The banking sector has witnessed stress due to the shrinking profit in the first quarter of the ongoing fiscal 2020-21. The flexible debt moratorium facility provided by the Central Bank affects the earning of the banks as all borrowers have received six months moratorium until mid-January 2021, up to nine months until mid-April 2021 for moderately affected, and a year for hard-hit businesses. Recently, the Central Bank in its first quarter review of the Monetary Policy 2020-21 has barred banks from auction of collateral pledged by the borrowers if the debt servicing is irregular only in the last six months.

Commercial banks first quarter profit has shrunk by 6.53% in the first quarter of this fiscal. Negative profit growth has been witnessed after a long time as the economy faces an unprecedented crisis. In the first quarter 18 banks out of 27commercial banks in operation faced decline in profits compared to the corresponding period of the previous fiscal.

The theory of survive, revive and thrive is also applicable for each industry globally during the pandemic except few that are related to the health, pharma and essential goods and services. Famous industrialist and philanthropist Ratan Tata is often quoted reflecting on the sensitivity of the looming crisis, “Survival is the great dividend for businesses in 2020.”

Stress in the financial system was presumed globally since the Covid 19 outbreak. Later, International Monetary Fund termed the situation as ‘greater economic depression’ which is considered more serious than an economic crisis.

The pandemic has changed the landscape of the top banks in Nepal. Some of the banks with larger merger and acquisition backgrounds have expanded their balance sheets, maximised earnings.

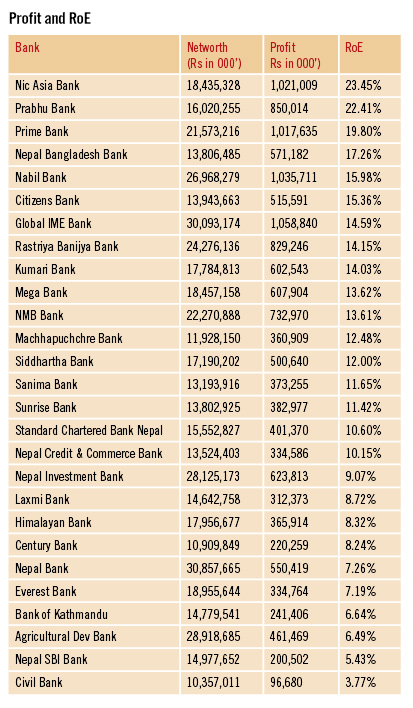

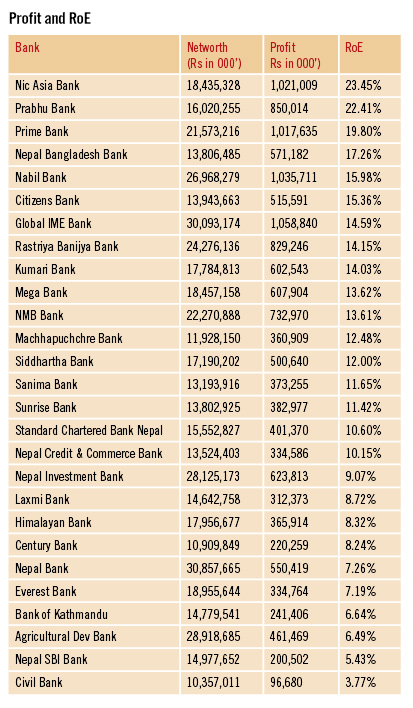

Global IME Bank ranked at the top among 27 commercial banks in operation securing net profit worth Rs. 1.05 billion, followed by Nabil (Rs. 1.03 billion), NIC Asia (Rs 1.02 billion), Prime Bank (Rs 1.01 billion) and Prabhu Bank (Rs 850 million).

In terms of accelerating profit growth Prime Bank, NMB Bank, Kumari, Mega, Nepal Bangladesh Bank emerged at the forefront.

Banks are now operating on a low return of just 3.01%. The return on equity (RoE) was above 14% before the pandemic. The first quarter (Q1) of ongoing fiscal 2020-21 paints a bleak picture of performance due to flexible moratorium, plummeting loan demand and rise of non-performing loans. In terms of RoE, NIC Asia ranked on the top with 23.45% return, followed by Prabhu Bank (22.41%), PrimeBank (19.8%), Nepal Bangladesh (17.26%) and Nabil Bank (15.98%).

Banks are currently flushed with the liquidity; the Central Bank has mopped up Rs 60 billion through reverse repo and Rs 102 billion through short-term deposit collection instruments. The base rate of banks stands at a low of 7.73%. Banks add on some premium on the base rate while fixing interest rate for borrowers. Despite the low interest rate, credit demand has yet to go up as the pandemic weakens investor confidence.

Banks are now operating on a low return of just 3.01%. The return on equity (RoE) was above 14% before the pandemic. The first quarter (Q1) of ongoing fiscal 2020-21 paints a bleak picture of performance due to flexible moratorium, plummeting loan demand and rise of non-performing loans.However, Maha Prasad Adhikari, Central Bank Governor has said that the loan demand is gradually rising after the first quarter as the administration withdraws lockdown and curfews on people’s movement, which was enforced before to stem the spread of virus. “The low interest rate for borrowers is an opportunity as they were demanding for single-digit credit rate since long,” he said. The Governor added, “This is right time for investment as the invention of the vaccine against Covid 19 is set to be distributed globally and we can assume that the pandemic will be controlled.” As the banks flushed with liquidity started lowering deposit rates to minimise their liability, the Central Bank using its prerogative of protecting depositors instructed banks to not lower more than 5% between fixed deposit rate and other deposit products (excluding call deposits). According to the Central Bank, banks have collected Rs 219 billion in deposits since mid-July to end of November and lent Rs 202 billion. Based on the trend of loan growth in the second quarter, the Central Bank has presumed that the situation of excessive liquidity will not exist much longer. However, Nepal Rastra Bank - the central regulatory and monetary authority - has said that it will enhance supervision to control loan evergreening practices. The Central Bank has already announced that it will be strict on overdraft loan and margin lending. It is going to tighten the margin lending as the stock market continuously rallied in the recent weeks and financial institutions are allegedly pumping funds into the stock market due to lack of lending opportunities. The global economy is moving ahead at a critical juncture but despite shrinking profitability, banks are struggling to maintain overall financial stability without compromising on the quality and efficacy of service delivery. Anal Raj Bhattarai, Financial Sector Analyst has said that the government’s capital expense is vital for demand generation including credit demand of the banks. “Slow and weak capital expenses of the government has been hindering the financial sector to find areas to place loan,” said Bhattarai, “The government must ramp up capital expenditure so that contractors, construction material suppliers and others start availing of loans. It will gradually peak the consumption demand when people have disposable income in their hands,” he elaborated.

Published Date: December 16, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Feature

-1765706286.jpg)

-1765699753.jpg)