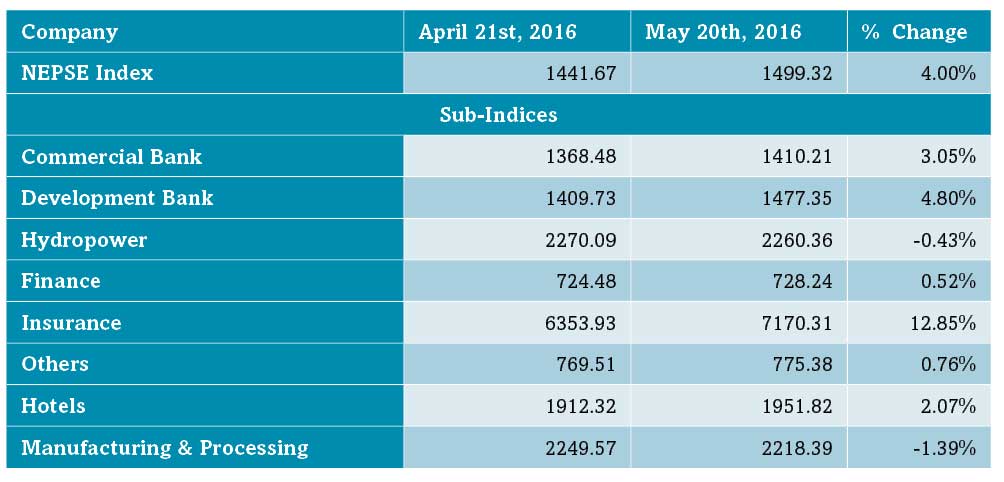

Nepal Stock Exchange (NEPSE) continued its record-setting spree with a fresh peak of 1507 points on 19 May and closing at 1499.32 points during the review period (22 April to 20 May). While the economy is struggling to recover from last year’s devastating earthquake and economic blockade as the Gross Domestic Product (GDP) is projected to grow by mere 0.77% during the current FY 2015-16, which is lowest in the past 14 years, whereas the stock market has already surged by over 50% since the beginning of the current fiscal year. The reversal pattern seen in our stock markets against the weak economic indicators suggests that our stock market being highly unrepresentative of the structure of our economy and immature. Our stock market has low representation from the real sector as almost 84% of listed companies are from the financial sector.The Insurance sub-index (+12.85%) led the pack of gainers primarily due to increase in share value of majority of the insurance companies. The top five gainers are NLG Insurance (+NPR 364), National Life Insurance (+NPR 300), Shikhar Insurance (+NPR 256), Siddhartha Insurance (+NPR 251) and Neco Insurance (+NPR 234). The Development bank sub-index (+4.80%) followed suit as share value of First Micro Finance (+NPR 233), Naya Nepal Laghubita Bikash (+NPR 229), Swabalamban Bikas Bank (+ NPR 220) and Kalika Microcredit Development (+ NPR 212).

Likewise, Commercial Banks sub-index (+3.05%) rose with appreciation in share value of Himalayan Bank (+NPR 115), Nepal Bangladesh Bank (+NPR 108), Nepal Bank (+NPR 57) and Laxmi Bank (+ NPR 54). Similarly, the Hotel sub-index (+2.07%) appreciated as share value of Soaltee Hotel (+ NPR 7) went up. Also, the Others sub-index (+0.76%) rose marginally with increase in share value of Nepal Telecom (+NPR 5). The Finance sub-index (+0.52%) rose with appreciation in share prices of Hama Merchant & Finance (+NPR 126) and Sagarmatha Finance (+NPR 26). Nonetheless, the Manufacturing & Processing and the Hydropower sub-index has landed in red zone. The Manufacturing and Processing sub-index (-1.39%) plummeted as share price of Uniliver Nepal (-NPR 601) went down. The Hydropower sub-index (-0.43%) continued with its losing streak as share prices of Chilime Hydropower (-NPR 35) and National Hydro Power (- NPR 14) declined.

News and Highlights

In order to meet the capital increment of Bank and Financial institutions (BFIs) as stipulated by Nepal Rastra Bank, BFIs are coming with the announcement of right share issue after approving in the Annual General Meeting (AGM). Moreover, the Securities Board of Nepal (SEBON) has relaxed the mandatory credit rating for BFIs for the right issuance subject to few conditions. As per the directive, BFIs which are in operation for the last five years and in profit for last three consecutive years can issue rights shares without credit rating. However, the net worth of the BFIs should be more than NPR 100 and the non-performing loan should be below the regulatory requirement. Some of the upcoming right shares are as follows; Nepal Bank is distributing the right share in the ratio 10:2.3 after approving in its 56th AGM. The bank‘s current paid up capital is NPR 6.46 billion. Sanima Bank has decided to issue 50% right share after issuance of 20% bonus shares as approved in its 11th AGM. The current paid-up capital of Sanima Bank is NPR 3.06 billion and after the issuance of bonus share and right share it‘s paid up capital will reach NPR 5.50 billion. Similarly, NIC Asia and Citizen Bank International are also issuing 25% and 55% right shares respectively. The current paid-up capital of NIC Asia and Citizen Bank International is NPR 3.79 billion and NPR 3.06 billion respectively. In the IPO front, Arun Kabeli Power Ltd. is issuing Initial Public Offer (IPO) worth NPR 150 million for resident of project affected area in Panchthar and Taplejung from May 16 to May 30, 2016. This will be followed by IPO issue worth NPR 300 million to the general public. Likewise, Khanikhola Hydro Power company is floating IPO worth NPR 0.46 million for the locals of Lalitpur from November 24 to December 8, 2016. After this IPO for the locals, the company will float share worth NPR 93 million to the general public. ICRA Nepal has assigned "IPO Grade 4+†indicating below average fundamentals to the both IPOs. Green Development Bank is also proposing to issue IPO worth NPR 45 million of shares by June (date not yet announced). The bank has share capital of NPR 55 million which will be NPR 100 million after the IPO allotment. The development bank has also been assigned "IPO Grade 4+†indicating below average fundamentals by ICRA Nepal.

Outlook

The total market turnover during the review period was approximately NPR 17 billion substantiating the current growth. Even though the index showed some fluctuation for a brief period on news about possible change in the government the market quickly rebounded after positive political developments. Investors seem to be in a wait and see situation as the fiscal policy for the fiscal year 2016/17 is to be announced shortly. Speculations on new policies are common phenomena in stock market hence investors are advised to invest wisely.

Published Date: June 17, 2016, 12:00 am

Post Comment

E-Magazine

Click Here To Read Full Issue

RELATED Beed Take