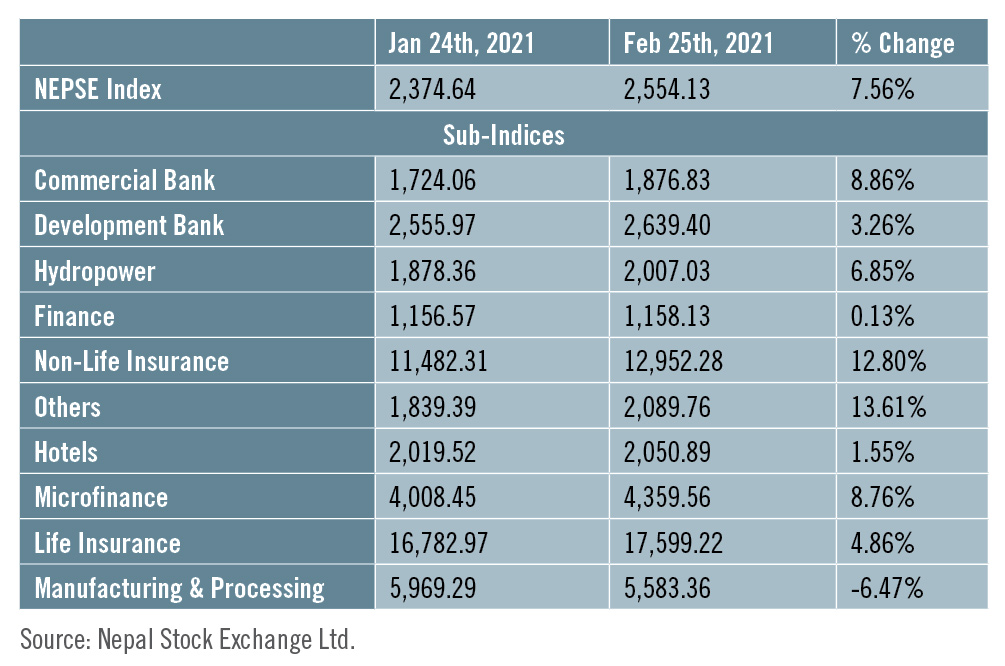

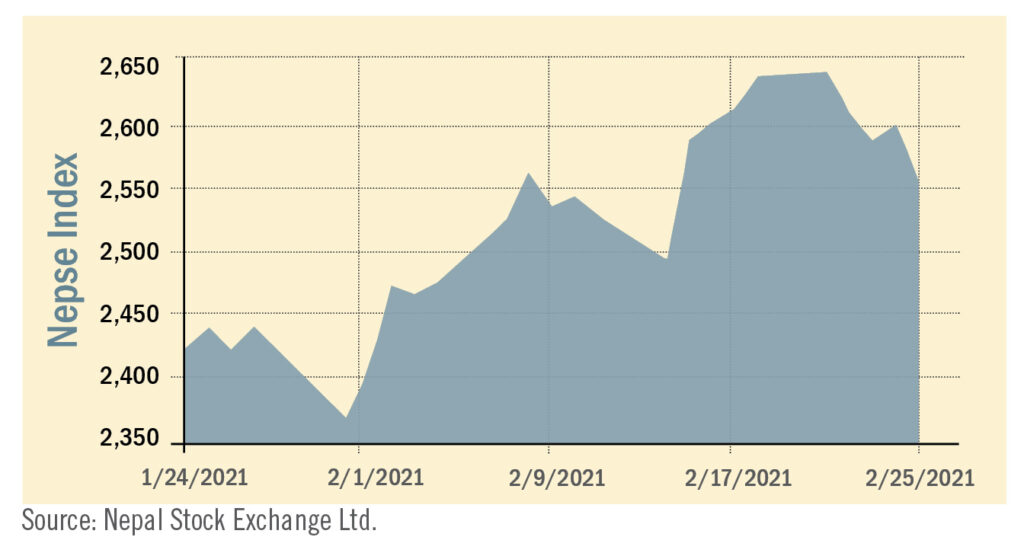

During the review period of January 24 to February 25, the Nepal Stock Exchange (NEPSE) index went up by a staggering 179.49 points (+7.56%) to close at 2554.13 points. The market had crossed the psychological threshold of 2,100 points in the previous review period. Continuing its record-setting spree, the secondary market traded above 2,350 points throughout the review period, and even reached an all-time high of 2,636.68 on February 18. The total market volume during the review period increased by a whopping 117.81% and stood at Rs 214.166 billion.

