The newly formed government has reviewed the provisions of the fiscal budget 2021-22 that was issued through an ordinance by the previous government led by KP Sharma Oli. The Replacement Bill to replace the Budget Ordinance was endorsed by the Parliament on September 20. The Replacement Act has reviewed the budget size, source of financing, projects and programmes, tax rates, incentives and also made some new announcements to lure investment and increase efficiency in budget execution.

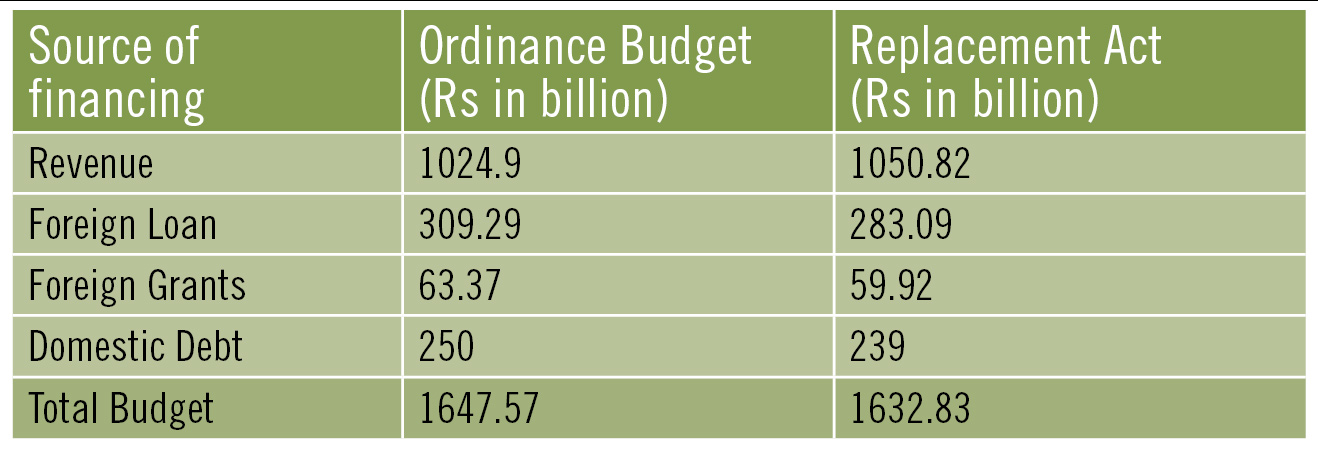

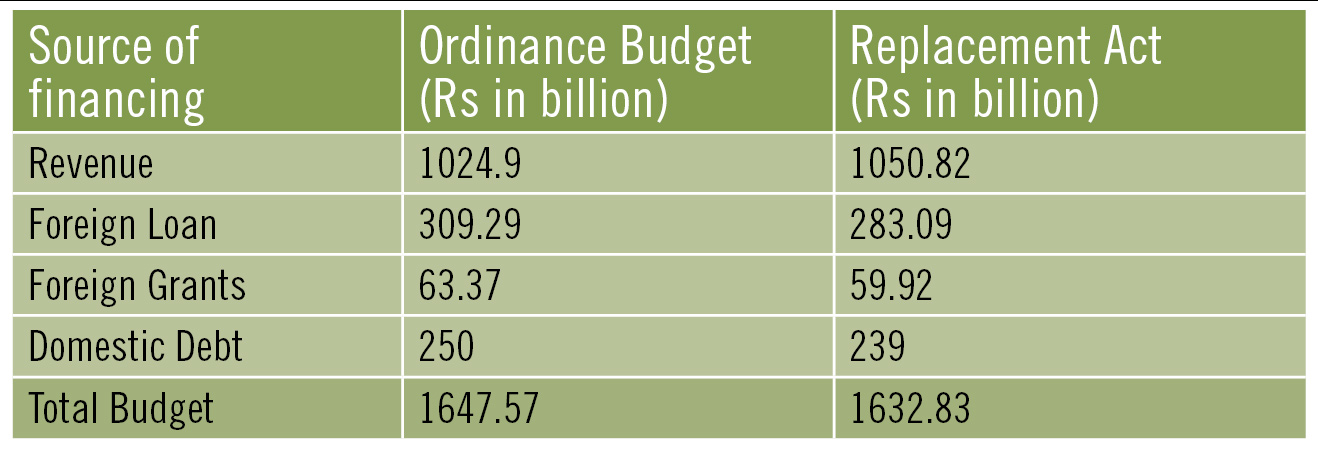

The total size of the budget has been downsized from Rs 1,647.57 billion earlier to Rs 1,632.83 billion for ongoing fiscal 2021-22. Similarly, it has reviewed the source of financing along with changing the figure of the budget.

