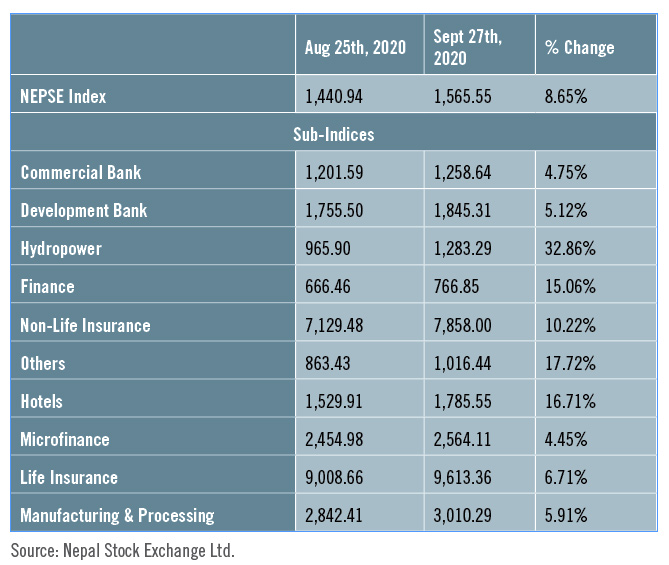

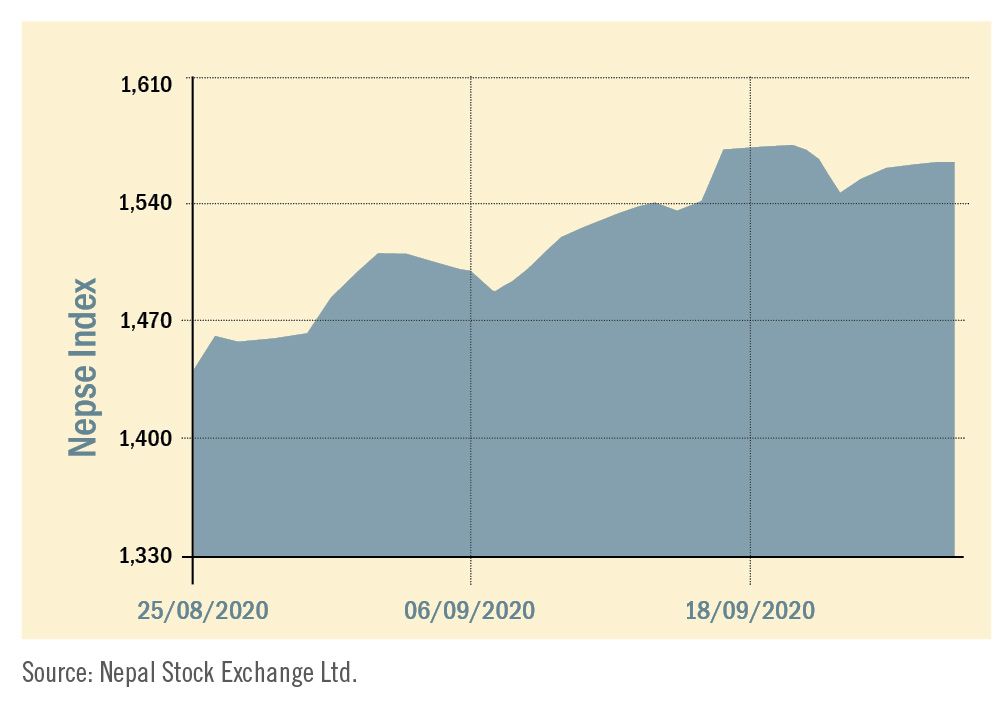

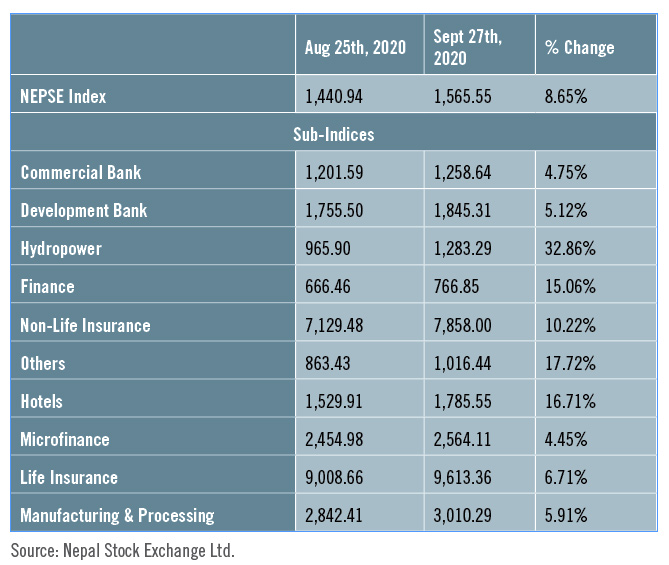

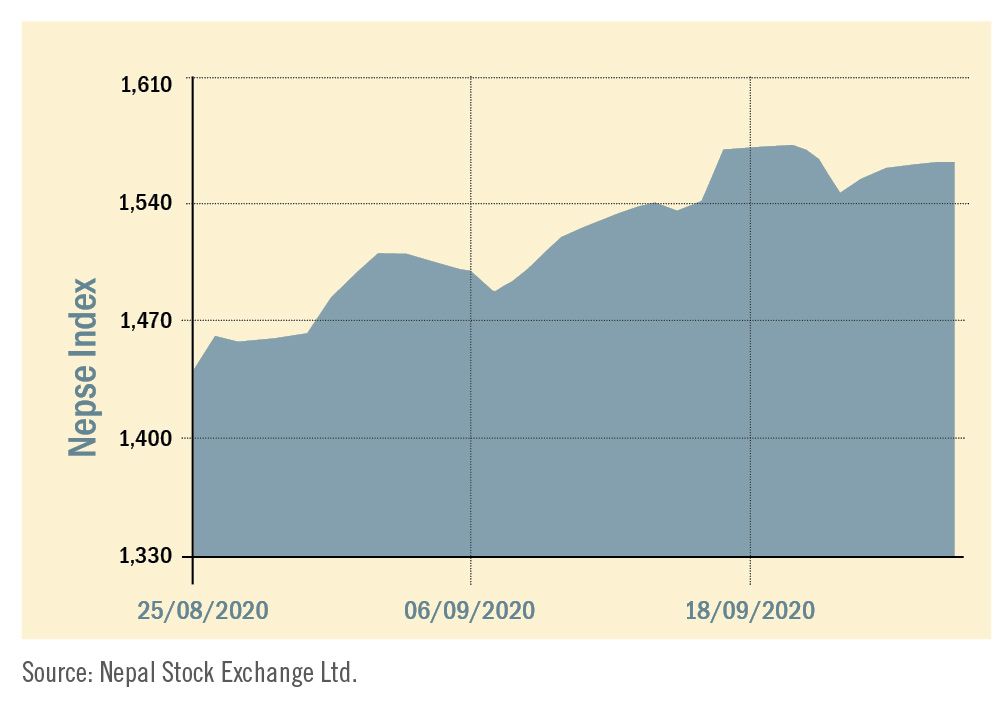

During the review period of August 25 to September 27, the Nepal Stock Exchange (NEPSE) index went up by a whopping 124.61 points (+8.65%) to close at 1,565.55 points. On September 3, the secondary market breached the psychological threshold of 1500 points after a period of six months. Also during the review period, the market crossed 1600 points briefly but couldn’t withstand the high selling pressure thus resulted in rapid market correction.

The market continued to witness an encouraging bullish trend largely on account of lower returns on bank deposits, easy accessibility of cheap margin loans and unfavorable investment climate in other sectors of the economy due to the current pandemic. The active participation of investors resulted in an astounding increment of market transactions; the total market turnover during the period rose by 92.74% and stood at Rs 58.63 billion.

During the review period, all sub-indices landed in the green zone. The Hydropowersub-index (+32.86%) was the biggest gainer as share value of Chilime Hydropower (+Rs 115), Arun Valley Hydropower (+Rs 97) and Synergy Power (+Rs 95) went up. Others sub-index (+17.72%) was second in line with ncrease in the share value of Citizen Investment Trust (+Rs 630) and Nepal Telecom (+Rs 38). Hotels sub-index (+16.71%) also followed suit with rise in the share value of Oriental Hotels (+Rs 41), Taragaon Regency (+Rs 41) and Soaltee Hotel (+Rs 31).