During the review period, contrary to the previous review period, nine of the sub-indices landed in the green zone while one fell in the red-zone.

Others sub-index (+13.61%) was the biggest gainer as share value of Citizen Investment Trust (+Rs 1265) went up. Non-life Insurance sub-index (+12.80%) was second in line with increase in the share value of Shikhar Insurance (+Rs 605), Neco Insurance (+Rs 382) and Sagarmatha Insurance (+Rs 354). Commercial Bank sub-index (+8.86%) followed suit with rise in the share value of Nabil Bank (+Rs 213), Global IME Bank (+Rs 132) and Nepal Bank (+Rs 107). Likewise, Microfinance sub-index (+8.76%) surged as share value of Januatthan Samudayik Microfinance (+Rs 1420), National Microfinance (+Rs 635) and Support Microfinance (+Rs 472) went up. Hydropower sub-index (+6.85%) also surged as the share value of Himalayan Power (+Rs 116), Arun Valley Hydropower (+Rs 92) and Nepal Hydro Developers (+Rs 62) rose. Following this, Life insurance sub-index (+4.86%) saw a rise in the share value of Asian Life Insurance (+Rs 219), National Life Insurance (+Rs 70) and Gurans Life Insurance (+Rs 54). Similarly, Development Bank sub-index (+3.26%) increased with surge in the share prices of Corporate Development Bank (+Rs 139), Kamana Sewa Development (+Rs 34) and Excel Development Bank (+Rs 33). Hotels sub-index (+1.55%) gained value with the rise in the share values of Oriental Hotels (+Rs 26) and Taragaon Regency Hotel (+Rs 7). Likewise, Finance sub-index (+0.13%) gained marginally as share values of Manjushree Finance (+Rs 81), Pokhara Finance (+Rs 27) and Multipurpose Finance (+Rs 5) went up.

However Manufacturing & Processing sub-index (-6.47%) witnessed a decrease in the share value of Bottlers Nepal (-Rs 275) and Shivam Cement (-Rs 161).

News and Highlights

At present, NEPSE posts details of events or information that could affect the stock market price on its website after analysing the details and reports submitted to them by the listed companies. This information proves vital for investing in securities. Considering the bull-run that the secondary market has been experiencing and entry of new investors, the Securities Exchange Board of Nepal (SEBON) has directed NEPSE to make public the five-year financial statements of all listed companies including their annual reports and quarterly reports on their website and keep it for at least five years. In the public issue front, during the review period, SEBON has approved the issuance of Initial Public Offering (IPO) of Jyoti Life Insurance worth Rs 660 million and Ru Ru Hydropower worth Rs 0.81 million. NMB Capital has been appointed as the issue manager for both the IPO issues. SEBON has also approved two debenture issuance proposed by Prime Commercial Bank – ‘8 years, 8.75% Prime Debenture 2085’ and NCC Bank – ’10 years, 9.5% NCC Rinpatra 2085’. SEBON has added the right share issuance of Api Power Company with 1:0.29 ratio worth Rs 567 million to its pipeline. Additionally, the debenture issue of Prabhu Bank – ‘Prabhu Bank Debenture 2087’ with a rate of 8.5% and a maturity of 10 years worth Rs 4 billion has also been added to its pipeline.Outlook

The current bull-run in the secondary market has attracted thousands of new investors into the capital market. As per the latest data, there are almost three million Depositary Participant accounts while recent primary issues have seen more than 1.5 million participants. As per NEPSE, more than 327,000 investors have taken usernames and passwords to trade online. For instance, on February 7, 50,923 investors participated in trading activities out of which 80.6% transactions took place online. To cope with the increased participation; technical, policy and institutional infrastructures at NEPSE need to be improved in line with the objective of NEPSE to make secondary market trading services easy, secure, reliable and transparent. To ensure greater maturity in the market, necessary effective and timely reforms are a must.

Published Date: March 30, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take