The revised budget presented as the Replacement Bill by Finance Minister Janardan Sharma has lowered the country’s dependence on debt - both foreign and domestic - as well as envisioned to optimise revenue without substantive revision is tax rates. The Finance Minister has said the revenue target of Rs 1,050.82 billion will be achieved through proper enforcement of tax compliances, expansion of the tax net, and prevention of revenue leakages.

The overridden public debt has been consistently questioned by the public as the country has been taking loans without improving efficiency in executing development projects, capital formation and enhancing productivity to rationalise that public debt has been spent properly. The country’s public debt position has almost doubled in the last four years from Rs 917.31 billion in fiscal 2017-18 to Rs 1,728.43 billion till last fiscal 2020-21. Debt to GDP ratio stands at 40.5% and the rapidly rising debt has been narrowing the fiscal space.

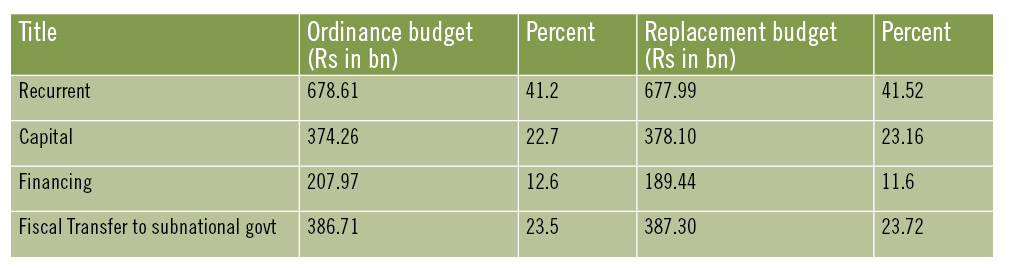

Against the backdrop of slow growth of capital expenditure against increasing recurrent expenditure, the replacement budget has increased capital expenses and lowered the recurrent expenditure of the Ordinance Budget. The Ministry of Finance has said it has trimmed down the projects - basically political pet projects - incorporated in the budget without any groundwork like pre-feasibility and feasibility study to take forward the projects towards execution. Minister Sharma has expressed commitment that the Finance Ministry will not issue any guarantee of providing resources for such piecemeal projects. Such malpractices have been deep rooted in the Ministry thus depleting the national coffer.

Former Advisor to the Ministry of Finance, Economist Keshav Acharya, says that development (capital) budget has been crawling, however there has been an exponential surge in recurrent expenditure. “We must make the authorities responsible to execute the budget properly,” he added. In the last five years - between fiscal 2016-17 to 2020-21 - recurrent expenditure surged by 74% whereas capital expenditure has grown by merely 9.75%. In fiscal 2016-17 allocation on recurrent and capital expenditure was Rs 545 billion and Rs 311.95 billion respectively. Likewise, in last fiscal 2020-21 allocation on recurrent expenditure surged to Rs 948 billion while allocation for capital expenditure was Rs 342 billion.

Meanwhile, Binod Chaudhary, President of Chaudhary Group and the only Forbes listed billionaire of Nepal, says the country is spending Rs 85 as administrative cost to make an investment of Rs 15 for development works and what is worse is that a large chunk of the allocated amount for development works remains unspent. “Poor infrastructure is the major impediment for the expansion of private sector,” he states, “The government should keep an eye on how other countries are developing their infrastructure and providing incentives for investors to enhance the production base.”

Chaudhary further states that there should be a perfect blend of economic managers and political activists in national politics to bring about change citing the example of how former Indian Prime Minister PV Narasimha Rao inducted an apolitical person, Manmohan Singh as the Finance Minister, who is credited for modernising the Indian economy through deregulation and vast reforms.

In the context of increasing recurrent expenses the Replacement Budget has made some course correction on expenditure pattern by slightly increasing capital expenditure as compared to the Budget Ordinance.

Former Advisor to the Ministry of Finance, Economist Keshav Acharya, says that development (capital) budget has been crawling, however there has been an exponential surge in recurrent expenditure. “We must make the authorities responsible to execute the budget properly,” he added. In the last five years - between fiscal 2016-17 to 2020-21 - recurrent expenditure surged by 74% whereas capital expenditure has grown by merely 9.75%. In fiscal 2016-17 allocation on recurrent and capital expenditure was Rs 545 billion and Rs 311.95 billion respectively. Likewise, in last fiscal 2020-21 allocation on recurrent expenditure surged to Rs 948 billion while allocation for capital expenditure was Rs 342 billion.

