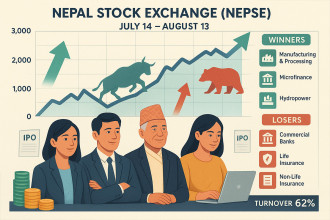

The Nepal Stock Exchange (NEPSE) benchmark index dropped marginally by 6 points (-0.37%) to close at 1,629.75 points during the review period (20th July to 17th August, 2017).The market started with a brief uptrend however, the trend couldn’t sustain as supply pressure mounted in the market amidst listing of bonus and rights shares of Banks and Financial Institutions (BFIs) scrip’s. Nonetheless, on a positive note-trading volume increased by 31% with total volume during the review period amounting to NPR 17.23 billion, indicating fresh buying of stocks.

During the review period, majority of the sub-indices landed in the green zone while the key sub-index; Commercial Bank and Hydropower sub-index closed on a negative note.

The Finance sub-index (+10.41%) led the pack of gainers with the increase in share value of Progressive Finance (+ NPR 36), United Finance (+ NPR 16) and Pokhara Finance (+ NPR 9). This was followed by the Manufacturing and Processing sub-index (+ 8.40%) with increase in share value of Unilever Nepal (+ NPR 950), Bottlers Nepal-Terai (+ NPR 565) and Himalayan Distillery (+ NPR 498). Likewise, the Hotels sub-index (+6.89%) followed suit as share price of Oriental Hotels (+ NPR 209) and Taragaon Regency Hotel (+ NPR 12) went up. Similarly, the Insurance sub-index (+ 2.77%) increased as share value of Rastriya Beema Company (+ NPR 3,750), Sagarmatha Insurance (+ NPR 175) and NB Insurance (+ NPR 126) surged. Also, the Others sub-index (+2.53%) went up as the share value of Nepal Telecom (+ NPR 29) appreciated. The Development Bank sub-index (+1.93%) managed to remain on gaining side as share values of Mirmire Microfinance (+ NPR 870), Janautthan Samudayic Microfinance (+ NPR 530), Summit Microfinance (+ NPR 476) and Kalika Microfinance (+ NPR 474) increased.

Nonetheless, the Hydropower sub-index (-3.96%) went down with the decrease in share values of Sanima Mai Hydropower (- NPR 523), Arun Kabeli Hydropower (- NPR 49) and Chilime hydropower (- NPR 35). Similarly, the Commercial Bank sub-index (-3.11%) toppled as share value of Standard Chartered Bank (- NPR 81), Nepal Bangladesh Bank (+ NPR 51), Siddhartha Bank (- NPR 41) and Laxmi Bank (- NPR 40) declined.

News Highlights

With view of maintaining good governance in the capital market, Securities Board of Nepal (SEBON) has implemented ’Nepal Securities Board Members Code of Conduct, 2074’that has directed its employees and Board of Directors (BOD) not to invest in shares of listed stocks and trade in secondary market. Likewise, SEBON’s board members can no longer join the board of any brokerage company, or any company either listed or is in the process of being listed in the secondary market. Further, board members are also barred from working as full-time employees of the afore mentioned organisations. Similarly, any decisions and discussions made while performing duties by board members should not be disclosed to any individuals or media.

On the public issue front, the market witnessed both Initial Public offering (IPO) and Further Public offering (FPO) during the review period. Nepal Hydro Power issued IPO of 390,000 units at NPR 100 per share. The current paid up capital of the company stands at NPR 221 million. After the IPO, the paid up capital will reach NPR 260 million. The credit rating agency, ICRA Nepal, has assigned grade 4 rating to this issue, indicating below average fundamentals,

The Finance sub-index (+10.41%) led the pack of gainers with the increase in share value of Progressive Finance (+ NPR 36), United Finance (+ NPR 16) and Pokhara Finance (+ NPR 9). This was followed by the Manufacturing and Processing sub-index (+ 8.40%) with increase in share value of Unilever Nepal (+ NPR 950), Bottlers Nepal-Terai (+ NPR 565) and Himalayan Distillery (+ NPR 498). Likewise, the Hotels sub-index (+6.89%) followed suit as share price of Oriental Hotels (+ NPR 209) and Taragaon Regency Hotel (+ NPR 12) went up. Similarly, the Insurance sub-index (+ 2.77%) increased as share value of Rastriya Beema Company (+ NPR 3,750), Sagarmatha Insurance (+ NPR 175) and NB Insurance (+ NPR 126) surged. Also, the Others sub-index (+2.53%) went up as the share value of Nepal Telecom (+ NPR 29) appreciated. The Development Bank sub-index (+1.93%) managed to remain on gaining side as share values of Mirmire Microfinance (+ NPR 870), Janautthan Samudayic Microfinance (+ NPR 530), Summit Microfinance (+ NPR 476) and Kalika Microfinance (+ NPR 474) increased.

