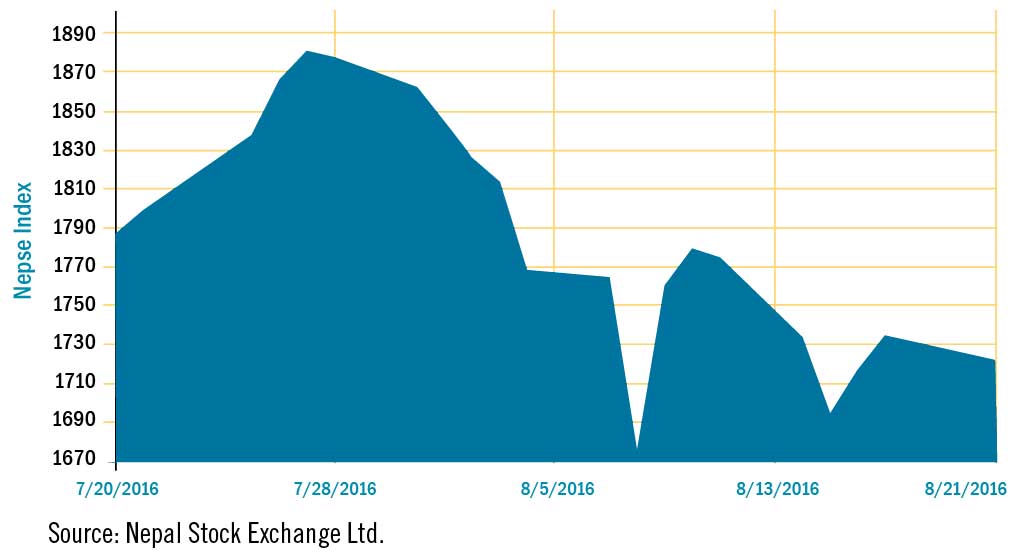

The Nepal Stock Exchange (NEPSE) index failed to sustain its upward momentum as it lost a staggering 64.41 points (-3.60%) and closed at 1,722.43 points during the review period (July 21st to August 21st). The secondary market witnessed a turbulent month with the index hovering at all-time high of 1,881.45 points on 27th July and then plunging to 1,675.91 on 8th August i.e. a drop of 10.92% in just a span of 12 days. The free-fall could be attributed primarily to the information floating in the market regarding the plan of Securities Board of Nepal (SEBON) to probe illicit funding into capital market and the recent change in the government. Moreover, the current trend can be considered as a correction in the market as the market had been in a bullish run since past several months.

During the review month, apart from the Development Bank and the Hotel sub-index, all other sub-indices landed in the red zone.

Amongst the pack of losers, the Manufacturing and Processing sub-index (-11.54%) led the group as share price of Bottlers Nepal (Terai) Limited (-NPR 3,682) plummeted; this sub-index was the highest gainer during the previous review period. Likewise, the Insurance sub-index (-8.10%) followed suit as share value of almost all the insurance companies such as Shikhar Insurance (- NPR 525) and National Life Insurance (- NPR 280) and Prime Life Insurance (-NPR 220) went down. Similarly, the Hydropower sub-index (- 7.56%) saw a downfall as it could not sustain its gains as share prices of Api Power (- NPR 180), Chilime Hydropower (- NPR 114) and Sanima Mai Hydro (- NPR 78) descended.

Furthermore, the Others sub-index (-4.87%) shed value as share price of Nepal Telecom (- NPR 4) declined. Likewise, the Commercial Bank sub-index (- 4.17%) slumped owing to the fall in the share prices of all key commercial banks such as Standard Chartered (- NPR 338), Everest Bank (- NPR 210), Nabil Bank (- NPR 135) and Nepal Investment Bank (- NPR 113). Also, the Finance sub-index (- 2.32%) went down with the decline in share price of Sagarmatha Finance (- NPR 24) and Manjushree Financial Institute (- NPR 16).

Nonetheless, the Hotel sub-index (+8.16%) and the Development Bank sub-index (+1.44%) continued with their upward momentum. The gain of the Hotel sub-index was due to the hike in share prices of Soaltee Hotel (+ NPR 33) and Taragaon Regency Hotel (+ NPR 30), while the Development Bank retained its growth due to surge in share prices of NMB Microfinance (+ NPR 398), NagBeli Laghubitta (+ NPR 390), Miteri Development Bank (+ NPR 134) and Tourism Development Bank (+ NPR 93).

News and Highlights

With the view to regulate the pricing offered by the listed companies for public issue, SEBON has come up with new pricing regulation for both Initial Public Offering (IPO) and Further Public Offering (FPO). For IPO pricing, SEBON has sought approval of the Ministry of Finance (MoF) to allow companies to float their primary shares on free-pricing model. This would allow companies to issue their primary shares at more than NPR 100 per share subject to some cap on such pricing by SEBON. Such pricing model would encourage more real sector companies to be listed on NEPSE. On the other hand, to control the trend of high premium in FPOs, SEBON has announced new standards for determining share price of FPO where average price of four specified criteria, i.e. Capitalized Earning, Net worth per Share / Book Value per share, 180 Days Average of Closing Market Price and Discounted Cash Flow (DCF), has to be considered. All the upcoming FPOs that are to be issued in premium have to calculate share price accordingly.

In order to expedite the process of dematerialization of shares, SEBON has directed depository participants and share registrars to open beneficiary accounts within three days and provide debit instruction slips. The depository participants are also directed to submit documents provided by the beneficiaries for dematerialisation of share certificates to the share registrars within seven days. The share registrars should then dematerialise the share certificates within three days after checking the documents. Similarly, the registrars should also ensure that bonus and right shares of investors are deposited in the beneficiary’s account within three days from listing of those shares.

On the IPO font, National Microfinance Bittya Sanstha issued IPO worth NPR 30 million from July 31st to August 3rd 2016, which was oversubscribed by more than 400 times, with the total collection of NPR 11.30 billion. The paid-up capital of national level microfinance will reach NPR 100 million after the IPO allotment. Similarly, RSDC Laghubitta Bitiya Sanstha (RSDC) floated its primary share worth NPR 40 million from 21st to 28th of August 2016. RSDC is a wholesale microfinance lender licensed by Nepal Rastra Bank (NRB) headquartered in Rupandehi. It has been assigned “IPO Grade 4” indicating below-average fundamentals by the credit rating company - ICRA Nepal.

Outlook

Investors need to exercise restrain as the market is in a correction mode; the index has already gone down by 8% since it reached its highest peak at 1,881.45 points. The current trend is an outcome of profit booking and dwindling investors’ confidence against the backdrop of impressive profit growth reporting by the listed companies. Though the market may showcase more volatility in the short run, demand for the Bank and Financial Institutions (BFI’s) scrips is likely to go up in anticipation of impressive stock dividends as BFIs have posted good growth in the fiscal year 2015/16. The capital requirement as stipulated by the central bank has to be met by BFIs by the end of the current fiscal year 2016/17.