Meanwhile, Binod Chaudhary, President of Chaudhary Group and the only Forbes listed billionaire of Nepal, says the country is spending Rs 85 as administrative cost to make an investment of Rs 15 for development works and what is worse is that a large chunk of the allocated amount for development works remains unspent. “Poor infrastructure is the major impediment for the expansion of private sector,” he states, “The government should keep an eye on how other countries are developing their infrastructure and providing incentives for investors to enhance the production base.”

Chaudhary further states that there should be a perfect blend of economic managers and political activists in national politics to bring about change citing the example of how former Indian Prime Minister PV Narasimha Rao inducted an apolitical person, Manmohan Singh as the Finance Minister, who is credited for modernising the Indian economy through deregulation and vast reforms.

In the context of increasing recurrent expenses the Replacement Budget has made some course correction on expenditure pattern by slightly increasing capital expenditure as compared to the Budget Ordinance.

Former Advisor to the Ministry of Finance, Economist Keshav Acharya, says that development (capital) budget has been crawling, however there has been an exponential surge in recurrent expenditure. “We must make the authorities responsible to execute the budget properly,” he added. In the last five years - between fiscal 2016-17 to 2020-21 - recurrent expenditure surged by 74% whereas capital expenditure has grown by merely 9.75%. In fiscal 2016-17 allocation on recurrent and capital expenditure was Rs 545 billion and Rs 311.95 billion respectively. Likewise, in last fiscal 2020-21 allocation on recurrent expenditure surged to Rs 948 billion while allocation for capital expenditure was Rs 342 billion.

Meanwhile, Binod Chaudhary, President of Chaudhary Group and the only Forbes listed billionaire of Nepal, says the country is spending Rs 85 as administrative cost to make an investment of Rs 15 for development works and what is worse is that a large chunk of the allocated amount for development works remains unspent. “Poor infrastructure is the major impediment for the expansion of private sector,” he states, “The government should keep an eye on how other countries are developing their infrastructure and providing incentives for investors to enhance the production base.”

Chaudhary further states that there should be a perfect blend of economic managers and political activists in national politics to bring about change citing the example of how former Indian Prime Minister PV Narasimha Rao inducted an apolitical person, Manmohan Singh as the Finance Minister, who is credited for modernising the Indian economy through deregulation and vast reforms.

In the context of increasing recurrent expenses the Replacement Budget has made some course correction on expenditure pattern by slightly increasing capital expenditure as compared to the Budget Ordinance.

Former Advisor to the Ministry of Finance, Economist Keshav Acharya, says that development (capital) budget has been crawling, however there has been an exponential surge in recurrent expenditure. “We must make the authorities responsible to execute the budget properly,” he added. In the last five years - between fiscal 2016-17 to 2020-21 - recurrent expenditure surged by 74% whereas capital expenditure has grown by merely 9.75%. In fiscal 2016-17 allocation on recurrent and capital expenditure was Rs 545 billion and Rs 311.95 billion respectively. Likewise, in last fiscal 2020-21 allocation on recurrent expenditure surged to Rs 948 billion while allocation for capital expenditure was Rs 342 billion.

Meanwhile, Binod Chaudhary, President of Chaudhary Group and the only Forbes listed billionaire of Nepal, says the country is spending Rs 85 as administrative cost to make an investment of Rs 15 for development works and what is worse is that a large chunk of the allocated amount for development works remains unspent. “Poor infrastructure is the major impediment for the expansion of private sector,” he states, “The government should keep an eye on how other countries are developing their infrastructure and providing incentives for investors to enhance the production base.”

Chaudhary further states that there should be a perfect blend of economic managers and political activists in national politics to bring about change citing the example of how former Indian Prime Minister PV Narasimha Rao inducted an apolitical person, Manmohan Singh as the Finance Minister, who is credited for modernising the Indian economy through deregulation and vast reforms.

In the context of increasing recurrent expenses the Replacement Budget has made some course correction on expenditure pattern by slightly increasing capital expenditure as compared to the Budget Ordinance.

