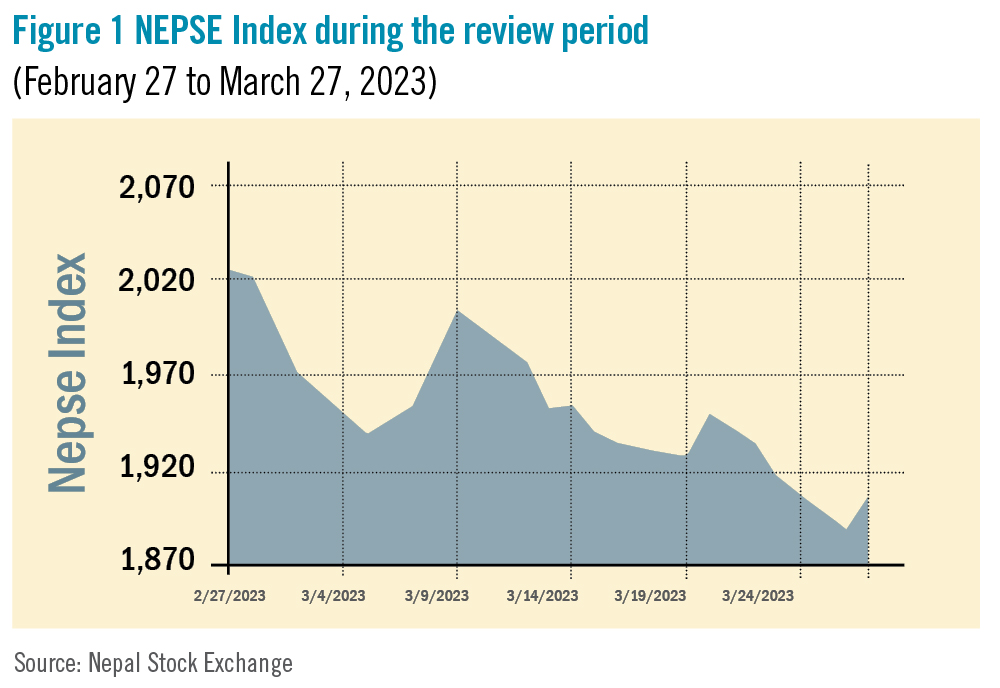

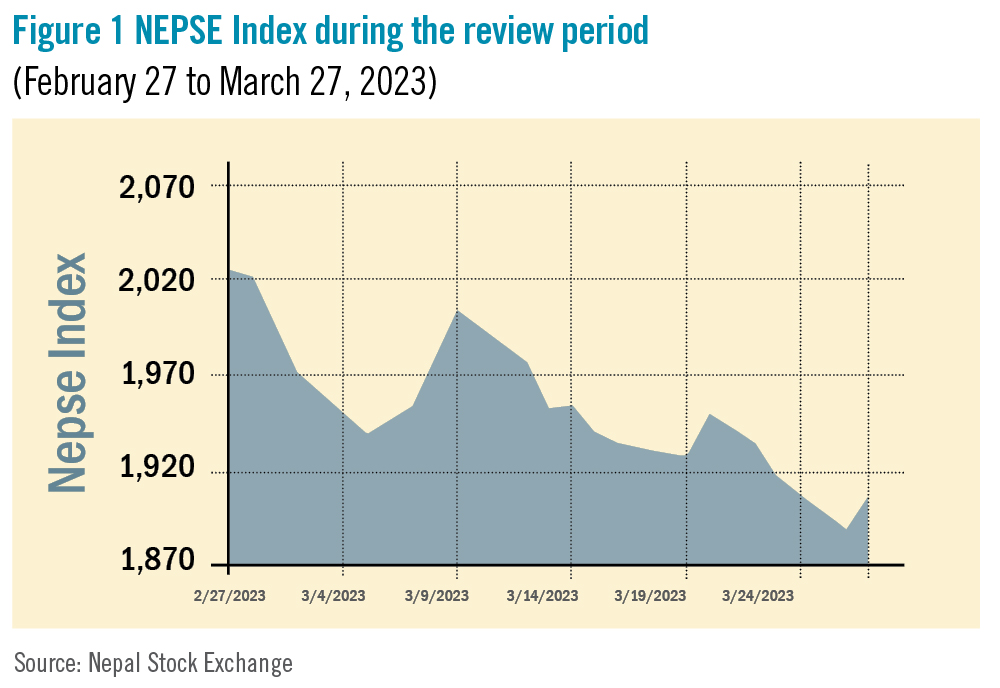

During the review period of February 27 to March 27, the Nepal Stock Exchange (NEPSE) index plunged by 121.19 points (-5.98%) to close at 1,906.00 points. The secondary market, which had crossed the 2,000-point threshold in the previous review period, faced a downward momentum in this review period, and reached its lowest point of the review period on March 26 at 1,888.30 points. Some of the major reasons behind the bearish trend of the market include the continued liquidity crisis of the economy, surging cases of non-performing loans and increasing fiscal deficit, all of which led to low investor confidence. Likewise, the political instability exhibited by the shifts in recently-formed coalitions of political parties, introduction of stringent policies for microfinance institutions (MFIs) by the Central Bank, etc have also contributed to this notable decline. The overall total market volume plummeted by 33.36% to reach Rs 24.165 billion.

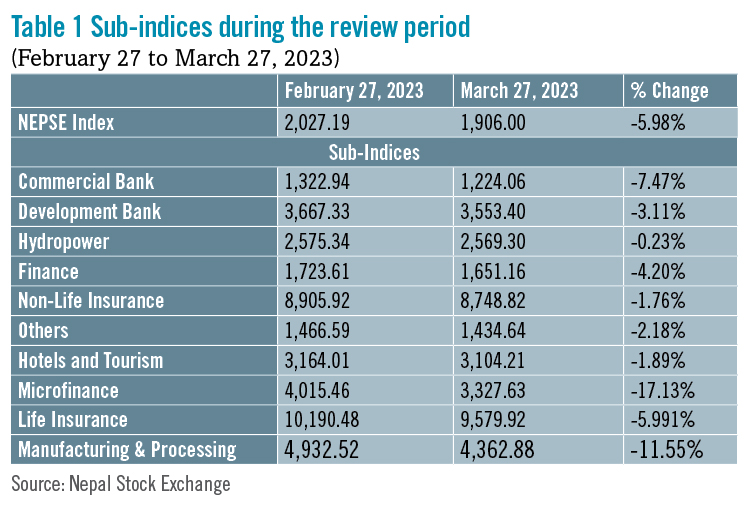

