Early in the year, Alibaba’s Co-founder and Executive Chairman Jack Ma donated $14 million to develop the Corona virus vaccine. Apart from this Jack Ma foundation has been supplying PCR reagents, personal protective equipment and other medical equipment in donation and Nepal is one of its recipients. In the first week of the August, Gates Foundation donated $150 million to distribute Covid 19 vaccine to developing nations as they struggle with the accelerating pandemic. These are but a few examples of how philanthropy is being done globally.

Philanthropy carries the mission of reducing inequalities in the world and is also viewed as a tool to help achieve sustainable development goals. Nepal’s government is facing limitations in ensuring basic needs for all and meeting the needs of the Corona virus pandemic has deepened the hole. At the onset of the pandemic, the private sector and different government entities contributed Rs 2.77 billion to a fund set up by the government for prevention and management of Covid 19 and treatment of its patients.

The government had provided a facility of deducting the donated amount while calculating taxes of the donor companies. The tax benefit (incentive) is fundamental for charities identifies a recent report published by the Centre for Asian Philanthropy and Society (CAPS). CAPS has been releasing its report every two years titled the Doing Good Index. The 2020 report shows Nepal and Cambodia in weak position among the Asian countries in terms of charity works.

There are mandatory provisions of corporate social responsibility (CSR) in Nepal for companies and firms that have an annual turnover of more than $1.26 million wherein it is mandatory for them to spend 1% of their profit on CSR activities as per the Industrial Enterprises Act (IEA).

Noncompliance incurs a penalty equivalent to 0.75% of the company’s annual revenue. However, a major loophole in the law is that it gives ample room for companies to define which activities classify as CSR creating a potential gap between intended and actual spending, according to the CAPS report. Similarly, the Nepal Rastra Bank Act 2002 requires banks and financial institutions to set aside at least 1% of their net profit for CSR funding. This funding must be spent in prescribed areas, including “social projects, direct grant expenses, SDGs or/and setting up a child day care center for employees.” Noncompliance carries both fine and imprisonment; more stringent penalties than the IEA. Experts are of the view that the government at least should prepare data and publicize it on how much CSR funding was generated year-on-year basis.

In India, corporates have to spend 2% of their profit on CSR activities. It is found that CSR activities are effective in India.

Here lack of tax benefits is hindering corporates from voluntary charities, it is said. “Corporates need to take approval from the government if they would like to donate funds for a certain purpose like provide rescue and relief benefit to people affected by the natural disasters, or in any other justified areas like health, education among others,” said Finance Secretary Sishir Kumar Dhungana adding, “Corporates and individuals are provide tax benefits when they contribute funds set up by the government.”

Amidst the Covid 19 pandemic, the government has urged corporate houses, government agencies, and social organisations as well as individuals to contribute to the fund established by the government for prevention and control of Covid 19.