Nonetheless, the Hydropower sub-index (-3.96%) went down with the decrease in share values of Sanima Mai Hydropower (- NPR 523), Arun Kabeli Hydropower (- NPR 49) and Chilime hydropower (- NPR 35). Similarly, the Commercial Bank sub-index (-3.11%) toppled as share value of Standard Chartered Bank (- NPR 81), Nepal Bangladesh Bank (+ NPR 51), Siddhartha Bank (- NPR 41) and Laxmi Bank (- NPR 40) declined.

News Highlights

With view of maintaining good governance in the capital market, Securities Board of Nepal (SEBON) has implemented ’Nepal Securities Board Members Code of Conduct, 2074’that has directed its employees and Board of Directors (BOD) not to invest in shares of listed stocks and trade in secondary market. Likewise, SEBON’s board members can no longer join the board of any brokerage company, or any company either listed or is in the process of being listed in the secondary market. Further, board members are also barred from working as full-time employees of the afore mentioned organisations. Similarly, any decisions and discussions made while performing duties by board members should not be disclosed to any individuals or media.

On the public issue front, the market witnessed both Initial Public offering (IPO) and Further Public offering (FPO) during the review period. Nepal Hydro Power issued IPO of 390,000 units at NPR 100 per share. The current paid up capital of the company stands at NPR 221 million. After the IPO, the paid up capital will reach NPR 260 million. The credit rating agency, ICRA Nepal, has assigned grade 4 rating to this issue, indicating below average fundamentals,

Similarly, Pokhara Finance has issued FPO of 983,682 units shares worth NPR 216.4 million at NPR 220 per unit to maintain its promoter - public share structure at 51:49.After the FPO, its paid up capital will reach NPR 655.7 million and the reserve of the company will grow by NPR 118 million. ICRA Nepal has assigned grade 4 rating to this issue, indicating below average fundamentals.

Outlook

Despite impressive fourth quarterly financials published by listed companies and announcement of capital plan by listed insurance companies to increase their paid-up capital, the market has not shown adequate confidence. The market is currently tracking sideways without a clear trend during this period. With the festive season around the corner, selling pressure may mount in the market as indicated by historical trends, however as listed companies start to announce dividends the market is likely to gain momentum again.

Disclaimer

This is an analysis from beed invest ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Similarly, Pokhara Finance has issued FPO of 983,682 units shares worth NPR 216.4 million at NPR 220 per unit to maintain its promoter - public share structure at 51:49.After the FPO, its paid up capital will reach NPR 655.7 million and the reserve of the company will grow by NPR 118 million. ICRA Nepal has assigned grade 4 rating to this issue, indicating below average fundamentals.

Outlook

Despite impressive fourth quarterly financials published by listed companies and announcement of capital plan by listed insurance companies to increase their paid-up capital, the market has not shown adequate confidence. The market is currently tracking sideways without a clear trend during this period. With the festive season around the corner, selling pressure may mount in the market as indicated by historical trends, however as listed companies start to announce dividends the market is likely to gain momentum again.

Disclaimer

This is an analysis from beed invest ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

The Finance sub-index (+10.41%) led the pack of gainers with the increase in share value of Progressive Finance (+ NPR 36), United Finance (+ NPR 16) and Pokhara Finance (+ NPR 9). This was followed by the Manufacturing and Processing sub-index (+ 8.40%) with increase in share value of Unilever Nepal (+ NPR 950), Bottlers Nepal-Terai (+ NPR 565) and Himalayan Distillery (+ NPR 498). Likewise, the Hotels sub-index (+6.89%) followed suit as share price of Oriental Hotels (+ NPR 209) and Taragaon Regency Hotel (+ NPR 12) went up. Similarly, the Insurance sub-index (+ 2.77%) increased as share value of Rastriya Beema Company (+ NPR 3,750), Sagarmatha Insurance (+ NPR 175) and NB Insurance (+ NPR 126) surged. Also, the Others sub-index (+2.53%) went up as the share value of Nepal Telecom (+ NPR 29) appreciated. The Development Bank sub-index (+1.93%) managed to remain on gaining side as share values of Mirmire Microfinance (+ NPR 870), Janautthan Samudayic Microfinance (+ NPR 530), Summit Microfinance (+ NPR 476) and Kalika Microfinance (+ NPR 474) increased.

Nonetheless, the Hydropower sub-index (-3.96%) went down with the decrease in share values of Sanima Mai Hydropower (- NPR 523), Arun Kabeli Hydropower (- NPR 49) and Chilime hydropower (- NPR 35). Similarly, the Commercial Bank sub-index (-3.11%) toppled as share value of Standard Chartered Bank (- NPR 81), Nepal Bangladesh Bank (+ NPR 51), Siddhartha Bank (- NPR 41) and Laxmi Bank (- NPR 40) declined.

News Highlights

With view of maintaining good governance in the capital market, Securities Board of Nepal (SEBON) has implemented ’Nepal Securities Board Members Code of Conduct, 2074’that has directed its employees and Board of Directors (BOD) not to invest in shares of listed stocks and trade in secondary market. Likewise, SEBON’s board members can no longer join the board of any brokerage company, or any company either listed or is in the process of being listed in the secondary market. Further, board members are also barred from working as full-time employees of the afore mentioned organisations. Similarly, any decisions and discussions made while performing duties by board members should not be disclosed to any individuals or media.

