The king of industrial metals was trading in the range market from 2017 till 2019. The global economy was moving forward and so was copper, digesting any market forces and reflecting the state of affairs as it were. Copper is efficient when used as a conductor of heat and electricity and is consumed for building material as a constituent of various metal alloys. During this period, copper had dethroned its counterpart gold as the most sought after industrial metal.

However, with the emergence of the pandemic in the first quarter of 2020, copper prices indicated the change in the global economic landscape. Having commenced at $2.7932 per pound, the prices plunged by 30% to reach $1.9628 per pound in March at the height of the pandemic in China. The level was the lowest since February 2016. However, prices have since recovered in the following three months from April to June rising to $2.6588 per pound at the time of this article.

Although the march to recovery is well on, it will require ample hawkish news from major economies. While Coronavirus has dominated the headlines, the disease is not the only risk factor. The US is still at trade war with China. The difficult times may have eased the tensions between the two powerhouses but the arguments have rekindled in the recent days.

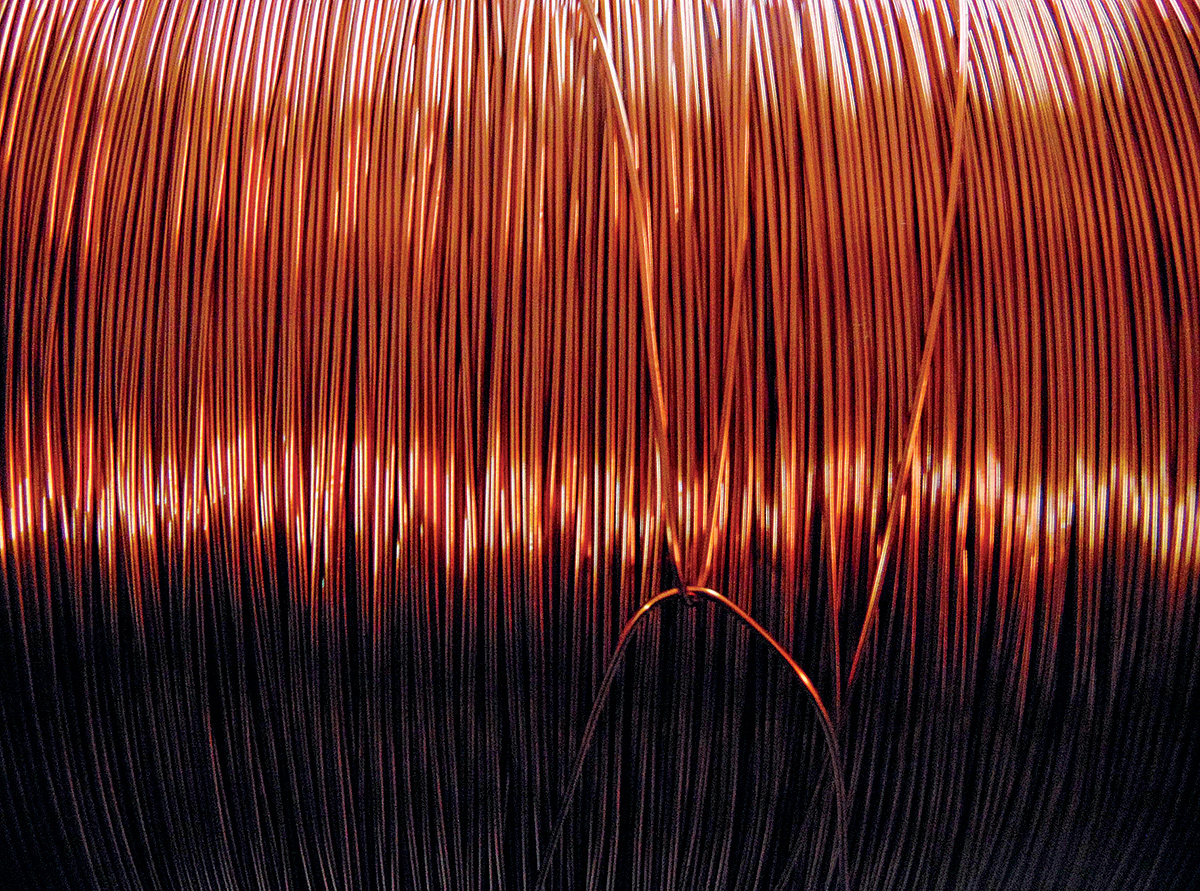

An Indispensable Commodity

The status of the manufacturing industry will impact the demand for the metal. Copper is vital to technology. It is the designated key economic reader since it moves the market based on its demand in multiple applications and uses. However, copper as an investment commodity does have its limitations. Traders do not turn to it in times of uncertainty and conundrum like they do to gold and silver. When the global economy is observing a downturn in the form of recession or slowdown, the demand for the industrial metal also decreases due to lowered consumption.Domination of China

China is the world’s major player in the global copper industry holding a major presence within the global copper supply link. Being the largest consumer and also one of the largest producers, China’s impact on the metal cannot be undermined. Given the resurgent nature of the global economy before slow down due to COVID 19, all driving factors showed that copper prices were on the verge of breaking the resistance level of $3 per pound, a breakthrough not observed since June 2018. The industrial production figures for China in 2019 were constantly higher than the numbers in 2018. But the beginning of 2020 showed a different picture. The months of January and February reported a combined -13.5% vis-à-vis 2019. The assessments coincided with the arrival of the pandemic.Boom in Asian Trading Activity

With the slump in prices of copper, the participation of traders and resulting trading activities during the Asian time zone has fast-tracked. According to CME Group, trading during Asia time zone, demarcated at 8 am to 8 pm in Singapore, inclined 4% in comparison to the same period in 2019. Additionally, the figures also accounted for 34% of the total average monthly copper futures traded in the first quarter of 2020. This significant trend has continued through April and May, with 35% of the volume in transactions. The Asian economy has climbed the ladder and become the supreme leader in the consumption of copper accounting for 70% of the global refined copper usage in 2018 as per International Copper Study Group (ICSG). In a comparative study with the statistics of 1960, the Asian markets have come a long way and leapfrogged all others in a surprising revelation. In 1960, the leader in the race was the European market with 57% and the Asian market was languishing behind with only 10%. How the tables have turned in favour of the Asian market is a testimony of the emergence of the territorial powerhouses mainly in the form of China and India.Conclusion

Despite the flagging global economy and the resulting global copper equations due to the pandemic, trading activities remain robust, especially in the Asian markets. The return of higher copper prices is slowly gaining momentum and the race towards pre-pandemic levels and $3 per pound is on the cards.

Published Date: July 10, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Commodity Perspective