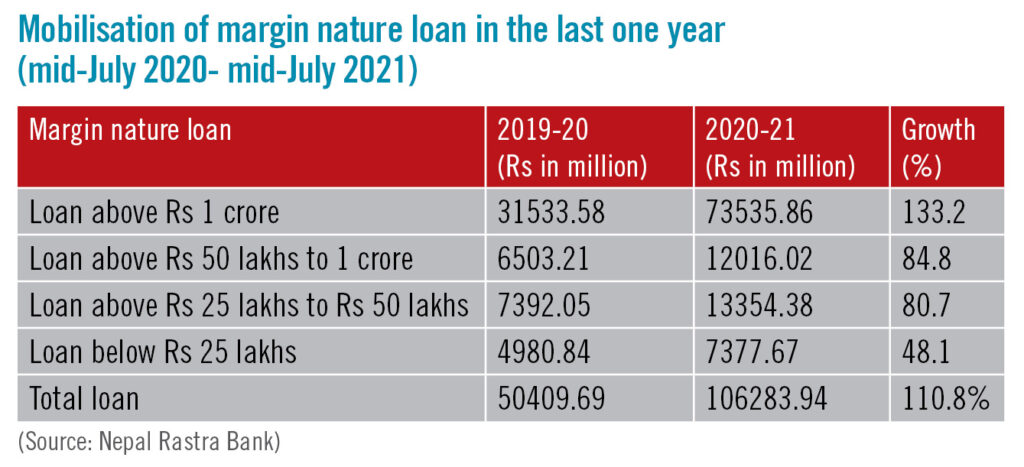

In recent days, due to lack of investment windows in other sectors of the economy due to the pandemic, investors have been lured to the stock market as a lucrative sector for short-term gain. Banks and financial institutions (BFIs) were flushed with liquidity and offered cheaper interest credit as loan demand went down. Meanwhile, remittance flow has also been less affected due to the early recovery of labour destinations. Automation in share trading has also provided access to investors to trade from their homes despite the lockdowns and restrictions in movement imposed by the government to stem the spread of the Covid 19. According to Nepal Rastra Bank - the central regulatory and monetary authority - margin lending soared by 110% to Rs 106 billion. Similarly, loan of ticket size above Rs 1 crore against collateral of stocks increased exponentially by 133% in a year which tempted the central bank to announce a new policy regarding loan mobilisation in the stock market and that has become the most debated issue among stakeholders. NRB, through its Monetary Policy 2021/22 unveiled in August, has capped loans to up to Rs 40 million from a single bank or financial institution and the total limit for a borrower has been set at Rs 120 million. Those who have already availed loans that are more than the given limit must narrow down below the given threshold. The Nepse index which stood at 1,363.4 points in mid-July last year rose to 2,883.4 points by mid-July 2021. Nepse reached a record high of 3,198.60 points on August 18 with market capitalisation touching Rs 4.4 trillion which is more than country's GDP and started its decline with the central bank issuing a directive that provisions a year to bring it down to the given single obligor limit.  Dev Kumar Dhakal, Spokesperson of NRB says that most loans availed through collateral of securities is reinvested in the secondary market. He believes that borrowers should only invest in the stock market from the money they make after having invested in the other sectors of the economy. This would create a sustained cycle of investment rather than quick and frequent buying and selling of shares. To minimise this phenomenon and provide stability to the stock market, the fiscal budget 2021/22 has provisioned 5% capital gain tax (CGT) if an investor sells their stock after a year of investment. However, 7.5% CGT is levied if the securities are sold within a year. Jhakka Prasad Acharya, former Director General of Inland Revenue Department, says the provision was introduced to safeguard small and medium investors who often lose out due to excessive volatility in the stock market caused by speculators with deep pockets. Though investment in the stock market is one of the riskiest investments, government and regulators in the past opened up borrowing against collateral of stocks and introduced government-owned non-banking financial institutions like Employees Provident Fund and Citizen Investment Trust as market makers when the stock market was going through a depression in late 2007. Wave in the stock market went through two negative candles in August and September, and analysts believe the Nepse index will saturate at around 2,750 points for this quarter if investors do not panic sell. In November 2020, the Nepse index broke its earlier record high of 1,881.45 points achieved in July 2016 and the bullish trend continued with new records being set. According to Prakash Rajaure, Stock Market Analyst, the bull run witnessed in the stock market between August 2015 to July 2016 was a rare incident in the stock market within a year.

Dev Kumar Dhakal, Spokesperson of NRB says that most loans availed through collateral of securities is reinvested in the secondary market. He believes that borrowers should only invest in the stock market from the money they make after having invested in the other sectors of the economy. This would create a sustained cycle of investment rather than quick and frequent buying and selling of shares. To minimise this phenomenon and provide stability to the stock market, the fiscal budget 2021/22 has provisioned 5% capital gain tax (CGT) if an investor sells their stock after a year of investment. However, 7.5% CGT is levied if the securities are sold within a year. Jhakka Prasad Acharya, former Director General of Inland Revenue Department, says the provision was introduced to safeguard small and medium investors who often lose out due to excessive volatility in the stock market caused by speculators with deep pockets. Though investment in the stock market is one of the riskiest investments, government and regulators in the past opened up borrowing against collateral of stocks and introduced government-owned non-banking financial institutions like Employees Provident Fund and Citizen Investment Trust as market makers when the stock market was going through a depression in late 2007. Wave in the stock market went through two negative candles in August and September, and analysts believe the Nepse index will saturate at around 2,750 points for this quarter if investors do not panic sell. In November 2020, the Nepse index broke its earlier record high of 1,881.45 points achieved in July 2016 and the bullish trend continued with new records being set. According to Prakash Rajaure, Stock Market Analyst, the bull run witnessed in the stock market between August 2015 to July 2016 was a rare incident in the stock market within a year.