During the review period, all of the sub-indices landed in the red zone, indicating a worrisome state across the sub-sectors.

Microfinance sub-index (-17.13%) was the biggest loser due to the impact of the new directive issued by the central bank for MFIs restricting their proposed dividends, which caused the share value of Global IME Microfinance (-Rs 318.6), Chhimek Microfinance (-Rs 315.1), and Swarojgar Microfinance (-Rs 274) to decrease substantially. Manufacturing and Processing sub-index (-11.55%) was second in line as it witnessed a fall in the share prices of Bottlers Nepal (-Rs 1,561), Himalayan Distillery (-Rs 390), and Shivam Cements (-Rs 72.2).

Commercial Bank sub-index (-7.47%) followed suit with decrease in the share prices of Nabil Bank (-Rs 57), Himalayan Bank (-Rs 50.1) and Nepal SBI Bank (-Rs 25.8). Likewise, Life Insurance sub-index (-5.99%) also fell as share value of Nepal Life Insurance Co (-Rs 46), Prime Life Insurance Company (-Rs 27.1) and Asian Life Insurance Co (-Rs 26) went down.

Finance sub-index (-4.20%) went down as share prices of ICFC Finance (-Rs 23.3), Guheshwori Merchant Bank and Finance (-Rs 12.3) and Gurkhas Finance (-Rs 12) decreased.

