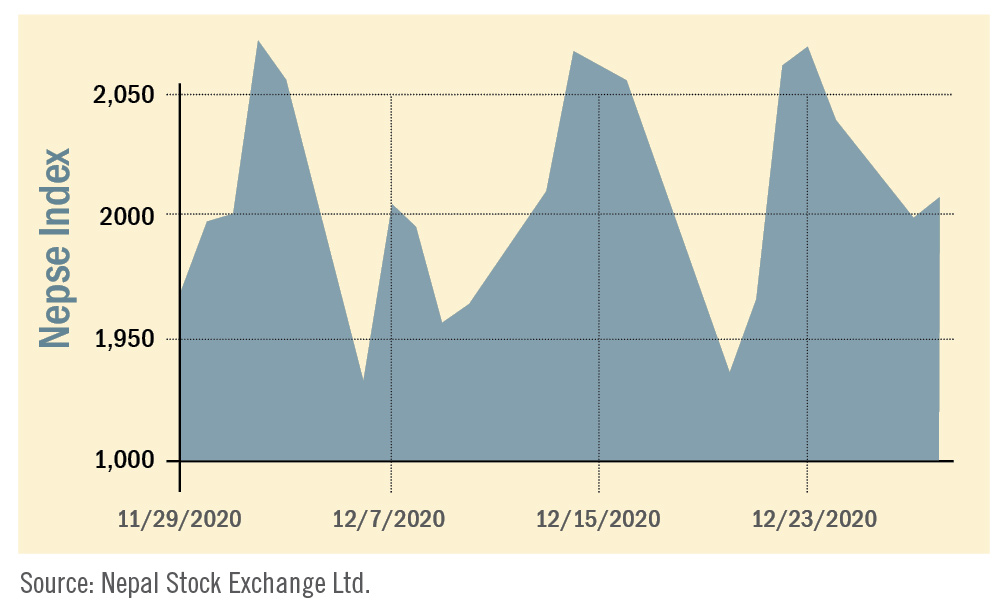

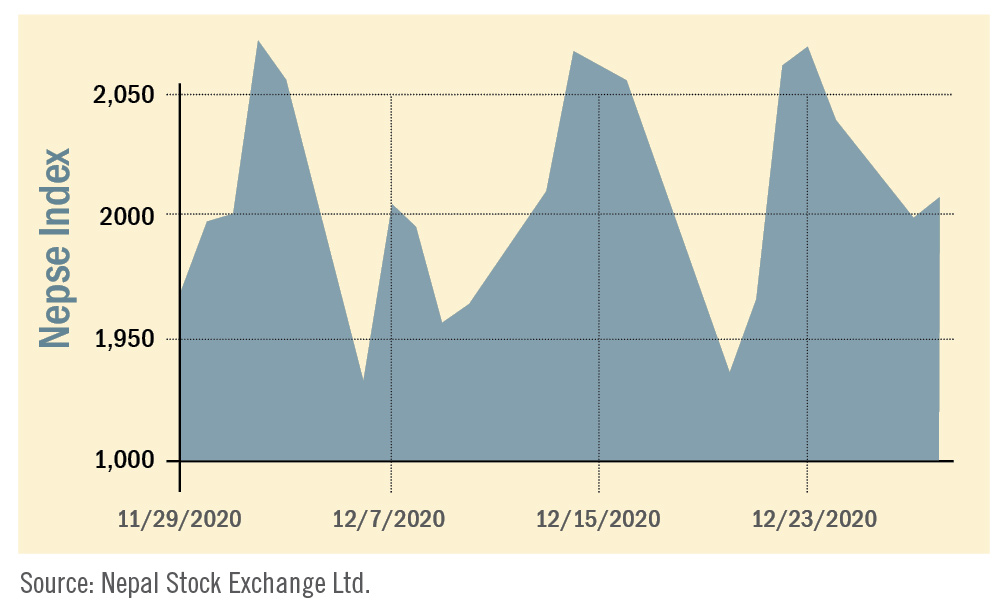

During the review period of November 29 to December 28, 2020, the Nepal Stock Exchange (NEPSE) index went up by a whopping 114.05 points (+6.02%) to close at 2,007.29 points. The market witnessed an all-time high of 2071.03 on December 2 however adverse political developments lead to the highest single day fall of 96.88 points on December 20 as investors reacted with panic selling. Contrary to expectations, the market has recovered from the biggest sell-off; nonetheless the market has slightly lost momentum as investor confidence has been disrupted and there seems to be a ‘wait and watch’ approach as signaled by the declining market volume in recent trading days. The total market volume during the period went up a whopping 99.35% and stood at Rs 142.322 billion.

