunities. Furthermore, most banks have at least one female on their board, following the government's mandatory provision in the new Banks and Financial Institutions Bill 2024 which requires two independent directors, including one woman, to promote diversity and inclusion in decision-making. One commendable initiative in the banking sector was introduced by NMB Bank, which established branches managed exclusively by women to cultivate female management leaders.

Access to finance still a distant concept

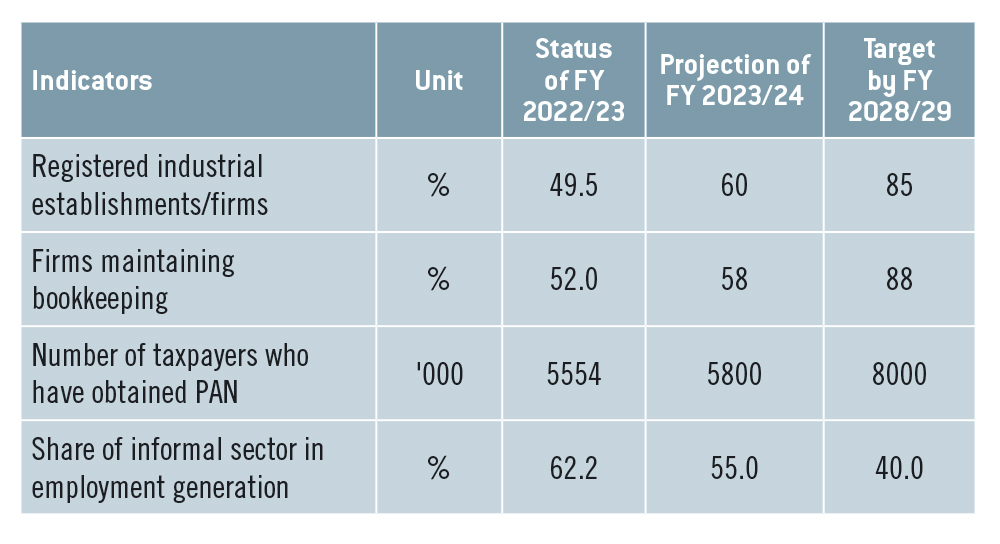

While ‘access to finance’ is a frequently used term by policymakers, streamlining access to credit remains an ongoing challenge. The 16th plan highlights a stark reality: access to finance is still a distant concept for the country, as nearly half of all enterprises operate informally or are unregistered, with a significant number being female-run. Furthermore, a considerable portion of these enterprises do not maintain proper accounting records. Consequently, they are ineligible for financing under conventional criteria.

Access to finance is a fundamental prerequisite for effective financial inclusion. It empowers individuals and businesses to save for the future, secure credit for expanding economic endeavors, facilitate payments, and protect against risks and uncertainties. Further, access to finance and credit fosters economic growth, reduces poverty and strengthens financial and macroeconomic stability; goals that are challenging to achieve while excluding a significant portion of the population from credit access.