Development Bank sub-index (-3.11%) decreased with fall in the share value of Shangrila Development (-Rs 45), Excel Development (-Rs 26.9) and Corporate Development (-Rs 20.5).

Along the same lines, Others sub-index (-2.18%) witnessed a decline in the share price of Nepal Telecom (-Rs 10.8), and Hydroelectricity Investment and Development Corporation (-Rs 1.2). Hotels and Tourism sub-index (-1.89%) saw a decrease in the share value of Chandragiri Hills (-Rs 69), Taragaon Regency (-Rs 35) and Oriental Hotels (-Rs 26).

Further, Non-Life Insurance sub-index (-1.76%) was also on the losing end with decline in the share prices of Rastriya Beema Company (-Rs 594), NLG Insurance Company (-Rs 74.2) and Prabhu Insurance (-Rs 42). Hydropower sub-index (-0.23%) also followed suit with decline in the share value of Chhyangdi Hydropower (-Rs 27), Dibyashwori Hydropower (-Rs 6.1), and Khanikhola Hydropower (-Rs 5.3).

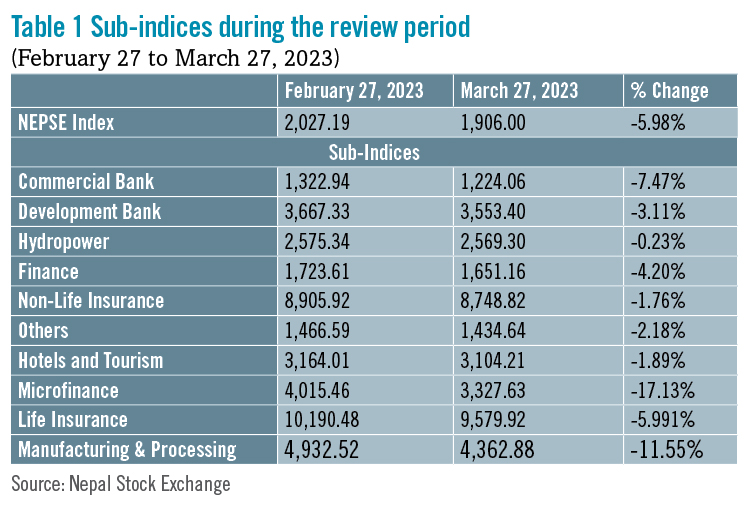

During the review period, all of the sub-indices landed in the red zone, indicating a worrisome state across the sub-sectors.

Microfinance sub-index (-17.13%) was the biggest loser due to the impact of the new directive issued by the central bank for MFIs restricting their proposed dividends, which caused the share value of Global IME Microfinance (-Rs 318.6), Chhimek Microfinance (-Rs 315.1), and Swarojgar Microfinance (-Rs 274) to decrease substantially. Manufacturing and Processing sub-index (-11.55%) was second in line as it witnessed a fall in the share prices of Bottlers Nepal (-Rs 1,561), Himalayan Distillery (-Rs 390), and Shivam Cements (-Rs 72.2).

Commercial Bank sub-index (-7.47%) followed suit with decrease in the share prices of Nabil Bank (-Rs 57), Himalayan Bank (-Rs 50.1) and Nepal SBI Bank (-Rs 25.8). Likewise, Life Insurance sub-index (-5.99%) also fell as share value of Nepal Life Insurance Co (-Rs 46), Prime Life Insurance Company (-Rs 27.1) and Asian Life Insurance Co (-Rs 26) went down.

Finance sub-index (-4.20%) went down as share prices of ICFC Finance (-Rs 23.3), Guheshwori Merchant Bank and Finance (-Rs 12.3) and Gurkhas Finance (-Rs 12) decreased.

Development Bank sub-index (-3.11%) decreased with fall in the share value of Shangrila Development (-Rs 45), Excel Development (-Rs 26.9) and Corporate Development (-Rs 20.5).

