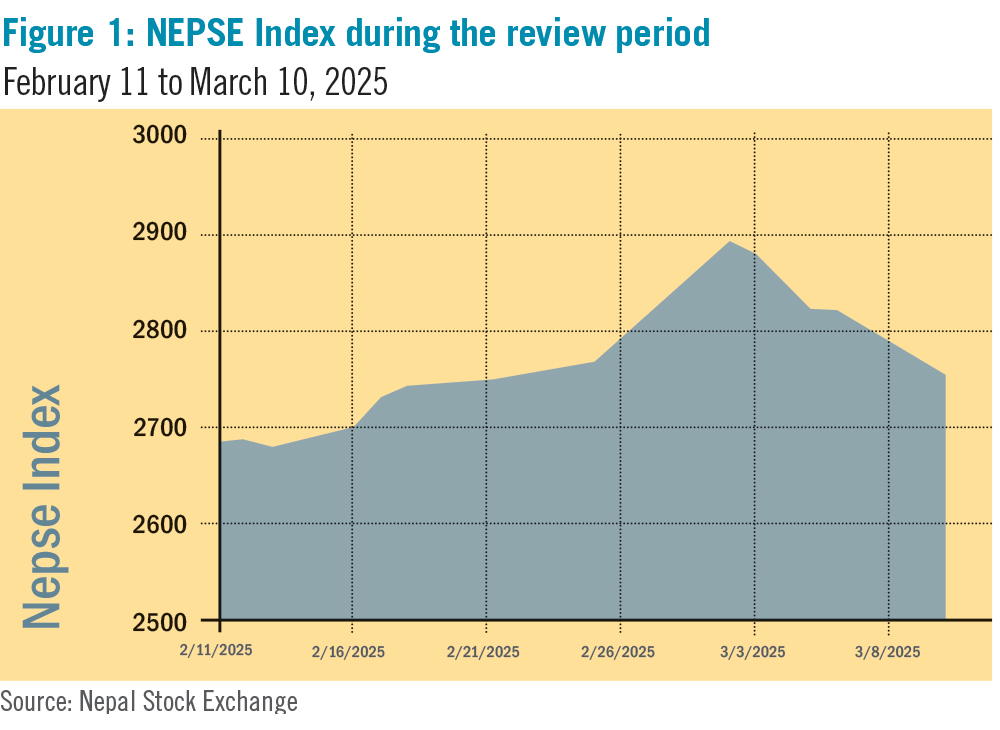

The Nepal Stock Exchange (NEPSE) index increased by 73.34 points (+2.74%) to close at 2,751.42 points during the review period between February 11 and March 10, 2025. The index hit its highest point on March 2 at 2,890.28 points. The period saw a steady upward trajectory before reaching its peak on March 2, after which a dip followed. Towards the end of the review period, the market was not able to sustain the momentum and dropped by 138.86 points to close at 2,751.42 points. Nonetheless, the market volume during the review period rose by 17% to reach Rs 187.43 billion, indicating improving investor confidence. (See Figure 1)