However, panic selling led the market towards depression in March 2019 when the Nepse index plunged to around 1,100 points. In 2019, price-earnings (PE) ratio of stocks except microfinance and insurance companies plunged to the level of 'stock market crash' of June 2011. "This will not happen this time as we can see the stock prices of banks and insurance companies that are providing attractive returns to shareholders have not increased substantially as compared to hydropower companies, finance, trading and microfinance companies," analyses Rajaure. "This means people who have invested in banks and insurance firms are not involved in frequent trading and might have invested for the long term." But long-term investors might also face an adverse impact due to the central bank's policy on margin lending. "Since the central bank has asked BFIs to bring down loans against collateral of stocks to the given threshold within a year, investors who have availed loans that are more than the limit could face problems in renewing their loan from the end of this quarter because banks will start asking them to gradually bring down their loan as per the regulatory limit," he says. Nara Bahadur Thapa, former Executive Director of NRB, meanwhile blames the central bank and Securities Board of Nepal (SEBON) for unnecessary meddling in the stock market stating that the regulators and government leadership are guided with a conservative mindset of controlling, capturing and repressing the market. "The government and regulators do not need to worry about the stock market as investors are aware about where they are going to invest," he says adding, "The government cannot and should not tell investors about the ideal price of stocks, whether it is on the higher side or on the lower end." Rather than capping loans, the central bank should have simply asked banks and financial institutions to be careful about their exposure to high risk sectors including margin nature loans. As the central bank allowed BFIs to lend up to 40% of tier 1 capital against collateral of securities, it is contradictory now to set a limit on loan mobilisation, according to Thapa. "Similarly, SEBON's move of unveiling a list of 51 listed companies stating 'risky to invest' in mid-June this year is simply immature and beyond the jurisdiction of a prudent regulator," he remarks.

On June 15 this year, SEBON had made public a list of 51 companies stating they have been termed risky to invest as stock prices of some of these companies increased exponentially by up to 300% within a year. It also informed that some of the company stocks had price-earnings (P/E) at 100 and over, some had negative earnings per share (EPS), and per share net worth of some were lower than the book value, based on latest financial statements. SEBON further declared that it would conduct a comprehensive investigation regarding possible offences related to insider trading, circular trading and stock cornering, among other malpractices and unlawful activities in the secondary market and crack down on those involved in such practices. Capping of loans against collateral of securities has hit investment companies hard. Rajaure, Stock Market Analyst, says the central bank should withdraw the regulatory provision of capping margin loans for investment companies. "The central bank imposing a threshold on personal loans against collateral of securities can be justified but it is an injustice for investment companies that have been established and are abiding with the prevailing laws and filing their CGT and TDS (tax deduction at source) to the government," he elaborates saying, "They are contributing to the development of the capital market through broader and inclusive participation." Stakeholders should realise that the capital market is an important element for mobilising capital. Some weeks back, Kul Man Ghising, Managing Director of Nepal Electricity Authority (NEA), had said that issuing rights shares could help NEA raise capital from the stock market to pay back the loans availed earlier to construct the 456-MW Upper Tamakoshi electricity project. Shareholders of Upper Tamakoshi were excited about the returns that the company could offer to its shareholders if it was able to pay back the loans obtained earlier through issue of rights shares. "If Upper Tamakoshi decides to issue rights shares, then the NRB threshold on margin lending becomes a barrier for those who have already availed loans above Rs 120 million," says Rajaure. However, central bank officials mention that the Rs 120 million single borrower limit is sufficient for genuine investors. "Those involved in share cornering by availing large amounts of loans are against this policy," a high-level source at the central bank said, "We can see how the stock price of certain companies went up rapidly. It is all because of unlimited cheaper loans in the past and we must curb such malpractices to safeguard a majority of investors and also to maintain stability in the stock market." Cornering of stocks means to acquire enough shares of a particular security type, such as those of a firm in a niche industry or to hold a significant commodity position to be able to manipulate its price. The term implies that the market has been backed into a corner, and there is nowhere for the market to move to find other sellers and buyers. An investor needs deep pockets to be able to corner a market. A few stock investors in Nepal have availed more than Rs 1 billion loan against collateral of securities and these deep pockets can easily corner the market and keep buying and selling stocks within their network until the price of the stocks goes up to their desired level. And only when the stock of certain companies becomes expensive, the stocks will be available to common investors. Since the liquidity-strapped BFIs have cut down their loan volume and increased interest rates, it is said the stock market might further reel under uncertainty if government expenses remain consistently low and liquidity position of the BFIs further deteriorates. Read this also :

-1761806697.jpg)

-1758006240.jpg)