Along the same lines, Others sub-index (-2.18%) witnessed a decline in the share price of Nepal Telecom (-Rs 10.8), and Hydroelectricity Investment and Development Corporation (-Rs 1.2). Hotels and Tourism sub-index (-1.89%) saw a decrease in the share value of Chandragiri Hills (-Rs 69), Taragaon Regency (-Rs 35) and Oriental Hotels (-Rs 26).

Further, Non-Life Insurance sub-index (-1.76%) was also on the losing end with decline in the share prices of Rastriya Beema Company (-Rs 594), NLG Insurance Company (-Rs 74.2) and Prabhu Insurance (-Rs 42). Hydropower sub-index (-0.23%) also followed suit with decline in the share value of Chhyangdi Hydropower (-Rs 27), Dibyashwori Hydropower (-Rs 6.1), and Khanikhola Hydropower (-Rs 5.3).

During the review period, all of the sub-indices landed in the red zone, indicating a worrisome state across the sub-sectors.

Microfinance sub-index (-17.13%) was the biggest loser due to the impact of the new directive issued by the central bank for MFIs restricting their proposed dividends, which caused the share value of Global IME Microfinance (-Rs 318.6), Chhimek Microfinance (-Rs 315.1), and Swarojgar Microfinance (-Rs 274) to decrease substantially. Manufacturing and Processing sub-index (-11.55%) was second in line as it witnessed a fall in the share prices of Bottlers Nepal (-Rs 1,561), Himalayan Distillery (-Rs 390), and Shivam Cements (-Rs 72.2).

Commercial Bank sub-index (-7.47%) followed suit with decrease in the share prices of Nabil Bank (-Rs 57), Himalayan Bank (-Rs 50.1) and Nepal SBI Bank (-Rs 25.8). Likewise, Life Insurance sub-index (-5.99%) also fell as share value of Nepal Life Insurance Co (-Rs 46), Prime Life Insurance Company (-Rs 27.1) and Asian Life Insurance Co (-Rs 26) went down.

Finance sub-index (-4.20%) went down as share prices of ICFC Finance (-Rs 23.3), Guheshwori Merchant Bank and Finance (-Rs 12.3) and Gurkhas Finance (-Rs 12) decreased.

Development Bank sub-index (-3.11%) decreased with fall in the share value of Shangrila Development (-Rs 45), Excel Development (-Rs 26.9) and Corporate Development (-Rs 20.5).

Along the same lines, Others sub-index (-2.18%) witnessed a decline in the share price of Nepal Telecom (-Rs 10.8), and Hydroelectricity Investment and Development Corporation (-Rs 1.2). Hotels and Tourism sub-index (-1.89%) saw a decrease in the share value of Chandragiri Hills (-Rs 69), Taragaon Regency (-Rs 35) and Oriental Hotels (-Rs 26).

Further, Non-Life Insurance sub-index (-1.76%) was also on the losing end with decline in the share prices of Rastriya Beema Company (-Rs 594), NLG Insurance Company (-Rs 74.2) and Prabhu Insurance (-Rs 42). Hydropower sub-index (-0.23%) also followed suit with decline in the share value of Chhyangdi Hydropower (-Rs 27), Dibyashwori Hydropower (-Rs 6.1), and Khanikhola Hydropower (-Rs 5.3).

During the review period, all of the sub-indices landed in the red zone, indicating a worrisome state across the sub-sectors.

Microfinance sub-index (-17.13%) was the biggest loser due to the impact of the new directive issued by the central bank for MFIs restricting their proposed dividends, which caused the share value of Global IME Microfinance (-Rs 318.6), Chhimek Microfinance (-Rs 315.1), and Swarojgar Microfinance (-Rs 274) to decrease substantially. Manufacturing and Processing sub-index (-11.55%) was second in line as it witnessed a fall in the share prices of Bottlers Nepal (-Rs 1,561), Himalayan Distillery (-Rs 390), and Shivam Cements (-Rs 72.2).