During the review period, contrary to the previous period, five of the sub-indices landed in the green zone while the rest five landed in the red zone. In the green zone, Life Insurance sub-index (+20.47%) was the biggest gainer as share value of Nepal Life Insurance (+Rs 559), Life Insurance Company (+Rs 222) and National Life Insurance (+Rs 180) went up. Microfinance sub-index (+11.54%) was second in line with the increase in the share value of Suryodaya Microfinance (+Rs 350), Forward Community Microfinance (+Rs 342) and Global IME Microfinance (+Rs 260). Manufacturing and Processing sub-index (+11.24%) also followed suit with rise in the share value of Himalayan Distillery (+Rs 845) and Shivam Cement (+Rs 261). Likewise, Hydropower sub-index (+7.03%) surged as share value of Upper Tamakoshi Hydropower (+Rs 120) and Radhi Power Company (+Rs 130) went up. Lastly, Commercial Bank sub-index (+6.69%) continued to attract investors as share value of Nabil Bank (+Rs 249), NIC Asia Bank (+Rs 230) and Nepal Credit and Commerce Bank (+Rs 134) increased.

On the losing side, Hotels sub-index (-6.13%) faced the biggest drop as the share value of Oriental Hotels (-Rs 28) and Soaltee Hotel (-Rs 15) went down. Following this, Finance sub-index (-3.71%) saw a decrease in the share value of Pokhara Finance (-Rs 38), Multi-purpose Finance (-Rs 24) and Reliance Finance (-Rs 19). Similarly, Non-Life Insurance sub-index (-3.53%) also fell with decrease in the share value of Rastriya Beema Company (-Rs 2750) and Nepal Insurance (-Rs 44). Development Bank sub-index (-0.44%) also saw a downfall with the fall in the share value of Muktinath Bikas Bank (-Rs 58) and Shangrila Development Bank (-Rs 21). Likewise, Others sub-index (-0.25%) decreased marginally as share value of Nepal Telecom (-Rs 6) went down.

News and Highlights

The Securities Exchange Board of Nepal (SEBON) has revised the commission rate of stock brokers in line with government policies to boost the secondary market through attracting more numbers of investors. The commission rate has been revised by up to 60% attributing to increased transactions via online trading platforms (more than 85%) and a reduction in the operation costs of the brokerage companies. In the revised rate, brokerage companies are permitted to take 0.4% commission in transaction amount of up to Rs 50,000; 0.37% in transactions between Rs 50,000 to Rs 500,000; 0.34% in transactions between Rs 500,000 to Rs 2,000,000; 0.3% in transactions between Rs 2,000,000 to Rs 10,000,000; and 0.27% in transactions above Rs 10,000,000. SEBON also published a statement on November 30 urging investors to invest based on capital preservation in mind and not on rumors in the market. On the public issue front, during the review period SEBON has approved the issuance of Initial Public Offering (IPO) of Nepal Infrastructure Bank worth Rs 8 billion. NIBL Ace Capital has been appointed as its issue manager. The right shares of Citizen Investment Trust (1:0.8284) worth Rs 1.359 billion has also been approved. RBB Merchant Banking has been appointed as its issue manager. Likewise, SEBON has also approved issuance of debentures of Nepal Investment Bank Limited – ‘Nepal Investment Bank Bond 2084’ with a rate of 8.5% and a maturity of seven years worth Rs 1.600 billion. RBB Merchant Banking has been appointed as its issue manager. The debenture of NMB Bank – ‘NMB Debenture 8%- 2084/85’ has been added in the pipeline.

Outlook

In the previous review period, the market had crossed the highest point ever and had entered a new unchartered territory backed by strong volume and investor confidence. However, with the new political developments and looming uncertainty, investors have become more cautious as evident by the drop in daily trading volume in the recent daily market volume. Further, with revision in margin lending, slight increase in bank rates and second quarter ending approaching, investors are likely to be more watchful. Nonetheless, increasing participation of investors in both primary and secondary market via digital platforms indicates greater adaptation and development of the capital market. The market is likely to see some sideway trends in the coming days.

Published Date: January 18, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take