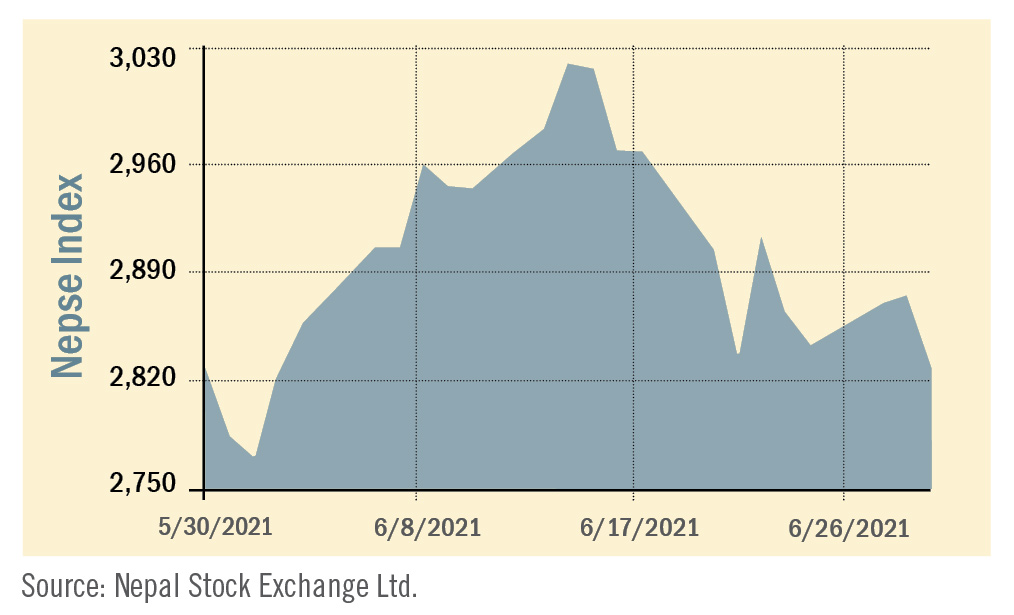

During the review period of May 30 to June 29, the Nepal Stock Exchange (NEPSE) index went up by 12.61 points (+0.45%) to close at 2,828.00 points. The review period witnessed new milestones in the Nepali secondary market history. The benchmark NEPSE index reached its all-time high of 3,061.81 points on June 15, and also witnessed a highest single day volume of Rs 19.55 billion on June 13. Nonetheless post public announcement made by the Securities Board of Nepal (SEBON), the market has been in a continuous downward spiral. In a public statement, SEBON has listed 51 overpriced stocks and has suggested potential manipulation in the secondary market. Despite the volatility, total market volume during the review period increased substantially by 74.35% and stood at Rs. 303.252 billion.

