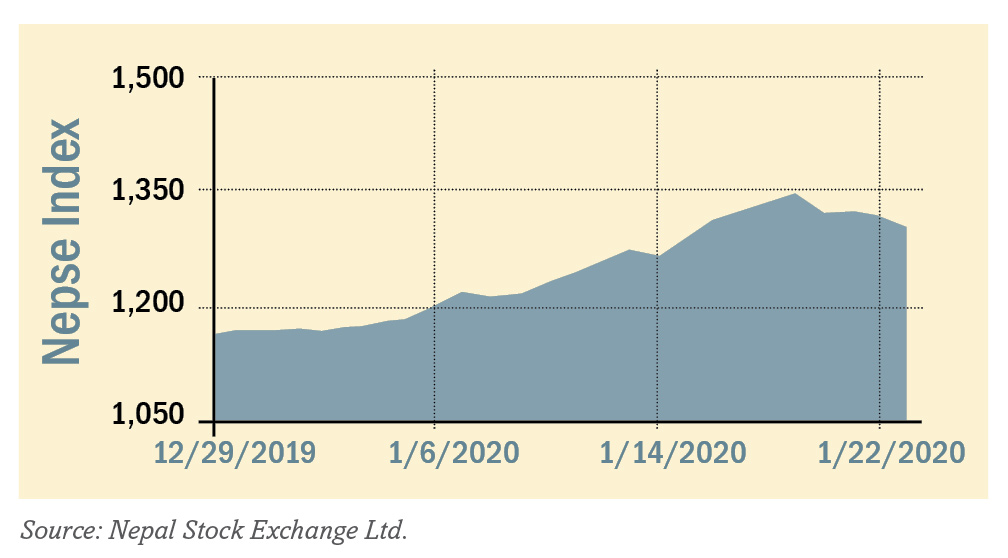

During the review period of December 26, 2019 to January 23, 2020, the Nepal Stock Exchange (NEPSE) index went up by 130.06 points (+11.14%) to close at 1297.47 points. The market went up to as high as 1343.66 points. The market also witnessed some corrections arising from excessive selling pressure for booking profits. Despite that, the overall sentiment in the secondary market has been upbeat and resulted in modest positive trading during the review period. The total market turnover during the period rose by 108.12% and stood at Rs 21.75 billion. On January 19, the market witnessed a record breaking daily turnover of Rs 2.09 billion.

During the review period, contrary to the previous phase, nine of the sub-indices landed in the green zone while one landed in the red zone. The Life Insurance sub-index (+27.43%) was the biggest gainer as share value of Guras Life Insurance (+Rs 225), Life Insurance Company (+Rs 153) and Prime Life Insurance (+Rs 151) went up. Microfinance sub-index (+24.10%) was second in line with the increase in the share value of Global IME Microfinance (+Rs 470), National Microfinance (+Rs 324) and Laxmi Microfinance (+Rs 318).

Non-Life Insurance sub-index (+20.08%) followed suit with the rise in the share value of Rastriya Beema Company (+Rs 850) and Prudential Insurance (+Rs 220). Similarly, Finance sub-index (+15.46%) was also on the gaining side with rise in the share value of United Finance (+Rs 60) and Pokhara Finance (+Rs 30). Hotels sub-index (+10.86%) also faced an increase in the share value of Oriental Hotels (+Rs 70) and Taragon Regency (+Rs 42). Following this, Development Bank sub-index (+10.04%) saw a jump in the share value of Muktinath Bikas Bank (+Rs 43) and Miteri Development (+Rs 35). Likewise, Commercial bank sub-index (+9.25%) also went up with rise in the share value of Everest Bank (+Rs 85) and Standard Chartered Bank (+Rs 75). Hydropower sub-index (+7.44%) also saw a surge with the increase in the share value of Chilime Hydropower (+Rs 59) and Sanima Mai (+Rs 33). Manufacturing & Processing (+6.55%) also saw a significant rise in the share value of Himalayan Distillery (+Rs 64) and Shivam Cements (+Rs 45). On the losing streak, the Others sub-index (-1.98%) witnessed a fall in the share value of Citizen Investment Trust (-Rs 208).

News and Highlights

Bhisma Raj Dhungana has been appointed the new Chairperson of Securities Board of Nepal (SEBON), the apex regulatory body of capital markets in Nepal. Earlier he was with Nepal Rastra Bank as Executive Director. He will serve as the Chairperson of SEBON for the next four years.

On the public issue front, SEBON has added the proposed Initial Public Offering (IPO) of two hydropower companies to its pipeline. Madhya Bhotekoshi Hydropower is worth Rs 1.5 billion, with Global IME Capital as its issue manager. Similarly, Bindhabasini Hydropower is worth Rs 250 million with Sanima Capital as its issue manager. The proposed IPO of NIC Asia Laghubitta worth Rs 475 million has also been added to its pipeline. This issue is considered to be the largest IPO from the Microfinance sector in the Nepali market. Sanima Capital has been appointed as its issue manager and CARE Ratings Nepal has assigned “CARE-NP IPO Grade 4+” to the issue.

On the right issue front, SEBON approved the right issue of NLG Insurance and Prudential Insurance worth Rs 384.2 million and Rs 384.9 million respectively. Similarly, SEBON has also given its approval to float the debentures of Agricultural Development Bank (ADB) under ‘10.35% ADBL Rinpatra 2083’ worth Rs 2.50 billion with 10.35% interest rate and a maturity period of seven years.

Outlook

Investor confidence continued during the review period which took momentum from early December last year. Signs of ease in liquidity in the banking system along with attractive underpriced securities triggered buying in the secondary market. Nonetheless the market is likely to see some correction as investors tend to book short-term profits. However, if the market continues to maintain this mark with noteworthy volume and investor optimism, the market might continue its current upward momentum in the days ahead.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.