On the public issue front, the market witnessed both Initial Public offering (IPO) and Further Public offering (FPO) during the review period. Nepal Hydro Power issued IPO of 390,000 units at NPR 100 per share. The current paid up capital of the company stands at NPR 221 million. After the IPO, the paid up capital will reach NPR 260 million. The credit rating agency, ICRA Nepal, has assigned grade 4 rating to this issue, indicating below average fundamentals,

The Finance sub-index (+10.41%) led the pack of gainers with the increase in share value of Progressive Finance (+ NPR 36), United Finance (+ NPR 16) and Pokhara Finance (+ NPR 9). This was followed by the Manufacturing and Processing sub-index (+ 8.40%) with increase in share value of Unilever Nepal (+ NPR 950), Bottlers Nepal-Terai (+ NPR 565) and Himalayan Distillery (+ NPR 498). Likewise, the Hotels sub-index (+6.89%) followed suit as share price of Oriental Hotels (+ NPR 209) and Taragaon Regency Hotel (+ NPR 12) went up. Similarly, the Insurance sub-index (+ 2.77%) increased as share value of Rastriya Beema Company (+ NPR 3,750), Sagarmatha Insurance (+ NPR 175) and NB Insurance (+ NPR 126) surged. Also, the Others sub-index (+2.53%) went up as the share value of Nepal Telecom (+ NPR 29) appreciated. The Development Bank sub-index (+1.93%) managed to remain on gaining side as share values of Mirmire Microfinance (+ NPR 870), Janautthan Samudayic Microfinance (+ NPR 530), Summit Microfinance (+ NPR 476) and Kalika Microfinance (+ NPR 474) increased.

Nonetheless, the Hydropower sub-index (-3.96%) went down with the decrease in share values of Sanima Mai Hydropower (- NPR 523), Arun Kabeli Hydropower (- NPR 49) and Chilime hydropower (- NPR 35). Similarly, the Commercial Bank sub-index (-3.11%) toppled as share value of Standard Chartered Bank (- NPR 81), Nepal Bangladesh Bank (+ NPR 51), Siddhartha Bank (- NPR 41) and Laxmi Bank (- NPR 40) declined.

News Highlights

With view of maintaining good governance in the capital market, Securities Board of Nepal (SEBON) has implemented ’Nepal Securities Board Members Code of Conduct, 2074’that has directed its employees and Board of Directors (BOD) not to invest in shares of listed stocks and trade in secondary market. Likewise, SEBON’s board members can no longer join the board of any brokerage company, or any company either listed or is in the process of being listed in the secondary market. Further, board members are also barred from working as full-time employees of the afore mentioned organisations. Similarly, any decisions and discussions made while performing duties by board members should not be disclosed to any individuals or media.

On the public issue front, the market witnessed both Initial Public offering (IPO) and Further Public offering (FPO) during the review period. Nepal Hydro Power issued IPO of 390,000 units at NPR 100 per share. The current paid up capital of the company stands at NPR 221 million. After the IPO, the paid up capital will reach NPR 260 million. The credit rating agency, ICRA Nepal, has assigned grade 4 rating to this issue, indicating below average fundamentals,

Similarly, Pokhara Finance has issued FPO of 983,682 units shares worth NPR 216.4 million at NPR 220 per unit to maintain its promoter - public share structure at 51:49.After the FPO, its paid up capital will reach NPR 655.7 million and the reserve of the company will grow by NPR 118 million. ICRA Nepal has assigned grade 4 rating to this issue, indicating below average fundamentals.

Outlook

Despite impressive fourth quarterly financials published by listed companies and announcement of capital plan by listed insurance companies to increase their paid-up capital, the market has not shown adequate confidence. The market is currently tracking sideways without a clear trend during this period. With the festive season around the corner, selling pressure may mount in the market as indicated by historical trends, however as listed companies start to announce dividends the market is likely to gain momentum again.

Disclaimer

This is an analysis from beed invest ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Similarly, Pokhara Finance has issued FPO of 983,682 units shares worth NPR 216.4 million at NPR 220 per unit to maintain its promoter - public share structure at 51:49.After the FPO, its paid up capital will reach NPR 655.7 million and the reserve of the company will grow by NPR 118 million. ICRA Nepal has assigned grade 4 rating to this issue, indicating below average fundamentals.

Outlook

Despite impressive fourth quarterly financials published by listed companies and announcement of capital plan by listed insurance companies to increase their paid-up capital, the market has not shown adequate confidence. The market is currently tracking sideways without a clear trend during this period. With the festive season around the corner, selling pressure may mount in the market as indicated by historical trends, however as listed companies start to announce dividends the market is likely to gain momentum again.

Disclaimer

This is an analysis from beed invest ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

Published Date: September 22, 2017, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take