Replacement Bill: A mandatory provision

On July 12, the mandamus order of the Supreme Court revived the Parliament and urged the President to appoint Sher Bahadur Deuba, who had garnered support of a majority of the parliamentarians, as Prime Minister as per section 76 (5) of Nepal’s Constitution. Erstwhile Prime Minister KP Sharma Oli, who had dissolved the House of Representatives on May 21, announced the fiscal budget of 2021-22 through an ordinance.The country’s public debt position has almost doubled in the last four years from Rs 917.31 billion in fiscal 2017-18 to Rs 1,728.43 billion till last fiscal 2020-21. Debt to GDP (gross domestic product) ratio stands at 40.5% and the rapidly rising debt has been narrowing the fiscal space.Along with the formation of a new government and revival of the Parliament, it was mandatory for the newly formed government to table the Ordinance. They brought the Replacement Bill after the Ordinance did not receive the Parliament’s nod. Due to the continuous sloganeering by the opposition CPN UML lawmakers, the Ordinance could not be approved within 60 days of it being submitted at the Parliament on July 18. The deadlock caused a government shutdown for a week until the Parliament passed the Replacement Budget on September 20. Madhu Kumar Marasini, Finance Secretary, has said the Replacement Bill was mandatory following the revival of the Parliament.

Distributive approach

Meanwhile, Finance Minister Sharma has also followed competitive populism through the budget though he has often talked about fiscal discipline and accountability. The fiscal budget has a provision to distribute one-time cash grant of Rs 10,000 to five lakh deprived families who lost jobs due to the Covid 19 pandemic. “We have addressed the formal sector through different schemes including subsidised loans, refinancing, and other fiscal and monetary incentives,” said Minister Sharma, adding, “Though a large number of jobs are generated by the informal sector the state had not addressed the plight of those who suffered after losing livelihoods due to the pandemic so we introduced this grant.” The government has earmarked Rs 5 billion for this programme and the cash grant will be transferred through bank accounts based on the list of eligible beneficiaries prepared by the local level governments. Those receiving other social security allowances and with other alternative income sources or if any of the family members are working abroad will not be eligible to receive the cash grant. The Ministry of Finance has submitted the guidelines to transfer the cash grant to the Parliament and the provision will come into effect once the guidelines receive a nod from the Parliament.The Replacement Act is focused on boosting production, embracing entrepreneurship and optimising tax collection through proper enforcement of tax compliances as well as preventing leakages.

Addressing the Controversy

The Ministry of Finance has clarified the controversy on the provision of relaxing the disclosure of income source. The Replacement Bill has relaxed the disclosure related provision while investing in the infrastructure sector till mid-April 2023. However, this provision has raised eyebrows and the government has been criticised for favouring the flow of illicit capital. Against this backdrop, the Ministry has clarified through a minister-level decision that capital suspected of having been gained through money laundering, corruption and other criminal activities that are prevented by the prevailing laws will not be allowed to invest.Focus: Production, jobs and tax

The Replacement Act is focused on boosting production, embracing entrepreneurship and optimising tax collection through proper enforcement of tax compliances as well as preventing leakages. The Replacement Budget has envisioned creating at least 500 enterprises in one municipality/rural municipality by providing subsidised loans. The budget has earmarked funds for the interest subsidised credit scheme that is being executed since long basically for MSMEs, women, Dalits, marginalised people and migrant returnees. The government expects this scheme will help expand the MSMEs sector which is critical for inclusive and sustained growth as well as for economic stability. Similarly, the government has provided tax incentives to production industries and assembling plants. The government has waived the customs duty on the import of sponge iron that is used to produce billet in the country. Similarly, the Replacement Budget has lowered the excise duty on billet produced in the country. MS billet is one of the major imports of the country, and the Ministry of Finance has said the scheme is being given to substitute the import of billet and boost domestic production of the commodity. According to Finance Secretary Marasini, the government has introduced this policy to consume the excess electricity produced in the country by promoting electricity-intensive industries as these industries create more jobs as they are labour intensive too. On the other hand, Marasini has said the import substitution will help to narrow down the alarming trade deficit and save foreign exchange reserves. The government has discouraged the import of billet by increasing excise duty to Rs 2.50 per kg from Rs 1.65 per kg earlier. The Replacement Budget has kept the 5% customs duty on import of billet unchanged in a bid to discourage imports. Industries importing billet have said the government policy is biased against them as there was similar duty on both sponge iron and billet in the past. The opposition leader and former Prime Minister KP Sharma Oli has termed this policy provision as ‘policy corruption’. The Replacement Budget has also provided incentives to assembly plants but the import of finished products, mainly two-wheelers has become dearer. The government has raised excise duty from 40- 50% on 125 to 155 cc and 50- 60% on 200 to 250 cc two-wheelers.

Published Date: October 20, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Feature

-1765706286.jpg)

-1765699753.jpg)