Likewise, Finance sub-index (+15.06%) was also on the gaining side with increase in the share value of United Finance (+Rs 58), Guheshwori Merchant Bank & Finance (+Rs 38) and Janaki Finance (+Rs 36). Non-life Insurance sub-index (+10.22%) went up with the rise in the share value of Rastriya Beema Company (+Rs 1795) and Neco Insurance (+Rs 87).

Similarly, Life Insurance sub-index (+6.71%) also increased with rise in the share value of Gurans Life Insurance (+Rs 102) and Surya Life Insurance (+Rs 97). Manufacturing & Processing sub-index (+5.91%) also saw a jump in the share value of Bottlers Nepal (+Rs 200) and Shivam Cements (+Rs 96). Likewise, the Development Bank sub-index (+5.12%) witnessed a surge in the share value of Corporate Development Bank (+Rs 35), Miteri Development Bank (+Rs 28) and Green Development Bank (+Rs 20). Commercial Bank sub-index (+4.75%) saw a rise in the share value of Nabil Bank (+Rs 44), Nepal Bank (+Rs 40) and Bank of Kathmandu (+Rs 33). Microfinance sub-index (+4.45%) was amongst the least to gain; the share value of Asha Microfinance (+Rs 112), Mero Microfinance (+Rs 94) and Chhimek Microfinance (+Rs 47) rose.

Likewise, Finance sub-index (+15.06%) was also on the gaining side with increase in the share value of United Finance (+Rs 58), Guheshwori Merchant Bank & Finance (+Rs 38) and Janaki Finance (+Rs 36). Non-life Insurance sub-index (+10.22%) went up with the rise in the share value of Rastriya Beema Company (+Rs 1795) and Neco Insurance (+Rs 87).