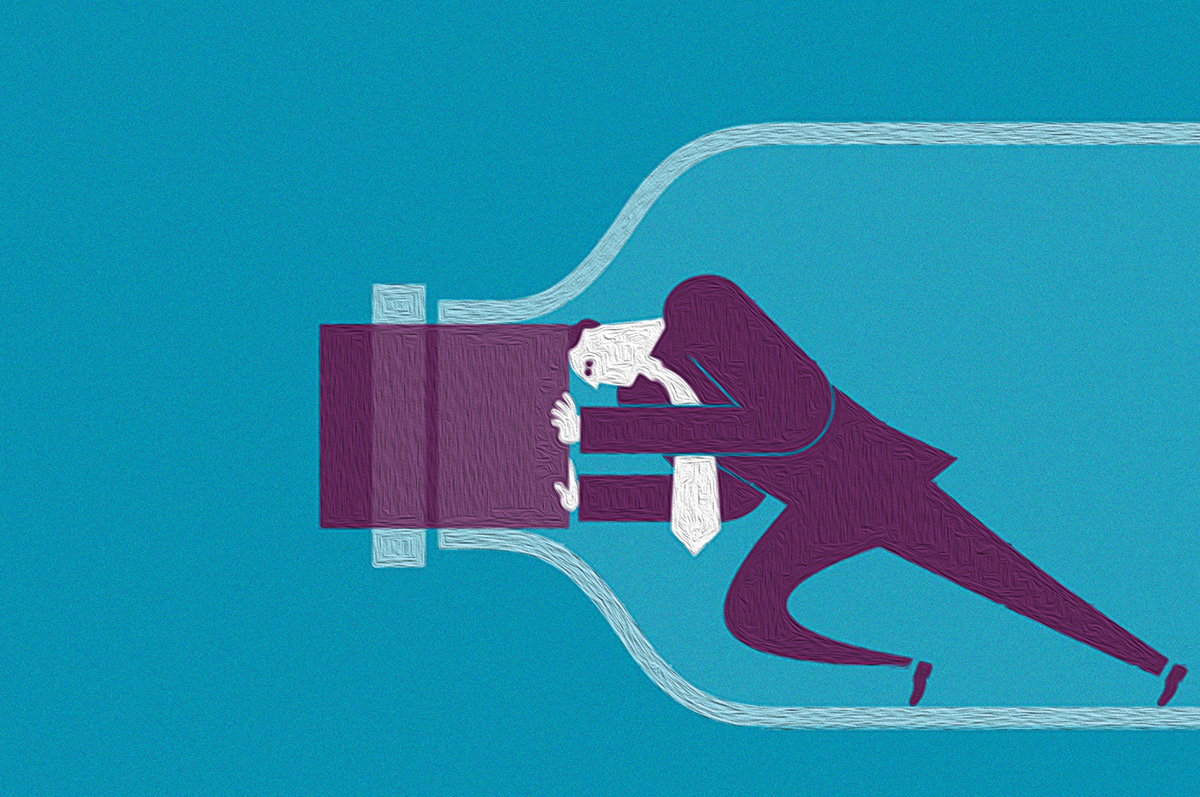

There are mandatory provisions of corporate social responsibility (CSR) in Nepal for companies and firms that have an annual turnover of more than $1.26 million wherein it is mandatory for them to spend 1% of their profit on CSR activities as per the Industrial Enterprises Act (IEA). Noncompliance incurs a penalty equivalent to 0.75% of the company’s annual revenue.Chaudhary Foundation, the philanthropic arm of Chaudhary Group, has proposed to develop a well-facilitated hospital in Surkhet of Karnali province instead of chipping in money to the fund established by the government. The foundation has signed an agreement with the province government too. However, the federal government did not allow building of the hospital and asked to donate funds directly to the government. Despite the Chaudhary Foundation’s active support of PCR reagents, PPEs, ventilators to the government, it did not allow the foundation to build a hospital in Karnali as proposed. There are few other similar examples of other corporates who are barred from doing charities of their choice even though the proposals were justified. Corporates would like to invest CSR funds to create impact in people’s lives or spend on environmental conservation or for the development of certain sectors like education, health, sports among others. Take the example of Ncell which has mobilised around Rs 900 million as CSR funds since the telecommunication service provider operated as Ncell, however the company is interested in CSR spending where it can create maximum impact. Corporate heads complain about regulatory barriers, lack of tax benefit, lack of ecosystem as major barriers to promoting philanthropy. It is certain that the flow of foreign funds will decline in the post pandemic scenario, the funding gap should be fulfilled by the charitable works, according to Dr. Ruth A. Shapiro, Co-Founder and Chief Executive of the CAPS, “If the Asian Countries allocate 2% of their economy, a total of $587 billion will be available and the amount is 12 times higher than the grant being received by Asian countries.” Asian Countries are facing funding gap of $1.5 trillion to achieve the SDGs and the amount comes from the 2% of Asian Economies is 40% of the aforesaid funding gap. Asia has one third of the global wealth and two third of the world’s poverty. Against this backdrop, the study carried out by CAPS shows that Asian countries including Nepal should work towards poverty alleviation, environmental conservation and building social resilience from its own resources. Around 19% of the country’s population is estimated living below poverty line; it could be more severe along with the job losses, income shocks due to plummeting demands due to the pandemic. A recent study unveiled by the International Finance Corporation shows an alarming situation in Nepal as around 50% of the micro, small and medium enterprises (MSMEs) are on the verge of collapse due to the pandemic. The MSMEs are critical for the resilience of the economy and contribute 22% to the economy while providing direct employment to 1.75 million individuals. Job losses will trigger demand shock which is fatal for an economy like Nepal, where 82% of the country’s GDP is based on consumption. The country could be pushed into a vicious cycle of extreme poverty which will pose challenges to sustain the achievements on the human development front. It is believed that the country should achieve 7% growth to reduce poverty by 1.5%, but the growth in 2019-20 and 2020-21 might nosedive binging manifold challenges to the economy. To promote philanthropy, the country must provide tax benefits on corporate and individual donations. In Nepal, 77% of social organisations receive funds from foreign countries and donor agencies; around 43% receive government donations and 36% of the social organisations work for the government. Only around 32% of social organizations and non-government organisations receive corporate donations. One of the critical aspects that hinders philanthropy in Nepal is the government’s mandatory approval. There are also grave challenges in bringing in foreign donations due to strict money laundering prevention laws, according to the CAPS report which states that it takes 45 days to bring such donations into Nepal from foreign countries. The CAPS report highlights that dubious laws are a major barrier to elevate charity work in Nepal.

Published Date: October 14, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Feature

-1765706286.jpg)

-1765699753.jpg)