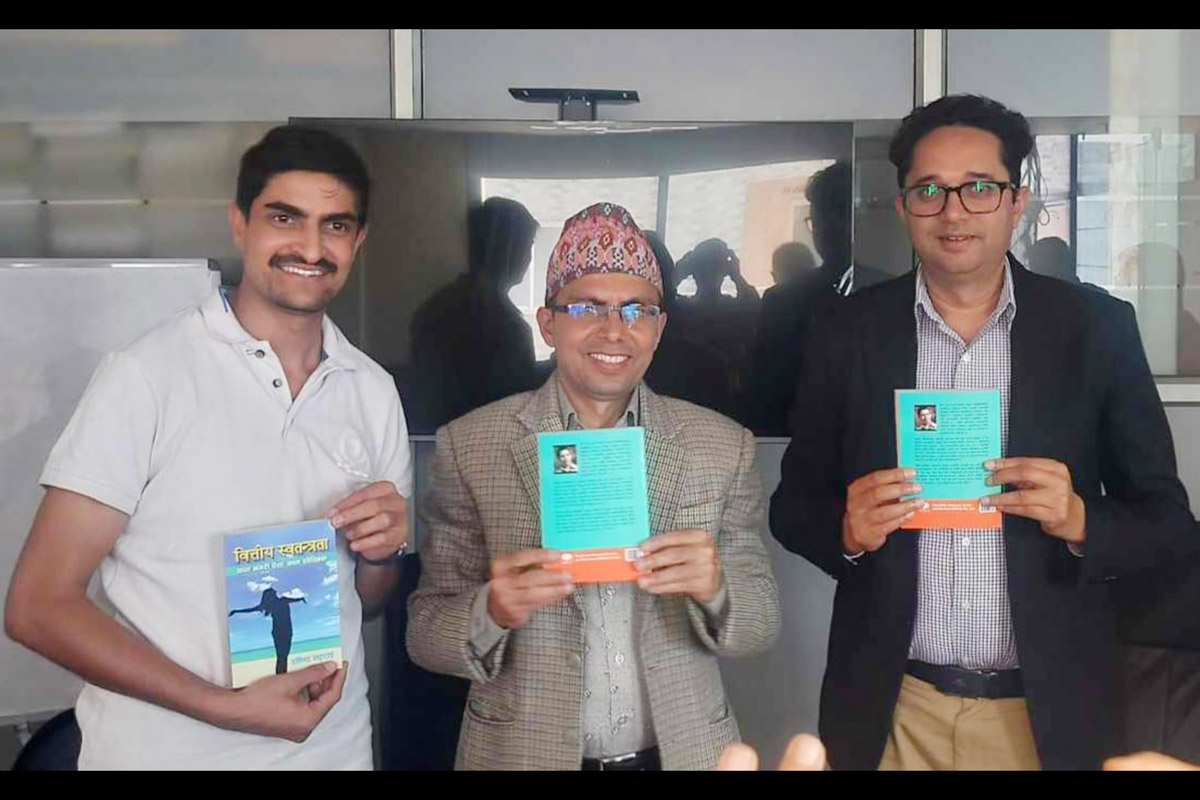

KATHMANDU: 'Bittiya Swatantrata' (Financial Independence), a book authored by stock market analyst Rabindra Bhattarai, has been launched recently.

The book was unveiled at an event by Bhattarai, President of the Society of Economic Journalists-Nepal (SEJON) Sujan Oli, and former SEJON President Gokarna Raj Awasthi. Bhattarai stated that the book provides insights into achieving financial independence and strategies for further economic progress.

During the discussion, Bhattarai suggested that companies should be allowed to issue initial public offerings (IPOs) at a price lower than the nominal value of Rs 100. He argued that reducing the nominal value would increase the number of shares issued. "IPOs can even be issued at a nominal value of Re 1; once the number of shares is increased, the required capital will still be raised," he said.

Bhattarai also opined that high-value companies could enhance accessibility through 'stock splits', a process in which a company issues additional shares while proportionally reducing their price.

Furthermore, he proposed that companies should be permitted to distribute dividends quarterly instead of annually, citing examples of firms in developed countries that issue cash dividends monthly. "A system could be implemented to allow quarterly dividend distributions; the income of certain sectors, including hydropower, is predictable," Bhattarai remarked.

Bhattarai expressed his support for a privately operated stock exchange, criticising the government-run Nepal Stock Exchange for failing to modernise technology and expand market capacity. "In most countries worldwide, stock exchanges are not state-owned," he said. "Here, government ownership results in political appointments to the board, including the chairperson, which hinders independent decision-making."

He mentioned that while institutional investors drive markets in other countries, Nepal has a limited number of institutional investors, and existing entities lack sufficient capacity. He also stressed the necessity of enabling trading on stock indices. "There was a plan to introduce the NEPSE 30 Index, but it never materialised," he stated.

Bhattarai criticised social media posts encouraging individuals to buy or sell specific shares. "In Canada and other countries, if someone recommends a company and causes financial loss or damage, there are legal penalties, including compensation," he said. "No one should be advising others to buy or sell shares."