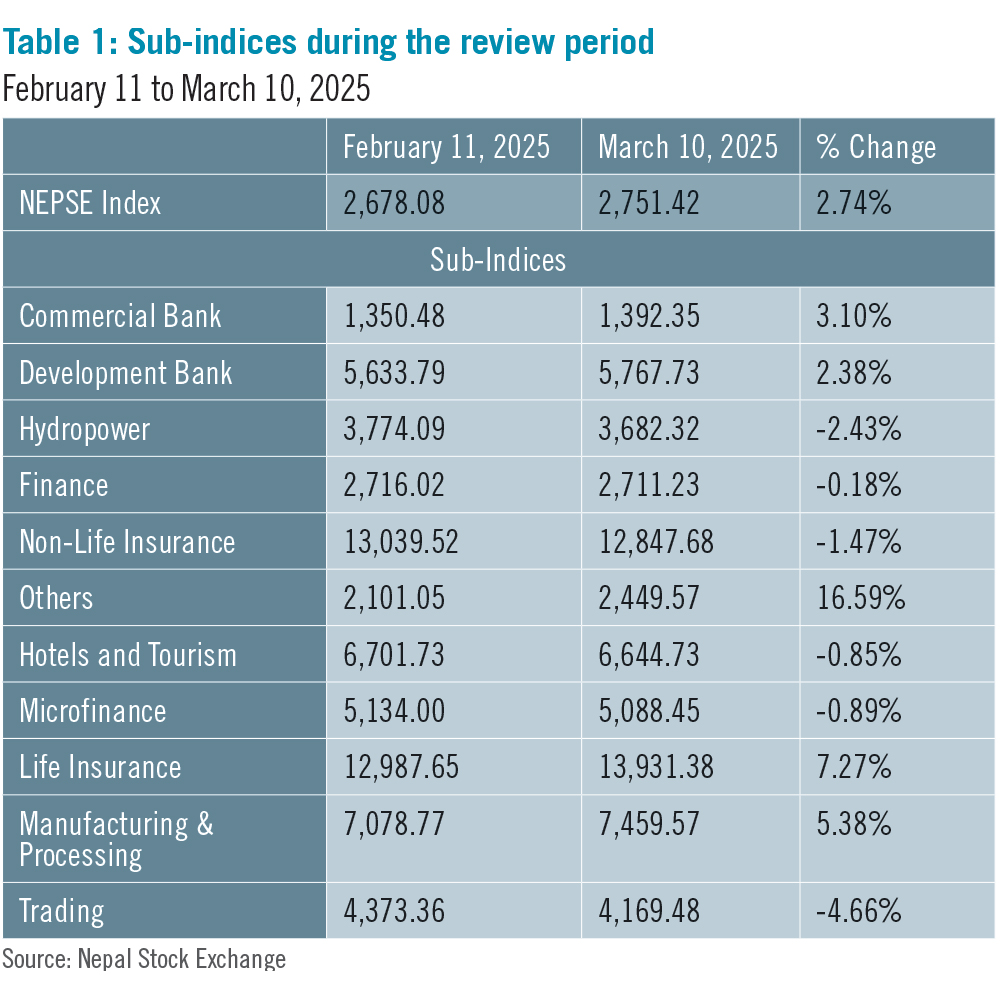

During the review period, five of the eleven sub-indices landed in the green zone, and the remaining six in red.

Others sub-index (+16.59%) was the biggest winner as the share value of Nepal Reinsurance Company (+Rs 300), Himalayan Re-Insurance (+Rs 170.7) and Nepal Telecom (+Rs 15.9) went up. Life Insurance sub-index (+7.27%) followed with a rise in share prices of Guardian Micro-Life Insurance (+Rs 1,633.9), Nepal Life Insurance (+Rs 57) and National Life Insurance (+Rs 53.9).

Manufacturing and Processing sub-index (+5.38%) was next in line as the share value of Bottlers Nepal (Balaju) (+Rs 3,149.4), Ghorahi Cement Industry (+Rs 49.1) and Himalayan Distillery (+Rs 21.9) increased. Similarly, Commercial Bank sub-index (+3.10%) witnessed a rise in share values of Sanima Bank (+Rs 16.8), NMB Bank (+Rs 15) and NIC Asia (+Rs 14.9). Similarly, Development Bank sub-index (+2.38%) saw a rise in the share prices of Narayani Development Bank (+Rs 577.6), Sindhu Bikash Bank (+Rs 117) and Saptakoshi Development Bank (+Rs 72.1).

In the red zone, Finance sub-index (-0.18%) witnessed drop in prices of Central Finance (-Rs 58.6), Multipurpose Finance (-Rs 43.1) and Samriddhi Finance (-Rs 42). The Hotels and Tourism sub-index (-0.85%) followed with decline in share values of City Hotel (-Rs 59), Kalinchowk Darshan (-Rs 19.9) and Shivam Holdings (-Rs 19.5). Microfinance sub-index (-0.89%) also saw lowering in prices of Upakar Microfinance (-Rs 1,872), Samaj Microfinance (-Rs 740) and Shrijanshil Microfinance (-Rs 308).

Non-Life Insurance sub-index (-1.47%) followed with a decline in share values of NLG Insurance (-Rs 286.2), Himalayan Everest Insurance (-Rs 35) and United Ajod Insurance (-Rs 35). Similarly, Hydropower sub-index (-2.43%) witnessed drop in the share prices of Dordi Khola Jal Bidyut (-Rs 250), Nyadi Hydropower (-Rs 244.1) and Super Madi Hydropower (-Rs 144.9). Trading sub-index (-4.66%) was the biggest loser with fall in the share values of Bishal Bazar Company (-Rs 400). (See Table 1)

News and Highlights

With the appointment of Santosh Narayan Shrestha as the new Chairperson of Securities Board of Nepal (SEBON), Initial Public Offering (IPO) issues resumed after nearly a year. Pure Energy issued its IPO worth Rs 800 million under the ‘Others’ sector for locals and general public with Nabil Investment Banking as the issue manager.

However, SEBON’s proposed amendments to the Security Registration and Issuance Regulation 2073 requiring companies to issue at least 20% of their shares to the general public for enhanced transparency could pose challenges for pending IPO applications, should it be implemented.

In addition to addressing the IPO backlog, the Government of Nepal has designated SEBON as the regulatory body for investment companies with a paid-up capital of Rs 50 million or more or annual transactions exceeding Rs 100 million. These companies, previously governed by general corporate laws and AML regulations, must now register with SEBON, providing necessary documents to ensure compliance under the Asset (Money Laundering) Prevention Act 2064.

On February 20, SEBON also issued new guidelines for securities market participants requiring regular checks against the UN sanctions list, freezing assets of sanctioned entities, and preventing support for terrorism or weapons proliferation. SEBON is also introducing reforms in Regulations on Securities Issuance and Transactions for Small and Medium Organised Institutions 2081 such as facilitating SMEs with a capital of up to Rs 250 million to raise capital through IPOs. SEBON is also exploring the potential for a private sector stock exchange offering bond options for private companies.

Outlook

SEBON’s new policies are expected to bring increased regulatory oversight, particularly for larger investment companies and stricter guidelines for securities market participants. The IPO market will likely continue to adjust as companies adapt to the revised share issuance requirements, with a focus on transparency and market stability. Reforms for SMEs and the potential introduction of a private sector stock exchange may provide more opportunities to raise capital and expand the market. As primary market activity increases, investors are closely monitoring market trends, signalling a positive shift in sentiment.