Commercial Bank sub-index (-7.47%) followed suit with decrease in the share prices of Nabil Bank (-Rs 57), Himalayan Bank (-Rs 50.1) and Nepal SBI Bank (-Rs 25.8). Likewise, Life Insurance sub-index (-5.99%) also fell as share value of Nepal Life Insurance Co (-Rs 46), Prime Life Insurance Company (-Rs 27.1) and Asian Life Insurance Co (-Rs 26) went down.

Finance sub-index (-4.20%) went down as share prices of ICFC Finance (-Rs 23.3), Guheshwori Merchant Bank and Finance (-Rs 12.3) and Gurkhas Finance (-Rs 12) decreased.

Development Bank sub-index (-3.11%) decreased with fall in the share value of Shangrila Development (-Rs 45), Excel Development (-Rs 26.9) and Corporate Development (-Rs 20.5).

Along the same lines, Others sub-index (-2.18%) witnessed a decline in the share price of Nepal Telecom (-Rs 10.8), and Hydroelectricity Investment and Development Corporation (-Rs 1.2). Hotels and Tourism sub-index (-1.89%) saw a decrease in the share value of Chandragiri Hills (-Rs 69), Taragaon Regency (-Rs 35) and Oriental Hotels (-Rs 26).

Further, Non-Life Insurance sub-index (-1.76%) was also on the losing end with decline in the share prices of Rastriya Beema Company (-Rs 594), NLG Insurance Company (-Rs 74.2) and Prabhu Insurance (-Rs 42). Hydropower sub-index (-0.23%) also followed suit with decline in the share value of Chhyangdi Hydropower (-Rs 27), Dibyashwori Hydropower (-Rs 6.1), and Khanikhola Hydropower (-Rs 5.3).

News and Highlights

During the review period, NEPSE was engaged in updating the data of the last five years of all the listed companies. NEPSE plans to introduce a new index, ‘NEPSE 50’ for trading shares of 50 selected companies once the data is ready with a launch date in April 2023 and implementation within the current fiscal year 2022/23. The 50 companies will be chosen based on their market volume, capitalisation, liquidity, and a requirement that at least 25% or more of the company’s shares must have been traded to the general public with an average daily turnover of Rs 2.5 million or more for a period of six months and an average daily transaction of 5,000 shares or more. In line with this, a preliminary draft of the new index titled ‘Procedures for Development, Management, and Regulation of Indices under NEPSE 2079’ has been prepared and is currently under internal review. In addition, it is anticipated that ‘NEPSE 50’ will represent the market and may later be traded as a derivative instrument. In light of this, the CEO of NEPSE has announced that a committee will be formed to work on the model of ‘NEPSE 50’ implementation in Nepal. On the public issues front, the Securities Board of Nepal (SEBON) approved the IPO of Rawa Energy Development worth Rs 280 million and City Hotel worth Rs 1.67 billion. Prabhu Capital and Global IME Capital have been appointed as the respective issue managers. SEBON also kept the IPO of three insurance companies in its pipeline under preliminary review. They are Sun Nepal Life Insurance Company at Rs 2.40 billion, IME Life Insurance Co at Rs 3.312 billion, and Citizen Life Insurance Company at Rs 3.15 billion. Nepal SBI Merchant Banking, Civil Capital Market and NIBL Ace Capital have been appointed as the respective issue managers. SEBON also has the IPO of Vision Lumbini Urja Company, a hydropower company worth Rs 382 million under preliminary review. Civil Capital Market is its issue manager.Outlook

The liquidity crunch in the market and the announcement of stringent policies for microfinance institutions accompanied with changing political landscape has negatively affected the secondary market in the review period. This leads to low investor confidence and acts as an inhibiting factor that prevents potential investors from entering the market. Investment decisions, under these circumstances, are also not reliable. Hence, it is crucial for the government to emphasise on creating more developmental policies and programmes for the secondary market. Only if enabling policies are implemented effectively, market optimism can be improved in the coming months. This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Published Date: April 30, 2023, 12:00 am

Post Comment

E-Magazine

Click Here To Read Full Issue

RELATED Beed Take