Similarly, Life Insurance sub-index (+6.71%) also increased with rise in the share value of Gurans Life Insurance (+Rs 102) and Surya Life Insurance (+Rs 97). Manufacturing & Processing sub-index (+5.91%) also saw a jump in the share value of Bottlers Nepal (+Rs 200) and Shivam Cements (+Rs 96). Likewise, the Development Bank sub-index (+5.12%) witnessed a surge in the share value of Corporate Development Bank (+Rs 35), Miteri Development Bank (+Rs 28) and Green Development Bank (+Rs 20). Commercial Bank sub-index (+4.75%) saw a rise in the share value of Nabil Bank (+Rs 44), Nepal Bank (+Rs 40) and Bank of Kathmandu (+Rs 33). Microfinance sub-index (+4.45%) was amongst the least to gain; the share value of Asha Microfinance (+Rs 112), Mero Microfinance (+Rs 94) and Chhimek Microfinance (+Rs 47) rose.

Likewise, Finance sub-index (+15.06%) was also on the gaining side with increase in the share value of United Finance (+Rs 58), Guheshwori Merchant Bank & Finance (+Rs 38) and Janaki Finance (+Rs 36). Non-life Insurance sub-index (+10.22%) went up with the rise in the share value of Rastriya Beema Company (+Rs 1795) and Neco Insurance (+Rs 87).

Similarly, Life Insurance sub-index (+6.71%) also increased with rise in the share value of Gurans Life Insurance (+Rs 102) and Surya Life Insurance (+Rs 97). Manufacturing & Processing sub-index (+5.91%) also saw a jump in the share value of Bottlers Nepal (+Rs 200) and Shivam Cements (+Rs 96). Likewise, the Development Bank sub-index (+5.12%) witnessed a surge in the share value of Corporate Development Bank (+Rs 35), Miteri Development Bank (+Rs 28) and Green Development Bank (+Rs 20). Commercial Bank sub-index (+4.75%) saw a rise in the share value of Nabil Bank (+Rs 44), Nepal Bank (+Rs 40) and Bank of Kathmandu (+Rs 33). Microfinance sub-index (+4.45%) was amongst the least to gain; the share value of Asha Microfinance (+Rs 112), Mero Microfinance (+Rs 94) and Chhimek Microfinance (+Rs 47) rose.

Likewise, Finance sub-index (+15.06%) was also on the gaining side with increase in the share value of United Finance (+Rs 58), Guheshwori Merchant Bank & Finance (+Rs 38) and Janaki Finance (+Rs 36). Non-life Insurance sub-index (+10.22%) went up with the rise in the share value of Rastriya Beema Company (+Rs 1795) and Neco Insurance (+Rs 87).

Similarly, Life Insurance sub-index (+6.71%) also increased with rise in the share value of Gurans Life Insurance (+Rs 102) and Surya Life Insurance (+Rs 97). Manufacturing & Processing sub-index (+5.91%) also saw a jump in the share value of Bottlers Nepal (+Rs 200) and Shivam Cements (+Rs 96). Likewise, the Development Bank sub-index (+5.12%) witnessed a surge in the share value of Corporate Development Bank (+Rs 35), Miteri Development Bank (+Rs 28) and Green Development Bank (+Rs 20). Commercial Bank sub-index (+4.75%) saw a rise in the share value of Nabil Bank (+Rs 44), Nepal Bank (+Rs 40) and Bank of Kathmandu (+Rs 33). Microfinance sub-index (+4.45%) was amongst the least to gain; the share value of Asha Microfinance (+Rs 112), Mero Microfinance (+Rs 94) and Chhimek Microfinance (+Rs 47) rose.

News and Highlights

NEPSE has approved an IT policy which makes the provision of information technology to help the online secondary market business become more effective. However, the Application Programming Interface (API) policy within the IT policy has not been approved yet owing to reasons like Nepal Securities Board’s instruction to make the API a different policy. The changes in API policy will help resolve some of the problems that investors currently face such as not being able to log in to NEPSE’s TMS and not seeing purchase or sale orders. On the public issue front, during the review period, the Initial Public Offering (IPO) of Sanima General Insurance worth Rs 300 million was approved by SEBON. NIC Asia Capital has been appointed as its issue manager. Likewise, the IPO of General Insurance Company worth Rs 300 million which has been offered to general public from September 27 has been over-subscribed on its first day. NIBL Ace Capital has been appointed as its issue manager.Outlook

The review period highlights the growing investor confidence which took momentum since the reopening of the market and some positive provisions supporting the market development. The current surge has been further aggravated by additional investments being poured into the equity market as interest rates on deposits by most BFIs are on a decreasing trend. If the market continues to depict this strength in volume and investor optimism, it is likely to continue an upward momentum in the days ahead. Nonetheless, as listed companies will gradually start announcing their dividends to its shareholders from the ast fiscal year earnings, the market movement is likely to be affected accordingly.

Published Date: October 14, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take