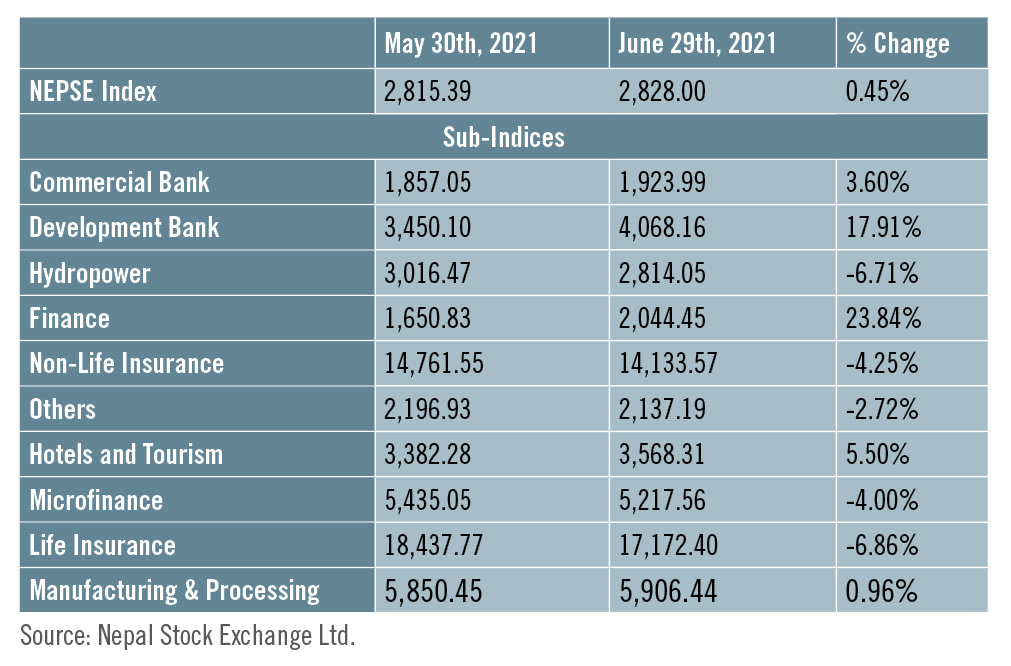

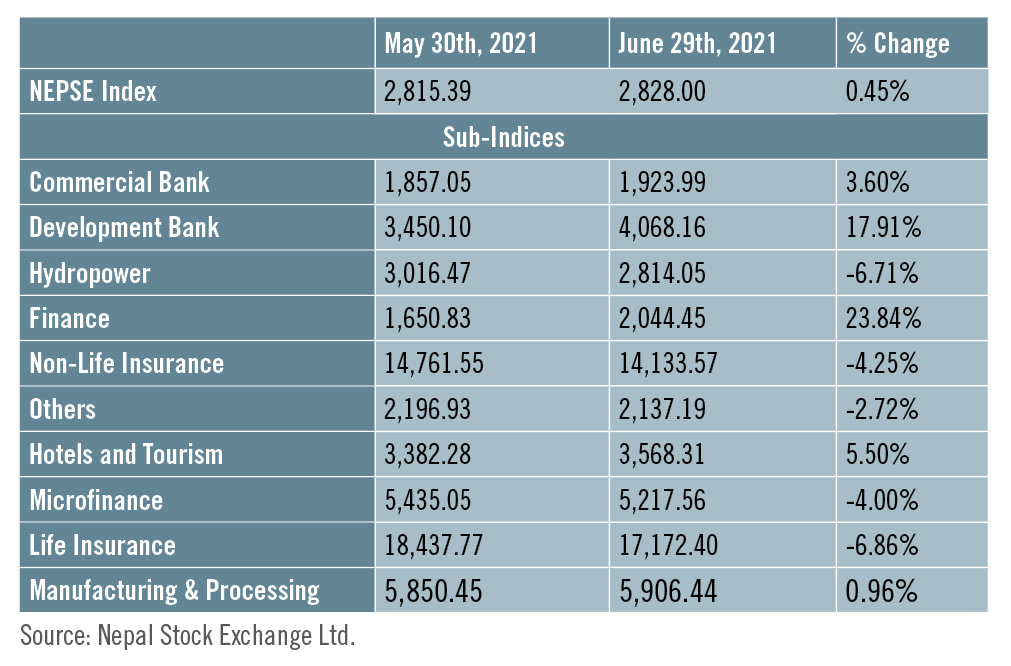

During the review period, contrary to the previous review period, five of the sub-indices landed in the green zone while the rest landed in the red zone.

Finance sub-index (+23.84%) was the biggest gainer as share value of Gurkhas Finance (+Rs 351), Manjushree Finance (+Rs 325) and Pokhara Finance (+Rs 178) went up. Development Bank sub-index (+17.91%) was second in line with increase in the share value of Lumbini Development Bank (+Rs 201), Excel Development (+Rs 116) and Muktinath Development (+Rs 103). Hotels and Tourism sub-index (+5.50%) followed suit with rise in the share value of Taragaon Regency (+Rs 77). Likewise, Commercial sub-index (+3.60%) surged as share value of Laxmi Bank (+Rs 61), Siddhartha Bank (+Rs 48) and Citizen Bank (+Rs 42) went up. Manufacturing & Processing sub-index (+0.96%) also rose marginally with increase in the share value of Himalayan Distillery (+Rs 598).

On the flip side, Others sub-index (-2.72%) witnessed a decrease as share value of Nepal Telecom (-Rs 83) tumbled. Likewise Microfinance sub-index (-4.00%) decreased with drop in the share prices of Janautthan Microfinance (-Rs 150), Neruda Microfinance (-Rs 142) and Mero Microfinance (-Rs 128). Similarly, Non-life insurance sub-index (-4.25%) also saw a fall as share prices of Rastriya Beema Company (-Rs 2425), Siddhartha Insurance (-Rs 297) and IME General Insurance (-Rs 198) went down. Likewise, Hydropower sub-index (-6.71%) was also on the losing side with decrease in the share value of Radhi Hydropower (-Rs 275), Chilime Hydropower (-Rs 91) and Rairang Hydropower (-Rs 86). Along the same lines, Life Insurance sub-index (-6.86%) was the biggest loser with drop in share prices of Nepal Life Insurance (-Rs 145), Surya Life Insurance (-Rs 125) and National Life Insurance (-Rs 122).

News and Highlights

SEBON published a list on June 15 consisting of 51 listed companies in NEPSE which appear risky in terms of their current market value. As per the statement, the stock pricesof some of the listed companies have increased by more than 300% while their P/E ratio is over 100. Likewise, some stocks have negative Earning Per Share (EPS) and net worth suggesting abnormality and irregularity in their trading. SEBON also added that there were indications of insider trading, circular trading and cornering among the mentioned companies. Out of the 51 companies, 22 are hydropower companies, 5 life insurance companies, 5 non-life insurance companies and 4 finance companies. SEBON also issued another statement on June 24 wherein it reduced the price fluctuating range of stocks to 2% from the existing 5% in pre-open market session of the stock market. Here, the pre-open market session refers to the period of trading shares that takes place just before the secondary market opens for transactions on trading days (10:30 am to 10:55 am is the benchmark). In the statement, it was also stated that SEBON had revised the pricing range of stocks in pre-open market session in the NEPSE in order to check the excess rise in share prices on daily trading in the stock market. On the public issue front, during the review period, SEBON has approved the Initial Public Offering (IPO) of Manakamana Smart Microfinance worth Rs 38.9 million, Terathum Hydropower worth Rs 120 million and Union Life Insurance worth Rs 645 million. NMB Capital has been appointed as the issue manager for Manakamana Smart Microfinance whereas NIBL Ace Capital is the issue manager for Terathum Hydropower. Likewise, Prabhu Capital is working as the issue manager for Union Life Insurance. SEBON has also added the IPO of NESDO Sambridha Microfinance worth Rs 82.87 million to its pipeline.Global IME Capital has been appointed as the issue manager. It has also approved two debenture issuances, namely: ’7 years, 8.75%, Muktinath Bikas Bank Debenture’ by Muktinath Development Bank and ’4% Agricultural Bond, 8 & 9 years’ during the review period.Outlook

As the current fiscal year comes to an end, in retrospect it has been highly rewarding for investors and overall market development. The market since the beginning of the current fiscal year has gone up by 107.6% and continues to showcase strong positive momentum. Even though the statement by the regulator has dented the current trajectory of the market nonetheless the effort should be lauded to protect retail investors especially the new entrants. As interest rates in the banking system is gradually pushing upwards and the monetary policy for the new fiscal year is due soon, investors seem to be in wait and watch mode. This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Published Date: July 27, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take